Unit of Property

advertisement

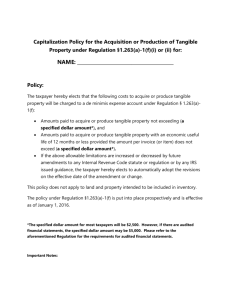

n n n n Overview of Tangible Property Regulations Greatest Impacts to your Clients Avoid the Traps of the Temporary Regs Action Steps to Prepare for 2013 Filing n Acquire, Produce, Improve. n 10 yrs. 300+ Pages Lots of Examples Not Many Bright Lines n n n n n Best Executive Summary of Temp Regulations Copies of the Final Regulations AICPA Summary Dispositions Cost to Improve Tangible Property Materials and Supplies Cost to Acquire Tangible Property n Partial Disposition Election 1.168(i)-8(d)(2) n Taxpayers may elect to treat a partial disposition of an asset as a disposition. n The election is made in the taxable year that the disposition occurs starting in 2014. Ability to write off assets that are no longer in use with Partial Disposition Election n Renovations n Remodels n Replacements, n Abandoned in Place n Common Items – Roofs, HVAC, Electrical Ability to write off assets that are no longer in use. Ghost Assets removed. n n n n Roof Replacement HVAC Redo Plumbing Redo Electrical n Value of what went into the Dumpster. n Relative to the value that your client paid for the building. n Disposed of as a Partial Disposition. n Write down to the basis of the property in years 2012 and 2013. • $1.5 m Nursing Home with major renovations • $91k in assets removed = Asset Valuation Study • $31k in cash flow • Basis Write Down Tax Savings at Sale • • • Asset Valuation $53k Cost Segregation on Renovation $126k Year of OPT In Matters o 2013 Get Both o 2014 No Past Disposition 2012 l& 2013 2014 2012 2013 l 2014 l Temporary Regs Opt in Period Final Regs Same Methods Disposition back to 1987 2012 l& 2013 2014 2012 2013 l 2014 l 3-6 3115s Scope Limitations Multiple 3115 Audit Protection Disposition back to 1987 2012 l& 2013 2014 2012 2013 l 2014 l Temporary Regs Opt in Period Scope Limitations Multiple 3115 Audit Protection Disposition back to 1987 Final Tangible Regulations Automatic 2012 l& 2013 2014 2012 2013 l 2014 l No Extended Scope Temporary Regs Limitations. Opt in Period No Multiple 3115s. Scope Limitations Limited to one 3115 every 5 years Final Per Accounting Method Disposition back to 1987 Final Tangible Regulations Automatic Both TPR and Cost Seg 2012 l 2013 l 2014 l Temporary Regs Opt in Period Partial Disposition is an Annual Election In the tax year item removed Scope Limitations Multiple 3115 Audit Protection Correct Past Capitalization Expense Issues / Disposition Final Final Tangible Regulations Automatic Current Economic Disposition not taken for catch up tax savings results. IRS says…“Use it or lose it”. Basis Reduced without the benefit of the deduction. At time of sale: Unexpected recapture How do I get “The Number”? IRS says to use: n n Reasonable Method Cost Segregation is a Certain Method 1. 2. Discounting the cost of the replacement asset to its placed-in-service year cost using the Consumer Price Index. Pro rata Allocation of the unadjusted depreciable basis of the GAA based on the replacement cost of the disposed of asset and the replacement cost of all of the assets in the GAA or Multiple Asset Account. 3. A Study allocating the cost of the asset to its individual components. Cost Segregation is a certain method. n n n n n Scan Plans – Estimating Software IRS accepted Cost Databases Defined Engineeringbased Methodology The Study: Report Form meets IRS Report Criteria Defendable n Large Renovations n Complicated Remodels n Retired components and Partial Disposition The process of analyzing and identifying commercial building components that are eligible for accelerated depreciation providing a significant tax benefit for the taxpayer. Personal Property is segregated from Real Property $50-$80k per $1 Million Works on $200k building Personal Property - Section 1245 Property - Non-structural building components - Depreciated over 5, 7, or 15 years - Eligible for double declining depreciation - Land Improvements Real Property - Section 1250 Property - Structural building components - Depreciated over 27.5 or 39 years - Straight line depreciation - Land Improvements not subject to depreciation/amortization vs. Future Value of Invested Tax Savings I n v e s t e d S a v i n g s $2,000,000 $1,900,000 $1,800,000 $1,700,000 $1,600,000 $1,500,000 $1,400,000 $1,300,000 $1,200,000 $1,100,000 $1,000,000 $900,000 $800,000 $700,000 $600,000 $500,000 $400,000 $300,000 $200,000 $100,000 $- $100,000 @ 8% $1,050,000 $500,000 $200,000 1 3 5 7 9 11 13 15 17 19 21 23 25 Years of Ownership 27 29 31 33 35 37 39 Partial Disposition allows the write down of retired elements. No recapture on retired building pieces Permanent Tax Savings at Time of Sale Rates reduced from Ordinary Income level (35-41%) to Capital Gains (20%) Office Condo Office Condo Summary Building Cost: Tax Savings Benefit: $324,000 $30,609 Study Fee Before Tax: $3,400 Study Fee After Tax: $2,176 ROI: 14:1 Manufacturing Company Manufacturing Company Actual Savings Overview Building Cost $ 783,000 Date Acquired October 2007 Tax Year: 2007 2010 2011 Current Method Accumulated Depreciation Reported 39 year straight line method $ 4,189 $ 64,417 $ 84,494 Alternative Method Cost Segregation Study Accumulated Depreciation 5 yr. 15 yr. 39 yr. Total $ $ $ $ 15,112 2,408 2,865 20,385 $ 121,741 $ 27,855 $ 44,062 $ 193,658 $ 138,529 $ 34,701 $ 57,794 $ 231,024 Results for Tax Year: Increased Accumulated Depreciation Expense Tax Rate (Estimated) 2007 $ 16,196 36.0% 2010 $ 129,241 36.0% 2011 $ 146,530 36.0% Estimated Accumulated Tax Savings Benefit $ $ 46,527 $ 52,751 5,831 Auto Dealership Auto Dealership Actual Savings Overview Building Cost $ 2,036,777 Date Acquired August 2010 Tax Year: 2010 2011 2014 Current Method Accumulated Depreciation Reported 39 year straight line method $ 19,614 $ $ $ $ $ 101,839 38,699 6,865 153,222 $ $ $ $ $ 2010 133,608 71,837 $ 228,506 Alternative Method Cost Segregation Study Accumulated Depreciation 5 yr. 15 yr. 39 yr. Total Results for Tax Year: Increased Accumulated Depreciation Expense Tax Rate (Estimated) Estimated Accumulated Tax Savings Benefit $ 38.0% $ 50,771 264,781 112,226 25,143 417,946 $ $ $ $ 479,865 291,564 79,977 883,053 2011 346,109 $ 2014 654,547 38.0% $ 131,521 $ 38.0% 248,728 Dispositions Cost to Improve Tangible Property Materials and Supplies Cost to Acquire Tangible Property Anyone with Tangible Property - New regulations provide guidance on whether an expenditure on tangible property should be considered a capitalization or expense. Purpose - Provide guidance and clarification on applications of Sec. 162(a) and 263(a) with regards to amounts paid to acquire, produce, or improve tangible property - Code Section 162(a)- Cost are deductible as a repair expenses if incidental in nature and neither adds to the value of property nor appreciably prolong its useful life. - Code Section 263(a) – Costs are capitalized if for permanent improvements or betterments that increase the value of property, restore its value or use, substantially prolong useful life, or adapt it to new or different use. Purpose - Provide guidance and clarification on applications of Sec. 162(a) and 263(a) with regards to amounts paid to acquire, produce, or improve tangible property • Supposed to summarize all case history relating to Cost Seg. December 2003 – Notice 2004-06 Requesting comments on the issues August 2006 – Proposed Regulations issued March 2008 - Re Proposed regulations – Lots of bad feedback December 2011 “New” temp regulations and proposed regs are released Effective for tax years beginning Jan. 1st, 2012 Later deferred until tax years beginning 1/1/2014 IRS – Notice 2012-73 March 2012 - Rev. Proc. 2012-19 & 2012-20 (IRS guidance on Regs.) September 2013 – Final Regulations Sept 9, 2013 OCT / NOV 2013 – Final Procedural Guidance Relief for Small Businesses - small taxpayers (<$10M) can elect not to apply improvement rules to eligible building (<$1M). If total amount paid < $10,000 or 2 percent of unadjusted basis of the building. Changes to definitions of Betterments and Restorations Routine Maintenance Safe Harbor rule – extend safe harbor to buildings but require 10 years as the period which a taxpayer must reasonably expect to perform the relevant activities more than once. Dispositions – the Proposed Regulations for Dispositions change the rules for partial dispositions of assets. Requires making a qualifying disposition election for certain situations when assets are held in GAA. Partial Disposition election is made on Federal return for the taxable year in which the portion of the asset is disposed by the taxpayer. Cost Segregation Studies are more relevant for repair determination and for retirement purposes. Many sections of regs. must be applied retroactively to all prior years where it presents a material difference in tax liability. IRS has not provided clear guidance on how far back to go. Must File Form 3115 “Change of Accounting Method” for several sections of the regulations. (most taxpayers 4-6 CAMs) Rules generally apply to tax years beginning on/after 1/1/2014 (but also apply to cost incurred in prior years) Taxpayers that incurred costs to repair or improve tangible property are required to conform prior years expenditures to the Final Repair Regs. If you did a “repair study” in a prior year, you may have to revisit those. Final & Temp Repair Regs. require Changes of Accounting Methods to be filed. Several sections require full 481(a) adjustments for prior years as mentioned above. (2012 & 2013) Options for tax years beginning 2012 & 2013 Continue with existing accounting methods Early adopt the 2011 Temp Repair Regs. Early adopt the Final Repair Regs. All taxpayers must conform to the Final Repair Regs for tax years beginning 1/1/2014 Can still apply to 2012 (180 day window) Sections below do NOT require 481(a) adjustments. Applied to amounts for tax years on/after 1/1/2014 with option to apply to tax years beginning on/after 1/1/2012, Materials and supplies (Reg. sec. 1.162-3); De minimis rule ("capitalization threshold“) (Sec. 1.263(a)-1(f)); Costs for acquisition of real property (Sec. 1.263(a)-2(f)(2)(iii)); Employee comp and overhead costs for acquisition of real/personal property (Reg. sec. 1.263(a)-2(f)(2)(iv)) Inherently facilitative amounts for acquisition or production of real/personal property (Reg. sec. 1.263(a)-2(f)(3)(ii)); Safe harbor for small taxpayers (Reg. sec. 1.263(a)- 3(h)); Continued… Optional regulatory accounting method for amounts to repair, maintain, or improve tangible property (Reg. sec. 1.263(a)-3(m)); Election to capitalize repair and maintenance costs (Reg. sec. 1.263(a)-3(n)); Section 263A direct material costs (Reg. sec. 1.263A-1(e)(2)(i)(A)); Section 263A indirect material costs (Reg. sec. 1.263A-1(e)(3)(ii)(E)). For early adopters, there is transition relief to make certain elections on 2012 & 2013 amended returns. General Asset Account Election issue addressed – do not have to elect GAA treatment to forgo loss upon retirement of structural component De minimis Rule Change - eliminated the ceiling! Amounts less than $5,000 per item (invoice) can be expensed for tax as long as they are expensed on financial statements. Taxpayers without Applicable Financial Statements can use De minimis rule with a limit of $500 per item (or invoice) Routine Maintenance Safe Harbor rule –extend safe harbor to buildings but require 10 years as the period which a taxpayer must reasonably expect to perform the relevant activities more Issue Prior Temp/Final Regulations Regulations De minimis Rule n/a • Eliminates Ceiling • Properly Expensed to be Deductible • No Statement Restrictions • <$5,000 per invoice or item • (with AFS) De minimis Rule Safe Harbor Scope n/a • <$5,000 per invoice or item. • Economic useful life 12 months or less • (with AFS) • <$500 per invoice or item (without AFS) Issue Prior Regulations Acquisition / Production • Capitalize amounts Cost paid to acquire / produce tangible property or defend or protect title Temp/Final Regulations • Largely restate prior rules • New list of inherently facilitative cost • Safe Harbors for employee comp /overhead and real property investigatory cost Issue Prior Regulations Temp/Final Regulations UOP General rule N/A Functional Interdependence UOP Building N/A Each building and its structural components UOP– Plant Property N/A Each Component that performs a discrete and major function or operation Issue Materials and Supplies Prior Regulations Temp/Final Regulations • Not Defined • New Definitions • Incidental –deduct • Same General when purchased Methods • Elections available to • Non-Incidentalcapitalize and depreciate deduct when used or or deduct under the consumed De minimis rule • Special rules for rotables and temporaries $200 limit Issue UOP – Leased Property Prior Regulations N/A Temp/Final Regulations Lessor: Each building and its structural components Lessee: Portion of each building subject to lease and structural components of leased portion Improvement Standards N/A Betterment Adaptation Restoration Issue Prior Regulations Temp/Final Regulations Relief for Small Businesses N/A Exempt from Improvement Rules if • Less than $10,000 • Or 2% of unadjusted basis of building • < $1M basis • Less than $10M Disposition (rules not final) Include sale, exchange, retirement, abandonment, destruction, scrap, involuntary conversion Add retirement of Structural Components of a Building Partial Disposition Issue Routine Maintenance for Safe Harbor Changes to Betterment and Restoration Prior Regulations N/A Temp/Final Regulations • extend safe harbor to buildings • 10 years as the period which a taxpayer must reasonably expect to perform the relevant activities. Results in changes to is Rev. Proc. 2012-19 Repairs / Unit of Property Improvements Routine Maintenance Safe harbor Optional Regulatory Method Incidental Supplies Non-Incidental Supplies Rotable Spare Parts De minimis Rule Dealer Facilitative Sales Costs Non-dealer Facilitative Sales Cost Real Property Investigatory Costs Capitalize Costs to Acquire/ Produce Property Rev. Proc. 2012-20 Depreciation / Amortization of Leasehold Improvements Disposition of buildings or structural components Changes within single, multiple or general asset accounts Disposition of tangible depreciable assets (other than buildings) Late general asset account elections Defined as tangible property used in taxpayer's business that is not inventory and A component acquired to maintain, repair, or improve a UOP that is not acquired as part of any single UOP; Fuel, lubricants, water, & similar items expected to be consumed < or =12 months from beginning of use; UOP with a useful life of < or = 12 months; CHANGE: UOP < $200 (from $100 in Temp Regs.); Property identified in published guidance in the Federal Register or in the IRS Bulletin as materials and supplies. Incidental materials and supplies • Deductible when purchased Non-Incidental materials and supplies • Deductible when used or consumed CHANGE: Election to capitalize and depreciate is now only available for rotable, temporary, or standby emergency spare parts. Taxpayers must Capitalize Cost associated with Real or Personal property paid to: • Produce or Acquire the property • Facilitate the Acquisition • Defend or Perfect the Property De Minimis Safe Harbor Expenses CHANGE: $5,000 expensing threshold per item or invoice for property if taxpayer Has an Applicable Financial Statement (AFS) Has written expensing policy for amounts under a certain dollar amount Treats the amounts as expenses on the AFS as well $500 expense threshold per item or invoice if taxpayer does not have an Applicable Financial Statements Must still have written expensing policies in place at the beginning of the tax year. Elected, it is also applied to all eligible materials & supplies except, rotable, temporary, and standby emergency spare parts. If tangible property is acquired with intent of being used to produce property, 263A may required capitalization. De minimis Safe Harbor is elected annually for all amounts paid in that tax year that meets the safe harbor. No deductions if exceeded. Includes materials and supplies that meet requirements for qualification. Cannot exclude qualifying expenses. De Minimis Safe Harbor Expenses Deductible – must reasonably expect (at time UOP is placed in service) to perform more than once during class life (alternative depreciation system (ADS)) Safe harbor does not apply to Betterments, Adaptations, or some Restorations (see Reg. § 1.263(a)-3(i)(3)) Consider - recurring nature of activity, industry practice, manufacturers' recommendations, and taxpayer's Taxpayers must Capitalize or Expense cost associated with improving tangible property based on the Unit of Property Concept. Determine Unit of Property Apply Improvement Standards Consider whether Routine Maintenance Safe Harbor Applies Capitalization Expenditure For Real and Personal Property (except buildings) • a Unit of Property is comprised of all components that are functionally interdependent (i.e., the placing in service of one component is dependent on the placing in service of the other component). • EXAMPLES Tires on a Truck HVAC System (pumps, compressors, piping, etc.) Except for certain defined building systems, a building is considered a single Unit of Property. New regulations require taxpayer to consider effects on expenditures of “building systems” rather than the building as a whole. Units of Property within a building must be defined in order to properly apply new temporary regulations and final regulations. Taxpayers have depreciation schedules that need revision in regards to UOP. The smaller the Unit Of Property, the more likely to Capitalize Facts and Circumstances Driven Must analyze each cost in relation to UOP $7,000 in a UOP valued at $40,000 - Improvement $7,000 in a UOP valued at $400,000 Repair Building and its structural components are considered a single Unit of Property 1.263 (a)-3T(e)(2)(i) Building Structure consist of “building and its structural components other than the structural components designated as Building Systems… 1.263(a)-3T(e)(2)(ii)(a) 1. 2. 3. 4. 5. 6. 7. 8. 9. HVAC Fire Protection & Alarm Elevators/Escalators Electrical Plumbing Gas Distribution Security Systems Any other systems identified in published guidance Rest of Building(walls, flooring, ceiling…) Cost Segregation Depreciation The Building Elements/Units of Property Site Work / Improvements Water Well Site Drainage Parking Lot Exterior Signage Structure Parking Lot Striping / Barriers Sidewalks Landscaping Security Lighting Poles Aggregate Base Paved Area Exterior Fencing / Decking Retaining Walls Fabricated Steel - Bollards Patio Concrete Exterior Wood Trellis Systems Gazebo Building Structure Structural Components Roofing Systems Foundations HVAC Electrical Plumbing Masonry Doors & Windows Insulation Gas Distribution Drywall Painting Fire Protection & Alarm Gutters & Downspouts $ 5,464,546.00 $ 19,318.45 $ 48,990.57 $ 138,639.38 $ 17,790.84 $ 23,325.00 $ 711.12 $ 68,635.17 $ 6,374.77 $ 192,436.06 $ 31,986.93 $ 16,024.07 $ 2,926.12 $ 10,848.65 $ 2,783.73 $ 4,605.26 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 8.00 559,508.38 66,975.93 234,535.89 179,747.78 242,472.40 68,844.81 40,657.35 17,063.50 43,168.87 4,989.84 13,092.14 23,796.64 15,192.82 12,335.58 Building Components $ 6.00 Cabinets / Millwork Moldings Wood Paneling Flooring - Vinyl Tile Flooring - Carpet Window Treatments Air Curtain Building Signage Specialty Electrical - Kitchen Equip. Communication / Data Specialty Plumbing - Cooler Equip. / Kitchen Sinks Security / Exterior Lighting FRP Wall Panels Rear Entry Canopy Interior Overhead Doors - Security Slatwall / Pegboard Paneling Surveillance System Interior Wood Trellis Systems Liner Panels Paging System Windmill Exhaust Hood Fire Extinguishers Cooler Movable Storage Units $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 20,085.41 8,286.30 2,062.22 519.68 9,084.00 187.90 1,709.08 122.56 15,216.78 32,356.35 10,181.63 9,827.88 1,003.24 20,084.92 21,931.82 9,657.00 4,375.25 6,046.21 109,271.70 1,688.23 17,244.53 11,258.61 1,833.25 10,635.63 30,431.69 Lessor - entire building UOP For multi-tenant buildings, UOP is always the entire building Lessee – UOP is portion of the building that is leased. For multi-tenant buildings UOP is their space CHANGE: Amounts paid by lessee are NOT separate UOP from leased property. Combine all future improvements to leased portion into the UOP being leased Ex 5. p148. In year 2, “T” pays for large extension of building they lease. In year 5, adds overhead door to the extension. UOP is now the entire building including the extension and overhead door. Special rules for: Plant Property Special Rule – UOP are components that perform a discrete and major function within the functionally interdependent equipment Two pieces of equipment that are functionally interdependent cannot be separate UOP Network Assets- UOP is based on facts and circumstances. Capitalize…Amounts paid for new building or improvements 1.263(a)-3T • Betterments… that increase value of property, • Adaptations… bring property to new or different use • Restorations…return of original condition Expense... Amounts paid for incidental repairs and maintenance of property 1.263 (a)-1 • Refresh… ? Betterments Adaptations Capitalize Improvements Restorations A Betterment is an expenditure that - Corrects a Material Defect existing prior to the taxpayer’s acquisition of the UOP or one that arose during the production of the UOP at acquisition or production; - Is a Material Addition ( physical enlargement, expansion or extension) to the UOP; - Is a Material Increase in capacity, strength, productivity, efficiency, quality, or output of the UOP. Betterment-1.263 (a)-3T(h) is to capitalize. Lessee Improvements: A lessee improvement constitutes a separate Unit of Property from the leased property being improved, and must be capitalized. The new property interest is separate and identifiable from the lessor’s interest in the underlying property. Adapting to New or Different Use Change not consistent • with the taxpayer’s intended use • the Unit of Property at the time originally placed in service o Example: Fabrication shop converted to retail store. o Example: Warehouse converted to apartments Roofing HVAC Fire Protection Electrical System Plumbing System General Remodel..removing walls, painting, flooring, ceiling tiles, carpet, floor tiles Windows Flooring Restoration1.263(a)-3T(i)(5) CHANGE: Major Component – Parts that Perform a discrete and critical function in operation of UOP CHANGE: Substantial Structural Part - A large portion of the physical structure of the UOP Must consider all facts and circumstances - both quantitative & qualitative Not just the cost, but the size, type, function etc. Replacement of minor component of UOP will not constitute a major component or substantial structural part Even though it affects the function of the UOP (example: roof tiles) CHANGE: For Buildings - Major Component or Substantial Structural Part if Replacement includes parts that comprise a major component or a significant portion of a major component of a building or building system. OR Replacement includes parts that comprise a large portion of the physical structure of the building or building system. Refresh • Capitalization is not needed. • Does not materially increase capacity, productivity, efficiency, strength or quality of the building’s structure • A refresh keeps the building structure and systems in ordinary efficient operating condition that is necessary to continue to attract customers. • An automobile dealer owns a car dealership. To remain competitive in the marketplace and maintain customer traffic and sales, the owner does occasional refreshes to the dealerships • • Cosmetic: Example….patching holes in the walls, repainting interior , replacing damaged ceiling tiles, and repairing and cleaning vinyl flooring. Qualify: • Did not deal with any defects that existed at acquisition of building • Did not result in any addition to the store buildings. • Did not increase capacity, productivity, efficiency, strength, or quality of the building’s structure • Did not change other building systems; • Did not have to be considered a betterment. Section 168 • Includes: - Sale or Exchange - Retirement - Physical Abandonment - Destruction - Transfer to supplies or scrap - Involuntary conversion - Retirement of a structural component (or improvement to) of a building. New rule allows tax payers to not depreciate both the removed and replacement property. • Old Rule: Replace roof, depreciate old and new roof. • New Rule: Replace roof, deduct the Tax NBV of old roof……Write down result (Sec . 1231 loss). Recognition of loss is no longer mandatory. • Election is retroactive to date of improvement. • Must keep records of GAA groupings. A business owner buys 20 year old building and replaces the Roof after 5 years of ownership. Old Regs: 5 years Cost of Roof Hidden in Larger Building Number 39 years A business owner buys 20 year old building and replaces the Roof after 5 years of ownership. New Regs: 5 years 39 years Before 2014 Elect to apply Temp or Final Regulations: Requires Change in Accounting form 3115…19 codes A. B. C. D. Tax years 2012 / 2013 allow for multiple change in accounting changes for same property/entity. Possible write down of previously retired building elements resulting from demolition/restoration/improvements. Cost Segregation study may be done concurrently to achieve building depreciation redefinition for accelerated tax lives. Cost Segregation Study can identify elements for catch up/ write down opportunities…defendable. After 1/1/2014 A. Automatically requires use of Final Regulations. B. Cost Segregation Study may be done concurrently to achieve building depreciation for accelerated tax lives. C. Cost Segregation Study can identify elements for write down opportunities for future with defined units of property, or element of the unit of property. • May give guidance for expense within Unit of Property for future • Elect by filing Form 3115 and attaching the required documentation listed in the Regs and Revenue Procedures • Waiting for Procedural Guidance in Oct/Nov. • IRS trying to simplify process. • Tax payers who are on calendar year have until January 1, 2014 to comply with method change rules and not be subject to the scope limitations of section 4.02 Will these be extended? Not Likely. • Need to plan by making appropriate elections in 2012 and 2013 • You may not have the right to write-off structural components after 2013 if you don’t elect the provisions of the temp regulations that allow it. Oct/Nov clarification • Could have negative affect on taxpayer. • Eliminate Ghost Assets on client’s depreciation schedules Accounting Transactions for Disposition Disposition Study Valuation Disposition of 1231 property - Reported as sale for $0 - Scrapped -Loss equal to undepreciated basis Calculate 481 (a) adjustment 481 (a) adjustment calculated and taken as -Other expense -Allowed in accordance with Temp Regs. (old regs did not allow a partial disposition) Cost Segregation Specialist Form 3115 IRS is beginning to look hard at incorrect depreciation (errors) and advises taxpayers to make the necessary corrections now during this opportunity. Experts project each business entity will make between 3 and 4 changes in accounting methods (3115) by the end of 2013. Start the Process Now…..It is getting late for 2013! Qualify your clients to make them aware of “catch up” for 2013 tax year. • Find all clients with depreciation on building assets. • Qualify clients with estimated Disposition and Cost Segregation economic needs. • Get an engineering-based study for each client with a qualified Cost Segregation Company that produce Engineering-based Study that meets the IRS 13 Criteria for a Quality Study. • Apply the Change in Accounting Form 3115 with study results to the client’s return. Performing Engineering-based studies for over 13 years, National capability, 8,000 Studies completed across the U.S., always on-time. Qualify the tax savings estimates in 48 hrs. for your client. Full engineering-based studies completed in 4-8 weeks. Perform Change in Accounting Form 3115 and 481(a) adjustments. Use CSSI as your engineering-based service provider for your clients. 100 Circular 230 Disclosure To comply with IRS requirements, we inform you that any tax advice contained in this communication is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties under the Internal Revenue Code.