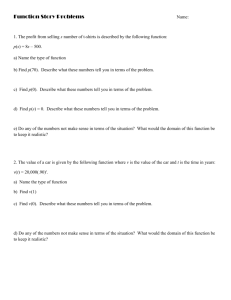

here

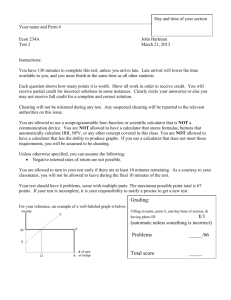

Your name and Perm #

Econ 134A

Final exam (11 am class), Version A

John Hartman

Dec. 12, 2013

Instructions:

You have 120 minutes to complete this test, unless you arrive late. Late arrival will lower the time available to you, and you must finish at the same time as all other students.

Cheating will not be tolerated during any test. Any suspected cheating will be reported to the relevant authorities on this issue.

You are allowed to use a nonprogrammable four-function or scientific calculator that is NOT a communication device. You are NOT allowed to have a calculator that stores formulas, buttons that automatically calculate IRR, NPV, or any other concept covered in this class. You are NOT allowed to have a calculator that has the ability to produce graphs. If you use a calculator that does not meet these requirements, you will be assumed to be cheating.

Unless otherwise specified, you can assume the following:

Negative internal rates of return are not possible.

Equivalent annual cost problems are in real dollars.

You are allowed to turn in your test early if there are at least 10 minutes remaining. As a courtesy to your classmates, you will not be allowed to leave during the final 10 minutes of the test.

Your test should have 6 problems (47 points), some with multiple parts. The maximum possible point total is 48 points. If your test is incomplete, it is your responsibility to notify a proctor to get a new test.

For your reference, an example of a well-labeled graph is below:

Grading:

Filling in front page of test correctly, & having photo

ID

Problems

___ /1

(

automatic unless something is incorrect

)

_____/47

Total score _____/48

For the following problems, you will need to write out the solution. You must show all work to receive credit. Each problem (or part of problem) shows the maximum point value. Provide at least four significant digits to each answer or you may not receive full credit for a correct solution. Show all work in order to receive credit. You will receive partial credit for incorrect solutions in some instances. Clearly circle your answer(s) or else you may not receive full credit for a complete and correct solution.

1. (7 points) Manuela is considering buying a European call option with an exercise price of $56 today.

This option can be used to buy 100 shares of stock at the exercise price. The stock’s current value is $50, and the expiration date of the option is one year from today. From her estimate, the value of the stock will be some value from $54.05-$56.05 on the expiration date. She further estimates that each of these values will occur with equal probability. (In other words, the probability of $54.05 occurring is the same as

$54.06, $54.07, and any other value up to $56.05.) If Manuela is risk-neutral and her effective annual discount rate is 10%, what is the most that Manuela is willing to pay for this option, assuming her estimates are correct?

2. Betsy has run a regression of the security market line, just as you did in your econometrics assignment, with beta and expected returns entered as decimals. (For example, an expected return of 5% is entered as

0.05 for the regression) Based on her sample size, she finds in her regression results that her point estimate for the slope is 0.1 with a standard error of 0.009. Her point estimate for the y-intercept is 0.06 with a standard error of 0.005. Explain all answers below with words, an equation, and/or a graph.

(a) (2 points) What is the estimated rate of return for a risk-free asset? Explain your answer in 25 words or less.

(b) (3 points) What is the estimated rate of return for an asset with beta equal to 1? (Note: I am referring to the meaning of beta referred to in this class, not the beta meaning that is commonly referred to in econometrics classes.)

(c) (3 points) What is the 95% confidence interval for the y-intercept? If you do not have enough information for a numeric answer, leave your answer in terms of as few variables as possible, and explicitly state what your variable(s) mean. If helpful, you can assume that the sample size is n .

3. Solve each of the following:

(a) (3 points) In 50 words or less, give an example of a synergy. You need to explain why this example is a synergy within your 50-word limit.

(b) (3 points) Do all real options lead to increased NPV for a company? Explain why or why not in 50 words or less.

(c) (3 points) What is the weighted average cost of capital for a company that has one-third of its value in stocks, two-thirds of its value in bonds, the rate of return of stocks is 7%, and the rate of return of bonds is

2%?

(d) (3 points) Erick will receive $100 in 14 months. What is the present value of this payment if Erick’s stated annual discount rate is 14%, compounded every 3 months?

4. There are three known states of the world, Seal, Walrus, and Whale. Each state occurs with one-third probability. When Seal occurs, Stock A has a rate of return of 6% and Stock B has a rate of return of 19%.

When Walrus occurs, Stock A has a rate of return of 14% and Stock B has a rate of return of 2%. When

Whale occurs, Stock A has a rate of return of 10% and Stock B has a rate of return of 15%.

(a) (1 point) What is the average rate of return for each stock. (Note: Both must be correct to receive credit.)

(b) (3 points) What is the standard deviation for the rate of return of each stock?

(c) (4 points) What is the correlation coefficient for the rate of return for these two stocks?

5. (5 points) In the city of Corn Chowder, USA, Maude has won the local lottery. The lottery promises to pay $1,000 every year forever, starting one year from today. Kleitos has offered to take all of the payments from the lottery in return for a single payment to Maude of $12,000 today. If Maude accepts the offer, what can you say about her effective annual discount rate?

6. (7 points) Grubber Baby Food, Inc. is expected to pay out a dividend of $15 per share later today, followed by 10% annual growth for each of the next 6 years. After that, they will pay constant dividends for each of the next 10 years. After that, Grubber will go out of business and pay nothing else to stockholders. (Note that the last dividend payment will be made 16 years from today.) If the effective annual interest rate for this stock is 11%, what is the present value for each share of stock?