Essentials of Economics, Krugman Wells Olney

advertisement

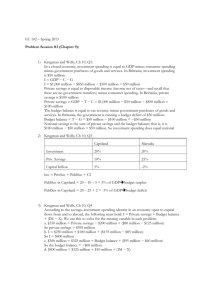

Prepared by: Fernando & Yvonn Quijano © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 2 of 31 chapter With accurate economic data, Portugal was able to make the transition from revolution in 1975 to a prosperous democracy today. What you will learn in this chapter: ➤ How economists use aggregate measures to track the performance of the economy ➤ What gross domestic product, or GDP, is and the three ways of calculating it ➤ The difference between real GDP and nominal GDP and why real GDP is the appropriate measure of real economic activity ➤ The significance of the unemployment rate and how it moves over the business cycle ➤ What a price index is and how it is used to calculate the inflation rate © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 3 of 31 chapter The National Accounts The national income and product accounts, or national accounts, keep track of the flows of money between different sectors of the economy. “In fact, the accuracy of a country’s accounts is a remarkably reliable indicator of its state of economic development.” © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 4 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney chapter The National Accounts The Circular-Flow Diagram, Revisited and Expanded Consumer spending is household spending on goods and services. A stock is a share in the ownership of a company held by a shareholder. A bond is borrowing in the form of an IOU that pays interest. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 6 of 31 chapter The National Accounts The Circular-Flow Diagram, Revisited and Expanded Government transfers are payments by the government to individuals for which no good or service is provided in return. Disposable income, equal to income plus government transfers minus taxes, is the total amount of household income available to spend on consumption and to save. Private savings, equal to disposable income minus consumer spending, is disposable income that is not spent on consumption. The banking, stock, and bond markets, which channel private savings and foreign lending into investment spending, government borrowing, and foreign borrowing are known as the financial markets. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 7 of 31 chapter The National Accounts The Circular-Flow Diagram, Revisited and Expanded Government borrowing is the amount of funds borrowed by the government in the financial markets. Government purchases of goods and services are government expenditures on goods and services. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 8 of 31 chapter The National Accounts The Circular-Flow Diagram, Revisited and Expanded Goods and services sold to residents of other countries are exports; goods and services purchased from residents of other countries are imports. Investment spending is spending on productive physical capital, such as machinery and construction of structures, and on changes to inventories. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 9 of 31 chapter Consumer spending is household spending on goods and services. A stock is a share in the ownership of a company held by a shareholder. A bond is borrowing in the form of an IOU that pays interest. Government borrowing is the amount of funds borrowed by the government in the financial markets. Government purchases of goods and services are government expenditures on goods and services. Government transfers are payments by the government to individuals for which no good or Goods and services sold to residents of other service is provided in return. countries are exports; goods and services purchased from residents of other countries Disposable income, equal to income plus are imports. government transfers minus taxes, is the total amount of household income available to spend on consumption and to save. Private savings, equal to disposable income minus consumer spending, is disposable income that is not spent on consumption. Investment spending is spending on productive physical capital, such as machinery and construction of structures, and on changes to inventories. The banking, stock, and bond markets, which channel private savings and foreign lending into investment spending, government borrowing, and foreign borrowing are known as the financial markets. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 10 of 31 chapter HW p. 391 #2 p. 392 #5 • Coca-Cola invests • Delta sells used plane • Moneybags buys stock • Wine exported • Perfume imported • Publisher adds books toof inventory © 2007 Worth Publishers Essentials Economics Krugman • Wells • Olney 11 of 31 chapter What GDP does NOT count? Public transfer payments Social Security, welfare Private transfer payments $100 from Grampa Stock market transactions You purchased 200 shares of Microsoft – not counted BUT! The services of the stockbroker are counted. Secondhand sales Used cars, clothing © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney chapter The National Accounts Gross Domestic Product Final goods and services are goods and services sold to the final, or end, user. Intermediate goods and services are goods and services—bought from one firm by another firm— that are inputs for production of final goods and services. Gross domestic product, or GDP, is the total value of all final goods and services produced in the economy during a given year. Aggregate spending, the sum of consumer spending, investment spending, government purchases, and exports minus imports, is the total spending on domestically produced final goods and services in the economy. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 13 of 31 chapter 2 most common ways GDP is measured Expenditures, Income Expenditures Approach - Measures GDP in terms of all of the money that was spent on buying it. Income Approach - Measures GDP in terms of all of the incomes that were derived in producing it. C +Ig + G + Xn = Wages + Rents + Interest + Profits © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney chapter 3 ways of Calculating GDP “Government statisticians use all three methods” Hypothetical economy has 3 firms • • • American Motors, Inc – produces 1 car/year American Steel, Inc – produces steel for car American Ore, Inc – produces iron ore for steel This economy produces 1 car worth $21,500. So, GDP = ? But, let’s look at 3 ways of getting to that # so that we can do it for more complex economies. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 15 of 31 chapter The National Accounts Calculating GDP © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 16 of 31 chapter 2. 3. 1. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney Calculating GDP 3 Ways (Expert Groups p. 372-5) chapter 1. Measuring GDP as the Value of Production of Final Goods and Services 2. Measuring GDP as Spending on Domestically Produced Final Goods and Services 3. Measuring GDP as Factor Income Earned from Firms in the Economy © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 18 of 31 chapter The National Accounts Calculating GDP Measuring GDP as the Value of Production of Final Goods and Services The value added of a producer is the value of its sales minus the value of its purchases of inputs. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 19 of 31 chapter The National Accounts Calculating GDP Measuring GDP as Spending on Domestically Produced Final Goods and Services Another way to calculate GDP is by adding up aggregate spending on domestically produced final goods and services. That is, GDP can be measured by the flow of funds into firms. The following equation breaks GDP down by the four sources of aggregate spending: C = Consumer spending I = Investment spending (15-1) GDP = C + I + G + X - IM G = government purchases X = exports IM = Imports © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 20 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 21 of 31 chapter The National Accounts Calculating GDP Measuring GDP as Factor Income Earned from Firms in the Economy Another way to calculate GDP is to add up all the income earned by factors of production from firms in the economy—the wages earned by labor; the interest earned by those who lend their savings to firms and the government; the rent earned by those who lease their land or structures to firms; and the profit earned by the shareholders, the owners of the firms’ physical capital. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 22 of 31 chapter p392 #4 4. a. b. c. Different ways of getting to $275 Value Added Final Goods Factor Income © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 23 of 31 chapter P. 377 #1 Revise your answers now if need be. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 24 of 31 chapter The National Accounts Calculating GDP The Components of GDP © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 25 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney chapter The National Accounts Calculating GDP The Components of GDP Net exports are the difference between the value of exports and the value of imports. What GDP Tells Us The most important use of GDP is as a measure of the size of the economy, providing us a scale against which to measure the economic performance of other years, or compare the economic performance of other countries. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 27 of 31 chapter Nominal GDP – to show comparison among nations http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal) © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 28 of 31 chapter Real GDP – to show change over time © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 29 of 31 chapter Real GDP and Aggregate Output Calculating Real GDP Real GDP is the total value of all final goods and services produced in the economy during a given year, calculated using the prices of a selected base year. Nominal GDP is the value of all final goods and services produced in the economy during a given year, calculated using the prices current in the year in which the output is produced. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 30 of 31 chapter Real GDP and Aggregate Output Calculating Real GDP with 2 products… TABLE 15-1 Calculating GDP and Real GDP in a Simple Economy Year 1 Year 2 Quantity of apples (billions) 2,000 2,200 Price of apple $0.25 $0.30 Quantity of oranges (billions) 1,000 1,200 Price of orange $0.50 $0.70 GDP (billions of dollars) $1,000 $1,500 Real GDP (billions of year 1 dollars) $1,000 $1,150 Year 1 Year 2 Nominal 2000x.25 + 1000x.50 = 1,000B 2200x.30 + 1200x.70 = 1,500B Real Same 2200x.25 + 1200x.50 = 1,150B © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 31 of 31 chapter p. 392 #6 Economy of Britannica with 3 goods % change = (current - initial)/ initial X 100 a. % change in production b. % change in prices c. Nominal GDP; % change in nominal d. Real GDP; % change in Real Computers Year P Q DVD’s Pizza P Q P Q %cha Prod %cha price C D P C DP ‘02 900 10 10 100 15 2 ‘03 1000 10.5 12 105 16 2 ‘04 1050 12 14 110 17 3 Nom GDP %cha nom ------ © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney Real GDP %cha real ------ 32 of 31 chapter Real GDP and Aggregate Output Calculating Real GDP with 2000 as base year TABLE 15-2 Nominal versus Real GDP in 1996, 2000, and 2004 Nominal GDP (billions of current dollars) Real GDP (billions of 2000 dollars) 1996 $7,817 $8,329 2000 9,817 9,817 2004 11,734 10,842 Why is Real GDP in 1996 higher than nominal? Why is Real GDP in 2004 lower than Nominal? © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 33 of 31 chapter p. 392 #7 a. Why is Real GDP greater than nominal in situations when we are comparing previous years to more current years? b. (current – initial) / initial X 100 c. Real GDP / population (do division and move decimal to the right 5 places) d. (current – initial) / initial X 100 e. % change in real GDP vs % change in GDP per capita © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 34 of 31 chapter Real GDP and Aggregate Output What Real GDP Doesn’t Measure GDP per capita is GDP divided by the size of the population; it is equivalent to the average GDP per person. http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(PPP)_per_capita © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 35 of 31 chapter Read “What Real GDP Doesn’t Measure” p.379 © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 36 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 37 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 38 of 31 chapter Human Development Index (HDI) Dark Green-Green-Light Green Yellow-Light Orange-Orange-Red-Brick-Black © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 39 of 31 chapter Infant Mortality Rates © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 40 of 31 chapter Literacy Rates © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 41 of 31 chapter Life Expectancy © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 42 of 31 Carbon Dioxide Emissions chapter (metric tons) © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 43 of 31 chapter Carbon-dioxide emissions © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 44 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 45 of 31 chapter If you are interested in sustainable economics… http://www.neweconomics.org/ © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 46 of 31 chapter Unemployment http://www.bls.gov/ © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 47 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 48 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 49 of 31 chapter Job sites http://www.monster.com http://www.craigslist.com http://www.careerbuilder.com/ © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 50 of 31 chapter What is the relationship between unemployment and GDP growth? Does GDP growth always mean a positive employment growth? © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney chapter The Unemployment Rate Growth and Unemployment © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 52 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney chapter The Unemployment Rate Understanding the Unemployment Rate © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 54 of 31 chapter Wednesday 4/6/2011 Today • Price Indexes and the CPI HW for tonight • Bring in Questions for tomorrow’s review session • Quiz - Friday © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 55 of 31 chapter Price Indexes and the Aggregate Price Level Market Baskets and Price Indexes A market basket is a hypothetical set of consumer purchases of goods and services. TABLE 15-3 Calculating the Cost of a Market Basket “Florida citrus frost increases prices” Pre-frost Post-frost Price of orange $0.20 $0.40 Price of grapefruit $0.60 $1.00 Price of lemon $0.25 $0.45 Cost of market basket (200 oranges, 50 grapefruit, 100 lemons) (200 × $0.20) + (50 × $0.60) + (100 × $0.25) = $95.00 (200 × $0.40) + (50 × $1.00) + (100 × $0.45) = $175.00 $175/$95 = 1.842 = 84.2%. So “the average price of a post-frost basket of FL citrus fruits is 84.2% higher than the pre-frost basket.” © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 56 of 31 chapter Quick practice Market basket for 100 homes in Coral Gables in 2000 = $400,000 Market basket for 100 homes in Coral Gables in 2010 = $600,000 What was the percent change in homes prices from year 2000 to 2010? © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 57 of 31 chapter Price Indexes and the Aggregate Price Level Market Baskets and Price Indexes A price index measures the cost of purchasing a given market basket in a given year, where that cost is normalized so that it is equal to 100 in the selected base year. (15-2) Price index in a given year Cost of market basket in a given year x 100 Cost of market basket in base year © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 58 of 31 chapter Practice. Page 393 #11 3 English books 2 math books 4 economics books 2002 2003 2004 Costs Price Index English 50 55 57 Math 70 72 74 Econ 80 90 100 2002 2003 English 50 Math Econ % change 2004 Costs Price Index % change 55 57 610 100 14% 70 72 74 669 109.7 5.7% 80 90 100 719 117.9 25% (e. inflation = 17.9%) © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 59 of 31 chapter Price Indexes and the Aggregate Price Level Market Baskets and Price Indexes The inflation rate is the percent change per year in a price index—typically the consumer price index. (15-3) Inflation rate Price index in year 2 - Price index in year 1 x 100 Price index in year 1 © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 60 of 31 chapter World Inflation Rates - 2007 © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 61 of 31 chapter Price Indexes and the Aggregate Price Level The Consumer Price Index The consumer price index, or CPI, measures the cost of the market basket of a typical urban American family. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 62 of 31 chapter Price Indexes and the Aggregate Price Level The Consumer Price Index © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 63 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney chapter 1982-4 = 100 © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney chapter Price Indexes and the Aggregate Price Level The Consumer Price Index © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 66 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 67 of 31 chapter Price Indexes and the Aggregate Price Level Other Price Measures The producer price index, or PPI, measures changes in the prices of goods purchased by producers. “Wholesale price index” “Early warning signal” The GDP deflator for a given year is 100 times the ratio of nominal GDP to real GDP in that year. © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 68 of 31 chapter Price Indexes and the Aggregate Price Level Other Price Measures © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 69 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney chapter KEY TERMS National income and product accounts (national accounts) Consumer spending Stock Bond Government transfers Disposable income Private savings Financial markets Government borrowing Government purchases of goods and services Exports Imports Investment spending Final goods and services Intermediate goods and services Gross domestic product (GDP) Aggregate spending Value added Net exports Real GDP Nominal GDP GDP per capita Market basket Price index Inflation rate Consumer price index (CPI) Producer price index (PPI) GDP deflator © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 71 of 31 chapter economics in action Good Decades, Bad Decades © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney 72 of 31 chapter © 2007 Worth Publishers Essentials of Economics Krugman • Wells • Olney