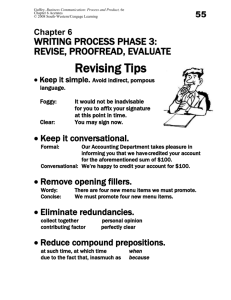

Chapter 13

advertisement

LESSON 13-1 Recording A Payroll CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 2 PAYROLL REGISTER CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning page 369 LESSON 13-1 3 ANALYZING PAYMENT OF A PAYROLL CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning page 370 LESSON 13-1 4 JOURNALIZING PAYMENT OF A PAYROLL page 371 December 15. Paid cash for payroll, $4,609.46. Check No. 335. 1 2 3 4 6 1. Write the date. 2. Write the title of the account debited. 3. Write the check number. 4. Write the account debited. 5 7 5. Write the total amount paid to employees. 6. Write the titles of accounts credited. 7. Write the amounts credited. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 13-1 LESSON 13-2 Recording Employer Payroll Taxes CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 6 UNEMPLOYMENT TAXABLE EARNINGS page 374 2 3 1 1. Enter accumulated earnings and total earnings for each employee. 2. Enter unemployment taxable earnings. 3. Total the Unemployment Taxable Earnings column. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 13-1 7 UNEMPLOYMENT TAXES Unemployment × Taxable Earnings $790.00 × Unemployment × Taxable Earnings $790.00 × Federal Unemployment Tax Rate 0.8% State Unemployment Tax Rate 5.4% page 375 Federal = Unemployment Tax = $6.32 State = Unemployment Tax = CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning $42.66 LESSON 13-1 8 JOURNALIZING EMPLOYER PAYROLL TAXES (continued on next slide) page 376 December 15. Recorded employer payroll taxes expense, $485.92, for the semimonthly pay period ended December 15. Taxes owed are: social security tax, $354.11; Medicare tax, $82.83; federal unemployment tax, $6.32; state employment tax, $42.66. Memorandum No. 63. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 13-1 9 JOURNALIZING EMPLOYER PAYROLL TAXES (continued from previous slide) 2 1 4 3 5 1. Write the date. 2. Write the title of the expense account debited. 3. Write the memorandum number. page 376 6 4. Write the debit amount. 5. Write the titles of the liability accounts credited. 6. Write the credit amounts. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 13-2 10 TERMS REVIEW page 377 federal unemployment tax state unemployment tax CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 13-1 LESSON 13-3 Reporting Withholding And Payroll Taxes CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 12 EMPLOYER ANNUAL REPORT TO EMPLOYEES OF TAXES WITHHELD CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning page 378 LESSON 13-1 13 EMPLOYER’S QUARTERLY FEDERAL TAX RETURN (continued on next slide) page 379 1 2 1. Heading 2. Number of employees CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 13-1 14 EMPLOYER’S QUARTERLY FEDERAL TAX RETURN (continued on next slide) page 379 3 4 5 6 7 3. Total quarterly earnings 4. Income tax withheld 5. Employee and employer social security and Medicare taxes 6. Social security plus Medicare taxes 7. Total taxes CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 13-1 15 EMPLOYER’S QUARTERLY FEDERAL TAX RETURN (continued from previous slide) page 379 9 8 8 8. Total taxes for each month 8 9. Total taxes CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 13-1 16 EMPLOYER ANNUAL REPORTING OF PAYROLL TAXES CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning page 381 LESSON 13-1 LESSON 13-4 Paying Withholding and Payroll Taxes CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning PAYING THE LIABILITY FOR EMPLOYEE INCOME TAX, SOCIAL SECURITY TAX, AND MEDICARE TAX CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning 18 page 383 LESSON 13-4 19 FORM 8109, FEDERAL DEPOSIT COUPON CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning page 384 LESSON 13-1 20 JOURNALIZING PAYMENT OF LIABILITY FOR EMPLOYEE INCOME TAX, SOCIAL SECURITY TAX, AND MEDICARE TAX page 385 January 15. Paid cash for liability for employee income tax, $757.00; social security tax, $1,451.38; and Medicare tax, $339.42; total, $2,547.80. Check No. 347. 1 5 3 2 1. Write the date. 2. Write the titles of the three accounts debited. 4 3. Write the check number. 4. Write the debit amounts. 5. Write the amount of the credit. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 13-1 21 PAYING THE LIABILITY FOR FEDERAL UNEMPLOYMENT TAX CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning page 386 LESSON 13-1 22 JOURNALIZING PAYMENT OF LIABILITY FOR FEDERAL UNEMPLOYMENT TAX page 387 January 31. Paid cash for federal unemployment tax liability for quarter ended December 31, $34.60. Check No. 367. 1 2 3 4 5 1. Write the date. 2. Write the title of the account debited. 3. Write the check number. 4. Write the debit amount. 5. Write the amount of the credit to Cash. CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 13-1 23 JOURNALIZING PAYMENT OF LIABILITY FOR STATE UNEMPLOYMENT TAX page 387 January 31. Paid cash for state unemployment tax liability for quarter ended December 31, $233.55. Check No. 368. 1 2 3 4 5 1. Date 2. Account debited 3. Check number 4. Debit amount 5. Credit amount CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 13-1 24 TERMS REVIEW page 389 lookback period CENTURY 21 ACCOUNTING © 2009 South-Western, Cengage Learning LESSON 13-1