From Wine to Beer - University of Toronto

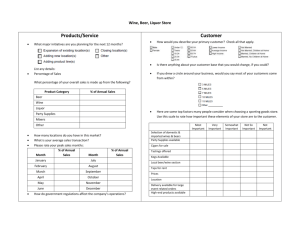

advertisement

From Wine to Beer: Changing Patterns of Alcoholic Consumption and Living Standards in Late-Medieval Flanders, 1300 – 1550 by John Munro (University of Toronto) revised 14 July 2010 From Wine to Beer in LateMedieval Flanders: Introduction • • • • 1) Northern Europe: land of beer & butter; vs. southern Europe as land of wine and olive oil: not always so: not in medieval Europe 2) Meagre evidence on this shift in the North: declining per capita wine consumption and rising per capita beer consumption: • from studies by: Margery James, Michael Postan, Hans Van Werveke, Jan Craeybeckx, Herman Van der Wee, Richard Unger: who all believe that there was such a shift • but who neither substantiate fully that belief nor fully explain how it happened (see below: the ‘hop thesis’). Van Werveke & Craeybeckx on Ghent wine consumption Years Per capita wine consumption in litres (annual) Years Per capita wine consumption in litres (annual) 1361 38.00 1406 16.00 1370 38.00 1410 25.00 1377 44.00 1413 15.00 1381 33.00 1431 17.50 1387 30.00 1432 30.00 1390 19.50 1433 23.00 1401 24.00 1437 26.00 1402 23.00 1452 16.50 1405 18.00 1466 16.50 Do Relative Price Changes Explain this Shift? (1) • 1) Premises: • a) that wine was always more expensive than beer: • b) that, by Engels’ Law, rising real incomes should have led to some shift from beer to wine – not the reverse as is posited here. • 2) Wine Prices: • see chart on wine prices and mason’s wages: compare with ‘penny ales’ (per gelte or gallon) • but did wine become relatively more expensive? • 3) Evidence on real wages of Flemish bldg craftsmen: rising overall from 1350 to 1470s (but we will focus later on mid-15th century) • - but regressing wine consumption on real wages for this entire period produces a negative result: • Multiple R = -0.59192; adjusted R-sq = 0.31319; • standard error = 10.86127; T-Statistic = -3.64858 Rhine Wine Prices & Mason’s Daily Wages at Antwerp: 1420-1470 Years Rhine Wine prices in d. gr. per litre Master Mason’s Daily Wage in d. gr. Litres of wine per daily wage One litre as Percentage of Daily Wage 1421-25 2.928 7.500 2.561 39.04% 1426-30 3.838 7.500 1.954 51.17% 1431-35 4.372 9.025 2.064 48.44% 1436-40 4.947 9.500 1.920 52.07% 1441-45 3.891 10.800 2.776 36.03% 1446-50 3.908 11.250 2.878 34.74% 1451-55 3.521 11.250 3.195 31.30% 1456-60 4.032 11.250 2.790 38.24% 1461-65 3.820 11.250 2.945 33.96% 1466-70 4.014 11.250 2.803 35.68% Climatic Changes and Wine Production in the North? • 2) Adverse climatic changes in later medieval Europe: • Was there any impact on northern wine growing? • - 14th & 15th centuries: descent in mean temperatures from the ‘Medieval Warming’ period (when wine had been cultivated in England): • - but relative stabilization in 15th century • - data from Craig Loehle and J. Huston McCulloch, ‘Correction to: A 2000-Year Global Temperature Reconstruction Based on Non-Tree Ring Proxies’, Energy and Environment, 19:1 (2008), 93-100 • 2) no evidence of adverse effects on northern European wine cultivation; • certainly not in southern Europe Do Relative Price Changes Explain this Shift? (2) • 1) Problems with wine and beer prices: • a) Wine prices, in consecutive series, available only from 1420s: those for Rhine wines at the Antwerp market • b) No beer prices: since beer prices per gelte or gallon were fixed (‘penny ale’): but beer quantities varied • 2) Best proxy for beer prices: • a) those for barley: consecutive annual series • b) but beer also brewed from wheat and oats • c) missing: prices of other ingredients (hops, gruit) and labour • 3) Evidence of prices: from 1420s: indeterminate, though they do not favour beer over wine: indeed, the reverse! The Wine Trade at Antwerp • 1) The wine import trade remained healthy at the Antwerp market in the 16th century • 2) Guicciardini: Italian merchant who published data on Antwerp’s trade in 1560s, on imports • 3) Extensive data on wine imports – from France, Rhineland, and Mediterranean (Italy, Spain, Portugal): 12.80% of total imports, and 28.19% of total nontextile imports • 4) No statistics on beer imports: from Germany and Holland: perhaps of no interest to this Italian! • 5) Evidence for beer consumption: town accounts The Postan Thesis: Technological Innovations: Hops • 1) The Postan Thesis (CEH: 1952): technological change: • - the crucial factor was the introduction of hops: in North German (Hamburg) and Dutch towns, from the 1320s • 2) Postan thesis basically endorsed by: Craeybeckx, Van der Wee, Unger (& many others): how valid is the thesis? • 3) The importance of hops: replacing gruit in brewing • a) Long Distance Trade: hops improved both the stability and durability of brewed beers (as well as taste): stored for longer times, transported over longer distances • b) Safety in ‘drinkability’: hops improved the sterilization process • not all bacteria killed by boiling: note that beer is about 90% water Beer & Wine: as Necessities • 1) Wine and Beer: in pre-modern societies, were not ‘sinful luxuries’ but vital necessities: because water and milk were generally unsafe to drink, especially in urban areas (pollution) • – though clearly many continued to drink unsafe water and milk • 2) Koch (1876), Pasteur (1878): discovery of bacterial transmission of diseases sewage & water purification systems in NW Europe, North America rapid fall in mortalities (reflecting prior bad water consumption) • 3) Cartoon: Hagar the Horrible (A Viking): which quite unintentionally makes this very point: on the ‘safety’ value of beer Importance of Beer in Later Medieval Household Budgets • 1) Robert Allen’s consumer price index: • - Beer: 20.6% share: in his basket of consumer expenditures (same for wine in southern Europe) • 2) other price indexes: Phelps Brown & Hopkins (England): 22.5% share; Rappaport (London): 20.0%; Munro (Flanders): 20.43%; Van der Wee (Brabant): 17.08% : all have beer; none has wine in the basket • 3) Nutritional Values: Allen’s caloric quantification: for annual household budgets: in late-medieval, earlymodern Europe • a) northern budget: 182 litres of beer = 77,532 C. • b) Mediterranean budget: 68.5 litres wine = 58,035 C. Per capita beer consumption: the Low Countries and Germany, 1370 -1650 Town Year Annual: litres Daily: litres Antwerp 1418 210 0.575 1526 369 1.011 1531 369 1.011 1567 295 0.808 1568 346 0.948 1612 259 0.710 1618 420 1.150 1372 277 0.759 1434 210 0.575 1472 271 0.742 1500 275 0.753 Leuven Per capita beer consumption: Low Countries and Germany, 1370 -1650 Town Year Annual: litres Daily: litres Leuven 1524 273 0.750 1574 273 0.748 1601 285 0.780 1650 350 0.960 1540 325 0.890 1582 307 0.840 1600 405 1.110 1639 277 0.760 Mechelen Per capita beer consumption: the Low Countries and Germany, 1370 -1650 Town Year Litres: Annual Litres: Daily ‘s-Hertogenbosch 1500 248 0.680 1530 274 0.750 1560 270 0.740 1590 164 0.450 1620 248 0.680 1650 212 0.580 1544 263 0.720 1550 263 0.721 1597 157 0.430 1600 158 0.433 Bruges Per capita beer consumption: the Low Countries and Germany, 1370 -1650 Town Year Annual: litres Daily: litres Ghent 1579 201 0.550 1606 157 0.430 1475 250 0.685 1514 158 0.433 1590 300 0.822 1514 228 0.625 1543 269 0.737 1571 267 0.732 1621 301 0.825 Haarlem Leiden Per capita beer consumption: the Low Countries and Germany, 1370 -1650 Town Year Annual: litres Daily: litres Hamburg 1450 250 0.685 1475 310 0.849 1500 320 0.877 1525 285 0.781 1550 400 1.096 Lübeck 1550 400 1.096 Nuremburg 1551 300 0.822 272 0.744 Mean Problems with the Hop Thesis: the Flemish Urban Evidence • 1) Basic problem with the ‘hop thesis’: major shift from wine to beer came too late: not till 1420s - 30s • 2) The Evidence the Treasurers’ accounts for Bruges and Aalst: annual sales of excise-tax farms on wine, beer, grains, meat, fish, textiles: • but chiefly alcoholic beverages (beer + wine) • 3) excise tax-farms (on urban household consumption only): urban revenues chiefly used to finance public debt payments: on rentes (annuities) • rentes: sold primarily to finance warfare (Europeanwide, except in England and Italy). Flemish Urban Accounts: Wine & Beer Excise Tax Farms • 4) Wine and Beer excise taxes: in Flemish urban accounts • chief taxes: on consumption of necessities that were also very addictive highly inelastic demand • - very highly regressive taxes on lower income strata of urban societies: • - note: data come from tax farm sales understate actual tax burden, since tax farmers expected to collect far more in taxes • - no public exemptions (except for religious orders): unlike property taxes (see final table: for Brabant) • - only urban consumers paid these excise taxes: not imposed in rural areas (whose inhabitants paid property & other direct taxes) The Bruges Financial Accounts • 1) Especially valuable: in two respects for Flanders: • a) the only urban accounts extant from early 14th century: from 1308, with few annual lacunae (unlike Ghent accounts; or Ypres – none extant until 1406): data in graphs and tables in this study to 1500 • b) evidence on consumption of foreign as well as domestic beers. • 2) Foreign beer imports: from Germany and Holland • a) Hamburg beers: from 1333 (possibly hop beers) • b) ‘Hop & Delft’ beers: from 1380: Dutch beers: initially much more important than Hamburg beers, but sharply diminishing from 1411: • - 1430: Delft beers amalgamated with German beers • c) from 1430s: foreign beers decline in both absolute (‘real’) & relative importance predominance of Bruges beer • d) Why? Warfare with Hanseatic League and England – to 1470s. Aalst vs. Bruges Financial Accounts • • • • • • • • • • 1) Importance of the Aalst annual financial accounts: - a) begin in 1395: but then virtually continuous (to 1550) - b) provide wage data to 1550: Bruges: none after 1485 2) Comparisons with the Bruges accounts on beer: a) Aalst: primacy of beer established from the beginning: 63% of total alcoholic excise farms in 1390s, but still only 67% ca. 1420 b) Bruges: beer: 34% of that total in 1308-10; only 33% in 1381-85; 37% in 1416-20 - note: Bruges wealthier, more mercantile, cosmopolitan town greater retained preference for imported wines. c) In both sets: more decisive shift to beer from late 1420s - i) Bruges: from 52% in 1431-35 to 70% in 1490s - ii) Aalst: from 73% in 1431-35 to 83% in 1466-70 (80% in 14961500) Estimating the Burdens of Urban Excise Taxes (1) • 1) Problem: the nominal money-of-account values of the excise-tax farms sales are otherwise useless in estimating tax burdens • 2) Reason: the impact of coinage debasements (finance warfare) consequent inflations • - grams silver in Flemish penny (groot): fell from 2.067 g in 1350 to 0.463 g in 1482 (0.479 in 1500) • - Flemish CPI (1451-75=100): rose from 60.5 in 1351-56 to 184.5 in 1486-90: 3-fold inflationary rise • 3) Note: periodic coinage debasements sharply reduced real incomes of wage-earners & those on fixed incomes (salaries, rents, pensions, etc.): RWI = NWI/CPI • - BUT so did the rises in highly regressive excise taxes Estimating the Burdens of Urban Excise Taxes (2) • 4) Two statistical methods of estimating the ‘real’ burden of urban excise tax farms: • a) Calculate the number of Flemish ‘commodity baskets’ (in the CPI) whose value = total revenues of the excise tax farms: especially on beer and wine • b) Calculate the number of years’ of a master mason’s money-wage income whose value = total revenues of the excise tax farms (for Bruges: total of alcohol-based excise tax farms) Real Tax Burdens during the Golden Age of the Artisans • 1) mid 15th-century ‘Golden Age of the Artisans’ (and labourers): concept based on evidence for real-wages of craftsmen in Flanders (and Brabant, and England): • 2) Rise in real wage index (RWI = NWI/CPI) from ca. 1440 to ca. 1470: basically determined by deflation: when coinage debasements had ceased and other forces for monetary contraction fall in price level Importance of the Aalst wage and excise-tax data • 1) The real wage data for Aalst during the Golden Age: also show marked rise c. 1440 – c. 1470 (RWI = NWI/CPI) • 2) BUT the real value or burden of the excise tax farms, as measured in annual incomes of master mason: also rise in the very same period, offsetting some of the rise in crude real wages • 3) Rising urban excise tax burden: rising taxes to finance steep rise in public debts incurred to finance previous and current warfare • - note: in England there were no such excise taxes until the 1640s (Civil War era) Flemish Economy from 1420s • 4) Importance of the post-1420s era for Flanders: • a) rising excise-tax burdens: from warfare, which had also spawned deleterious coinage debasements • b) more rapid decline in traditional woollen draperies: and economic declines of Bruges, Ypres and Ghent • c) period of more rapid shift from wine to beer • - was that more pronounced shift to beer due to real income changes? Demographic Questions • 1) Estimates of burdens of the urban excise taxes: based on assumptions of stable populations • 2) But, did Flemish populations (urban & rural) continue to decline, as in England? Evidence for Flanders is mixed: urban declines from 7% to 28% (Ypres); but a few towns did not suffer any significant decline. • 3) Significance of the question: if urban populations fell Δ per capita tax burden: i.e., increase in household taxes • 4) For duchy of Brabant, from 1437 to 1496 • – just to east of Aalst, evidence of severe population decline, along with increased poverty (poor hearths) • - a) small towns: overall decline of 25.14% • - b) villages: overall decline of 26.35% Living Standards and Alcoholic Consumption (1) • (1) The mid fifteenth-century as the Golden Age of the Artisan? • We now have many doubts that this long traditional view is valid for Flanders. • (2) Demography and the late-medieval economy • Was it the ‘Golden Age of Bacteria’, as Sylvia Thrupp once said? • How else do we explain continued population decline to ca. 1500, in both England and the Low Countries? • demographic decline does not reflect growing prosperity -- especially with increased percentages of non-taxed ‘poor hearths’ in Brabant Living Standards and Alcoholic Consumption (2) (3) Adverse Economic events and falling real incomes? • a) 1420s – 1430s: warfare coinage debasements inflation; • and also the onset of irredeemable decline and downfall of the traditional urban textile industries • b) 1440s – 1460s: end of warfare monetary stability deflation and rising real wages: BUT offset by rising excise taxes to pay for previous wars • - Also: serious conflicts with the Hanseatic League and England • c) 1470s – 1490s: more warfare (including civil wars) coinage debasements inflation • d) 1520s (to the end of this series: 1550): onset of Price Revolution in which consumer prices rose more than did nominal wages fall in real wage incomes of lower strata of Low Countries’ societies (but real burden of excise taxes fell with inflation, but not offsetting real wage decline) Living Standards and Alcoholic Consumption (3) (4) Comparisons of the shift to beer in Bruges and Aalst: • a) the 15th-century shift to beer was proportionately greater in Bruges, though the level of wine consumption remained higher than in Aalst, by the 1490s • b) The economic decline of Bruges and the loss of international trade to Antwerp, especially from the 1460s: • - did that reduce the percentage of foreign, especially Latinspeaking merchants there: and hence help explain the more rapid relative shift? • c) The relative shift from wine to beer may have been the greatest in the middle socio-economic strata of these urban societies, rather than in the still rich upper classes or relatively poor working classes – • especially if wines were too expensive for working-class households: how representative are the Rhine wine prices? A final observation • Beer is always golden – • for the Low Countries, at least – • except of course for those who prefer donker bier.