Agency Costs - UTA Economics

advertisement

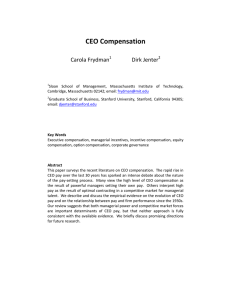

Lecture 17: Agency Costs • Employees or contractors not behaving as they should — is a part of what we call Agency Costs or Agency Problems. • Agency costs are a problem whenever a principal hires an agent to act on his behalf. Boss hires a worker. • Solving this universal problems is a key managerial problem in managing personnel and in controlling costs. Drawback of Firms: Agency Costs Agency costs arises from separation of ownership and control. Owners of firms are interested in profit maximization. Managers, employees, and suppliers are interested in maximizing their own self-interests. How do we give employees incentives to act as if they were owners of the firm? How do we get employees to not shirk—that is, work as hard as they can in the manner the owners would want? It is a matter of incentives. Agency Costs . . . • These are a problem because we are human. If we “cheat” ourselves, then no one else bears the cost. So the one-person firm does not suffer agency costs. • It is natural for us to want to exploit others: get others to pay more than they agreed to pay or we produce less than we agreed to produce. A divergence in interest between principal and agent in a multi-person organization and in contracts. Monitoring We have incentives to shirk – take more than we should or work less than we should. Monitoring is costly, so sensible to accept some losses. Many forms of monitoring exist (spot checks, etc.). Usually there is unequal (asymmetric) information between parties. One knows more than the other and can exploit that. Examples: Person selling used car (seller exploits buyer) Buying insurance (buyer exploits seller) Monitoring, Bonding & Signals • How do we assure customers that we can be trusted, so they should deal with us? Various devices: Fixed price contracts; Bonds; Warranties; Take payment as % later (Accenture) Less formal: Reputation. This matters greatly in the market. Diamond market in New York—close family, social and religious ties impose special discipline. Entrepreneurs and their Firms • Key Managerial Problem: Giving employees incentives to act as if they are owners. The entrepreneur or top manager must cede authority to others. The issue is: How do we structure an organization to reduce agency costs? The movement has been in this direction; especially in knowledge-based production. Decentralization: Pros & Cons • Empowering workers and managers. BENEFITS: 1. More effective use of local knowledge — those closest know the most 2. Conservation of senior management — top people cannot know or do everything 3. Training & motivation for local managers: helps attract and keep good managers and train future top managers Decentralization . . . Empowering workers and managers: COSTS: 1. Agency costs— shirking; self-dealing — so control and monitoring measures needed 2. Coordination costs and failures — duplication; pricing errors 3. Less effective use of central information— local managers cannot know all information the central managers have, so have inferior knowledge Team Production: Increasing or Decreasing Costs? Create teams of people with different expertise to make decisions— Ex.—Hallmark Cards had teams of art, design, production and marketing assigned by holiday with decision rights rather than move produce from functional area to area— cut time in half. Benefits—Improved use of specific knowledge and employee “buy in” due to better information, more cooperation & less blame. Costs—Collective-action and free-rider problems. Same thing in car production—team development tried at Chrysler; separate functional areas at GM. Tradeoffs. Decision Management & Control Agents (managers within a firm) do not bear the full cost of their actions, so cannot be delegated both decision management and control — hierarchy still necessary. Make authority and lines of control clear. Clear communications — top down and down up — are critical. Getting Workers to Monitor Each Other • Nucor has been one of the few successful steel makers in the U.S. It keeps management small and adapts new technology quickly. • Production workers are in teams. Base salaries are below industry standards. Teams are given production goals. Beating goals allows salary to be more than doubled. Penalties for mistakes are severe, so quality maintained. If one worker shirks then everyone suffers. • Who is likely to want to work at Nucor? Questions: How Do We Overcome Agency Costs? • The larger the organization, or the greater the distance from the owners to the workers, the more likely that agency costs will become significant —large corporation look more like an inefficient government agency. What economic incentives do firms take to try to give workers proper incentives? What about ESOPs? Compensation schemes? Why Pay Workers More the More Years They Work? • Wages tend to rise with job tenure. Is it Wages because older workers are more productive than younger workers? Pay Productivity Job Tenure Why “backload” wages? • Give younger workers incentive to work hard and get the rewards later—and know that loyalty is rewarded. • This reduces incentives to shirk. If you perform well, you will be taken care of later. • One study in Germany showed that workers with 5 years more tenure, but identical work skills, got 25% greater wages than younger workers. Does the Boss Deserve His/Her Pay? Many complaints about “excessive” compensation of CEOs. How much is it and how much is too much? Some athletes make $100 million a year—is that too much? Why is there resentment about CEOs who make $100 million per year? What if the CEO founded the company? Does that make a difference? Agency Problems at the Top CEOs capture about 8% of the accounting profit of public firms. Is that too much? Studies show that CEO compensation is higher the less monitoring there is: When boards are weak or ineffectual (loaded with friends of CEO). When there is no large outside shareholder. When there are fewer large institutional investors. When there is an anti-takeover arrangement. Evidence of Weak Monitoring If high compensation is deserved—why hide it? Some compensation non-transparent: Back dated stock options; Below market rate large loans (that may be forgiven); Generous pensions not related to performance; Generous in-kind benefits (company planes) not related to performance; Consulting contracts upon retirement or being forced out; Large bonus upon retirement, or even when forced out, that was not part of the compensation package; Use of compensation consultants who have every incentive to make the CEO happy. Corporations Have Problems In sum, the corporate form of organization is not perfect. The alternatives—non-profits and government bureaus—have far worse performance problems. Much of modern wealth is tied to the rise of the modern business organizations—getting incentives right. Question: Large Organization with Simple Monitoring • Mary Kay Cosmetics grew from sale of $200,000 in 1963 to over $600 million in 1993, 30 years later. The product is common and very competitive. The key to growth was measurement of employee effort and rewards. • What was it? Are Incentives Right? Dealers at casinos in Las Vegas earn about $100,000 per year—almost all on tips. Their wages are about $12,000. Casino owner Steve Wynn ordered tip money pooled and shared with managers. Why? Question on Team Incentives • Suppose different numbers of people are assigned to pull a rope “as hard as you can.” • One person pulls the rope. • Three people pull the rope together. • Eight people pull the rope together. • How does the pulling force (work effort) per person change across these three cases? Incentives of Managers In the fast-food industry, 30% of stores are company owned and run by a salaried manager. 70% of the stores are run as franchises by owner-operators who split profits with the parent company. 1) Which kind of store would you think would tend to be more profitable? 2) Why then does the parent choose to own some? Where would they be located? 3) Would you expect employees to see a difference in the managers?