Remarks from the IBP. - Global Initiative for Fiscal Transparency

advertisement

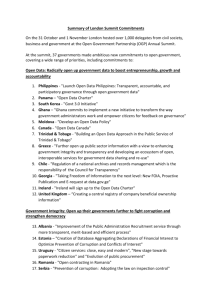

Welcome Remarks from the IBP Mr. Vivek Ramkumar International Advocacy and OBI Director, IBP 1 Welcome Remarks from the GIFT Mr. Juan Pablo Guerrero Network Director, GIFT 2 Keynote Address from the DBM Philippines Mr. Florencio Abad Secretary, DBM 3 SESSION 1: Open Government Partnership and the FOWG: Introduction and Overview of Progress 4 Fiscal Openness Working Group Open Government Parternship Asia Pacfic Workshop - September 2015 Juan Pablo Guerrero guerrero@fiscaltransparency.net #FiscalTransparency Fiscal Openness Working Group - OGP Overview 1 Objectives of the workshop 1 Open Government Partnership 1 Global Initiative for Fiscal Transparency 2 What fiscal transparency commitments did countries make in their OGP National Action Plans? 3 Some notable commitments and practices 4 What steps to increase fiscal transparency should countries include in their NAP? 7 Fiscal Openness Working Group - OGP The main objectives of the workshop are: Provide a platform for peer-to-peer exchange & learning on the process to advance fiscal transparency Learn about an incredible source of knowledge & evidence findings: Open Budget Survey 2015 Offer efficient & coordinated access to international good practices, tools, norms, assessments, and technical expertise on fiscal transparency & public participation Motivate additional governments to become champions of fiscal transparency & participation Define a GIFT regional work plan for the Asia Pacific Area 8 Fiscal Openness Working Group - OGP Open Government Partnership (2011-15) Voluntary, multi-stakeholder international initiative Aims to secure concrete commitments on promoting transparency, empower citizens, fight corruption, and harness new technologies to strengthen governance 65 countries today (8 in 2011): governments & civil society work together to develop & implement open government reforms, supported by an international forum for dialogue & sharing ideas & experience 9 Fiscal Openness Working Group - OGP OGP Structure & Conditions 1. OGP Steering Committee 2. Annual Conference 3. Support Unit 4. Independent Reporting Mechanism To become member a country must: 1. Endorse OGP declaration; 2. Make concrete commitments as part of country National Action Plan (beyond current practice); 3. Develop NAP through a multi-stakeholder process (active engagement of citizens & civil society); 4. Commit to a self-assessment and independent reporting on progress; 5. Contribute to open government in other countries (sharing practices, expertise, technical assistance, technologies) 10 Fiscal Openness Working Group - OGP OGP Eligibility Criteria – 4 key dimensions Fiscal transparency: Timely publication of essential budget documents (budget proposal + Audit report) Right to Access to Information: ATI law, RI constitutional provision or draft initiative under consideration Disclosures related to elected public officials: Rules that require disclosure of income & assets for elected and senior public officials Citizen engagement: citizen participation in policymaking & governance (civil rights & liberties) OGP countries in the region: Australia, Indonesia, Mongolia, New Zealand, the Philippines, South Korea 11 Fiscal Openness Working Group - OGP Action Network: Global Initiative for Fiscal Transparency (OGP-Fiscal Openness Working Group) Advance and institutionalize significant & sustainable improvements in fiscal transparency, participation and accountability in countries around the world, by working on global norms, incentives, peer-learning, and technical assistance. Funding comes from the World Bank, The Hewlett Foundation & Omidyar Network. 12 Fiscal Openness Working Group - OGP GIFT work streams Flexible framework for a network devoted to action & impact Global norms on fiscal transparency (FT) & open budget o High-level principles on FT, public participation (PP) & accountability (UN General Assembly, 2012) & working on a Convention on FT & PP o Harmonization of norms & global standards (IMF, OECD, PEFA, OBI/IBP) o Principles on public participation in fiscal policies & advance the right to participate in budget processes Incentives for FT & finding evidences of impact o 8 country case studies about public participation o Think-pieces on incentives for TF o Impacts of FT: review of evidence o Transparency on revenues & taxes o Country FT commitments in OGP (analysis) 13 Fiscal Openness Working Group - OGP Streams of work of GIFT (2) Technical assistance & peer learning OGP Fiscal Openness Working Group for enhancing & implementing commitments Support processes for TF in specific countries (TA & peer-to-peer exchanges) Engage countries in principles & standard discussions/making Technologies & open data Use of technologies for information disclosure & proactive dissemination Open formats for budget data with BOOST (World Bank-Open Knowledge) Community of practice: discussions, networks, webinars, blogs, videos, experiences, exchanges… 14 Fiscal Openness Working Group - OGP GIFT Lead Stewards In charge of the executive guidance of the network and working closely to the Network Director and the Coordination Team 15 Fiscal Openness Working Group - OGP GIFT General Stewards In charge of the definition of the strategic guidelines and the GIFT principles & to promote FT in their organizations and within their institutional environments 16 Fiscal Transparency & Public Participation High Level Principles on Fiscal Transparency, Participation & Accountability United Nations General Assembly – Dec. 2012 Preamble, plus 2 parts: o Access to Fiscal Information (principles 1-4) o The Governance of Fiscal Policy (principles 5-10) Framed by 2 fundamental rights principles: o A public right to fiscal information (from UDHR Art. 19) o A right to participate directly in fiscal policy design and implementation (from ICCPR Art. 25) 17 Fiscal Transparency & Public Participation I. High Level Principles on Fiscal Transparency • Access to Fiscal Information 1. Right to seek, receive and impart information on fiscal policies 2. Governments should publish clear and measureable objectives for aggregate fiscal policy 3. Presentation of high quality financial and non-financial information on past, present & forecast 4. Governments should communicate the objectives they are pursuing and the outputs they are producing 18 Fiscal Transparency & Public Participation II. High Level Principles on Fiscal Transparency • Governance of Fiscal Policy 5. All transactions should have their basis in law 6. Government sector clearly defined, & relationships with private sector disclosed 7. Roles and responsibilities clearly assigned between the legislature, the executive & the judiciary 8. No government revenue without the approval of the legislature 5. The Supreme Audit Institution should have statutory independence & the appropriate resources 19 Fiscal Transparency & Public Participation III. High Level Principles on Fiscal Transparency • A new fundamental civil right 10. Citizens should have the right and they, and all non-state actors, should have effective opportunities to participate directly in public debate and discussion over the design and implementation of fiscal policies. 20 Fiscal Transparency in OGP Countries What types of FT commitments do OGP countries make? • Most commitments under H-L Principle 3: High quality financial & non-financial information on past, present, & forecast fiscal activities, performance, fiscal risks, & public assets & liabilities….’ Focus is on flows rather than stocks • Many commitments on public participation (HLP10) • Few commitments on legislative oversight (HLP8); on macro-fiscal policy (HLP2); or on a citizen right to fiscal information (HLP1) • For further details of FT commitments see http://bit.ly/1Od71s3 or http://bit.ly/1NvfcOx 21 Fiscal Transparency in OGP Countries GIFT identified FT commitments within NAPs • Commitments were coded by GIFT as FT commitments where they related to any aspect of taxation, borrowing, spending, investment and management of public resources, including delivery of public services • Covers policy design, implementation, review • Includes: any public participation in fiscal policy • Excludes: general references to public participation, or RTI, or open data that do not specifically refer to FT 22 Fiscal Transparency in OGP Countries Overview of FT commitments in NAPs • A total of 360 FT commitments identified, in 43 out of the 45 NAPs for which IRM reports published = 38% of all commitments in these NAPs • The definition of a commitment varies widely within and across NAPs, however, reducing the comparability of data on commitments • There is a very wide range in the proportion of fiscal transparency commitments to total commitments in NAPs, from 0% (Chile, Romania) to 100% (Guatemala); the average share is 34% 23 Fiscal Transparency in OGP Countries, & the Implementation of OGP Commitments: An Analysis Implementation of FT commitments Figure 3 Total Fiscal Transparency Commitments by Level of Completion 12% 7% Completed Subst Compl Limited compl Not started Unclear and Withdrawn 23% 33% 25% n = 318 24 Fiscal Transparency in OGP Countries Notable country FT reforms • Of those countries with more than 5 FT commitments, notable progress in implementation of FT commitments was made by: • Croatia – 12 out of 16 commitments completed or substantially completed • Mexico – 12 out of 17 • Brazil – 10 out of 10 • Indonesia – 10 out of 11 • Moldova – 8 out of 14 • The Philippines – 8 out of 16 25 Fiscal Transparency in OGP Countries Country Implementation of FT by Level of Ambition: Low Ambition High Implementation Low Implementation 26 Denmark Italy Spain UK USA Canada South Korea Georgia Ukraine Paraguay South Africa Estonia High Ambition Brazil Mexico Albania Colombia Jordan Israel Sweden Greece Macedonia Slovakia Czech Rep. Norway Armenia Montenegro Latvia Uruguay Croatia Indonesia Moldova Philippines Azerbaijan Bulgaria El Salvador Honduras Dominican Rep. Guatemala Tanzania Peru Kenya Fiscal Transparency in OGP Countries Some notable OGP commitments • GFMIS reforms in the Philippines, Liberia, Honduras, Dominican Rep. • Commitments to strengthen procurement in many countries, those for which the IRMs reported reasonable implementation progress include Brazil, Mexico, Paraguay, Uruguay • EITI commitments in a number of countries e.g. Indonesia, The Philippines, Colombia, Guatemala, Mexico, Peru, USA • The Philippines: commitment to engage citizens in public audits • Honduras: update and disseminate the PEFA assessment • Indonesia: publish local services delivery-level budgets in health & education • Transparency of external assistance from the donor side, including conforming with the IATI standard: Canada, Denmark, Spain, Sweden, UK & USA 27 Fiscal Transparency in OGP Countries Some innovative commitments • DR: publish data on public complaints at the level of individual agencies • Slovakia: making the NAP a legally binding document (responsible institutions take actions or explain the lack of action) • Macedonia: create a portal for citizen feedback on public services • Mexico: an open & interactive geo-referencing platform allows citizens to track public resource allocation • Peru: improve mechanisms for public consultation on budget preparation, approval, implementation & reporting • The Philippines: institutionalize social audits; create a People’s Budget interactive web site 28 Fiscal Transparency in OGP Countries What steps to increase FT should countries include in their (next) NAPs? • First, OGP members should publish documents already produced within government: • 9 countries produce a Pre-Budget Statement but do not publish it including AR, CL, DR, SV, PE • 3 countries produce but do not publish in-year budget reports including Costa Rica • 7 countries produce but do not publish a mid-year report • 3 countries and 1 country respectively produce but do not publish a year-end report and an audit report 29 Fiscal Transparency in OGP Countries Steps to improve fiscal transparency (2) • Other reports not currently produced, but which would take relatively effort, are a Citizens’ Budget (not published in 27 OGP members), and a mid-year report (not produced in 18 OGP members) • OGP members that have gone backwards on fiscal transparency in recent years should give priority to decisively reversing this trend • Countries should also give early priority to: • Strengthening legislative oversight • Strengthening SAI independence and resourcing • Introducing social auditing • Consulting the public more during budget preparation • Opening up legislative committee budget hearings to the public 30 Fiscal Transparency in OGP Countries Recommended consultation practices • Designation of a lead agency responsible for each commitment • Publication of the names of specific CSOs who are working with government on each commitment • Countries need to follow much more closely the OGP process requirements for public consultation in the design & implementation of their NAPs • Engage in a process: go beyond traditional civil society consultation models towards institutionalising systematic, on-going & meaningful dialogue with non-government actors and the public 31 Fiscal Transparency in OGP Countries In conclusion GIFT stands ready to assist countries with the design & implementation of fiscal transparency initiatives, whether they are current members of OGP or are non-members. info@fiscaltransparency.net 32 Fiscal Transparency in OGP Countries, & the Implementation of OGP Commitments: An Analysis Selected references Fiscal Transparency in OGP Countries, and the Implementation of OGP Commitments: An Analysis. GIFT Background Paper for the FOWG Meeting in San Jose, 18 November 2014. Fiscal Openness Working Group 2014 Work Plan: www.fiscaltransparency.net/fowg/ GIFT Expanded High Level Principles: http://www.fiscaltransparency.net/eng/principles.php OGP By The Numbers: What the IRM Data Tell Us About OGP Results. IRM Technical Paper1, Joseph Foti. http://www.opengovpartnership.org/sites/default/files/attachments/Technical%20paper%201_final.p df 33 Engage with us @FiscalTrans fiscaltransparency.net Experiences and challenges on fiscal transparency and the role of the international community Indonesia 35 Experiences and challenges on fiscal transparency and the role of the international community Cambodia 36 Experiences and challenges on fiscal transparency and the role of the international community Vietnam 37 Experiences and challenges on fiscal transparency and the role of the international community India 38 Experiences and challenges on fiscal transparency and the role of the international community Sri Lanka 39 Open Forum 40 End of Session 1 41