Risk Management in Building is no longer an

advertisement

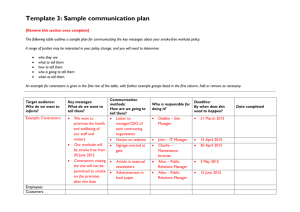

Risk Management in Building - no longer an oxymoron - Tony Williams Building Value Limited May 2002 Synonyms of risk attempt gamble chance (of) (en)danger/ effect/ /mischance dare expose harm hazard (im)peril jeopardy lay bare loss menace possible/ probable stake threat venture Synonyms of manage administer contrive conduct/control cope deal with direct domineer guide handle influence organise run service succeed/ supervise wield Synonyms of building contract construct (ion) co-ordinate create edifice erect (ion) form (ation) lay/make manufacture produce put together structure subcontractor top out work Alternative synonyms of building b***tard combatant cowboy cut-throat high risk know-it-all itinerant late loss making robbing (see top left) unreliable ruthless unkempt sexist xenophobic Definition of risk Risk means chance of injury or loss due to uncertain danger, peril or hazard A particular decision or course of action is said to be subject to risk when there is a range of possible outcomes…. ….then, objectively known probabilities can be attached to these outcomes Risk vs uncertainty Risk is, thus, distinguished from uncertainty, where there is a plurality of outcomes where objective probabilities cannot be assigned Many situations, which in practice are called ‘risky’ are, on a strict definition, really subject to uncertainty not risk …..and finally,if you are Zurich IC Squared, “risk is an investment” Definition of Risk Management (RM) Involves anticipating and/or identifying potential risks and taking steps to avoid them or to mitigate the resulting harm The aim is to minimise the sum of: - retained losses - insurance or other risk transfers - loss control expenses A builder’s definition of RM Risk is an uncertain event, feature, activity or situation that can have a positive or negative effect on an object Note, that this encompasses both the upside and downside of risk RM is a formal process that identifies, assesses, plans and manages the risk Why builders have RM? “A risk aware organisation, capable of identifying and managing uncertainty in order to maximise opportunity & deliver max. value” “…Its primary aim is to help maximise business value by doing the right projects, right the first time.” RM quality “and the successful identification, reduction, communication and control of risk are key issues and performance drivers….” Why builders have RM? The group “assesses and manages risk to ensure that: - the public, our employees and the environment are safe from the potential hazards in our operations; - that new essential assets are created to the maximum obtainable benefit of their intended users and the community at large; - the potential for damage to our clients and the Group’s corporate reputation and/or financial loss to our stakeholders is minimised” Insurance Management (IM) Underwriting focuses on the past e.g. historic losses, litigation, court decisions Insurance coverage is designed empirically Insurance industry traditionally adopts a ‘rear view mirror’ to predict and manage the future Risk ‘puzzle’ unidentified/mis-measured Insurance buyers need to move from IM to RM RM vs IM • • • • • • • • Active Dynamic Protection orientated Financial / analytical Seeks responsibility Broad based Creative Involved in company’s activity • • • • • • • • Reactive Passive Security orientated Administrative Seeks safety Narrow Responsive May be involved or relies on other RM in Building Every activity/project faces full risk spectrum Tied to health & safety, environment, regulations, labour (supply/law), transport etc In broad terms, risk can be divided: • • • • strategic operating financial information Strategic risks • • • • • • Environmental Natural/man made disasters Political Laws/regulations Industry Competition Financial markets • • • • • Organisational Corporate objectives & strategies Leadership Management Investor/credit relations Human resources Other types of risk • • • • • Operating risks Workforce Suppliers Plant & machinery Protection Customers Financial risks • Capital/funding • Investing • Regulatory environment Information risks • Systems • Strategic • Operating RM and risk control Mgt process • Identify and analyse exposure • Evaluate alterative • Select most promising technique • Implement choice • Monitor process and change as necessary Control • Avoidance • Prevention • Reduction (stop losses or reduce damage) • Segregation of loss exposures • Contractual risk transfer Building: 4 types of player Building materials • Heavy (eg Hanson) • Light-side (eg Novar) • Distribution (eg Wolseley) Housebuilders • Speculative • Public sector • Property development Contractors • Pure (sic) • Mixed (e.g. PFI) • Plant hire Professional Services • Architects • Surveyor/engineer • QS/cost consultant Building materials characteristics Heavy Light • Cement, rmc, aggregates • Largest/Europe dominates • International/rationalised • Resource/extractive base • • • • Fragmented Competitive Semi-international Poor performers Distribution • Rationalised/rationalising • Europe cross border push • 10% margin best in class Other players characteristics Contractors • • • • Housebuilders Low value/valuation Awful record International Creeping rationalisation • • • • Rationalisation International? Key raw material is land Undervalued Professional Services • Move to one stop shop • International • Fee based Industry EBIT % margins • • • • • • • Cement Aggregates/rmc Light materials Distribution Contracting Housebuilding Professional Services • • • • • • • 20-30 15-20/10-15 10 4-8 (TPK = 10) 1-3 (pretax) 10-20 5-30 Drivers of change • • • • • Today’s focus is on the UK; US, at least on par Continental Europe is five years behind LSE & FSA inspired corporate governance First Cadbury, now Turnbull (Sept. 1999) Internal Control, Guidance for Directors on the Combined Code of Corp. Governance • Widespread endorsement and application Drivers of change2 • Latham Report 1994 • Agile Report 1998 “variation in control of project cost and payment leads to an unpredictable outcome” • Two thirds of projects over budget and threequarters run late; site deaths at 2-3 per week • Egan ‘Rethinking Construction’ 1998 • Industry needs total new approach to delivery of construction product Drivers of change3 • Aftermath of 11 September • A major insurance broker is currently concluding renewals in range from +20-200% • A small private building material company (revenue of circa £130m), has been told to budget for a minimum of +50% in premiums Heavy Building Materials A case study HBM: approach to risk • Corporate Governance umbrella unfurled by internal auditors who act as scribes; however, managers manage the programme • Regular review of all business units and overall risk management structure • Biggest risk, of course, is a commercial one i.e. product prices fall or demand collapses; and you cannot insure against it • Insure for what you cannot control HBM: risk process • CFO is custodian of risk and risk management • Group co-ordinates with single broker • Insurance carried for liability, property, people etc with normal array of cover after assessing how much is claimed; plus uninsured loss • In addition, there is third party and contractual risk (fire, flooding etc), but company carries a threshold of risk HBM: management • For managers, “there is no such thing as insurance”; they should manage all principal and operational risk • If the premium is high and you insure to the “first £1”, this will spoil management • Eg motor insurance is 3rd party only • Could pay big premium and avoid bearing risk internally; but this is costly & removes responsibility from managers HBM: Health & Safety • Health & Safety (H&S) is paramount but industry record is poor • Dupont was used as facilitator • Attitude is critical: hearts and minds; plus dismissal for H&S contravention • H&S is first item on monthly board agenda • Prevention is better than cure eg separating people from moving vehicles; driving school • Particular problem is use of external contractors; governed by company H&S rules but do not always adhere HBM: the environment • Sophisticated environmental management is vital in an extractive industry • Each and every site is reviewed; many risks can be removed eg water leakage etc • Above all, company needs to guard against ‘loss of right’; restoration, community relations, being a good citizen are vital HBM: liability • Company also has catastrophe insurance • In US, based on infamous case of ready mix lorry colliding with school bus & $300m claim • Sadly, in terms of cost it is better for someone to be killed than injured • In other areas such a legal liability, compensation, sexual abuse etc, company is self insured with a range of thresholds • The US is much more expensive, because there are more cases HBM: costs 6-9% of EBIT • In terms of products and materials performance – there is product liability • However, the key avoidance method is continuous testing so as to establish integrity • All insurance premiums account for 3-5% of EBIT plus self insured risk/loss is an additional 3-4%; this includes catastrophe insurance • In past ten years the cost has not grown commensurately with the business Contractors A word of warning Structural issues remain • Operating climate improving eg partnering, PFI etc • Immense skills exist • But…..accounting is a ‘black art’ • The risk/reward ratio is lamentable • There is notorious ease of entry • Financial record is poor; investors do not (will not) understand • Corruption remains rife Clients are no angels • Project cost rule of thumb: land (one third); materials (one third); all fees (one third) • Everyone’s an expert; love to ‘beat up’ contractors • Given industry margins of 1-3%, a modest concession could win immodest co-operation • UK government is also hard nosed • Former Railtrack CEO saw no reason why rail maintenance should attract more than the normal contractors’ margin i.e.1% Capital adequacy; something for another day • A contractor generally works on negative capital employed (thus on ROE) • Like a bank, he makes a large part of his return in assuming contractual obligations and holding cash • The key concept is capital adequacy – the relationship between shareholders funds and company’s total commitments • A new category called “orders in hands” (net of cash received and work performed) would be created and added to the asset base Capital adequacy; something for another day • On the other side of the balance sheet are contract obligations – the contract value of all work the firm has undertaken to deliver • These are stated net of invoiced sales but include a separate line for provisions (i.e. not netting them off work-in-progress). • For example, a contractor has shareholders funds of £100m (including “orders in hand”) and contract-related assets of £825m • His capital adequacy ratio would be 12.1x Contractors A case study Risk catalyst • Every construction company knows about the principal of risk • Historically, there was no single or formal approach to RM • Initiation can spring from failure/disaster • In its wake, questions are asked, causes identified and solutions proffered • Indeed, a failure can be a powerful catalyst for a serious change in management Need for proactive RM • How to manage risk especially with incoming acquisitions? • Began with Health & Safety, spread into internal audit/finance • However, ‘Risk Manager’ was purely an insurance manager • Part of the solution is insurance, claims etc; however, proactive RM is vital (not simply a pass off) & some things cannot be insured Audit, benchmark & Turnbull • An audit of risk assessment • It was modest, reactive & variable (with comparison impossible) • Extra mural, best practice was benchmarked • Plus external impetus, starting with Cadbury and, then, Turnbull • However, company was well on the way, preTurnbull and, three years ago, employed external consultants External help • AEA Technology (Atomic Energy Association) was used as technical consultant; plus broker • Leading implementation experts signed up • Steven Male (value management) and Nigel Smith (risk management), both professors at University of Leeds • Representatives from its main business areas appointed as ‘champions’; not just ‘top down’ Software • 18 months into the process, an externally designed software package was rolled out • Currently launching second version, on which company has had more impact • Mark II is reckoned to be “one of the better construction based packages” and to afford a “marketing edge” One size fits all • In oil & power industries, RM is first class but standard • A large contractor may have 1000 sites (and 10-20,000 employees); its RM, needs to be flexible • Application, however, must be homogeneous i.e.“one size fits all” • A concise ‘Group framework for RM’ now exists, including, ‘Uniform Risk Assessment’ Consensus & application • Training of personnel is essential • The strength of the process was to win consensus; “everyone has to be behind risk review” • RM also needs to be applied to each stage of a bid: initial identification; pre-qualification; design; pricing; on site; and living with it (eg PFI facilities management for, say, 25 years) Value management • Seek to enhance value management over life (& maintenance) of the project • Take a concept and ask how it can be value engineered; what can be done differently • In accounting terms the costs rise but the value management increases five fold • Client involvement facilitates the process Knowledge is the key • The key to RM is knowledge and maximisation of information flow through life of the project • It is also important to record what courses of action were rejected • On site, previously rejected ideas may be (re)considered; it is thus vital to know why they were shelved • In the future, when a new project is planned, an empirical history of analysis and action exits; a working register Risk grading • RM is now used almost everywhere in the company; and all major contracts are required to use it • This includes generic risk assessment, where appropriate eg repetitive tasks • The process can also be quantified with the Risk Grading Tool via a 10-15 minute electronic menu What it looks at • This encompasses a number of formal stages, involving the identification, definition and assessment of: - business or project objectives - relevant risks according to nature, causes or sources and consequences - the likelihood or risks Risk categories Key headings of analysis (comprising some 80 separate risks) are: - Client - Contractual - Resource - Design - Regulations - Financial/commercial - Scope of work/location/technical difficulty - Compliance: H&S, legal etc Colour coded risk • The output is a matrix on which all principal risks are plotted • The Y axis registers consequences, while X caters for likelihood • The matrix is colour coded: top right is Red (‘no’); bottom left is Green (‘yes’); with Orange and Yellow in between Quantitative risk • A total numerical risk score is also calculated, plus individual category risk scores (1-5) • Numerically, if a score is less than 25 and there is no individual risk greater than 5, the risk is low and the project is a ‘go’ • Conversely, with 25+ and a number of ‘5s’, it is rejected Mitigation of risk • Once this is complete, the identification of effective controls and action plans is enacted • Steps are taken to: - avoid the risk altogether - reduce the opportunity for risk to occur - reduce the impact of risk if it occurs • However, system allows risks to be analysed and mitigated eg changes to design etc • Mitigation reduces likelihood and/or severity of risk Colour approval • Activities with residual risks and a Red rating can only proceed with main board approval • All Red risks are also sorted and stored in a critical reference process • Orange risk can commence with appropriate authorisation • Yellow is in the middle, but appropriate arrangements already exist or will be developed at the relevant stage • Green: appropriate normal monitoring and review procedures are in place Focus on risk & its cause • All risk needs to be identified but the company also needs to win work • Once a risk has been converted into a value, “do not lose sight of what is behind it all” • The focus must be on the risk, and its cause, not the financial impact “If you take no risks, you will suffer no defeats. But if you take no risks, you will win no victories” R M Nixon (1913-94) Presentation by Tony Williams +44 (0) 1394 410 073