Macro_Module_45

advertisement

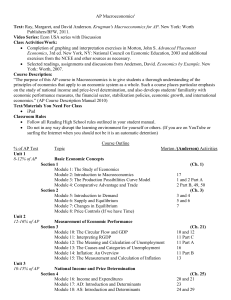

Module 45 Putting it All Together KRUGMAN'S MACROECONOMICS for AP* Margaret Ray and David Anderson What you will learn in this Module: • How to use macroeconomic models to conduct policy analysis • How to approach free-response macroeconomics questions A Structure for Macroeconomic Analysis 1. A starting point 2. A pivotal event 3. Initial effects of the event 4. Secondary and long-run effects of the event Assume that the United States economy is in a long-run equilibrium. (a) Draw a correctly labeled long run graph of aggregate demand and aggregate supply and show each of the following for the United States. The current equilibrium output level, labeled Ye, and the current equilibrium price level, labeled PLe. A Structure for Macroeconomic Analysis 1. A starting point 2. A pivotal event 3. Initial effects of the event 4. Secondary and long-run effects of the event (b) Suppose that consumer confidence in the United States experiences a significant downturn. In the graph drawn in part (a), show the impact of weakened consumer confidence. In the graph, show any changes to the equilibrium price level and the equilibrium output level. A Structure for Macroeconomic Analysis 1. A starting point 2. A pivotal event 3. Initial effects of the event 4. Secondary and long-run effects of the event (c) Assume that the central bank of the United States is prepared to take action to reverse the economic impacts shown in part (b). (i) Should the central bank buy or sell bonds in an open market operation? (ii) How does the central bank’s action in part (c)(i) affect the nominal interest rate? Explain. A Structure for Macroeconomic Analysis 1. A starting point 2. A pivotal event 3. Initial effects of the event 4. Secondary and long-run effects of the event (d) The United States and Mexico are major trading partners. How would the weak consumer confidence in the United States affect the balance of payments current account with Mexico? Explain. A Structure for Macroeconomic Analysis 1. A starting point 2. A pivotal event 3. Initial effects of the event 4. Secondary and long-run effects of the event (e) Consider the foreign exchange market for the United States dollar. Based only upon your response to part (d), how are each of the following affected? (i) The supply of the United States dollar relative to the Mexican peso. (ii) The value of the dollar relative to the peso. The Starting Point •AD/AS Model • Long-run macroeconomic equilibrium • A recessionary gap • An inflationary gap The Pivotal Event •Recession •Inflation •Expectations change •Wealth change •Supply shocks Table 45.1 Major Factors that Shift Curves in Each Model Ray and Anderson: Krugman’s Macroeconomics for AP, First Edition Copyright © 2011 by Worth Publishers The Initial Effect of the Event •The effects of a curve shifting Secondary and Long-Run Effects of the Event •Secondary Effects • Changes in the price level or real interest rate result in changes in some or all of the following: • International Capital Flows • Net Exports • Investment Secondary and Long-Run Effects of the Event •Long-run Effects • Government budget • "Crowding Out" • Capital formation • Economic growth Figure 45.1 (a) Analysis Starting Points Ray and Anderson: Krugman’s Macroeconomics for AP, First Edition Copyright © 2011 by Worth Publishers Figure 45.1 (b) Analysis Starting Points Ray and Anderson: Krugman’s Macroeconomics for AP, First Edition Copyright © 2011 by Worth Publishers Figure 45.1 (c) Analysis Starting Points Ray and Anderson: Krugman’s Macroeconomics for AP, First Edition Copyright © 2011 by Worth Publishers Unnumbered Figure 45.1 Ray and Anderson: Krugman’s Macroeconomics for AP, First Edition Copyright © 2011 by Worth Publishers Unnumbered Figure 45.2 Ray and Anderson: Krugman’s Macroeconomics for AP, First Edition Copyright © 2011 by Worth Publishers Unnumbered Figure 45.3 Ray and Anderson: Krugman’s Macroeconomics for AP, First Edition Copyright © 2011 by Worth Publishers Unnumbered Figure 45.4 Ray and Anderson: Krugman’s Macroeconomics for AP, First Edition Copyright © 2011 by Worth Publishers