Practice Final

advertisement

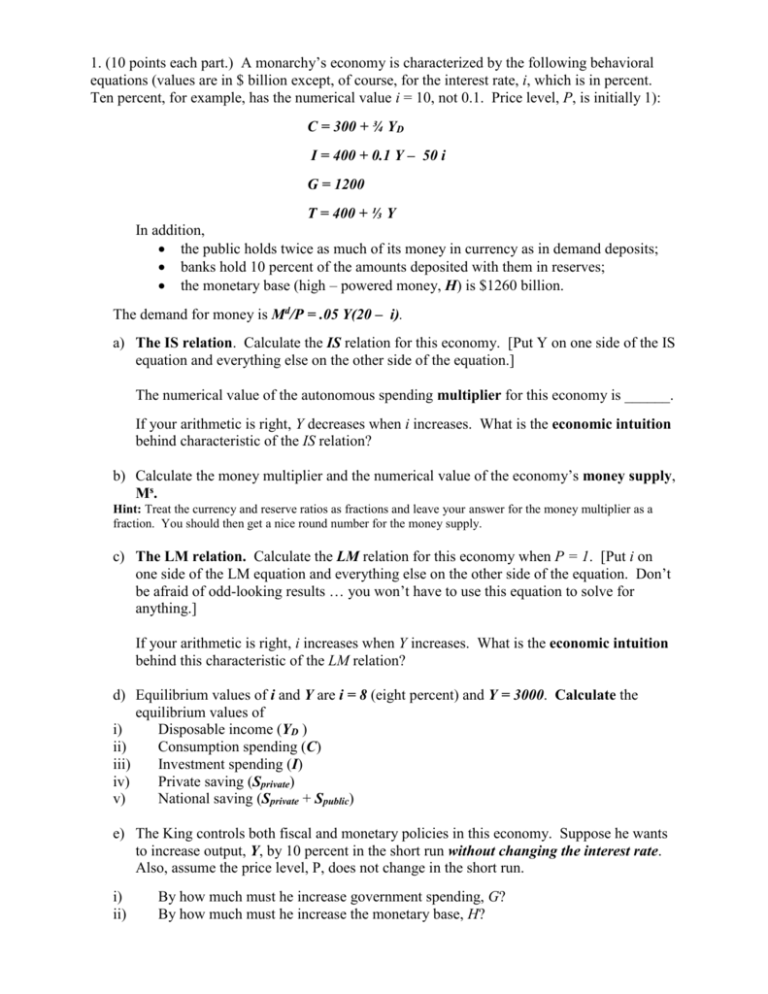

1. (10 points each part.) A monarchy’s economy is characterized by the following behavioral equations (values are in $ billion except, of course, for the interest rate, i, which is in percent. Ten percent, for example, has the numerical value i = 10, not 0.1. Price level, P, is initially 1): C = 300 + ¾ YD I = 400 + 0.1 Y – 50 i G = 1200 T = 400 + ⅓ Y In addition, the public holds twice as much of its money in currency as in demand deposits; banks hold 10 percent of the amounts deposited with them in reserves; the monetary base (high – powered money, H) is $1260 billion. The demand for money is Md/P = .05 Y(20 – i). a) The IS relation. Calculate the IS relation for this economy. [Put Y on one side of the IS equation and everything else on the other side of the equation.] The numerical value of the autonomous spending multiplier for this economy is ______. If your arithmetic is right, Y decreases when i increases. What is the economic intuition behind characteristic of the IS relation? b) Calculate the money multiplier and the numerical value of the economy’s money supply, Ms. Hint: Treat the currency and reserve ratios as fractions and leave your answer for the money multiplier as a fraction. You should then get a nice round number for the money supply. c) The LM relation. Calculate the LM relation for this economy when P = 1. [Put i on one side of the LM equation and everything else on the other side of the equation. Don’t be afraid of odd-looking results … you won’t have to use this equation to solve for anything.] If your arithmetic is right, i increases when Y increases. What is the economic intuition behind this characteristic of the LM relation? d) Equilibrium values of i and Y are i = 8 (eight percent) and Y = 3000. Calculate the equilibrium values of i) Disposable income (YD ) ii) Consumption spending (C) iii) Investment spending (I) iv) Private saving (Sprivate) v) National saving (Sprivate + Spublic) e) The King controls both fiscal and monetary policies in this economy. Suppose he wants to increase output, Y, by 10 percent in the short run without changing the interest rate. Also, assume the price level, P, does not change in the short run. i) ii) By how much must he increase government spending, G? By how much must he increase the monetary base, H? 2. (25 points each part) Suppose that the economy in Question 1 was in medium run equilibrium when the King increased government spending and the money supply. Contrary to your assumption and the King’s wish, however, the price level does not remain unchanged when output increases: SRAS is upward sloping. Assume that price expectations are adaptive, i.e., each year people expect price to remain where it was the year before: Pet = Pt-1. a) Describe in words how the monarchy’s economy responds over time to the increased government spending and money supply. How do the final values of Y, C, I, and i compare with their initial values. Why don’t things work out quite the way the King intended, even in the short-run? (You may want to wait until after you have plotted IS/LM/AD/AS movement over time in the next part of Question 2 before answering this part of Question 2). b) Trace the movement of the economy from its initial equilibrium to its final equilibrium when government spending and money supply are increased as in Question 1. Show all shifts through time on the graphs below. You need not show numerical values. What you draw here should correspond to the description of short-run and medium-run responses that you give in part (a) of this question. W/P WSo Real Wage (W/P)o PSo Y P Price ASo Po ADo Y i Interest Rate LMo io ISo Y 3. The expectations augmented Phillips Curve for an economy is given by π - πe = 2 - .5u and Okun’s Law for this economy is Δu = -0.5 gy where π = the inflation rate; πe = the expected inflation rate; u = the unemployment rate; gy is the rate of real output growth; and time subscripts are not shown. Inflation rate π, unemployment rate u, and growth rate gy are expressed as percents: ten percent unemployment, for example, is u = 10, not 0.1. Inflation has been galloping along at a 22% annual rate (π = 22) for a number of years and the unemployment rate has been steady as well. Expectations of inflation are adaptive, i.e, people expect each year’s inflation rate to equal the rate actually experienced in the prior year (πte = πt-1). But now a new Chairman, Mike M. Hirt, has taken over at the central bank. His slogan: “No sacrifice too great!” a) What are the initial values of π, u, gy , and gm (the rate of money growth expressed as a percent) in this economy when the new chairman takes over? Show these values under Year 0 in the table below. Show any necessary calculations here. (10 points) b) “I will double the unemployment rate this year. I will double it again next year. And, if necessary, I will double it yet again the year after next until inflation is down to zero,” Chairman Hirt vows. “No sacrifice is too great!” In the table below, show that inflation will indeed fall to zero after three years if the public’s expectations are adaptive and Chairman Hirt follows through on his threat. Also show how he must manage money growth over these three years and how output growth and inflation will respond yearafter-year to the Hirt Disinflation. (20 points) Year Inflation rate, π Δπ Unempl rate, u Δu Output growth, gy Money growth,gm 0 1 2 3 Space for calculations: c) “Mike, you’ll be drawn and quartered before you complete your disinflation plan,” his friends warn him. “You’re asking for too much sacrifice. But even if you see it through and succeed, you’ll wreck the economy: it never will recover. People will be out of work for so long that they’ll lose their health and their skills. Productivity will fall and the NAIRU will never get back to where it was.” How can reduced productivity increase an economy’s equilibrium rate of unemployment in the medium-run when price expectations are realized (π = πe) but expectations of productivity growth may lag behind actual productivity? How about in the long-run, when expectations of both productivity growth and of price are realized (A =Ae and π = πe)? (10 points) d) “Not to worry,” the Chairman says. “Once people realize I’m serious about ending inflation, it won’t take much sacrifice at all.” Why does Hirt think his commitment to disinflate will make disinflation painless? (10 points) 4. Supply – side growth (10 points each part). a) Why will an increase in a nation’s saving rate increase its rate of economic growth in the short run but not in the long run? b) What does a nation’s long run rate of economic growth depend on? c) Why is “too much” saving a bad thing? d) What difference, if any, does a nation’s saving rate make in the long run? Illustrate your answer with a diagram showing steady-state outputs per worker for two different saving rates. e) Suppose output (Y) depends on capital (K) and labor (N) inputs as follows: Y = 2 K1/2 N1/2 . In addition, capital depreciates at a 20 percent annual rate (δ = .2). Compute steady-state capital per worker (K/N), output per worker (Y/N), and consumption per worker (C/N) at this economy’s “golden rule” rate of saving. What is special about the “golden rule” rate of saving? (10 points)