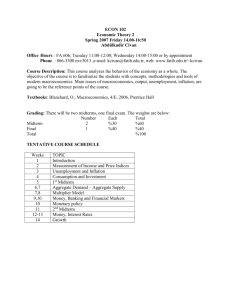

Chapt1-2

advertisement

EC 204 Slides to Accompany Chapters 1 and 2 The Data of Macroeconomics 1 The Data of Macroeconomics 2 The Data of Macroeconomics 3 The Data of Macroeconomics 4 Gross Domestic Product Two Perspectives: 1. Total Expenditure on domesticallyproduced final goods and services. 2. Total Income earned by domesticallylocated factors of production. The Data of Macroeconomics 5 Gross Domestic Product Precise Definition: “Market value of all final goods and services produced within an economy in a given period of time.” The Data of Macroeconomics 6 Issues in Measuring GDP • • • • • • Adding apples and oranges Used goods Inventories Intermediate goods and value added Housing and other imputations Real versus Nominal The Data of Macroeconomics 7 Nominal and Real GDP NGDPt = SPitQit RGDPt = SPioQit where summation is over i. The Data of Macroeconomics 8 Fixed Base-Year Weighting RGDPt = SPioQit 1+gt = RGDPt/RGDPo = S[PioQit]/S[PioQio] = Swi[Qit/Qio] where wi = PioQio/ S[PioQio] The Data of Macroeconomics 9 Computer Prices and Problems Measuring Real GDP Price of Computers Declined Sharply in 1980s to 1990s Implying That Base Year Price of Computers Is Much Higher Than Current Year Price Leads to Bias Upward in Real GDP for Recent Years Leads to Bias Downward in Real GDP for Earlier Years New Chain-weighted Measure of Real GDP Allows for More Frequent Updating of Prices The Data of Macroeconomics 10 Chain-weighted Real GDP • Over time, relative prices change, so the base year should be updated periodically. • In essence, “chain-weighted Real GDP” updates the base year every year. • This makes chain-weighted GDP more accurate than constant-price GDP. • See Supplements 2.1, 2.2, 2.4, and 2.6 for more information on GDP. • See Supplements 1.2 and 1.3 for a discussion of using GDP growth to predict the outcome of Presidential elections and a discussion of how to tell when we are in a recession. The Data of Macroeconomics 11 Chain-Weighted Real GDP Example: Two goods: Apples (A) and Oranges (O). Growth Rate Using a Fixed Base-Year Measure: Growth Rate Using a Chain-Weighted Measure: “Chain” the Growth Rates to get the Level (Index) of Real GDP: The Data of Macroeconomics 12 GDP Price Index Similar approach allows measurement of the overall rate of change for the prices of goods and services in GDP: “Chain” the Inflation Rates to get the GDP Price Index: The Data of Macroeconomics 13 Real GDP, Nominal GDP and the GDP Price Index And, if one chooses a base year where in which to set real and nominal GDP equal: Thus, the simple rule for approximating percent change continues to hold: Change in Price = Percent Change in Nominal GDP minus Percent Change in Real GDP The Data of Macroeconomics 14 Percent Change in Chain-type Real GDP (quarterly at annual rate) 8% 7% 6% 5% 4% 3% 2% 1% 0% -1% -2% 2000 2001 2002 2003 2004 The Data of Macroeconomics 2005 15 GDP and the Components of Expenditure, 2004 Total Per Person (billions of dollars) (dollars) Gross domestic product....... Personal consumption expenditures. Durable goods................... Nondurable goods...... .......... Services........................ Gross private domestic investment. Nonresidential................ Residential................... Change in private inventories... Net exports of goods and services. Exports......................... Imports.... ..................... Government co nsumption and gross investment...... ....... Federal......................... National defense.............. Nondefense.. .................. State and local................. 11734.3 8214.3 987.8 2368.3 4858.2 1928.1 1198.8 673.8 55.4 -624.0 1173.8 1797.8 39925.2 27948.6 3360.9 8058.0 16529.7 6560.2 4078.8 2292.6 188.5 -2123.1 3993.8 6116.9 2215.9 827.6 552.7 274.9 1388.3 7539.5 2815.9 1880.5 935.3 4723.6 The Data of Macroeconomics 16 Expenditure Components: Share of GDP, 2004 75% 70.0% 65% 55% 45% 35% 25% 18.9% 16.4% 15% 5% -5% -5.3% -15% Consumption Investment Net Exports The Data of Macroeconomics Government Purchases 17 Consumption, 2004 $ billions Consumption % of GDP 8214.3 70.0% 987.8 8.4% Nondurables 2368.3 20.2% Services 4858.2 41.4% Durables The Data of Macroeconomics 18 Investment, 2004 $ billions Investment % of GDP 1928.1 16.4% Business fixed 1198.8 10.2% Residential fixed Inventory The Data of Macroeconomics 673.8 5.7% 55.4 0.5% 19 Investment vs. Capital • Capital is one of the factors of production. At any given moment, the economy has a certain overall stock of capital. • Investment is spending on new capital. The Data of Macroeconomics 20 Stocks vs. Flows Flow Stock More examples: stock flow a person’s wealth a person’s saving # of people with college degrees # of new college graduates the govt. debt the govt. budget deficit The Data of Macroeconomics 21 Government spending, 2004 $ billions Gov spending % of GDP 2215.9 18.9% 827.6 7.1% Defense 552.7 4.7% Non-defense 274.9 2.3% 1388.3 11.8% Federal State & local The Data of Macroeconomics 22 Net exports (NX = EX - IM) U.S. Net Exports, 1960-2004 100 0 -100 -200 -300 -400 -500 -600 -700 1960 1964 1968 1972 1976 1980 1984 1988 1992 1996 2000 2004 The Data of Macroeconomics 23 An important identity Y = C + I + G + NX where: Y = GDP = the value of total output C + I + G + NX = aggregate expenditure The Data of Macroeconomics 24 Why does output = expenditure? • Unsold output goes into inventory, and is counted as “inventory investment”… …whether the inventory buildup was intentional or not. • In effect, we are assuming that firms purchase their unsold output. The Data of Macroeconomics 25 GNP vs. GDP • Gross National Product (GNP): total income earned by the nation’s factors of production, regardless of where located • Gross Domestic Product (GDP): total income earned by domestically-located factors of production, regardless of nationality. (GNP – GDP) = (factor payments from abroad) – (factor payments to abroad) The Data of Macroeconomics 26 (GNP – GDP) as a percentage of GDP (selected countries, 1997) U.S.A. Bangladesh Brazil Canada Chile Ireland Kuwait Mexico Saudi Arabia Singapore 0.1% 3.3 -2.0 -3.2 -8.8 -16.2 20.8 -3.2 3.3 4.2 The Data of Macroeconomics 27 Some Useful Identities GDP = C + I + G + NX GNP = GDP + Factor Paymen ts From Abroad – Facto r Paymen ts to Abroad NNP = GNP – Deprec iation The Data of Macroeconomics 28 Other Measures of Income National In come = NNP – Ind irec t Busine ss Taxes Personal In come = National Income – Corpora te Profits – Social In surance Cont ribu tions – Net In tere st + Divid ends + Govt. Trans fers to Ind ividua ls + Personal In tere st Dispos able Personal Income = Personal Income Π Personal Tax and Non-t ax P aymen ts The Data of Macroeconomics 29 Components of National Income 2004 Net Interest 5% Corporate Profits 13% Rental Income 1% Proprietors' Income 9% Compensation of Employees 72% The Data of Macroeconomics 30 Percent of Personal Disposable Income Personal Saving Rate 12 10 8 6 4 2 0 -2 1980 1983 1986 1989 1992 1995 The Data of Macroeconomics 1998 2001 2004 31 Consumer Price Index (CPI) • A measure of the overall level of prices • Published by the Bureau of Labor Statistics (BLS) • Used to – track changes in the typical household’s cost of living – adjust many contracts for inflation (i.e. “COLAs”) – allow comparisons of dollar figures from different years The Data of Macroeconomics 32 How the BLS constructs the CPI Surveys consumers to determine composition of the typical consumer’s “basket” of goods. Every month, collect data on prices of all items in the basket; compute cost of basket CPI in any month equals the cost of this basket divided by its cost in the “base” year multiplied by 100. The Data of Macroeconomics 33 The Composition of the CPI’s “Basket” Food and bev. 5.8% 17.6% Housing 2.8% Apparel Transportation 5.9% 2.5% 4.5% 4.8% Medical care Recreation 16.2% Education Communication 40.0% Other goods and services The Data of Macroeconomics 34 Reasons why the CPI may overstate inflation • Substitution bias: The CPI uses fixed weights, so it cannot reflect consumers’ ability to substitute toward goods whose relative prices have fallen. • Introduction of new goods: The introduction of new goods makes consumers better off and, in effect, increases the real value of the dollar. But it does not reduce the CPI, because the CPI uses fixed weights. • Unmeasured changes in quality: Quality improvements increase the value of the dollar, but are often not fully measured. The Data of Macroeconomics 37 The CPI’s bias • The Boskin Panel’s “best estimate”: The CPI overstates the true increase in the cost of living by 1.1% per year. • Result: the BLS has refined the way it calculates the CPI to reduce the bias. • It is now believed that the CPI’s bias is slightly less than 1% per year. The Data of Macroeconomics 38 GDP Deflator (Price Index) versus CPI • GDP Price Index measures prices of all goods and services produced, CPI only measures prices of goods and services bought by consumers. • GDP Price Index includes only goods produced domestically, CPI includes imports. • Weighting used to compute indexes differs: GDP Price Index uses changing weights, CPI uses fixed weights. The Data of Macroeconomics 39 Alternative Inflation Measures 16 14 GDP Price Index PCE Price Index CPI Percent Change 12 10 8 6 4 2 0 1980 1982 1984 1986 1988 1990 1992 1994 1996 The Data of Macroeconomics 1998 2000 2002 2004 40 Categories of the population • employed working at a paid job • unemployed not employed but looking for a job • labor force the amount of labor available for producing goods and services; all employed plus unemployed persons • not in the labor force not employed, not looking for work. The Data of Macroeconomics 41 Two important labor force concepts • unemployment rate percentage of the labor force that is unemployed • labor force participation rate the fraction of the adult population that ‘participates’ in the labor force The Data of Macroeconomics 42 Three Groups of the Population Millions, 16 years & older 2004 Population = 223.4 76.0 Employment Unemployment Not in Labor Force 139.3 8.1 The Data of Macroeconomics 43 Three Groups of the Population (16 years and older) 2004 34% Employment Unemployment Not in Labor Force 62% 4% The Data of Macroeconomics 44 Three Groups of the Population 16 years and older 2002 33% Employment Unemployment Not in Labor Force 63% 4% The Data of Macroeconomics 45 Unemployment and Employment (Millions, 2004) 8.1 Labor Force = 223.4 Employment Unemployment 139.3 The Data of Macroeconomics 46 Unemployment and Employment (Percent of Labor Force, 2004) 5.5% Employment Unemployment 94.5% The Data of Macroeconomics 47 The Data of Macroeconomics 20 04 20 00 19 96 19 92 19 88 19 84 19 80 19 76 19 72 19 68 19 64 19 60 Percent of Labor Force Unemployment Rate 12 10 8 6 4 2 0 48 Okun’s Law states that a one-percent decrease in unemployment is associated with two percentage points of additional growth in real GDP Okun’s Law Percentage change 10 in real GDP 8 6 1951 1984 2000 4 1999 1993 2 1975 0 -2 -3 1982 -2 -1 0 1 2 3 4 Change in unemployment rate The Data of Macroeconomics 49