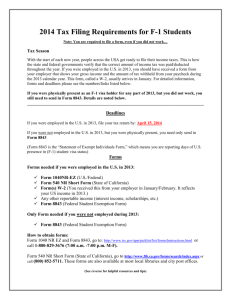

International student Income Tax Workshop Agenda

advertisement

Catholic University: Tax Filing March 2, 2011 Mary Fortier Nonresident Alien Tax Office www.towson.edu/nratax Tax Terms Overview Withholding – The amount of money taken out of your paycheck to pay taxes Reporting Forms - Ex: W2, 1042-S, 1099 Tax Return - Ex: 1040NR, 1040NR-EZ Filing – An individual “files” (submits) a tax return Internal Revenue Service – Federal tax agency Resident vs. Nonresident – IRS term is different than state term Tax Status Tax Residency Status (Federal) US Citizen Permanent Resident Alien Resident Alien for Tax Purposes Nonresident Alien for Tax Purposes If a person is not a US Citizen or PRA – Tax terms not immigration Categories! Employer is legally required to determine tax residency status (a person cannot choose) Possible tax status – – – Nonresident alien or resident alien for tax purposes Typically if you are in F1 or J1 status for 5 years, you are NRA Term applies to federal tax only NRA vs. RA NRAs May not choose withholding allowance & marital status Follow different tax laws US income is only taxed Mandatory rate of Single, 1, NRA RAs May choose withholding allowance & marital status Follow same tax laws as US Citizen or PRA Taxed on worldwide income Tax Status: Substantial Presence Test (SPT) See Decision Tree: http://international.cua.edu/res/docs/taxes/decidesptexempt.pdf Objective: To determine if you are exempt from counting days using SPT If F, J, M or Q Full-time Student & compliant with legal status Years of Presence: If Student: Have you been in US less than 5 years total? If Scholar: Have been in US 2 out of the last 6 consecutive calendar years? If Yes: You are exempt from counting days towards SPT: You are a NRA If No: You must count days as part of SPT to determine NRA or RA (see http://international.cua.edu/taxes/SPT.cfm) Tax Year JANUARY PAYER Pays individual & withholds tax JANUARY 1 DECEMBER INDIVIDUAL Receives Money APRIL 18 PAYER Report income & tax withheld (For tax year 2010) INDIVIDUAL Complete & submit tax return (For tax year 2010) What is Taxable Income Payment for Services Working = Wages = Payment/paycheck Scholarship Anything above qualified tuition and fees is taxable income; Payroll Office calculates this and charges student Other Payments Travel grants, competitive grants, interest income For more information see: http://www.towson.edu/nratax/ustaxes/incometaxwitholding1.htm http://www.towson.edu/nratax/ustaxes/incometaxwitholding3.htm Working = Form W4 Work Authorization: You can only work for Catholic University Employment (Working): Taxes must be withheld every time you get paid; to determine how much to withhold, a Form W-4 must be completed by individual and submitted to your employer; otherwise default amount is used Source: http://international.cua.edu/taxes/W4.cfm NRA Mandatory Tax Withholding NRAs must complete: Single 1 NRA • • • X X X W-4 For Different States Live in one state, work in another; NRA rate is same for federal Work authorization only for on-campus employment Reciprocal tax agreements betweens states See below at: http://treasurer.cua.edu/forms.cfm Tax Treaty: New Form Each Year Submit new 8233each year: March 15, 2011 Tax Treaty Benefit - For individuals under a tax treaty benefit please be advised that your 8233 is due no later than March 15, 2011. If we do not received the current year 8233 your treaty benefits will be suspended until the form has been received and benefits are not retroactive. See: http://treasurer.cua.edu/payroll/ About 60 treaties in effect. For list go to: http://www.irs.gov/businesses/international/article/0,,id=96739,00.html Individual must meet all requirements to be eligible Withholding agent (employer) does not have to grant Treaty is also claimed when filing a tax Does not mean it will be allowed by IRS return Not recognized by all states, ex: Maryland Treaty income reported on 1042S Taxable Scholarship 14% mandatory for NRAs – Unless exempt by a tax treaty General practice - Apply to student account before rebate checks are issued – Which will affect rebate amount NRAs Tax must be withheld in the same semester as award is given RAs Does not apply Form 8843 Yes Everyone Must File 8843 Requirement All students in F-1 & J-1 status, Adult dependents in F-2 or J-2 (ex: spouse) Taxpayer ID # No SSN or ITIN required – just leave blank if none Form 8843 Sample Complete Form For how to complete: http://www.towson.edu/nratax/docs/Form8843example.pdf Interactive Form to Fill Out Find interactive form at: http://www.irs.gov/pub/irs-pdf/f8843.pdf Mail form to: Department of the Treasury, IRS Center, Austin, TX 73301-0215 Deadline: June 15, 2011 Income Employer: Report Tax Reporting Process Tax Reporting Flow (electronic) 1st 2nd 3rd • Employer/Institution • Internal Revenue Service • State Tax Agency Tax Reporting Form (mailed forms) YOU 1 TAX RETURN Important to understand in case information is not accurately reported Employer Reporting Deadlines Type of Income Withholding Form Form W-4 Reporting Form Form W-2 Mail by Date 1/31 Other income n/a Form 1099 1/31 Scholarship income n/a Form 1042-S 3/15 Employment income Individual Deadline: April 18th Form W-2: Employment Income Form W-2 (Money for Working) If Box 1 has # in it – that is your federal income – Federal tax withheld is reported in Box 2 – Box 16 will have state wages; Box 17 state tax withheld – If you did not receive yours contact Payroll Office – 1042-S: Scholarship Income See Handout – If Box 1 is blank you have a tax treaty Box 16 will be complete (maybe 17 if state tax withheld) – Must wait to receive Form 1042-S to file return Reporting Forms (Institution) Form 1042-S (Scholarship Income) –Institution completes & reports income earned to IRS –Must be mailed by employer by 3/15 of each year –Request duplicate at 410-260-7964 Reporting Forms (Institution) Form 1099- INT Reports interest income - - NOT taxable income – Must be mailed by 1/31 each year – Reporting Forms (Institution) Form 1098-T NRAs cannot claim this deduction – But often are sent form – Individual: File Tax withholding is not a precise calculation: This is why each year you must file a tax return each year Overpay (Refund) versus underpay (Owe) Federal – Do I Have to File? Form 1040NR: www.irs.gov 2010 Filing Requirement If you are Single, under 65 years of age: ⁻ ⁻ ⁻ If you earned less than $3,650 (Box 1, W-2) No federal tax was withheld = 0 (Box 17, W-2) You do not have to file return Should file if tax was withheld (Box 17, W-2) = >$1 State – Do I Have to File? Refer to the state in which you live to determine criteria ⁻ ⁻ ⁻ Individual income tax Filing requirement What type of tax was taken out or did you claim exempt as part of state tax reciprocal agreement Maryland: www.marylandtaxes.com Virginia: http://www.tax.virginia.gov/ West Virginia: http://www.wva.state.wv.us/wvtax/default.aspx Pennsylvania: http://www.revenue.state.pa.us/portal/server.pt/community/revenue_home/10648 Must File – Which Forms? NRA Tax Forms – 1040NR-EZ NRA completes Form 1040NR-EZ (short form) –Individual claims to IRS income earned in previous year Treaty Forms: 8233 NRA Tax Forms - 8843 Form 8843 –Required of all students in F-1 & J-1 status, and adult dependents in F-2 or J-2 Tax Form Terms Tax Filing Terms - Exclusion Exclusion An exclusion is income you receive AND is – Not included in your U.S. income – Not subject to U.S. tax Examples – Interest income (1099-INT) – Qualified scholarships (not reported to IRS) (tuition, required fees, books) – Foreign source income Tax Filing Terms – Personal Exemption Personal Exemption Reduces taxable gross income Generally, one personal exemption amount per person/dependent claimed on tax return Non-residents may typically only claim one exemption (for themselves), even if they have a dependent spouse or children The amount for 2010 tax year is $3,650 Tax Filing Terms – Deduction Standard or Itemized Deduction NOT available to NRAs (except students from India) *This is reason for extra tax withholding (Single, 1, NRA) Deduction of certain allowable expenses from gross income – Itemized: Must list each expense separately on Schedule A of 1040 – Standard: Determined by IRS! Eliminates need to itemize; use 1040-EZ Amount varies by filing status Highlights NRA Tax Filing May claim only one personal exemption ($3650 for 2010) – Regardless of marital status or children May not claim the standard deduction (excepts students from India) – An expense amount listed which is subtracted from total gross income when calculating taxable income Other deductions are limited (State taxes withheld; charitable contributions) May not deduct education (1098-T) File 1040NR or 1040NR-EZ File as single individual (unless can claim dependents from Canada, Korea, Mexico, India (F1/J1 only), Japan (old treaty), and American Samoa & Northern Mariana Islands Need to apply for ITIN – Common Errors Completing wrong tax form(s) Entries in the wrong line Mathematical errors Illegible handwriting – – Use block letters and write numbers as shown here: 1234 567 890 Failure to use the social security spelling of your name Leaving lines blank – Enter a straight line or a zero if not applicable Records Keep photocopies of all your tax records for at least 7 years These records include: – – – – Form 1040NR or 1040NR-EZ Form W-2, 1042-S, 1099 Form 8843 All worksheets and receipts you used for calculations Important if you apply to change immigration status – May be required to submit tax records with application Why File a Tax Return? Comply with US regulations – – As part of F1 or J1 immigration status Required (previous years) if you plan to apply for permanent residency or US citizenship Avoid interest and penalties Start statute of limitations period (3 yrs) Obtain tax refund, if any Reminders April 18th DEADLINE Federal – www.irs.gov Complete Federal tax return first; then State Form 8843 for all students in F1 or J1 status