Review Problems for Final Examination

advertisement

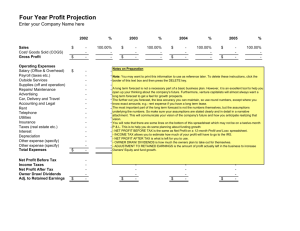

ACCT 100 – PROFESSOR FARINA PRACTICE PROBLEMS FOR FINAL EXAM Problem #1 - Transactions between buyer and seller: Bryant Company (buyer) and Schmidt, Inc. (seller) engaged in the following transactions during February 2013: Bryant Company DATE TRANSACTIONS 2013 Feb. 10 Purchased merchandise for $2,400 from Schmidt, Inc., Invoice 1980, terms 1/10, n/30. 13 Received Credit Memorandum 230 from Schmidt, Inc., for damaged merchandise totaling $200 that was returned; the goods were purchased on Invoice 1980, dated February 10. 19 Paid amount due to Schmidt, Inc., for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. Schmidt, Inc. DATE TRANSACTIONS 2013 Feb. 10 Sold merchandise for $2,400 on account to Bryant Company, Invoice 1980, terms 1/10, n/30. 13 Issued Credit Memorandum 230 to Bryant Company for damaged merchandise totaling $200 that was returned; the goods were purchased on Invoice 1980, dated February 10. 19 Received payment from Bryant Company for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. 1.a Journalize the transactions above in a general journal for Bryant Company. 1.b Journalize the transactions above in a general journal for Schmidt, Inc. 1 Problem #2 – Journalizing cash receipts: Southern Gift Shop, a retail business, started business on April 29, 2013. It keeps a $300 change fund in its cash register. The cash receipts for the period from April 29 to April 30, 2013, are shown below. DATE TRANSACTIONS April 29 Cash sales per the cash register tape, $1,527. Cash count, $1,823. 30 Cash sales per the cash register tape, $1,440. Cash count, $1,741. Record the cash receipts on April 29 and April 30, 2013, in a general journal. Problem #3 – Preparing a bank reconciliation and related journal entries: On August 1, 2013, the accountant for Far West Imports downloaded the company's July 31, 2013, bank statement from the bank's Web site. The balance shown on the bank statement was $28,800. The July 31, 2013, balance in the Cash account in the general ledger was $13,798. Jenny Irvine, the accountant for Far West Imports, noted the following differences between the bank's records and the company's Cash account in the general ledger. a. An electronic funds transfer for $14,800 from Foncier Ricard, a customer located in France, was received by the bank on July 31. b. Check 1422 was correctly written and recorded for $1,200. The bank mistakenly paid the check for $1,240. c. The accounting records indicate that Check 1425 was issued for $66 to make a purchase of supplies. However, examination of the check online showed that the actual amount of the check was for $96. d. A deposit of $860 made after banking hours on July 31 did not appear on the July 31 bank statement. e. The following checks were outstanding: Check 1429 for $1,253, and Check 1430 for $145. f. An automatic debit of $266 on July 31 from CentralComm for telephone service appeared on the bank statement but had not been recorded in the company's accounting records. 1. Prepare a bank reconciliation for the firm as of July 31. 2. Record general journal entries for the items on the bank reconciliation statement that must be journalized as of July 31, 2013. 2 Problem #4 – Preparing adjusting entries: a-b. Merchandise Inventory, before adjustment, has a balance of $8,400. The newly counted inventory balance is $8,900. c. Unearned Seminar Fees has a balance of $6,900, representing prepayment by customers or five seminars to be conducted in June, July, and August 2013. Two seminars had been conducted by June 30, 2013. d. Prepaid Insurance has a balance of $17,400 for six months insurance paid in advance on May 1, 2013. e. Store Equipment costing $10,190 was purchased on March 31, 2013. It has a salvage value of $590, and a useful life of five years. The equipment will be depreciated using the straight-line method. f. Employees have earned $340 that has not been paid at June 30, 2013. g. The employer owes the following taxes on wages not paid at June 30, 2013: SUTA, $10.20; FUTA, $2.72; Medicare, $4.93; and Social Security, $21.08. h. Management estimates uncollectible accounts expense at 1% of sales. This year's sales were $2,900,000. i. Prepaid Rent has a balance of $7,950 for six months rent paid in advance on March 1, 2013. j. The supplies account in the general ledger has a balance of $490. A count of supplies on hand at June 30, 2013 indicated $195 of supplies remain. k. The company borrowed $12,000 from First Bank on June 1, 2013 and issued a four-month note. The note bears interest at 9%. Based on the above information, record the adjusting journal entries that must be made for John Gavone Consulting on June 30, 2013. The company has a June 30 fiscal year-end for the general journal. Problem #5 – Preparing a classified income statement: The worksheet of Alec's Office Supplies contains the following revenue, cost, and expense accounts. The merchandise inventory amounted to $59,575 on January 1, 2013, and $52,525 on December 31, 2013. The expense accounts numbered 611 through 617 represent selling expenses, and those numbered 631 through 646 represent general and administrative expenses. Accounts 401 Sales 451 Sales Returns and Allowances 491 Miscellaneous Income 501 Purchases 502 Freight In 503 Purchases Returns and Allowances 504 Purchases Discounts 611 Salaries Expense—Sales 614 Store Supplies Expense 617 Depreciation Expense—Store Equipment 631 Rent Expense 634 Utilities Expense 637 Salaries Expense—Office 640 Payroll Taxes Expense 643 Depreciation Expense—Office Equipment 646 Uncollectible Accounts Expense 691 Interest Expense $ 247,500 Cr. 4,330 Dr. 380 Cr. 103,400 Dr. 1,955 Dr. 3,580 Cr. 1,780 Cr. 45,100 Dr. 2,290 Dr. 1,490 Dr. 13,300 Dr. 2,980 Dr. 20,900 Dr. 5,800 Dr. 550 Dr. 700 Dr. 700 Dr. Prepare a classified income statement for this firm for the year ended December 31, 2013. 3