Årsrapport 2007/08 præsentation, 26. november 2008 Ved

advertisement

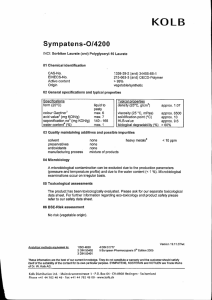

Annual Report 2007/08 presentation, 26 November 2008 By Lars Marcher, CEO, and Anders Arvai, CFO Agenda Developments in 2007/08 More ambitious strategy Outlook for 2008/09 26 November 2008 2 Highlights 2007/08 a satisfactory year Solid growth in revenue and operating profit Growth in revenue at a higher level Growth in virtually all markets and for the entire product programme Ambu wins market share Activities launched earlier within production, product development and sales are having the desired effect Economic slowdown in the world economy has not affected Ambu so far 26 November 2008 3 Revenue Revenue of DKK 784m for FY 2007/07 – up 10% (15% when reported in local currencies) USA back on track Streamlining of sales efforts beginning to bear fruit Negative effect of exchange rates of approx. DKK 36m 800 600 400 200 0 03/04 26 November 2008 04/05 05/06 06/07 07/08 4 Revenue by business area DKKm 2006/07 2007/08 Respiratory Care 271.2 317.1 Cardiology 266.2 276.9 Neurology 69.4 79.0 CPR Training 61.3 63.6 Immobilization 46.9 47.8 715.0 784.4 Total Respiratory Care Double-digit growth Cardiology figures in all important markets – exceeding Growth at a higher level – Respiratory Care Cardiology Neurology CPR Training Immobilization Neurology Double-digit growth refocusing of sales efforts figures in several Particularly strong growth important markets market growth in the USA, Spain and Broadly founded growth Italy attracting considerable Electrode production interest – strongest growth within laryngeal masks relocated from Ølstykke to and ventilation bags Malaysia 26 November 2008 Improved needles Still attractive growth potential 5 Revenue by geographical region DKKm 2006/07 2007/08 Europe 467.4 511.4 North America 182.5 211.9 65.1 61.1 715.0 784.4 Rest of the world Total Europe Europe North America Rest of the world USA Growth exceeds market growth Solid growth in core markets, except France Focused sales efforts are working Potential for continued solid growth 26 November 2008 Growth at a high level – 31% increase when reported in USD Double-digit growth within four out of five business areas Focused sales efforts for key products and targeting a broad spectrum of customers, including GPOs 6 Operating profit (EBIT) EBIT of DKK 86m against DKK 69m the year before Improvement is primarily attributable to higher revenue and higher gross profit margin 100 90 80 70 60 Changes in exchange rates: negative impact on EBIT of approx. DKK 5m 50 EBIT margin of 11.0% against 9.7% the year before 30 Exclusive of extraordinary legal fees, the EBIT margin was 12% 10 26 November 2008 40 20 0 03/04 04/05 05/06 06/07 07/08 7 Slightly improved cash flow DKKm 2006/07 2007/08 Cash flows from operating activities 89.5 84.5 Cash flows from investing activities: (56.0) (48.9) 33.4 35.6 Free cash flow The improvement is primarily attributable to a higher operating profit and lower investments 26 November 2008 8 Agenda Developments in 2007/08 More ambitious strategy Outlook for 2008/09 26 November 2008 9 Ambu heading for new goals Activities in the next two years Product development The launch of significantly more new and differentiated products than has been the case so far Acquisitions The acquisition of new products and activities Markets and products Increased focus on growing markets and product areas Sales Streamlining 26 November 2008 Enlarging the sales force and further focusing of sales efforts General streamlining of important areas 10 Several new products The ability to develop new products is decisive to ensuring higher growth Further focusing and intensification of development efforts Focus on products developed by Ambu as well as acquired products Several new products in the pipeline will contribute to revenue from 2008/09, but primarily in 2009/10 Primary focus on differentiated single-use products for: Hospitals Rescue services Outpatient surgery centres Identifying several new product areas – one being sleep diagnostics 26 November 2008 11 More efforts going into making acquisitions Acquisitions to stimulate growth Business areas: Continuous scanning of the market – focus is on the acquisition of small companies and product lines as well as large companies What we are finding is that prices are moving towards more realistic levels The criteria for making acquisitions remain the same – consolidation and synergies 26 November 2008 12 Sleep diagnostics – agreement with Sleepmate Conclusion of conditional agreement concerning the purchase of activities from Sleepmate Technologies Inc. in November 2008 Sensors used to examine obstructive sleep apnoea Sleepmate a leading player in the US market Some of Ambu’s products are already used within sleep diagnostics. Through acquisitions, a full product programme of sensors and electrodes can be offered Transaction expected to be finalised before the end of the year Price: USD 6.9m Sleep diagnostics – growth drivers Market growth of 15% Only a small percentage of the estimated 20 million people suffering from sleep apnoea have been diagnosed Obesity epidemic causes severe increase in sleep disorders High growth expected in Europe, which is an underdeveloped market compared with USA Shift to single-use products 26 November 2008 13 Focus on growth markets and bigger sales force Further streamlining of the sales efforts in Europe and the USA and taking on more salespeople Increased efforts in selected markets with high growth and developed health systems China – establishment of own sales offices Selected countries in Eastern Europe – expansion of distributor networks 26 November 2008 14 New production strategy Production will be based at the existing factories in Denmark, China and Malaysia in the coming four years Future production capacity expansions will be implemented in Malaysia – the factory in Malaysia will be extended by approx. 8,000 square metres Production in China will be maintained close to the current level Production in Denmark will be reduced – production of the Blue Sensor products will be moved to Malaysia. The move will start once the extension of the factory in Malaysia has been completed in the first half of 2010 Further streamlining of existing factories 26 November 2008 15 General streamlining of key areas Sales and marketing – further intensified efforts Development – including strengthening of search team Supply chain – including the establishment of strategic purchasing function, improvement of forecasting system and better inventory management Production – including improved management and higher efficiency and capacity utilisation at factories 26 November 2008 16 Financial objectives Growth at significantly higher level than market growth Increase in EBIT margin – no increase in 2008/09, however, due to increase in sales force Increase in cash flow – among other things via working capital optimisation 26 November 2008 17 Agenda Developments in 2007/08 More ambitious strategy Outlook for 2008/09 26 November 2008 18 Outlook for 2008/09 Growth in revenue of approx. 8%, corresponding to approx. DKK 850m (USD: 550) EBIT margin of approx 11-11.5%, corresponding to approx. DKK 97m Profit before tax of approx. 10-10.5% of revenue, corresponding to approx. DKK 87m Free cash flow of approx. DKK 50m (with investments amounting to approx. 7% of revenue) No significant effect so far of lower economic growth – recession may have a limited impact on Ambu 26 November 2008 19 Gearing for higher profitable growth in 2008/09 Launch of new products – more in the pipeline Acquisition of new products and activities – identification of opportunities Increased sales efforts in both growing markets and product areas – establishment of sales offices in China and expansion of distribution networks in selected markets in Eastern Europe Further focusing of sales efforts and expansion of sales force – taking on more salespeople in both Europe and the USA Continued optimisation of production – e.g. commencement of extension of the factory in Malaysia 26 November 2008 20 Questions For further information, please visit www.ambu.com For further information, please contact: Lars Marcher, CEO, lm@ambu.com or +45 5136 2490 Anders Arvai, CFO, aa@ambu.com or +45 7225 2000 26 November 2008 22