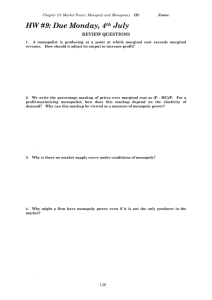

Monopoly

advertisement

Monopoly Monopoly Opposite of PC Occurs when output of entire industry is produced and sold by a single firm referred to as Monopolist Characteristics of Pure Monopoly Single supplier – the firm and the industry are the same. No close substitutes – the product is unique and unlike any others. Price maker – the firm has considerable control over price since it controls the total quantity supplied. Blocked entry – barriers to entry exist because there is no immediate competition. Example railways in Pakistan , PTCL was once a monopoly Barriers to Entry Economies of Scale Legal Barriers to Entry ◦ Patents[ gives right to a firm to produce a product for a given time period] ◦ Licenses[ govt gives licenses e.g. TV channels] Ownership or Control of Essential Resources [e.g. gas reserves] Price Maker Monopoly Price-Setting Strategies ◦ For a monopoly firm to determine the quantity it sells, it must choose the appropriate price. ◦ There are two types of monopoly price-setting strategies: ◦ A single-price monopoly is a firm that must sell each unit of its output for the same price to all its customers. ◦ Price discrimination is the practice of selling different units of a good or service for different prices. Single price monopolist PROFIT DETERMINATION COMPARING COSTS AND REVENUES A single price Monopolist Cost and Demand curve The cost curves[ AVC, ATC] of monopolist are U shaped just like PC firms, because cost depend on law of DR not market structure Monopoly firm is sole the supplier so it faces downward sloping demand, tradeoff between D and P A single price Monopolist Average Revenue When monopoly charges same price over all units sold, AR is identical to price. The market demand curve is also firm AR curve AR= TR/Q= [P x Q]/Q so Q cancels out and hence AR= P for single price monopoly A single price Monopolist Price and Marginal Revenue ◦ MR from sale of additional unit of production will be below demand curve ◦ Since the demand curve is negatively sloped hence the prices must be lowered on all units to sell an extra unit. Price and Marginal Revenue Marginal Revenue is Less Than Price • A Monopolist is Selling 3 Units at $142 • To Sell More (4), Price Must Be Lowered to $132 • All Customers Must Pay the Same Price • TR Increases $132 Minus $30 (3x$10) $142 132 122 112 Loss = $30 D 102 Gain = $132 92 82 0 1 2 3 4 5 6 Price and Marginal Revenue Marginal Revenue is Less Than Price • A Monopolist is Selling 3 Units at $142 • To Sell More (4), Price Must Be Lowered to $132 • All Customers Must Pay the Same Price • TR Increases $132 Minus $30 (3x$10) • $102 Becomes a Point on the MR Curve • Try Other Prices to Determine Other MR Points $142 132 122 112 Loss = $30 D 102 Gain = $132 92 82 MR 0 1 2 3 4 5 6 The Constructed Marginal Revenue Curve Must Always Be Less Than the Price Total, Average and Marginal Revenue Price P=AR Quantity Total Revenue TR= T x Q Marginal Revenues 9.1 9 81.9 9 10 90 8.1 8.9 11 97.9 7.9 Price elasticity and MR As noted earlier, since the demand curve facing a monopoly firms is downward sloping, MR < P MR > 0 when demand is elastic MR = 0 when demand is unit elastic MR < 0 when demand is inelastic Monopoly Revenue and Costs Demand, Marginal Revenue, and Total Revenue for a Pure Monopolist $200 Demand and Marginal Revenue Curves Elastic Inelastic Price 150 100 50 0 MR 2 4 $750 Total Revenue D 6 8 10 12 Total-Revenue Curve 14 16 18 500 250 0 TR 2 4 6 8 10 12 14 16 18 SR Monopoly equilibrium 1. 2. Two rules apply Produce or Not [ if monopolist cannot cover SR variable costs then shut down] If the firm does produce then MC = MR, the monopolist is maximizing profit. MC= MR Because MR< P for a monopoly then MR=MC< P When monopoly firm is in profit maximizing equilibrium ,its MC is always less than price it charges. MR = MC Determines the ProfitMaximizing Output** Elasticity and revenues Monopolist always produce where demand is elastic , MR is positive A profit maximizing monopoly will never sell in the range where demand is inelastic Monopoly profits Three possibilities economic profits Zero profits Losses Profit Maximization $200 By A Pure Monopolist Price, Costs, and Revenue 175 MC 150 125 100 75 Pm=$122 Economic Profit ATC D A=$94 MR=MC 50 25 0 MR 1 2 3 4 5 6 Quantity 7 8 9 10 Zero-profit monopolist Loss Minimization By A Pure Monopolist Price, Costs, and Revenue MC A Pm ATC Loss AVC V D MR=MC MR 0 Qm Quantity Economic Effects of Monopoly Price, Output, and Efficiency Pure Monopoly Purely Competitive Market S=MC MC Pm P=MC= Minimum ATC Pc b c Pc a D Qc MR Qm Qc Pure Competition is Efficient Monopoly Price is Greater Than MC And Is Therefore Inefficient D Supply for monopoly We are not equating p=MR= MC like we did in PC For a monopoly firm there is no unique relationship between markept price and quantity supplied Figure 13.5 Multi-plant monopolist How to allocate production between two or more plants? The given output will be allocated where the MC of plants equate Plant A MC=20 producing 30units Plant B MC=17 producing 25 units Cost reduce by 3 if you reallocate Overall MC for multi plant is the sum of MC curves for its individual plants Long Run Due to barriers to entry no firm can enter the market If monopoly has losses in SR then it can shut down in LR if they are unable to cover Variable costs If profits are earned in SR , they can continue in the LR also due to barriers to entry