presentation name

advertisement

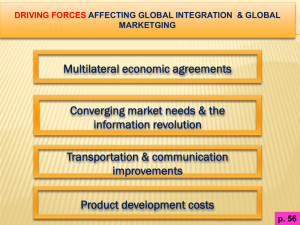

DRIVING FORCES AFFECTING GLOBAL INTEGRATION & GLOBAL MARKETGING Multilateral economic agreements p. 56 Multilateral Agreements NAFTA The North American Free Trade Agreement or NAFTA is an agreement signed by the governments of Canada, Mexico, and the United States, creating a trilateral trade bloc in North America. The agreement came into force on January 1, 1994. In terms of combined GDP of its members, as of 2010, the trade bloc is the largest in the world. ASEAN The Association of Southeast Asian Nations, commonly abbreviated ASEAN is a geo-political and economic organization of ten countries located in Southeast Asia, which was formed on 8 August 1967 by Indonesia, Malaysia, the Philippines, Singapore and Thailand. Since then, membership has expanded to include Brunei, Burma (Myanmar), Cambodia, Laos, and Vietnam. Its aims include the acceleration of economic growth, social progress, cultural development among its members, the protection of the peace and stability of the region, and to provide opportunities for member countries to discuss differences peacefully. ASEAN- Other Countries ASEAN has concluded free trade agreements with PR China, Korea, Japan, Australia, New Zealand and most recently India. The agreement with People's Republic of China created the ASEAN–China Free Trade Area (ACFTA), which went into full effect on January 1, 2010. In addition, ASEAN is currently negotiating a free trade agreement with the European Union. DRIVING FORCES AFFECTING GLOBAL INTEGRATION & GLOBAL MARKETGING • Converging market needs & the information revolution Converging market needs & the information revolution Information revolution DRIVING FORCES AFFECTING GLOBAL INTEGRATION & GLOBAL MARKETGING Transportation & communication improvements Transportation & Communication improvements DRIVING FORCES AFFECTING GLOBAL INTEGRATION & GLOBAL MARKETGING • Product development costs Product development costs Cost of developing a new drug in 1976- $54M Cost of developing a new drug in 2009-$400 Million Such huge investments can be recovered only in global market place. Refer Table 1-10 on Page 58 DRIVING FORCES AFFECTING GLOBAL INTEGRATION & GLOBAL MARKETGING Quality p. 59 Quality Global marketing strategies generate greater opportunities and greater revenue which intern support design and manufacturing quality. DRIVING FORCES AFFECTING GLOBAL INTEGRATION & GLOBAL MARKETGING World economic trends World Economic Trends DRIVING FORCES AFFECTING GLOBAL INTEGRATION & GLOBAL MARKETGING Leverage Leverage Global companies possess the unique opportunities to develop leverage. It means the type of advantage that a company enjoys by virtue of the fact that it has experience in more than one country. Experience transfer Scale of Economies Resource Allocation Global strategy Leverage: Experience Transfers A global company can leverage its experience in any market in the world. It can draw on management practices, strategies, products, advertising appeals, or sales or promotional ideas that have been tested in actual markets and apply them in other comparable markets. ABB- 1400 subsidiaries in 140 countries. Very famous for running the operations with the minimum number of staff Leverage: Scale of Economies The global company can take advantage of its greater manufacturing volume to obtain traditional scale advantages within a single factory. Also, finished products can be produced by combining components manufactured in scale-efficient plants in different countries. The larger scale of the global company also creates opportunities to improve corporate staff competence and quality. Leverage : Resource Allocation A major strength of the global company is its ability to scan the entire world to identify people, money, and raw materials that will enable it to compete most effectively in world markets. Global companies utilizes the resources where there is the greatest opportunity to serve a need at a profit RESTRAINING FORCES AFFECTING GLOBAL INTEGRATION & GLOBAL MARKETGING Management myopia & Organizational culture Opposition to globalization National controls – (to protect local industries) p. 62 Management myopia Management ignores (will not see) the opportunities to peruse global marketing. Global marketing does not work without a strong local team that can provide information about the local market conditions. Summary • Global marketing is the process of focusing resources on global marketing opportunities • Goal is to create customer value & competitive advantage by maintaining focus • FOUR classifications of management orientation: ethnocentric, polycentric, regiocentric, geocentric • Global marketing importance is shaped by a variety of driving & restraining forces Looking Ahead to Chapter 2 The global economic environment 1-23 Introduction • This chapter includes – – – – An overview of the world economy A survey of economic system types The stages of market development The balance of payments 2-24 The World Economy—An Overview • In the early twentieth century economic integration was at 10%; today it is 50% • EU and NAFTA are very integrated • Global competitors have displaced or absorbed local ones 2-25 Economic Systems Resource Allocation Market Private Market capitalism Centrally planned capitalism Market socialism Centrally planned socialism Resource Ownership State Command 2-26 Market Capitalism Individuals and firms allocate resources Production resources are privately owned Driven by consumers Government’s role is to promote competition among firms and ensure consumer protection Eg: United States 2-27 Centrally Planned Socialism • Opposite of market capitalism • State holds broad powers to serve the public interest; decides what goods and services are produced and in what quantities • Government owns entire industries and controls distribution • Demand typically exceeds supply • Eg: North Korea, Venezuela etc. 2-28 Centrally Planned Capitalism • Economic system in which command resource allocation is used extensively in an environment of private resource ownership • Examples – Sweden – Japan INDUSTRY SECTOR STATE OWNERSHIP Telecom 45% Airline 21% Banking 20% Alcohol 100% 2-29 13 Stages of Economic Development (p. 80-93) BIG EMERGING MARKETS (BEMs) • • • • • • • • • • China India Indonesia South Korea Brazil Mexico Argentina South Africa Poland Turkey BRIC • • • • Brazil Russia India China BRIC • Since the four BRIC countries are developing rapidly, by 2050 their combined economies could eclipse the combined economies of the current richest countries of the world. • These four countries, combined, currently account for more than a quarter of the world's land area and more than 40% of the world's population. WORLD’S TOP ECONOMIES Low-Income Countries • GNP per capita of $825 or less • Characteristics – – – – – – – Limited industrialization High percentage of population involved in farming High birth rates Low literacy rates Heavy reliance on foreign aid Political instability and unrest Concentrated in Sub-Saharan Africa 2-33 Lower-Middle-Income Countries • GNI per capita: $826 to $3,255 • Characteristics – Rapidly expanding consumer markets – Cheap labor – Mature, standardized, labor-intensive industries like textiles and toys • India is the only BRIC Country 2-35 Upper-Middle-Income Countries • GNP per capita: $3,256 to $10,065 • Characteristics – – – – – Rapidly industrializing, less agricultural employment Increasing urbanization Rising wages High literacy rates and advanced education Lower wage costs than advanced countries • Also called newly industrializing economies (NIEs) • Examples: BRCI COUNTRIES ARE BRAZIL, RUSSIA & CHINA 2-37 High-Income Countries • GNI per capita: $10,066 or more • Also know as advanced, developed, industrialized, or postindustrial countries • Characteristics – Sustained economic growth through disciplined innovation – Service sector is more than 50% of GNI 2-39 High-Income Countries – Importance of information processing and exchange – Ascendancy of knowledge over capital, intellectual over machine technology, scientists and professionals over engineers and semiskilled workers – Future oriented – Importance of interpersonal relationships 2-40 High Income countries High Income countries (Contd..) Marketing Opportunities in LDCs • Characterized by a shortage of goods and services • Long-term opportunities must be nurtured in these countries – – – – Look beyond per capita GNP Consider the LDCs collectively rather than individually Consider first mover advantage Set realistic deadlines 2-43 G-8, the Group of Eight • Goal of global economic stability and prosperity – – – – – – – – United States Japan Germany France Britain Canada Italy Russia (1998) 2007 G-8 leaders in Germany 2-44 Assignment-2 • Study about the Association of South East Asian Nations (ASEAN) and its marketing issues and opportunities. • Submit the assignment in the class and one group shall present the topic in the class. OECD, the Organization for Economic Cooperation and Development • • • • 34 nations Post–World War II European origin Canada, United States (1961), Japan (1964) Promotes economic growth and social wellbeing • Focuses on world trade, global issues, labor market deregulation 2-46 THE OECD The Triad • United States, Western Europe, and Japan • Represents 75% of world income • Expanded triad includes all of North America and the Pacific Rim and most of Eastern Europe • Global companies should be equally strong in each part 2-48 Balance of Payments • Record of all economic transactions between the residents of a country and the rest of the world – Current account—record of all recurring trade in merchandise and services, and humanitarian aid • Trade deficit—negative current account • Trade surplus—positive current account – Capital account—record of all long-term direct investment, portfolio investment, and capital flows 2-49 International finance: An Overview Overview of International Finance • Foreign exchange makes it possible to do business across the boundary of a national currency • Currency of various countries are traded for both immediate (spot) and future (forward) delivery • Currency risk adds turbulence to global commerce 2-51 • • • • Balance of Payments A balance of payments (BOP) sheet is an accounting record of all monetary transactions between a country and the rest of the world. These transactions include payments for the country's exports and imports of goods, services, and financial capital, as well as financial transfers. Sources of funds for a nation, such as exports or the receipts of loans and investments, are recorded as positive or surplus items. Uses of funds, such as for imports or to invest in foreign countries, are recorded as negative or deficit items. Balance of Payments The BOP is divided into 2 accounts • The Current account • The Capital account The Current Account: • A broad measure that includes merchandise trade and service trade. The Capital Account • A record of all long term direct investment, portfolio investment and other short term, long term capital flows • Refer Table 2.5 @ Page 93 Balance of Payments-Thailand Bank of Thailand EC_XT_010 : Balance of Payments (Summary) (Unit : Millions of Baht) Last Updated : 31 May 2011 14:32 Retrieved date : 08 Jun 2011 13:43 1 2 3 4 5 6 7 8 9 10 11 12 13 14 Source: Bank of Thailand Exports (f.o.b.) (% change) Imports (c.i.f.) (% change) Trade balance Net services income & transfers Current account balance Capital and financial account Monetary authorities Government Bank Others Net errors & omissions Balance of payments 2010 2009 2008 2007 6,120,927.59 5,155,054.37 5,831,085.78 5,212,208.04 18.73 -11.59 11.87 7.72 -5,681,327.14 -4,485,935.34 -5,845,351.76 -4,773,127.13 26.64 -23.25 22.46 -0.64 439,600.44 669,119.03 -14,265.97 439,080.90 23,963.61 85,355.33 81,646.47 100,623.25 463,564.05 754,474.37 67,380.49 539,704.16 503,431.31 -101,685.89 399,828.21 -61,663.39 82,631.52 50,005.17 1,096.65 -21,482.93 103,993.24 19,493.87 -15,461.11 -77,645.54 307,032.24 260,686.92 348,808.59 -46,582.40 9,774.29 -431,871.87 65,384.08 84,047.48 19,630.25 171,811.71 344,640.05 108,377.76 986,625.62 824,600.18 811,848.77 586,418.54 Purchasing Power Parity(PPP) • Purchasing power parity (PPP) is a theory of long-term equilibrium exchange rates based on relative price levels of two countries. • The concept is founded on the law of one price, the idea that in absence of transaction costs and official barriers to trade, identical goods will have the same price in different markets when the prices are expressed in terms of one currency. 3-55 Purchasing Power Parity(PPP) • A country’s currency is overvalued if the Big Mac price (Converted to dollars) is higher than in the US. • A country’s currency is undervalued if the converted Big Price is lower than the US price. 3-56 Managing Economic Exposure • Economic exposure refers to the impact of currency fluctuations on the present value of the company’s future cash flows • Two categories of economic exposure – Transaction exposure is from sales/purchases – Real operating exposure arises when currency fluctuations, together with price changes, alter a company’s future revenues and costs 2-58 Managing Exchange rate Exposure • Hedging – Forward & Future Markets – Options • Call • Put 3-59 Hedging • Hedging exchange rate exposure involves establishing an offsetting currency position such that the loss or gain of one currency position is offset by a corresponding gain or loss in some other currency. 3-60 Forwards • With a forward contract, the company can lock in a specific fixed exchange rate for a future date and thus immunize itself from the loss ( or gain) caused by the exchange rate fluctuation. In addition to spot prices, 30-, 60- and 180 day forward prices are traded for 3-61dozens of world currencies. Put Options • Gives the Holder the right,(not obligation) to sell a specified number of foreign currency units at a fixed price until the options expiration date. 3-62 Call Options Gives the holder the right,(not obligation) to buy a specified number of foreign currency units at a fixed price until the options expiration date. 3-63 Looking Ahead to Chapter 3 • The global trade environment 2-64