Neiman Marcus' Client Relationships

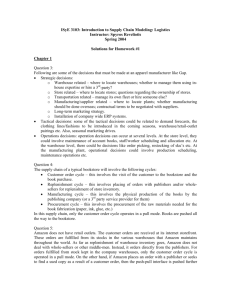

advertisement

Neiman Marcus A glimpse into the historical CRM icon Emily Olesik, Sydney Rotar, and Jessica Valentine Stanley Marcus perfectly highlights Neiman Marcus’s unparalleled commitment to service in his book, Minding the Store, with a musing from the Great Depression: “…it was true that many plain-looking country families came to us, shyly in some instances, to buy a new church outfit or winter coat. Perhaps they entered with some trepidation, for NeimanMarcus… developed a reputation for hauteur and aloofness. But when they found they were treated with kindness and understanding, they went away convinced that Neiman-Marcus was the store for them.” (Marcus 1997) The Neiman Marcus brand represents true fashion, exclusivity, luxury, and exceptional service. The company has integrated a focus on relationships with customers into every aspect of their operations. This analysis highlights the successes of Neiman Marcus’s initiatives in maintaining a client-based environment and a highly coveted loyalty program. But first, the infrastructure that provides the foundation for the CRM champion’s successes is discussed. Background Herbert Marcus’s philosophy was highly customer focused: he aimed to provide superior quality and a wide variety of luxury products, while supplying customers with superior fashion advice, personal service, and attention to detail. Neiman Marcus values this philosophy to this day, regarding the customer through operations in store design, merchandise selection, and service quality. They define their largest target customer segment as wealthy, fashionable women who seek tomorrow’s most unique, highquality fashions and value professional service (what they call a “Fashionista”). Target age range is 30-65, with an annual income of no less than $200,000, and a thirst for fashion. Additionally, Neiman’s caters to a large male segment of the same demographic, along with the children in these customers’ families. (Dewar 2006) Store Design Neiman Marcus’s typical department-style layout stands out with a unique separation of departments. Neiman’s creates many divisions to enhance the experience for their typical “Fashionista” shopper, while streamlining their men’s department for easy access. Women’s fashions are separated into “Designer One” (couture design), “Designer Two” (ready-to-wear), “Cusp” (Contemporary, younger styles), gowns, women’s shoes, lingerie, and accessories departments. A men’s department was debuted in 1928 (Neiman Marcus 2007), and now houses men’s suiting, apparel, jewelry, accessories, undergarments, and shoes as “The Man Shop”. Departments for cosmetics, children’s toys and apparel, designer jewelry, precious jewelry, and home and gifts (known as “Gift Galleries”) complete the store. These departments each command well-defined, separate section of the store for easy identification and navigation. Department managers work with visual coordinators to merchandise their department and create a unique “shop within a shop” atmosphere for each department. This upholds a dynamic atmosphere, enables unique experiences in each department for customers, and encourages a longer stay with more dollars spent. Overall design and layout of the store are also developed with the customer in mind. Visual coordinators are hired for each store to maintain and update store displays and design. An emphasis is placed on creating a fashionable and unique ambiance that enhances the customers’ shopping experience. Each location is dressed with original paintings and artwork, real floral arrangements, lighting and displays. Employees are “charged with the responsibility of making each customer feel like a distinguished guest of the Marcus family.” (Dewar 2006, 2) Unique, convenient merchandising techniques combined with luxurious artwork and design help visual managers achieve this goal. Merchandise Neiman Marcus attempts to cater to customers by “aligning location, price, service, and merchandise.” (Dewar 2006) USA Today quoted a regular customer of both Neiman’s and Saks Fifth Avenue, who attributed his increased preference for Neiman’s over Saks to "that originality that Neiman seems to have with its merchandise." (O'Donnell and Kowalski 2013) This originality allows Neiman’s to create an air where customers are matched with the perfectly suited product, whether it is a unique gift, a one-of-a-kind dress, or the most comforting new suit. Neiman’s buying office has a strong focus on maintaining a diverse mix of product options. Their long history of combining ultra-luxury products with more reasonably priced options has developed a strong reputation for luxury while maintaining a profitably sized market share. (Marcus 1997) For example, women’s “Designer One” products range in the thousands of dollars, while “Designer Two” pieces are generally under $1000 dollars. With 36 different micro-markets nationwide (Dewar 2006), corporate buyers are expected to pay attention to the changing and emerging fashions in different geographical areas. Location is a factor in product selection for each store. Stores in the “sun belt” have little need for winter clothing, while stores in colder climates offer winter fashions along with resort lines for the traveling client. Local preferences and culture are considered as well. A store in highly diverse community, like San Francisco, provides a wide range of international styles, while a store in Coral Gables caters to a large Latin American audience with bright and flamboyant merchandise. Segmenting store merchandise helps further build relationships. Neiman’s strives to fully understand what each type of customer desires and help them find the perfect product to suit their needs. (Dewar 2006) Luxury Services Neiman’s luxury services add extra value to the store, offering amenities like bridal services and wedding registries, gift-wrapping, delivery, a policy of undisputed returns and exchanges, and wine and champagne for customers upon request. Events are held in stores that include catering and entertainment. Designers frequently make personal appearances, offering fashion advice to clients and hosting events for their brand. The personal shopping experience is one of Neiman’s most coveted services. Clients book appointments with a highly experienced personal shopper, who then prepares a host of relevant product in a private room for the customer to browse upon arrival. The service appeals to a busy clientele who can’t find the time to shop, along with clients who desire to be styled for a special event. Neiman Marcus personal shoppers are extremely well-versed in current trends and classic styling, frequently accompanying buyers to worldwide fashion shows. One personal shopper client notes, “[whether] it’s a gift or if it’s a coat for me, she gets it. And she’s always on the other end of the phone, she’s always available” (Ephron 2012, 1). This service is just another way Neiman’s strives to develop rapport and extremely personal relationships with their clientele. Neiman Marcus’ Client Relationships Neiman Marcus has long prided itself on a dedication to customer service and relationships. Frequently interacting directly with consumers, the company strives to nurture relationships with customers, and thus embraces a clientele strategy. That is, the company encourages sales staff to consider each customer a “client”, whom with they must strive to build a long-lasting, profitable relationship. “Each of our stores is different from the others,” says Neiman Marcus Vice President of Communications Ginger Reeder, “in that the core of our business model is the relationships our associates have with their customers.” (Reagan 2012, 1) Customer-Focused Culture The sales philosophy developed by founder Herbert Marcus, and utilized to this day, is a derivative of the “Golden Rule”: "There is never a good sale for Neiman Marcus unless it's a good buy for the customer.” (Marcus 1997, 3) It is stressed to sales associates that they should assist customers in finding the perfect product, but also prevent clients from choosing the wrong item. Services like undisputed returns and personal shopping reiterate this philosophy, providing consumers with the most convenient and reliable experience while minimizing the visibility of corporate profit concerns. These practices aim to suggest to clients that the company cares more about its customers than profits. By sacrificing short-term sales from transactions customers consider less than ideal, trust is built between associate and client, along with the creation of customer delight. Thus a long-term, mutually beneficial relationship forms, creating a more profitable customer with a longer life-span. Empowering Employees Neiman Marcus’s employees are the vanguard of customer relationship initiatives. The company’s hiring process is highly-selective, with a focus on selecting individuals who desire to engage and interact with people daily. Neiman’s scouts for individuals who can be inspired by their business philosophy, and who will genuinely attain satisfaction from assisting clients. (Graj 2013) They engage these employees and prepare them for success through education programs and helpful technology. Employee Education Corporate HR initiatives focus on “educating” rather than “training” their employees. (Kats 2012) Stores are outfitted with classrooms, where new associates spend a week in full-day education programs and complete online programs during the first thirty days of employment. New hires are taught to develop customer relationships using modern tools like the FIRSTReport system and iPhones, while remembering that “simple and personalized approaches like follow-up phone calls or handwritten thank you notes still prove tremendously effective.” (Luxury Institute 2013, 1) A sense of personal, old-fashioned quality of service adds to customers’ perceived value, while technology enables employees to build relationships with ease. Support through technology Neiman-Marcus’s clientele system, FIRSTReport, is available on the point-of-sale (POS) system, smartphones, and through the Internet. Clientele strategy is at the heart of Neiman’s relationships with customers. In fact, the “FIRST” of “FIRSTReport” is an anagram meaning “Focused Intelligent Relationship Sales Tool.” Enabling associates to build profiles about specific, repeat customers helps retain these clients by providing them with relevant, personalized information. The system is integrated with the POS system, prompting associates to enter or retrieve customer data at the start of each transaction. A clients contact information, preferences, purchase history, important dates, and known family and friends are all available on command. This enables associates to better interact with customers, schedule reminders, run reports, and create mailings lists. The program helps sales associates to stay organized. It ensures they meet all of their clients’ needs consistently, continue developing relationships, and lure customers to the store. For example, an associate can send invitations to an in-store event for a specific brand, targeting only those customers who are likely to attend. (Cornell-Mayo Associates 2004) Neiman’s also outfitted all full-time employees with iPhones in 2011, complete with a mobile version of the FIRSTReport system. Associates are encouraged to use their phones on the floor when they are not busy, sending emails and text messages to update clients on order statuses. Associates often send picture messages to clients of new, relevant, merchandise, and regularly work off the clock to make sales using their phones. The phones have been widely embraced, with sales associates sending and receiving 200,000 text messages in April 2012 alone. (Blair 2012) Neiman’s goal is to use mobile technology to further develop employee-client relationships. Luxury Institute CEO Milton Pedraza explains that mobile technology is best utilized when it supports in-store experiences, rather than replacing them. (Kats 2012) By empowering employees to reach out to customers with new, popular technology, they reach a new level of personal interaction and create a venue for easy accessibility. This allows the relationship to grow, while enticing clients to shop with Neiman Marcus. Relationships Equal Profits The development of these relationships creates competitive advantage for Neiman Marcus in a world of department stores that focus less on these initiatives. High-end department stores like Nordstrom and Bloomingdales drive more traffic through stores, but Neiman Marcus, Bergdorf Goodman, and Barney’s New York far outshine the competition in the realm of customer relationships. (Luxury Institute 2013) For example, Nordstrom controls four times the market share of Bergdorf Goodman (a division of Neiman Marcus group), yet the rate of their customer-employee relationships is only one-third that of Bergdorf’s. (Luxury Institute 2013) The idea is that empowered employees striving to develop close bonds with their clients can “out-behave the competition.” (Kats 2012) While many consumers may be more familiar with stores like Nordstrom, the exclusive, unique service provided by Neiman Marcus creates a more inviting environment. Statistics supports these ideals, showing that 70 percent of affluent customers who develop a relationship with a specific sales associate agree they are more likely to spend more in stores and online. The largest affect these relationships have on wealthy consumers occurs in the luxury retail environment, specifically in men’s and women’s ready-to-wear fashion. (Luxury Institute 2012) This is likely due to the sense of added value provided by service. Customers who appreciate the impeccable service provided by the chain feel they receive more than just a product for their money, and thus become less price-sensitive. Neiman Marcus provides a shopping experience, creating a peaceful, enjoyable environment with champagne, a welcoming atmosphere, and impeccable service. This seems much more alluring than a crowded department store with pushy, impersonal sales staff. For example, on “Black Fridays” when Bloomingdales opens at dawn, Neiman Marcus opens an hour earlier, with subtle sale signage and a much calmer environment. Not only does Neiman’s provide substantial discounts, they also offer a much calmer escape from the shopping frenzy. Neiman Marcus strives to delight customers every day, going above and beyond their expectations. While a certain level of service is expected at Neiman’s price point, the added value of relationships helps employees to go above and beyond client’s expectations. Friendships are formed, with customers and employees often exchanging birthday cards and gossip. No tips are accepted, as employees strive to create a relationship, rather than just a service. This level of satisfaction helps retain customers, which generally costs less than acquiring new customers. The strong relationships built in this environment ultimately create customers with a much higher lifetime value, driving sales and profits Neiman Marcus’ Customer Loyalty Neiman Marcus excels at building exceptional relationships with clients through a client-focused environment, strong employee education programs and a thorough collection of customer data. While these efforts alone establish the brand as a leader in Customer Relations Management, they possess another key strategy. Their InCircle loyalty program helps sustain their positive customer relationships while encouraging customer loyalty amongst their affluent target market. In 1950, the Neiman Marcus credit card was introduced. Cash and this form of credit were the only methods of payment accepted by the company, practically forcing loyalty by requiring an account to shop. Thirty years later, Neiman’s began accepting American Express® credit cards. The Neiman’s card and American Express® are the only two cards eligible to gain points towards rewards in the InCircle program, further discussed in the following sections. In 2011, the luxury retailer finally accepted Visa® and MasterCard®. Chief Executive officer, Karen Katz, explained “the move is the latest to make the chain's stores more accessible to younger, if slightly less affluent, shoppers” (Mattioli, 2011). The company’s change in payment method helps prevent lost sales incurred by customers unable to pay with cash, American Express® or the Neiman’s card. The addition of new, more popular credit cards also makes it easier for new customers to be attained, as the brand switching costs are not as severe. Many new customers may be put off by the idea of opening a credit card with a store they do not already frequent. Neiman’s still encourages use of the card, but accepting other forms of payment opens the doors for new relationships to be formed. Occasional shoppers can shop the store with ease. As they begin to value the brand, shop more frequently, and develop relationships, the InCircle program and Neiman Marcus credit card become valuable to them. InCircle Program In 1984, the InCircle program was created to benefit Neiman’s best, most valuable customers. The program is a Type IV customer loyalty program, which uses customer’s information (i.e. – contact information, purchase history and personal preferences) to distribute specific offers and mailings personalized to clientele preferences. Members receive points (towards a reward) based on the amount spent with Neiman’s. InCircle’s terms and conditions outline the details of the program: “The InCircle® 2013 program gives you two points for virtually each dollar charged on your Neiman Marcus or Bergdorf Goodman credit card (1 dollar = 2 points). Based on your spend during the InCircle 2013 program year (January 1 through December 31, 2013), you will automatically be recognized at the level you have obtained”. Members can also earn points by using their American Express® Platinum or Centurion® card on Neiman Marcus purchases, however only one point is attributed per dollar spent and there are no bonus-point opportunities. Here, Neiman’s is encouraging customers to solely use their Neiman Marcus or Bergdorf Goodman credit card to maximize points earned. The program includes six different “benefit” levels, or tiers, which include Circle One through Circle Four, the President’s Circle, and for customers spending $600,000 or more, the Chairman’s Circle. Neiman Marcus stands by their InCircle motto, “The more you shop, the more benefits you receive”. For example, the President’s Circle rewards offer five points for every dollar spent, a $150 “perk” card, InCircle Access (Customized travel, fashion sourcing and tickets to dining reservations), gift packaging for purchases over $25, complimentary online 2-day shipping, and “one-of-a-kind private offers”. These perks far outshine the lower Circle levels that offer minimal perks. The opportunity to receive additional benefits, along with added prestige, encourages lower tiered members to spend more. Additionally, the program thanks Neiman’s most profitable customers for their loyalty, which further develops close relationships. A highly valued InCircle’s perk is the opportunity to attend exclusive events held in-store for all program members, regardless of rank. These lavish events include fashion shows, food, DJs, exceptional service, early or exclusive access to promotions, meet and greets with designers, and more. One client blogged, “I immediately was immersed in what felt like a private party with exceptional service.” (Collins, 2011). These private, complimentary events are for InCircle members only. Simply signing up for the loyalty program gives customers access to these luxurious, exclusive offers. Neiman’s then gains the benefits of collected customer data, while enticing shoppers to engage with the company more. Neiman Marcus thrives on its rich history delighting and befriending customers. The company boasts an environment rich with valuable, loyal, long-life customers and employees. Their dedication to building relationships and their appreciation for their employees and customers have set them up for a long road of success in the luxury retail field. Works Cited Blair, Adam. "Neiman Marcus Deploys Smartphones to 4,000 Full-Line Store Associates." Retail Info Systems News. 6 3, 2012. http://risnews.edgl.com/retail-news%5CNeiman-Marcus-Deploys-Smartphones-to-4,000Full-Line-Store-Associates80494 (accessed 7 23, 2013). Collins, C. (2011, September 19). Dallas fno: An exclusive look. Retrieved from http://lolomag.com/2011/09/dallas-fno-at-neiman-marcus/ Cornell-Mayo Associates. "Cornell_mayo Associates has Added the Rollout of the Neiman Marcus Retail Chain to its List of Successful Retail POS Installations." CMA Newsroom. 10 21, 2004. http://www.cornellmayo.com/pr_selection.htm?nm_pr1 (accessed 7 23, 2013). Ephron, Amy. "Secret Sharer." New York Times. 11 22, 2012. http://tmagazine.blogs.nytimes.com/2012/11/22/secret-sharer/?_r=1 (accessed 7 29, 2013). Dewar, Robert D. Customer Focus at Neiman Marcus: "We report to the Client". Casey Study, Harvard Business Review, 2006. Graj, Simon. "The Best Sales Associate for a Retail brand? Educated...Not Trained." Forbes. 3 25, 2013. http://www.forbes.com/sites/simongraj/2013/03/25/the-best-sales-associate-for-a-retail-brand-educatednor-trained/ (accessed 7 26, 2013). Kats, Rimma. "Luxury Institute exec: Humanize First, Mobilize Second." Luxury Daily. 10 16, 2012. http://www.luxurydaily.com/luxury-institute-exec-humanize-first-mobilize-second/ (accessed 7 23, 2013). Luxury Institute. "Ultra-Wealthy Shoppers Flock to Nordstrom but Barneys, Bergdorf, and Neiman Cultivate Relationship Business." Luxury Institute News. 6 20, 2013. http://luxuryinstitute.com/blog/?p=2525 (accessed 7 23, 2013). —. "Ultra-Wealthy Shoppers Spend More on Luxury Where They Maintain Personal Relationships." Luxury Institute News. 10 11, 2012. http://luxuryinstitute.com/blog/?p=2205 (accessed 7 23, 2013). Neiman Marcus. "The Neiman Marcus Story." Careers at Neiman Marcus Group. 2007. http://www.neimanmarcuscareers.com/story/timeline.shtml (accessed 7 31, 2013). Marcus, Stanley. Minding the Store. Denton, Texas: University of North Texas Press, 1997. Mattioli, D. (2011, October 27). Hoity-toity to hoi polloi: Neiman takes more plastic . Retrieved from http://online.wsj.com/article/SB1000142405297020450530457700010335567 O'Donnell, Jayne, and Megan Kowalski. "Saks, Neiman Marcus seek capital, consider deals." USA Today. 7 15, 2013. http://www.usatoday.com/story/money/business/2013/07/11/saks-fifth-avenue-neiman-marcusluxury-shopping/2492905/ (accessed 7 23, 2013). Reagan, Brooke. "Neiman Marcus Recipe for Success Blends Tradition with Innovation." SMU Fashion Media. 11 26, 2012. http://www.smufashionmedia.com/neiman-marcus-recipe-for-success-blends-tradition-andinnovation/ (accessed 7 23, 2013).