Website Usability Research: MarketingPower.com

advertisement

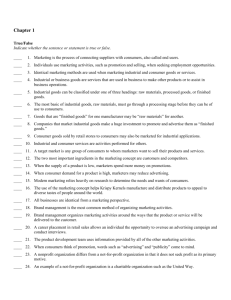

AMA Content Needs Assessment Nancy Pekala 11.22.11 1 2 Project Overview Methodology/Analysis Respondent Profile General Content Needs Specific Content Needs Next Steps PROJECT OVERVIEW Objectives Overall, this study was designed to assess the content needs and interests of marketing professionals in order to tailor AMA content for its website, www.marketingpower.com, as well as for other information delivery channels. More specifically, the study was designed to: Describe this population in terms of marketing role, marketing specialty, industry affiliation and AMA engagement Determine preferences among marketing topics and sub-topics Identify current and preferred sources for marketing-related content Discover currently used and preferred delivery channels for marketing-related content by topic Measure how often, and determine for what purposes, respondents seek marketing content 3 4 Methodology Research was conducted among three key stakeholder groups AMA members (1,081 respondents) Registered users of the AMA website (519 respondents) Sample of marketing professionals who are neither members nor site registrants (262) The only respondent qualification was the requirement to be aged 18 years or older. Surveys were conducted between October 10th and October 27th, 2011. The survey took on average 30 minutes to complete. . 5 The survey employed choice-based MaxDiff methodology which required respondents to indicate the topic of most interest and least interest to them among a subset (ranging from 6 to 25) of a complete list of topics (17). To uncover any unmet needs, each MaxDiff exercise was followed up with an open-ended question regarding any other topics of interest. Each respondent participated in a general MaxDiff exercise and up to two sub-topic MaxDiff exercises Because the MaxDiff form of data collection provides respondent ease of use, greater discrimination among subsets of items, robust scaling and reduction of scale use bias, it was an appropriate methodology for the AMA’s content subject matter objectives. 6 Online surveys were completed by 1,862 respondents. By Marketer Segment: Academic (259) Marketer (993) Researcher (266) Student (263) Other (81) By AMA Relationship: AMA Member (1,081) Website Registrants (519) Non-Member/Non-Registrant (262) 7 Respondent Population More than half of the study’s respondents described themselves as marketers, and the overwhelming majority of remaining respondents were evenly distributed among academic and research fields. The most common job functions among respondents included Marketing Strategy/Planning, Marketing Communications, Brand/Product Management and Marketing Research. Researchers were more likely to identify with the Marketing Research specialty only. AMA members were more likely to specialize in Brand/Product Management or Advertising than non-members. Higher Education and Professional Services were the most common industries named among total respondents. The top 5 industries (Higher Ed, Professional Services, Nonprofit, Technology and Marketing Research ) represented half of all respondents. Those with 10-19 years of experience are more likely to work in Professional Services than any other group. Those with 5 or fewer years of experience are more likely to work in retail or hospitality industries than others. Nearly 6 in 10 respondents were AMA members. Academics and students are more likely to be members than marketers and researchers. Non-members were more likely to be specialist marketers or client-side researchers. Approximately two-thirds of the non-member respondents have accessed AMA’s online offerings and/or are registered with the AMA website. About one-third have attended a local AMA chapter event, while one in seven subscribes to an AMA publication. 8 EXECUTIVE SUMMARY: GENERAL CONTENT NEEDS 9 Respondents regularly search for online marketing content. Three-fourths seek marketing content at least once a week while half of respondents do so more than once a week. Students are more likely to seek out marketing-related content to share or find new employment opportunities. One in five AMA members seeks out the latest AMA offerings, specifically. Top reasons for seeking marketing content are different for each marketing role group, although staying current on industry advancements is popular among academics, marketers and researchers. Academics spike on keeping up-to-date on the latest thought leadership in marketing. Marketers spike on gathering information on industry best practices. 10 Across all roles, marketers seek content to stay current on industry advancements, best practices and the latest thought leadership. All Purposes for Seeking Marketing Content Marketing Role TOTAL Academic Marketer Researche r AMA Relationship Student Other Member Nonmember A B C D E F G Total Answering 1860 259 992 265 263 81 1081 779 To stay current on industry advancements 78% 71% 82%ADE 82%ADE 65% 70% 76% 79% To gather information on industry best practices 74% 64%D 82%ACDE 75%ADE 55% 57% 73% 75% To keep up-to-date on the latest thought leadership in marketing 73% 69%D 80%ACDE 69%D 58% 57% 72% 73% To learn about new products and/or techniques 70% 54% 74%ADE 79%ADE 63%A 59% 70% 69% To pursue professional development opportunities (training, certifications) 43% 31% 48%ACE 40%AE 44%AE 25% 43% 43% To share or find new employment opportunities 28% 19% 28%ACE 18% 47%ABCE 17% 28% 27% To connect and collaborate with fellow marketers 27% 25%E 28%E 23%E 31%CE 12% 27% 26% To locate vendors or service providers 20% 10% 24%AD 26%AD 10% 23%AD 19% 22% To learn about the latest AMA benefits/offerings 18% 13% 17% 14% 32%ABCE 16% 21%G 13% For teaching material/class preparation General research For a specific project Other 2% 1% 1% 1% 11%BCDE 2%E 0% 1% 0% 0% 1% 1% 0% 1% 1% 1% 3%BCE 0% 1% 2% 0% 0% 1% 2% 3% 1% 0% 1% 2% 0% 1% 1% Testing at 95% significance for A/B/C/D/E F/G 11 What one marketing-related question or challenge would marketers most like to see addressed? Overall, marketers expressed a desire for topics related to marketing research, measures, analytics, or social media. Although more common among researchers, market research topics were popularly cited among all respondent groups. Social media was more commonly cited by marketers than by other groups. Those with less than 5 years of marketing experience are more likely than those with 5+ years experience to want to see careers addressed. 12 Industry experts are perceived as the most valuable source of marketing content amongst all marketer roles. One-third of respondents regard Industry Experts as the most valuable source of marketing content. This is especially true for marketers and researchers. 13% of respondents identified AMA-developed content as most valuable source of content 11% of respondents identified social media as the most valuable source of content. This is especially true for marketers with 5 or fewer years of experience. The vast majority (71%) most commonly use search engines to locate marketing content Respondents also commonly use third-party web sites (60%), business online communities (54%), referrals by colleagues (37%) and social networks (45%) to locate marketing content Respondents prefer to use third-party websites (51%), business online communities (50%), search engines (47%) and referrals by colleagues (28%) to gather marketing content Third-party websites are more preferred by researchers than by other groups while social networks are more preferred by students than by other groups. While the use of search engines to locate content is similar across all groups, their use is more preferred by academics and students. 13 Marketers seek out a variety of general and specific non-AMA content including social networks and publications. Those working for smaller companies (1 - 49 employees) are more likely than those working for companies with 50 or more employees to use more general sources. About one in 20 respondents use AMA content only. General mentions of non-AMA sources of content included websites, publications, blogs, books, networking and others. Specific mentions of non-AMA sources of content were varied and included LinkedIn, Ad Age, social networks and others. AMA members are more likely than non-members to use books and networking as sources of non-AMA marketing-related content. Researchers are much more likely to use Quirks than are other groups. Those with less than 10 years of marketing experience are significantly more likely than those with 10 years or more experience to use Twitter and Facebook. 14 Marketers across all roles seek content in professional social networks and business publications. Non-AMA Sources of Content Used – Specific Mentions TOTAL Total Answering Marketing Role AMA Relationship Academic Marketer Researcher Student Other Member Non-member A B C D E F G 259 993 266 263 81 1081 781 43% 47% 46% 1862 ABDE 48% A Specific Net 46% 38% 45% 61% LinkedIn 6% 2% 7%A 11%ABD 5%A 5% 6% 7% Ad Age 5% 6% 4% 3% 8%C 4% 7%G 4% Facebook/twitter 5% 2% 5%A 4% 8%A 4% 5% 5% Marketing Profs 4% 1% 6%ACD 2% 0% 2% 3% 5% Quirks 3% 1% 1%DE 20%ABDE 0% 0% 4% 3% Wall Street Journal 3% Harvard Business Review 3% Mashable G 1% 2% 4% 5% 4% 3% 3% 3% 2% 5% 2% 3% 3% 2%E 3%CE 1% 5%ACE 0% 3% 2% Hubspot 2% 1% 4%ACD 0% 0% 2% 2% 3% Marketing Sherpa 2% 0% 3%ACDE 1% 1% 0% 1% 3%F Emarketer 2% 2%D 2%D 1% 0% 2% 1% 2% Other – Specific 31% 24% 30%A 38%ABE 32% 26% 31% 31% Testing at 95% significance for A/B/C/D/E F/G 8% BCD 1% 15 Content Delivery Channel Preferences Reading text-based and subscription-based materials are the most common delivery channels for marketing content, both currently used by more than eight in ten respondents, although preferred by only two-thirds. Conversely, although only half of respondents attended an in-person event in the last three months, this delivery channel is preferred by two-thirds of respondents. Nearly 7 in 10 marketers prefer this method for one or more marketing topic areas. Those with 10+ years experience are more likely to prefer subscriptions, while those with less than 10 years experience are more likely to prefer in-person events. Students are less likely to access marketing content in the last 3 months Non-members are more likely to have watched a webcast/virtual event than members in last 3 mos. 16 Text-Based Materials Text-based materials, followed by subscription publications, are the channels of choice for most topics by more than half of respondents. Academics, in particular, favor subscriptions for a range of topics. Text-based channels are more preferred for marketing measurement, marketing research and product development topics. In-Person Events In-person events and virtual events are preferred by approximately four in ten respondents for each topic, while videos are preferred by between one-quarter and onethird of respondents. In-person events are the preferred channel for industry-specific marketing topics. In addition, it is the preferred channel for sales, strategy and teaching topics. AMA members are more likely to prefer in-person events than non-AMA members. Students are more likely to prefer in-person events in general, but researchers are more likely to prefer these events for Marketing Research than are those in other roles. 17 Virtual Events Virtual events are more preferred for online marketing and mobile marketing topics. Marketers prefer to have content delivered virtually, more so than academics and students. Podcasts Podcasts are more of a niche source of content, preferred by a much smaller (one in five) subset of respondents for any one topic. Students prefer podcasts for Mobile Marketing, as compared to marketers. Video Academics and students favor Video for selected topics over researchers and marketers. 18 EXECUTIVE SUMMARY: SPECIFIC CONTENT NEEDS 19 MaxDiff Results: General Marketing Topic Preferences Respondents were equally interested in general and industry-specific marketing topics. Researchers are slightly more interested in industry-specific topics than are other groups. Strategy was the general topic of most interest, followed by Branding, Consumer Behavior, Strategy and Online Marketing. 20 When asked what marketing topics interested them most via a menu-driven methodology, marketers identified Branding, followed closely by Consumer Behavior, Strategy and Online Marketing. Topics of least interest to respondents included Teaching and Professional Services. 21 Topics of interest varied by marketing role and AMA affiliation. Top Topics By Role: Marketer (Branding, Online Marketing, Strategy, Consumer Behavior/Marketing Measurement) Academic (Consumer Behavior, Branding, Teaching/Strategy, Marketing Research) Researcher (Marketing Research, Consumer Behavior, Branding, Strategy, Measurement) Student (Branding, Consumer Behavior, Advertising, Strategy, Online Marketing/Marketing Research) Top Topics By AMA Relationship AMA Member (Branding, Consumer Behavior, Strategy, Online Marketing, Advertising) Non-Member (Branding, Strategy, Consumer Behavior, Online Marketing, Marketing Measurement) 22 Topics of Least Interest By Role:| Marketer (Teaching, Shopper Insights, Professional Services, Green Marketing, Sales) Academic (Professional Services, Sales, Direct Marketing, Industry-Specific Marketing, Shopper Insights) Researcher (Teaching, Sales, Direct Marketing, Professional Services, Green Marketing) Student (Professional Services, Teaching/Marketing Measurement, Direct Marketing, Shopper Insights/Industry-Specific Marketing) Topics of Least Interest By AMA Relationship AMA Member (Teaching, Professional Services, Shopper Insights, Sales, Green Marketing) Non-Member (Teaching, Professional Services, Sales, Shopper Insights/Green Marketing, Global Marketing) 23 The industries of most interest to respondents were Health Care and Advertising, followed by the grouping of Consumer Products/Packaged Goods, Technology and Nonprofit. 24 Consumer behavior, branding and strategy tops the list of topics of interest across all marketing roles. Marketing Topics of Interest Marketing Role TOTAL AMA Relationship Academic Marketer Researche r Student Other Member Nonmember Total Answering 1860 A 259 B 992 C 265 D 263 E 81 F 1081 G 779 Branding Consumer Behavior Strategy Online Marketing Marketing Research Marketing Measurement Advertising Mobile Marketing Industry-Specific Marketing Product Development/Innovation Direct Marketing Global Marketing Green Marketing Shopper Insights Sales Professional Services Teaching Other 68% 64% 63% 59% 52% 50% 50% 43% 42% 35% 34% 31% 26% 24% 23% 19% 17% 5% 59% 63% 54% 45% 52%B 41%D 44% 34% 21% 30% 20%C 41%BC 34%BC 22% 20%C 16% 54%BCDE 10%BCD 74%ACD 60% 71%ACD 72%ACDE 43% 60%ACD 52%ACE 52%ACD 55%ACDE 33% 48%ACDE 29%C 24%C 20% 26%AC 22%ACD 10% 6%D 55% 77%ABDE 54% 37% 92%ABDE 52%AD 38% 31% 37%AD 48%ABD 12% 23% 17% 39%ABDE 11% 14% 7% 3% 67%C 66% 50% 46%C 46% 21% 62%ABCE 29% 24% 37% 22%C 39%BC 34%BC 24% 31%AC 13% 21%BC 2% 68%C 63% 64%D 59%ACD 47% 49%D 37% 41%D 35%A 36% 30%C 31% 23% 19% 27%C 31%ACD 15% 6% 69% 64% 62% 55% 50% 45% 54%G 40% 40% 37% 31% 34%G 26% 22% 24% 19% 18% 5% 66% 64% 65% 64%F 54% 57%F 44% 46%F 46%F 33% 38%F 28% 25% 25% 23% 20% 16% 5% Testing at 95% significance for A/B/C/D/E F/G 25 General Topic Sub-topic of Most Interest Area(s) of Additional Interest Advertising Creative Measures; Social Media Branding Brand Positioning Brand Reputation/Image/Awareness Consumer Behavior Behavior Drivers Measures Direct Marketing Direct Digital Marketing Social Media; Measurement Global Marketing Global Marketing Management Multicultural Marketing Green Marketing Sustainability Measures/Research Industry-Specific Marketing Best Practices Varied Marketing Measurement ROI Assessment Analytics Marketing Research Segmentation Methodology/Research Design Mobile Marketing Best Practices General Know-how Online Marketing Online Communities SEO/Online Advertising Product Development Product Strategy Product Planning and Management Professional Services Marketing Strategy Consulting/Strategic Alliances; Branding Sales Sales/Marketing Alignment Varied Shoppers Insights Targeting/Segmentation Customer Behavior/Engagement Strategy Strategic Planning Implementation; Brand Positioning Teaching Case Studies Networking 26 Respondents were asked to identify topic suggestions for each primary content category. General Topic Sub-Topics of Highest Interest Specific Topic Gaps Advertising Creative (18%) Digital (16%) Media Planning (10.9%) Mobile (10.0%) Print (8.8%) Branding Brand Brand Brand Brand “Effectiveness and ROI of advertising.” “Metrics on all of the above.” “Results!” “Stats on where advertising is happening as a whole and by industry.” “Social media, social marketing and social media advertising.” “Interactive advertising - click through rates, cost per click etc.” “Free events.” “Charitable advertising.” “No cost advertising.” “Migration of spending from traditional to new age media.” “Maximizing word of mouth advertising.” “Brain-based marketing.” “Ways to communicate the value of our brand to those who have never heard of us.” “Brand reputation management.” “Establishing a trusted brand.” “Social media tactics (effect, or lack of on branding).” “Social marketing sites, ad rates, effectiveness in a comparison and evaluation of all.” “Competitive analysis of other brands.” “Brand differentiation, mission and vision.” “Brand partnerships.” “Color and visual element in branding.” “Demographic-targeted branding.” Consumer Behavior Behavior Drivers (15%) Customer Experience (12.7%) Customer Insights (12%) Brand Positioning (11.9%) Loyalty (8.8%) Positioning (12%) Mgmt. (10.9%) Engagement (9.6%) Experience (9.4%) “Qualitative measures to capture consumer behavior.” “Perception measurement.” “How do you measure/analyze customer behavior.” “Customer engagement, community growth, community engagement, reach & effect, social media marketing motivators.” “Consumer trends.” “Consumer trust.” “B2B marketing.” “Brand equity.” “Customer loyalty programs. Reputation programs in communities.” 27 General Topic Sub-Topics of Highest Interest Specific Topic Gaps Direct Mktg. Direct Digital (17.1%) Email Mktg (15.9%) Segmentation (12.7%) Response Rates (12.4%) Measurement (11.2%) “Social networking and how to best use it for my company.” “Digital engagement strategies in a community or social network context.” “Content development.” “Content strategies and formats.” “Business to business direct mail, and decision-making behavior.” “B2B Content.” “Direct digital marketing.” “Landing pages.” “Linking website to direct efforts.” “Budgeting campaigns.” “Case studies.” “Cross-media measurement/ compilation.” “Customer lifetime value analysis.” Global Mktg. Global Mktg. Measurement (13.9%) Multicultural Mktg (13.3%) Global Mktg Research (11.2%) Global Brands (10.9%) Mktg Entry Strategies (10.5%) “Building successful multicultural marketing teams.” “Multicultural psychographics.” “Multinational demographic trends.” “Communicating to a global audience.” “Long term growth strategy in emerging markets.” “Global strategic marketing.” “Distribution strategies.” “Global distribution, managing CRM across borders.” “Altering a product from the home country to a foreign market.” “Brand image transfer between mother and host country.” “Cross-border legal issues and implications.” Green Mktg. Sustainability (23.8%) Social Responsibility (19.5%) Green Brands (16.5%) Design/Packaging (13.5%) Organizational Culture (11.7%) “How to incorporate it in the plan and how to measure its effectiveness.” “How to truly measure and report on the environmental impact (or lack thereof) of a specific program.” “Consumer research to understand demand for ‘green marketing’.” “True cost/benefit analysis, most models show short-term measures.” “How to show the value of green products.” “Product development & trends.” “Design & packaging.” “Grants for green initiatives.” “Green brand positive sentiment analytics.” “Innovation and sustainability.” “Market growth, statistics.” 28 General Topic Sub-Topics of Highest Interest Specific Topic Gaps IndustrySpecific Best Practices/Case Studies (13.9%) Mktg Plans (13.7%) Market Differentiation (13.5%) Engaging Influencers (12.4%) Branding (11.5%) “Social media strategies/marketing.” “Product development/management as it relates to marketing.” “Brand/customer loyalty.” “Consumer segmentation and decision influencers and payer segmentation.” “Behavioral targeting, online segmentation.” “Marketing in the non-profit environment.” “Benchmark data.” “Building thought-leadership.” “Developing and publishing Content.” “Philanthropic integration.” “Planning and budgeting.” Marketing Measurement ROI Assessment (18.2%) Customer Analytics (17.2%) Measurement Methodologies (16.7%) Social Analytics (13.7%) “Cross media analytic compilation.” “Social media analytics.” “Web (e.g. Google) analytics to understand what each metric means.” “Top analytic measurements without going overcomplicating matters.” “CRM/Social CRM.” “SEO.” “Effective CRM tools.” “Advertising effectiveness.” “Customer lifetime value.” “Performance modeling.” “Understanding relationship between marketing and sales ROI measurements.” Mktg Research Segmentation (7.2%) Statistical Analysis (6.7%) Quantitative Data Collection (6.4%) Market Studies (6.2%) Psychographic Research (6.0%) “Methodological design.” “Data collection methods, data analysis, qualitative data methodology, psychological measurements.” “Research design.” “Research on social media effectiveness and ROI.” “More on social media research.” “Statistics on consumer behavior integrated.” “Marketing research in B2B marketing.” ‘B2B promotional ideas not related to pricing discounts.” “Cognitive analysis of questionnaires, wording, quality control, professional standards.” “Inexpensively avoiding sample bias.” “International recruiting and research.” 29 General Topic Sub-Topics of Highest Interest Specific Topic Gaps Mobile Mktg Best Practices (19.3%) Websites (13.8%) Measurement (12.4%) Applications (12%) Mobile Commerce (11%) “Beginner/General info.” “Differences between a Mobile website and application.” “How to get started in data collection.” “Market Research through Mobile.” “Mobile analytics/ROI.” “Mobile research/insights.” “Consumer preferences/engagement.” “I would find gaming interesting if it helped promote my brand and it has humor.” “Advertising.” “Eye tracking.” “B2B Mobile behaviors.” Online Mktg Online Communities (11.5%) Social Networks (11.4%) Social Analytics (10.6% SEO (9.4%) WOM Marketing (8.5%) Online Adv (8.1%) “International SEO, web localization.” “Search engine marketing, QR codes.” “Online advertising benchmarks.” “Digital asset management systems website UX/UI design.” “Email marketing, lead generation.” “Viral marketing, Content marketing.” “Behavioral tracking.” “Blogs, Content management systems, online communities, social networks, virtual events, word of mouth marketing.” “Determining social ROI.” “Innovation/co-creation with online communities.” Product Development Product Strategy (20%) Ideation/Concept Development (19.7%) Mktg Growth (19%) Mktg Research (13%) “Are there trends or reasons why products succeed or fail?” “Product launch planning and execution.” “Product life cycle management.” “Advertising and promotions.” “Applying marketing research to product development. “Idea generation.” “Collaboration/interaction with customer.” “Customer insights.” “Competitive analysis.” “Effective techniques to using social media to determine product demand.” “Improved ways to test new concepts and products.” 30 General Topic Sub-Topics of Highest Interest Specific Topic Gaps Professional Services Mktg Strategy (27.1%) Competitive Differentiation (23.5%) Relationship Mgmt (16.9%) Business Development (15.5%) “Consulting services.” “Consulting to green companies or to companies that want to focus on sustainability.” “Key account strategy.” “Networking strategy/strategic alliances.” “Branding of professional services.” “Customer participation, process management.” “Innovative techniques for social media engagement and ideas for email marketing when the products are the same time after time.” “B2B professional services marketing strategy.” “Competitive advantage/differentiation.” “New service development.” Sales Sales/Mktg Alignment (16.5%) Sales Content (12.4%) Sales Techniques (12%) Lead Generation (12%) Sales Promotion (10.6%) “Sales process and strategies.” “Selling to nonprofits. Selling consulting (non-tangible products).” “Customer loyalty development.” “Motivation of sales team integration of mixed media in the sales tool kit.” “Sales/marketing alignment/collaboration.” “After sale made-sales follow up/negotiation skills.” “Best practices and innovation of the sales funnel.” “Forecasting.” “Proposal/presentation management.” Shopper Insights Targeting/Segmentation (25%) Loyalty Mktg (21.7%) Retail Analytics (13.3%) Coupons/Pricing (9.7%) “Consumer value perception and in-store placement.” “Customer engagement (motivation).” “Shopper behavior consumer choices process.” “Decision tree analysis and first moment of truth experience at shelf.” “Competitive analysis.” “In-store demonstrations and events.” “Impact of online research on store visit.” “Mystery shopping, online shopping vs. retail/online behavior.” “Pricing strategies.” “Psychology - how specifically products/services are being altered to allure consumers (color, packaging, design, placement, etc. ).” 31 General Topic Sub-Topics of Highest Interest Specific Topic Gaps Strategy Strategic Planning (23.1%) IMC (17.9%) Competitor Analysis (16.2%) Segmentation (12%) “Strategy implementation and evaluation.” “Marketing business strategy execution and value driven results.” “Bringing together business and brand strategy.” “Brand vs. Private label.” “Positioning.” “Scenario planning/planning cycle.” “The specific ‘how to’ of strategic planning.” “Relationship marketing.” “Portfolio architecture consumer insights.” “Focusing on specific customers.” “Brand differentiation in a highly competitive market.” “Critical challenges in corporate competition.” “When new opportunities blow your strategic plan out of the water.” Teaching Case Studies (17.7%) Tools/Techniques (14.8%) Course Materials (14%) Personal Branding (10.5%) Career Development (10%) “Mentors.” “Networking with other educators.” “Corporate alliances.” “Current events professional networking opportunities between faculty students and marketing professionals.” “Case studies personal branding.” “Best practices in classroom management.” “Career paths and job market for marketers.” “How to make transition from corporate world to academia - how to teach.” “Marketing in interviews.” “Innovation and development.” “New breakthroughs in marketing and retailing for college student textbooks.” “Cross-cultural differences.” “Developing small group exercises.” “Exams, cheating, ethics.” “Role play study tour how to motivate student to read.” 32 SUMMARY OF KEY CONCLUSIONS 33 Profile 1,862 total respondents 1,081 AMA members/781 non-members Marketers (993); Researchers (266); Students (263); Academics (259); Other (81) Most common job functions: Strategy/Planning, MarCom, Brand/Product Management; Marketing Research Most common industries: Higher Ed; Professional Services; Nonprofit: Technology; Marketing Research Non-Members: Job Function: Specialist marketers; client-side researchers 2/3 access AMA online offerings/site registrant 1/3 attended local chapter event 1 in 7 subscribes to AMA publication 34 Top Reasons for Seeking Marketing Content Members (M)/Non-Members (NM) To stay current (M-76%)(NM-79%) To gather info on industry best practices (M-73%) (NM-75%) Keep up-to-date on thought leadership (M-72%) (NM-73%) Learn about new products/techniques (M-70%) (NM-69%) Professional development (training/certifications) (M-43%)(NM-43%) Academic Marketer Researcher Student Other Stay current on industry advancements 71% 82% 82% 65% 70% Gather info on best practices 64% 82% 75% 55% 57% Keep up-to-date/thought leadership Learn about new products/techniques Pursue professional development 69% 80% 69% 58% 57% 54% 74% 79% 63% 59% 31% 48% 40% 44% 25% 35 Top Marketing Challenge Marketers: Topics related to research, measures, analytics; social media Social Media (especially marketers) Research (especially researchers, but across all respondent groups) Careers (especially those with <5 years of experience) Preferred Sources of Content Industry experts (33% of respondents) AMA-developed content (13% of respondents) Social media (11% of respondents; especially <5 yrs of experience) 36 Preferred General sources (especially companies with <50 employees) Websites, publications, blogs, books, networking AMA members more likely to use books and networking Twitter/Facebook (especially those with <10 years of mktg experience) Top specific sources (varied among marketing role) Non-AMA Sources of Content Academics (WSJ; Ad Age; HBR; LinkedIn/FB/Twitter/Mashable/Emarketer) Marketers (LinkedIn; Marketing Profs; FB/Twitter; HubSpot/Ad Age) Researchers (Quirks; LinkedIn; FB/Twitter; HBR; Ad Age) Students (Ad Age; FB/Twitter; LinkedIn; Mashable) AMA content only (1 in 20 respondents) 37 Top Marketing Topic Preferences (all respondents) All All Respondents Marketing Role Academics Marketers Researchers AMA Relationship Students Member Non-Member 1 Strategy Consumer Behavior Branding Research Branding Branding Branding 2 Branding Branding Online Mktg. Consumer Behavior Consumer Behavior Consumer Behavior Strategy 3 Consumer Behavior Teaching Strategy Branding Advertising Strategy Consumer Behavior 4 Strategy Strategy Consumer Behavior Strategy Strategy Online Mktg. Online Mktg. 5 Online Mktg Research Measurement Measurement Online Mktg Research Advertising Measurement 38 Content Delivery Channels (Usage) Test-based and subscription-based materials most common channel (used by 8 in 10 respondents) Half of respondents attended in-person event in previous 3 months Non-members more likely than members to have attended webcast or virtual event in previous 3 months (59%) Content Delivery Channels (Preferences) Text-based content and in-person events preferred by 66% of respondents; 7 in 10 prefer events for 1 or more topics Marketers with 10+ years of experience prefer subscriptions; <10 years prefer in-person events 39 Content Delivery Channels (By Topic) Text-based channels preferred for marketing measurement, research and product development In-person events preferred for industry-specific, sales, strategy and teaching topics Virtual events preferred for online and mobile marketing topics Marketers prefer content delivered virtually more than academics/students Academics/students prefer Video for selected topics AMA members (especially students) prefer in person-events Researchers prefer in-person events for research topics Top Industries of Interest (all respondents) Equal (50/50) interest in general and industry-specific topics Researchers slightly more interested in industry-topics Top industries of interest: Heath Care (34%); Advertising (32%); CPG (29%); Technology (28%); Nonprofit (28%); Professional Services (26%) Preferred Methods for Locating Content Third-party websites (51%-especially researchers); business online communities (50%especially students); search engines (47%--especially academics and students); referrals by colleagues (28%) 40 NEXT STEPS 41 Those interested in marketing have diverse marketing content interests. Neither general nor specific topics should be featured over the other and both should be delivered in multiple channels including text- and subscription-based materials, in-person events and webcasts/virtual events. It is important to consider that while marketers tend to use text-based materials, their preference for a number of topics includes a mix of virtual channels. Marketers are interested in obtaining a deeper understanding of the consumer, designing strategically-sound marketing programs, creating brand value for buyers and sellers, levering the Internet creatively and measuring the success of marketing efforts. Thus, Consumer Behavior, Strategy, Branding, Online Marketing, Marketing Research and Measurement and Social Media should all be primary focus areas of content for the AMA. AMA content featuring industry experts would be perceived especially valuable by marketers. Marketers have specific preferences as it relates to preferred delivery channels. Future content plans should take into consideration preferences for delivery channels (by topic) as well as preferred sources of content. 42 Content Needs Assessment Survey Objective: To identify the content needs and preferences of AMA members and the MarketingPower registrant audience. Deliverables: Survey results will help answer questions relating to preferences for content subject matter, formats, delivery mechanisms and objective. Content Audit/ Gap Analysis Objective: To quantify & qualify the Existing inventory of MP.com content assets and determine any gaps in content topics, formats and target segments. Deliverables: An itemization of all MP.com content based on category, topic, format and date. A report indicating Remaining gaps in topics, format or target segment. Heuristic Evaluation Objective: To identify website design and structural challenges impacting user experience. Deliverables: An evaluation of the following key areas: Home Page, Resource Library, Search Interface, Search Results, Site-Wide and Contextual Navigation. Content Organization Plan Objective: Based on results of Heuristic Evaluation and Content Assessment Survey, identify business requirements for a content & navigation re-organization plan for MarketingPower. Deliverables: A work and cost estimate for re-organization plan based on business requirements provided. 43 Develop Content Gap Analysis based on results of Content Audit and Content Needs Assessment Map existing inventory against identified content needs based on General Topic Category; Published Date and Content Type Share results of Content Needs Assessment and Content Audit with AMA content team Define content areas of opportunity for AMA based on top marketing content topics identified in Content Needs Assessment research Develop Content Strategy Action Plan Map Website Redesign to Content Strategy Plan