without

AP Microeconomics Unit 1 Notes/Practice Problems https://www.youtube.com/playlist?list=PL6B2DBE4C2FC8F845

The above link is all of the Mr. Clifford videos for this unit

Standard 1: Supply and Demand (look to AP Macroeconomics Notes)

Standard 2: Price Ceiling/Floors, Double Shift, Ceilings and Floors (AP Macroeconomics Notes)

Standard 3: Can you find the consumer and producer surplus on a graph? Can you calculate it? What if supply and/or demand shift, can you locate the new CS/PS? What are the effects of taxes on CS/PS/Total Welfare? What happens to allocative efficiency with government intervention—price controls (price ceilings/floors) or excise taxes (assuming no market failure)?

How much of the tax is the business paying and the consumer paying? What are the effects of tariffs on the domestic CS, PS,

Total Welfare/Surplus?

Consumer Surplus

The difference between the maximum price a consumer (or consumers are) willing to pay for a product and the actual price. o Below the demand curve and above the equilibrium price

Higher prices reduce consumer surplus, lower prices increase it.

You must be able to calculate the area of the CS or label it.

½ b*h=area of a triangle

b*h=area of a square/rectangle

1.

What is the area of the consumer surplus on the graph on the left?

2.

What is the area of the consumer surplus on the graph on the right?

Producer Surplus

Difference between the actual price a producer receives (or producers receive) and the minimum acceptable price.

Higher prices increase producer surplus, lower prices decrease it.

1.

What is the area of the PS on the graph on the left?

2.

What is the area of the PS on the graph on the right?

Math is same as above except

Total Revenue

Revenue is the amount of money that the business brings in

Doesn’t subtract for expenses—that’s profit

How do you calculate? Equilibrium price * equilibrium quantity

1.

What is the area on the graph on the left?

Shifts in Supply and Demand Changing the CS/PS

1.

If the price is P1, what is the area of the consumer surplus? Shade it on the graph on the left

Hint—you may want to draw the supply curve in.

2.

If the price is P2, what is the area of the CS? Shade it on the graph in the middle

3.

Assume the price changes from P1 to P2, how much does the CS change BY? Shade it on the graph on the right

Remember all of the shifters!!! Generally, they ask more about taxes and subsidies.

1.

At P1, what was the CS?

2.

At P1, what was the PS?

3.

4.

5.

At P2, what is the CS?

At P2, what is the PS?

By what did it change?

Total Surplus/Total Welfare

CS + PS=Total Surplus

Surplus=Welfare to society

Free markets maximize total welfare

We don’t care who is benefits (consumers or producers) as long as total welfare is maximized

If D or S shifts due to MARKET forces and total surplus decreases, then it is ok. There is no DWL. Society just doesn’t demand the stuff anymore or it is just too costly for producers to produce as much.

Government Involvement

Unless there is a market failure (last unit), government intervention results in less efficiency

Remember back to AP Macro—allocative efficiency is that society is producing the right mix of goods desired by society with the least costs to society—where marginal benefits=marginal cost. We want society to produce the right

QUANTITY of goods, where there is no surplus or no shortage.

This only happens when free competitive markets do their thing without government intervention (unless there is a market failure)

Price controls—price ceilings and floors result in surpluses or shortages, so the right quantity of goods is NOT produced.

Taxes result in less quantity being produced than is allocatively efficient (unless market failure)

Subsidies result in more quantity being produced than is allocatively efficient (unless market failure)

Does this mean that we should NEVER tax, subsidize, or place price controls (unless market failure)—Depends on your politics o All of these result in INEFFICIENCY o But what about equity concerns—Doesn’t NYC need low-wage workers who can’t afford housing without subsidies or price controls? o You just need to realize the cost to society when you favor one value (equity vs. efficiency) over the other

Excise Taxes (sales/gas)

Tax on a product, usually per unit. o Buy $10 worth of gas, pay $.30 in gas tax, Buy $20 worth of gas, pay $.60 o Different than a lump sum tax—business pays $1,000 a year to operate no matter how much they produce.

If normal elasticities (studying now)—buyer bears some of the tax and sellers bear some of the tax

The buyer always pays the equilibrium price

To figure out the price that the seller receives—look at the new equilibrium price and go down to the original supply curve

The tax is the amount in between the two supply curves

Assume that the top # on the graph is $13, the number at the bottom of the supply curve after the tax is $9

Q is 100, Q’ is 80

1.

How much did the consumer pay per unit?

2.

How much are they paying after the tax?

3.

What is the seller receiving after the tax?

4.

Shade the DWL and calculate it.

5.

Shade the CS after the tax and calculate it.

Another example

1.

Where is the CS at P1?

2.

Where is the PS at P1?

Price Ceilings and Floors

Effective price ceilings and floors will cause inefficiency

For BOTH the quantity will be less than the equilibrium quantity

Now assume that the reason for the change to

S2 is an increase in excise taxes.

1.

Where is CS at P2?

2.

Where is PS at P2?

3.

Where is the DWL?

4.

Where is tax revenue?

5.

How much is the tax?

6.

What price do the sellers receive?

7.

What price do the consumers pay?

8.

How much of the tax did the consumers pay

1.

After the price ceiling, what quantity is sold?

2.

If the government sets a price ceiling at .80, shade in the CS.

3.

If the government sets a price ceiling at .80, shade in the PS.

4.

Where is the DWL? Shade it in a different color.

1.

2.

After the price floor of 1.20, shade the CS.

Shade the PS

Tariffs and Quotas

Attempts to help domestic producers

Only benefit to a tariff over a quota is that the tariff gives government some tax revenue

Consumers will pay the world price if there are no barriers, so shade the domestic consumer surplus

If consumers pay the world price, then domestic sellers will only be able to sell the amount up to the world price, shade the domestic producer surplus

1.

How much will be produced domestically?

2.

How much will be imported?

If the government places a $2 tariff on the good

Now the effective world price is $4.

How much will we import?

Did this help domestic consumers?

Did this help domestic producers?

Shade the new CS, PS, tax revenue, and DWL

Calculate

CS

PS tax revenue

DWL

How much did we import after the tariff again?

The government could (instead of placing the tariff on the good) just limit the imported quantity to the same amount, but not collect the tax revenue. In that case, what would happen to the DWL?

Practice Problems

1. The difference between what consumers are willing to pay for units of a good and the price consumers actually pay for units of the good is called

(A) marginal utility

(B) producer surplus

(C) consumer surplus

(D) economic rent

(E) a positive externality

2. Assuming a downward-sloping demand curve and an upward-sloping supply curve, which of the following will occur as a result of an increase in the sales tax on a good?

(A) Supply will increase.

(B) Demand will increase.

(C) Quantity supplied will increase.

(D) Quantity demanded will decrease.

(E) The price paid by consumers will decrease.

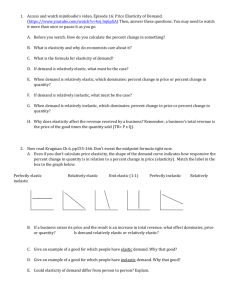

Standard 4: Price Elasticity of Demand and Supply, effect of elasticity on C/P Surplus and DWL

What is elasticity? Can you calculate price elasticity of demand and supply using the mid-point formula and the total revenue test (for demand only)? Can you use demand and supply graphs to show the differences in elasticity? How does price elasticity of supply and demand affect consumer/producer surplus when there is an excise tax?

Elasticity

Measures reaction to change

Types of Elasticity o Price Elasticity of Demand--measures how consumers respond to a change in price o Price Elasticity of Supply--Measures how producers respond to a change in price o Income Elasticity of Demand--Measures how consumers will respond to a change in income o Cross-Price Elasticity--Measures how a change in the prices of other goods affects the demand of the original good.

Price Elasticity of Demand

Measures how consumers respond to a change in price

If the price drops and you buy LOTS more stuff, then it is elastic OR if the price rises and you buy a lot LESS stuff, then the good is elastic because you have been very responsive to a price change.

If a price change doesn’t impact your buying habits much, then it is inelastic.

Think will I buy it no matter the price—if yes, then inelastic

Determinants of Price Elasticity of Demand

Substitutability

Portion of Income Spent

Luxuries versus Necessities

Habit Forming

Time

Elastic Inelastic

Simple Price Elasticity of Demand Formula

E d

=Elasticity Co-efficient

E d

=percent change in QD/percent change in price

If E d

>1, then elastic

If E d

<1, then inelastic

If E d

=1, then unit elastic

If Bob’s Burgers decides to increase prices by 30% and it sees a 50% decrease in sales, is the product elastic or inelastic?

If Hannah’s Hats decides to put everything on sale for half off, but her sales only increase by 10%, is the product elastic or inelastic?

Mid-Point Formula

How do you get a percent change?

Change/original

Say prices go from $4 to $5 and that changes the quantity demanded from 20 to 10, what is the elasticity co-efficient?

What if we said that the price was dropped from $5 to $4 and the QD increased from 10 to 20, what is the elasticity coefficient?

This is a problem because it should be the same no matter if the price is going up or down.

Solution—Use a mid-point formula

Ed=[Change in quantity/(sum of two quantities/2)]/[change in price/(sum of two prices/2)]

If the price change of $4-$5 causes a change in QD of 10 to 20, what is the elasticity co-efficient

Extreme Cases

Perfectly Inelastic o If the price is a million dollars, you will still buy it. o If a change in price, does not change quantity AT ALL, then the product is PERFECTLY INELASTIC. o Ex. Insulin to a diabetic o E d

=0

Perfectly Elastic o If the price goes up by even a penny and you buy NONE, then it is perfectly elastic o If a small decrease in price causes buyers to buy all they can obtain o E d

=

∞

Total Revenue Test

Whole point of studying this is to see what price changes do to profits.

Total revenue—total received from the sale of a product o Not profit—profit=total revenue minus total costs o TR=P x Q

If TR changes in the opposite direction from price, demand is elastic

If TR changes in the same direction as price, demand is inelastic

If TR is unchanged by the price change, then unit elastic

Example—If the price declines from $2 to $1 and the quantity demanded increases from 10 to 40, is it elastic or inelastic— o $2 x 10=$20 o $1 x 40=$40 o Price went down and TR went up o Opposite=Elastic

If the price declines from $2 to $1 and the quantity demanded increases from 10 to 12, is it elastic or inelastic— o $2 x 10=$20 o $1 x 12=$12 o Price went down and TR went down o Same=Inelastic

So, if you are a business, and you KNOW your product has an inelastic demand, should you raise prices or lower them?

On a graph

Demand for Most Products

Elastic at high prices and inelastic at low prices

Why? At high prices the percent change in QD is high a $1 change from $8 to $7 (1/8=12.5% price change) brings a 100% change in QD from 1 to 2 (1/1=100%). At low prices, change from $2 to $1 (50% price change) brings only a 14% change

QD from 7 to 8

Price Elasticity of Supply

Measures how responsive producers are to a price change

If prices go up, then producers will want to supply more

If they can produce more, then supply is elastic

If they can’t, then supply is inelastic

E s

=percent change in QS/Percent change in Price

Mid-Point Formula

NO TR test

Only determinant--Time

Farmer Joe and his Tomatoes

1. Farmer Joe gets to the farmers market with his truck load of tomatoes and suddenly sees that the prices of tomatoes has skyrocketed from $1 to $4 per tomato. Unfortunately, he can’t produce any more tomatoes that day. His supply is fixed.

2. However, he goes home to the farm and decides to attempt to increase his yield by adding fertilizer and adding his labor effort to pick all of them on time before they ruin. Next month, he is able to produce 1 and a half truck loads of tomatoes at the farmers market.

3. Farmer Joe thinks that the prices of tomatoes will stay high next year, so in planting for next year, he decides to convert 10 acres that were previously devoted to squash to tomatoes. Next year, he thinks that he will be able to produce 15 truckloads of tomatoes at every farmers market. The high prices also induce other farmers to get into the tomato growing business next year.

Situation 1=immediate market period when supply is fixed or perfectly inelastic

Situation 2=market in the short-term. Short-term=a time period when you can’t change plant capacity (can’t change your capital resources--—like tractors or factories--and the land that the capital resources sit on) but you can change other resources like labor.

Situation 3=Long-run. Time period when you can change your plant capacity. Businesses already producing the product can build another factory, and businesses who have never sold the good will now enter the market.

The quantity of peanuts supplied increased from 40 tons per week to 60 tons per week when the price of peanuts increased from $4 per ton to

$5 per ton. The price elasticity of supply for peanuts over this price range is

(A) elastic

(B) inelastic

(C) unit elastic

(D) perfectly elastic

(E) perfectly inelastic

Which of the following will tend to make the demand for a product more elastic?

(A) New firms which produce similar products enter the industry.

(B) A change in taste and preferences makes the product more desirable.

(C) The product is necessary for use with a complement.

(D) Production of the product is protected by a patent.

(E) Production cost of the product decreases.

If the demand for a good is perfectly price inelastic in the short run and the supply curve is upward sloping, imposing a sales tax on the good will

(A) leave the price paid by consumers unchanged

(B) decrease the after-tax revenues received by suppliers

(C) increase the after-tax revenues received by suppliers

(D) not change the after-tax revenues received by suppliers

(E) not change the total expenditures by consumers on the good

Promoters of a rock group know that if they charged $8 a ticket, 400 people would buy tickets for a concert, and if they charged $4 a ticket, 800 people would buy tickets. Over this price range, the demand for the concert tickets for the rock group is

(A) elastic

(B) inelastic

(C) unit elastic

(D) perfectly elastic

(E) perfectly inelastic

Standard 5: Income and Cross Price Elasticity

Can you determine whether or not a good is normal or inferior using the income elasticity formula? Can you determine whether or not a good is a complement or substitute using the cross-price elasticity formula?

Assume that Clark spends his entire income on the purchase of two goods, X and Y. If his income and the prices of good X and Y all double,

Clark will

(A) double the purchase of goods X and Y

(B) buy more of good X and less of good Y

(C) buy less of good X and more of good Y

(D) buy less of both goods X and Y

(E) buy the same amounts of goods X and Y

The cross-price elasticity of demand between good X and good Z measures the percentage change in the quantity demanded of good X in response to a percentage change in

(A) the price of good X

(B) income

(C) the price of good Z

(D) the supply of good Z

(E) total expenditures on good Z

Standard 6: Utility Maximizing Rule

Can you apply the utility-maximizing rule?

. Garcia is currently spending his entire lunch budget on 3 sodas and 4 hot dogs. At his current level of consumption, Garcia’s marginal utility for sodas is 5 utils and his marginal utility for hot dogs is 10 utils. In order to maximize his total utility, Garcia should

(A) consume more sodas and fewer hot dogs regardless of the prices

(B) consume more hot dogs and fewer sodas regardless of the prices

(C) maintain his current level of consumption of sodas and hot dogs regardless of the prices

(D) maintain his current level of consumption if the price of a soda is $1 and the price of a hot dog is $2

(E) maintain his current level of consumption if the price of a soda is $2 and the price of a hot dog is $1

According to the law of diminishing marginal utility, which of the following is true?

(A) Total satisfaction decreases as more units of a good are consumed.

(B) The additional satisfaction received from consuming extra units of a good decreases as consumption of the good increases.

(C) The additional satisfaction received from consuming extra units of a good decreases as consumption of the good decreases.

(D) The additional satisfaction received from consuming extra units of a good increases as consumption of the good increases.

(E) When marginal utility is decreasing, total utility is decreasing.

Which of the following is true if consuming one unit of a good yields 100 utils and consuming the second unit of the good increases satisfaction by 20 utils?

(A) The marginal utility of the first unit is 20.

(B) The marginal utility of the second unit is 80.

(C) The marginal utility of the second unit is 120.

(D) The total utility of consuming two units is 120.

(E) The total utility of consuming one unit is greater than the total utility of consuming two units.