Estate of Renee Radziwon-Chapman v. “WildCat Haven” Inc.

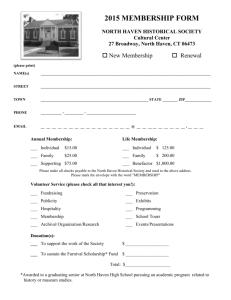

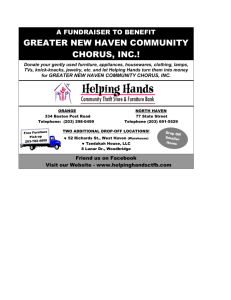

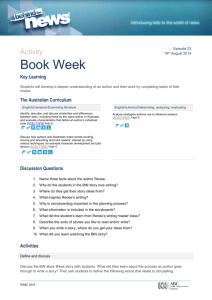

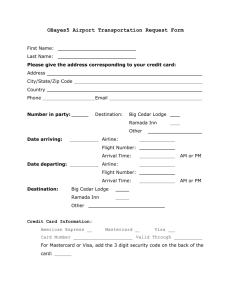

advertisement

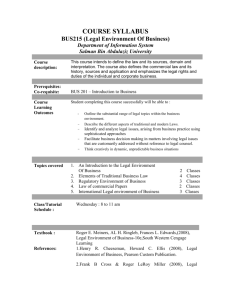

1 Running Head: Estate of Renee Radziwon-Chapman v. WildCat Haven, Inc. The Estate of Renee Radziwon-Chapman v. WildCat Haven, Inc. Brian Tunney Saint Louis University 2 Estate of Renee Radziwon-Chapman v. WildCat Haven, Inc. On the 9th of November, 2013, Renee Radziwon-Chapman was “mauled to death by a cougar while working at a wild-cat sanctuary in suburban Portland” (Wozniacka, 2014, para. 1). Now, the decedent estate of Renee Radziwon-Chapman has filed a lawsuit against WildCat Haven, Inc. and its owners Michael and Cheryl Tuller (Wozniacka, 2014, para. 2). The suit “alleges the sanctuary is liable for the death of Renee Radziwon-Chapman because she was left alone with the animals despite expressing concerns about working solo” (Wozniacka, 2014, para. 2). “Tuller reassured her that she would not be left alone with the cats, which would be a violation of WildCat Haven’s protocols, both written and oral,’ the lawsuit says” (Wozniacka, 2014, para. 10). However, on November 9th the owners Michael and Cheryl Tuller, as well as another employee who normally worked with Radziwon-Chapman were not present at the facility and Michael Tuller “intentionally instructed” Renee to work in the cages alone with the animals which was a violation of protocols (Wozniacka, 2014, para. 12). Although Renee Radziwon-Chapman is deceased her estate is able to sue the sanctuary as well as the owners, Michael and Cheryl Tuller, for “wrongful death, ultrahazardous or abnormally dangerous activity, intentional misconduct, employers’ liability law, and violations of the Oregon Safe Employment Act,” (Wozniacka, 2014, para. 5) because “an estate is a legal entity created as the result of a person’s death” (Internal Revenue Service, 2014, p. 7). The estate of Renee Radziwon-Chapman has standing to sue against the sanctuary and its owners because the estate and its beneficiaries have a stake in the outcome of the lawsuit and the suit involves a specific controversy (Cheeseman, 2013, p. 32). The suit was filed against WildCat Haven, Inc. and its owners Michael and Cheryl Tuller (Wozniacka, 2014, para. 2) because all three parties are liable of negligence which resulted in the 3 Estate of Renee Radziwon-Chapman v. WildCat Haven, Inc. death of Renee Radziwon-Chapman. Michael is responsible for negligence because he breached his “duty of care” to the plaintiff (Cheeseman, 2013, p. 91). When Michael Tuller “intentionally instructed” Renee to work in the cages alone which was a written and oral protocol for the sanctuary he did what “a prudent and reasonable man would not do” according to Anderson, (As cited in Cheeseman, 2013, p. 91) which was instruct an individual to work in a cage alone with several extremely dangerous animals. His instruction to Renee to work alone which was in violation of the sanctuary protocol was the “actual cause” (Cheeseman, 2013, p. 94) because according to the “but for” test, (Cheeseman, 2013, p. 94) had he not told her to work in the cage without another keeper, she would not have been in that situation which resulted in her death. Michael Tuller’s actions meet all the elements of negligence because he owed a duty of care to the plaintiff as a co-worker and as an individual in this society. He breached that duty of care when he “intentionally instructed” her to work in the cages alone, risking her safety. Radziwon-Chapman suffered injury (death). Lastly, Tuller’s act was the actual cause of Radziwon-Chapman’s death. Cheryl Tuller is also responsible for the wrongful death of Renee Radziwon-Chapman because she was negligent in her management of her organization. Cheryl Tuller is listed as the individual, whom the corporation is in the care of (“Tax-exempt organizations”, 2012). Since Cheryl Tuller was the owner of WildCat Haven and employer of Renee, she is subject to the employers’ liability law. The employers’ liability law states that if an injury were to occur, the normal principals of fault could determine the employer’s liability (Alunaru, Wagner, & Oliphant, 2012, p. 472). In this case, “Cheryl Tuller reassured her that she would not be left alone with the cats, which would be a violation of WildCat Haven’s protocols, both written and 4 Estate of Renee Radziwon-Chapman v. WildCat Haven, Inc. oral,” (Wozniacka, 2014, para. 10). Cheryl Tuller owed a duty of care to Renee under the Occupational Safety and Health Act which, during the investigation by the Occupational Safety and Health Administration (OSHA), it was discovered that she breached. “Investigators also said the latches on a smaller cage where cougars were locked out of the larger enclosure were inadequately designed. The ‘light duty substandard gate latch’ was designed for easy operation in backyards, but it was ‘inappropriate for securing dangerous cougars,” (Wozniacka, 2014, para. 15). Tuller breached her duty of care to her employee by violating both “specific duty standards” and “general duty standards” set forth by OSHA. The specific duty standards are rules that were “developed and apply to specific equipment, procedures,” (Cheeseman, 2013, p. 518) in order to protect the employees. The general duty standard is an employer’s duty to provide “a work environment that is free from recognized hazards that are causing or are likely to cause death or serious physical harm to its employees” (Cheeseman, 2013, p. 519) which were not upheld even though concern from Renee was brought to her attention. This breach of care led to the death of Renee Radziwon-Chapman. Cheryl Tuller’s negligence was “proximate cause” in the injury to the plaintiff because it is foreseeable that allowing the keepers to work alone in cages that were inadequately designed to protect the employees could lead to the injury the plaintiff sustained which was death (Cheeseman, 2013, p. 94). Cheryl Tuller’s actions meet the criteria for negligence because she owed a duty of care to Renee Radziwon-Chapman as her employer. She breached that duty because she did not maintain adequate equipment at the sanctuary for the protection of the employee and she allowed violation of protocol because the sanctuary was understaffed. The injury that was incurred 5 Estate of Renee Radziwon-Chapman v. WildCat Haven, Inc. because of the neglect could have been foreseen by Tuller and could have been avoided which makes it proximate cause. (Cheeseman, 2013, p. 95) The final party responsible for the death of Renee Radziwon-Chapman is WildCat Haven, Inc.; a non-profit incorporated in the state of Oregon in 2001. It is a no-kill, ‘last hope’ sanctuary for endangered species of wild cats. The corporation is vicariously responsible of negligence because of the actions of both Michael and Cheryl Tuller. Both individuals are directly liable for the death of Renee because they were negligent in their actions. Since corporations are viewed as separate legal entities, WildCat Haven, Inc. is the principal agent in the agency relationship between Michael and Cheryl Tuller. The Latin term respondeat superior (“Let the master answer”) is the common law doctorine which vicarious liability is based on in order to ensure that principals are liable for the negligent conduct of agents acting within the “scope of their employment” (Cheeseman, 2013, p. 503). “Vicarious liability (liability without fault) occurs where a principal is liable for an agent’s tortious conduct because of the employment contract between the principal and the agent, not because the principal was personally at fault” (Cheeseman, 2013, p. 503). “The doctorine of negligence rests on the principle that if someone (i.e., the principal) expects to derive certain benefits from acting through others (i.e., an agent), that person should also bear the liability for injuries caused to third persons by the negligent conduct of an agent who is acting within their scope of employment” (Cheeseman, 2013, p. 503) According to Cheeseman (2013) “the courts have applied a broad and flexible standard in interpreting scope of authority in the context of employment,” (p. 503) so if we were to look at 6 Estate of Renee Radziwon-Chapman v. WildCat Haven, Inc. the standards and compare them to this case it could be determined whether or not Michael and Cheryl’s conduct occurred within the scope of their employment (Cheeseman, 2013, p. 503). First, the act was specifically authorized by the principal (Cheeseman, 2013, p. 503) because Michael Tuller is an owner and he is authorized to request employees to perform certain tasks. Cheryl is also an owner and she is authorized to determine how work should be done as well. Second, it was the kind of act that the agent was employed to perform (Cheeseman, 2013, p. 503) because both were owners and they are both in charge of running the sanctuary which means that they determine what projects employees need to complete, such working in the cages. Third, their act occurred substantially within the time period of employment authorized by the principals (Cheeseman, 2013, p. 503) because they were working at another property in another county, where they planned to eventually move the sanctuary (Wozniacka, 2014, para. 10). Fourth, the act occurred substantially within the location of employment authorized by the employer (Cheeseman, 2013, p. 503) because Michael and Cheryl decided that they were going to work at another property owned by the WildCat Haven Corporation where Michael “intentionally instructed” the keeper to work in the cages alone with the animals (Wozniacka, 2014, para. 11). Lastly, both Michael and Cheryl were advancing the principal’s purpose (Cheeseman, 2013, p. 503) because they were getting the animals and the cages taken care of while still spending as little money as possible because they did not have to hire more employees to help Renee. Using the factors that courts rely on to determine whether or not Michael and Cheryl acted within the scope of their employment, (Cheeseman, 2013, p. 503) it could be determined that WildCat Haven, Inc. would be found liable of negligence and they would have to pay remedies such as lost wages, pain and suffering, emotional distress, and, possibly even 7 Estate of Renee Radziwon-Chapman v. WildCat Haven, Inc. punitive damages. Radziwon-Chapman’s estate is seeking $6 million dollars in reparations because of the negligence from all three parties. They might even be able to collect punitive damages from the suit. Punitive damages are additional “monetary damages that are awarded to punish a defendant who either intentionally or recklessly injured the plaintiff” (Cheeseman, 2013, p. 109). Fortunately for anyone who invests in WildCat Haven, other than Michael and Cheryl, since it is a corporation they do not have any personal liability for the debts or obligations that the corporation may incur (Cheeseman, 2013, p. 109). Their liability is limited strictly to the capital contribution they made so once the Corporation’s capital is gone they do not have to worry about paying any more money. Michael and Cheryl may be held personally liable for paying back the estate because although they work for the WildCat Haven Corporation they are not protected because they are “tortfeasors”. Tortfeasors are individuals “who intentionally or unintentionally (negligently) causes injury or death to another person” (Cheeseman, 2013, p. 662). Tortfeasors are always personably liable for their own tortious conduct (Cheeseman, 2013, p. 503). In conclusion, based on the information that I have gathered regarding Estate of Renee Radziwon-Chapman v. WildCat Haven, Inc. and my knowledge of the tort of negligence, the structure of corporations, principal-agent relationships, and liability; I believe that I can make an educated guess at what the outcome of this case will be. I believe that all three parties will be found liable for the wrongful death of Renee Radziwon-Chapman and her estate will collect their damages. I do not believe that they will receive punitive damages however because even though the actions that led to Renee’s death were negligent, they were not intentional or reckless which would constitute punitive damages to be awarded. 8 Estate of Renee Radziwon-Chapman v. WildCat Haven, Inc. References Alunaru, C., Wagner, G., & Oliphant, K. (2012). Employers' liability and workers' compensation. Berlin: De Gruyter. Cheeseman, H. R. (2013). Business law: Legal environment, online commerce, business ethics, and international issues/ Henry R. Cheeseman- 8th ed. New Jersey: Pearson. Internal Revenue Service. (2014). Employer identification number: Understanding your ein. Washington, DC. http://www.irs.gov/pub/irs-pdf/p1635.pdf Brizee, A., & Tardiff, E. (2014, June). The Purdue OWL: Citation Chart. Purdue Online Writing Lab. Retrieved from https://owl.english.purdue.edu/owl/resource/949/1/ Tax-Exempt Organizations. (2012). Wildcat Haven Inc. in Sherwood, Oregon (OR). Retrieved from faqs.org http://www.faqs.org/tax-exempt/OR/Wildcat-Haven-Inc.html Wozniacka, G. (2014, 11, 18). Estate of keeper killed by cougar sues sanctuary. Bloomberg Businessweek. Retrieved from http://www.businessweek.com/ap/2014-11-18/estateof-keeper-killed-by-cougar-sues-sanctuary