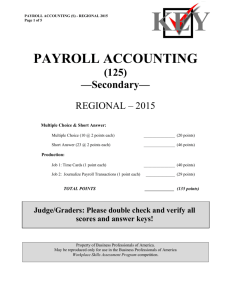

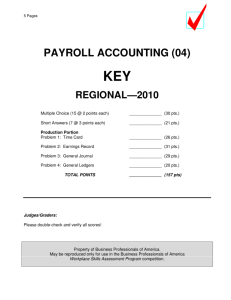

Chapter 13 Payroll Accounting

advertisement

PAYROLL REGISTER Lesson 14-1, page 332 © South-Western Educational Publishing ANALYZING PAYMENT OF PAYROLL Lesson 14-1, page 333 © South-Western Educational Publishing JOURNALIZING PAYMENT OF A PAYROLL December 15. Paid cash for semimonthly payroll, $2989.02 (total payroll, $3,803.75, less deductions: employee income tax, $273.00; social security tax, $247.26; Medicare tax, $57.07; health insurance premiums, $182.40; U.S. Savings Bonds, $35.00; United Way donations, $20.00). Check No. 312. Accounts Affected Salary Expense Employee Income Tax Payable Social Security Tax Payable Medicare Tax Payable Health Insurance Premiums Payable U.S. Savings Bond Payable United Way Donations Payable Cash Classification Expense Liability Liability Liability Liability Liability Liability Asset Change Increased Increased Increased Increased Increased Increased Increased Decreased Entered Debit side Credit side Credit side Debit side Credit side Credit side Credit side Credit side Lesson 14-1, page 334 © South-Western Educational Publishing JOURNALIZING PAYMENT OF A PAYROLL 4 2 1 5 3 6 1. Write the date. 2. Write the title of the account debited. 3. Write the check number. 4. Write the amount debited to Salary Expense. 5. Write the amount credited to Cash. 6. Write the titles of the accounts credited. 7. Write the credit amounts. 7 Lesson 14-1, page 334 © South-Western Educational Publishing UNEMPLOYMENT TAXES Calculate Unemployment Taxes—Federal Unemployment Taxable Earnings $183.75 Federal Federal Unemployment Unemployment Tax Rate = Tax 0.8% = $1.47 Calculate Unemployment Taxes—State Unemployment Taxable Earnings $183.75 State State Unemployment Unemployment Tax Rate = Tax 5.4% = $9.92 Lesson 14-2, page 338 © South-Western Educational Publishing JOURNALIZING EMPLOYER PAYROLL TAXES December 15. Recorded employer payroll taxes expense, $315.72, for the semimonthly pay period ended Dec. 15. Taxes owed are: social security tax, $247.26; Medicare tax, $57.07; federal unemployment tax, $1.47; state unemployment tax, $9.92. Memorandum No. 63. Accounts Affected Payroll Taxes Expense Soc. Security Tax Pay. Medicare Tax Payable Unemp. Tax Pay.—Fed. Unemp. Tax Pay.—State Payroll Taxes Expense Classification Expense Liability Liability Liability Liability Entered Debit side Credit side Credit side Credit side Credit side Change Increased Increased Increased Increased Increased Social Security Tax Payable Medicare Tax Payable normal balance normal balance normal balance 315.72 247.26 57.07 Unemployment Tax Payable—Federal Unemployment Tax Payable—State normal balance 1.47 normal balance 9.92 Lesson 14-2, page 339 © South-Western Educational Publishing JOURNALIZING EMPLOYER PAYROLL TAXES 2 3 4 1 5 6 1. Write the date. 2. Write the expense account debited. 3. Write the memorandum number. 4. Write the debit amount. 5. Write the titles of the liability accounts credited. 6. Write the credit amounts. Lesson 14-2, page 339 © South-Western Educational Publishing TERMS REVIEW federal unemployment tax state unemployment tax Lesson 14-2, page 340 © South-Western Educational Publishing EMPLOYER ANNUAL REPORT TO EMPLOYEES OF TAXES WITHHELD Lesson 14-3, page 341 © South-Western Educational Publishing EMPLOYER’S QUARTERLY FEDERAL TAX RETURN 1 2 4 3 5 3 6 7 1. Heading 2. Number of Employees 3. Total Quarterly Earnings 4. Income Tax Withheld 5. Employee and Employer Social Security and Medicare Taxes 6. Social Security plus Medicare Taxes 7. Total Taxes 8. Total Taxes for Each Month 9. Total Taxes 9 8 Lesson 14-3, page 342 © South-Western Educational Publishing PREPARING EMPLOYER’S QUARTERLY FEDERAL TAX RETURN Calculate Social Security and Medicare Taxes Total Earnings Social Security $22,575.00 Medicare $22,575.00 Tax Rate = Tax 13% 3% = = $2,934.75 $ 677.25 Calculate Social Security and Medicare Taxes Employee Employer Social Social Federal Income Security and Security and Federal Tax Tax Withheld + Medicare Tax + Medicare Tax = Liability Dec. 1-15 $273.00 Dec. 16-31 $269.00 Totals $542.00 + + + $304.33 302.08 606.41 + + + $304.33 $302.08 606.41 = 881.66 = $873.16 = $1,754.82 Lesson 14-3, page 343 © South-Western Educational Publishing EMPLOYER ANNUAL REPORTING OF PAYROLL TAXES Lesson 14-3, page 344 © South-Western Educational Publishing FORM 8109, FEDERAL DEPOSIT COUPON Lesson 14-4, page 347 © South-Western Educational Publishing JOURNALIZING PAYMENT OF LIABILITY FOR EMPLOYEE INCOME TAX, SOCIAL SECURITY TAX, AND MEDICARE TAX January 15. Paid cash for liability for employee income tax, $542.00; social security tax, $985.40; and Medicare tax, $227.42; total, $1,754.82. Check No. 330. Classification Liability Liability Liability Asset Employee Inc. Tax Payable Social Security Tax Payable normal balance normal balance 542.00 985.40 Entered Debit side Debit side Debit side Credit side Change Decreased Decreased Decreased Decreased Medicare Tax Payable normal balance Accounts Affected Employee Inc. Tax Pay. Social Security Tax Pay. Medicare Tax Payable Cash 227.42 Cash normal balance 1,754.82 Lesson 14-4 page 348 © South-Western Educational Publishing JOURNALIZING PAYMENT OF LIABILITY FOR EMPLOYEE INCOME TAX, SOCIAL SECURITY TAX, AND MEDICARE TAX 1 3 4 5 2 1. Write the date. 2. Write the title of the three accounts debited. 3. Write the check number. 4. Write the three debit amounts. 5. Write the amount of the credit to Cash. Lesson 14-4, page 348 © South-Western Educational Publishing PAYING THE LIABILITY FOR FEDERAL UNEMPLOYMENT TAX Lesson 14-4, page 349 © South-Western Educational Publishing JOURNALIZING PAYMENT OF LIABILITY FOR FEDERAL UNEMPLOYMENT TAX January 31. Paid cash for federal unemployment tax liability for quarter ended December 31, $8.40. Check No. 343. Entered Accounts Affected Classification Change Unemployment Tax Payable—Federal Liability Decreased Debit side Cash Asset Decreased Credit side normal balance 8.40 Cash normal balance Unemployment Tax Payable—Federal 8.40 Lesson 14-4, page 350 © South-Western Educational Publishing JOURNALIZING PAYMENT OF LIABILITY FOR FEDERAL UNEMPLOYMENT TAX 1 2 3 4 5 1. Write the date. 2. Write the title of the account debited. 3. Write the check number. 4. Write the debit amount. 5. Write the amount of the credit to Cash. Lesson 14-4, page 350 © South-Western Educational Publishing JOURNALIZING PAYMENT OF LIABILITY FOR STATE UNEMPLOYMENT TAX 1 2 3 4 5 1. Write the date. 2. Write the title of the account debited. 3. Write the check number. 4. Write the debit amount. 5. Write the amount of the credit to Cash. Lesson 14-4, page 350 © South-Western Educational Publishing