Federal

advertisement

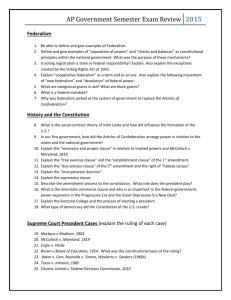

Constitutional Law I Prof. Karl Manheim May 28, 2015 slides: www.lls.edu/jls/materials copyright © 2015 – Karl Manheim The Federal Constitution 2 Our Constitutions 1. Articles of Confederation (1781-1789) Each state with 1 vote (and veto) 2. Federal Constitution (1789 “It is obviously impractical in the federal government of these states, to secure all rights of independent sovereignty to each, and yet provide for the interest and safety of all….” Geo Washington 3. Const’n of the Confederate States (1861-1865) Modeled after Federal Constitution Major difference in states' rights 50 State Constitutions 3 The Federal Constitution Creates a “union” (federal gov’t) Preamble Arts. 1-3 Vests power in three branches Specifies their modes of operation State/fed’l relations (supremacy) Arts. 4, 6 Limits federal power (indiv. rights) Original Constitution Bill of Rights Art. 1, § 9 Amds 1-10 Limits state power Original Constitution Citizenship, Eq.Pro, Due Process 4 Art. 1, § 10 14th Amd The Federal Constitution Creates a “union” (federal gov’t) Vests power in three branches Article I – the Congress Article II – the Executive Article III – the Judiciary every President also claims “inherent” power Limits state powers Protects individual rights 5 Gives rise to notion of Separation of Powers Nominally, each branch can exercise only those powers specified in the constitution The Federal Constitution Creates a “union” (federal gov’t) Vests power in three branches Article I – the Congress Article II – the Executive Article III – the Judiciary Federalism Executive Power Judicial Review these structural issues have generated the most const’l law controversies since the founding Limits state powers Preemption Preclusion 6 Major Themes in Con Law – Recap Federalism (States’ Rights) Limits on federal power; immunity; preemption Executive Power (Separation of Powers) Conflicts with congress, courts Executive privileges; immunities Judicial Review Power of courts to review (invalidate) laws Theories of interpretation (strict, fluid, etc.) Individual Rights Limits on (state & federal) government power 7 Case Studies (from 2012-2014 terms) Federalism - Federal Power NFIB v. Sebelius (2012) – Affordable Care Act Shelby County v. Holder (2013) – Voting Rights Act Federalism – State Power Arizona v. United States (2012) – Preemption Executive Power – Separation of Powers King v. Burwell (2015) – Agency powers Texas v. United States (2015) – Executive power Judicial Power – Justiciability Clapper v. Amnesty Int’l (2013) - Standing 8 Federalism / Federal Power Article I – the Congress Section 8 – Congress shall have power to .... Tax & spend for common defense, gen’l welfare 2. Regulate Interstate Commerce Every law passed by 5,6 Currency and banking Congress must be 8. Intellectual property sourced in an 10-16 Military & foreign affairs enumerated power 1. 18 clauses in all 18. Congress shall have power … To make all laws which shall be necessary and proper for carrying into execution the foregoing powers, and all other powers vested by the Constitution in the government of the United States 9 Federalism Article I – the Congress Section 8 – Congress shall have power to .... Tax & Spend for common defense & gen’l welfare Regulate Interstate Commerce Currency and banking Intellectual property Military & foreign affairs federalism lives in the tension between §8 and 10th Amendment Necessary & proper clause Tenth Amendment reserves state powers “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.” 10 Issues: 1. Whether Congress has power under Article I to mandate uninsured individuals buy health insurance. Interstate Commerce Clause Tax and Spend Clause 2. Whether the Medicaid expansion violates the 10th Am. by “coercing” states to implement a federal program 3. Whether the ACA must be invalidated in its entirety if any part is found unconstitutional because it is not “severable” from the remainder of the Act. 11 Federalism in Affordable Care Act Whether Congress has power under Art. I to mandate people buy health insurance Art. I, § 8 - The Congress shall have power: 1. To lay and collect taxes, duties, imposts and excises, to pay the debts and provide for the common defence and general welfare of the United States; 2. To regulate commerce with foreign nations, and among the several states, and with the Indian tribes; 12 The Interstate Commerce Clause Congress’ most prolific source of power Everything from highways to employment to crops to drugs to civil rights Is the lack of insurance (being self-insured) A species of interstate commerce, or Related to interstate commerce? 13 The ACA and Federalism Art. I, § 8, cl. 3 - Congress has power to: regulate includes licensing, prohibiting. Does it include “mandating”? interstate commerce at one time, read very restrictively; now nearly all commerce is interstate insurance is clearly “commerce” but can congress create commerce in order to regulate it? Also has power to: is the $695 a “tax” or a “penalty”? lay and collect taxes to provide for the general welfare 14 Congress can only tax & spend for gen’l welfare, not “regulate” it These seemingly technical questions go to the heart of government – should it be small & decentralized; or large enough to handle issues of our post-industrial society The ACA and Federalism Art. I, § 8, cl. 3 - Congress has power to: regulate includes licensing, prohibiting. Does it include “mandating”? interstate commerce at one time, read very restrictively; now nearly all commerce is interstate insurance is clearly “commerce” but can congress create commerce in order to regulate it? Also has power to: is the $695 a “tax” or a “penalty”? lay and collect taxes to provide for the general welfare 15 Congress can only tax & spend for gen’l welfare, not “regulate” it Nat’l Fed’n of Ind. Bus. v. Sebelius (2012) The Commerce Clause Power to [regulate] [interstate] [commerce] Holdings: 1. although insurance is interstate commerce, lack of it (or self-insurance) is not commerce 2. lack of insurance is not related to commerce 3. power to regulate commerce does not include power to create commerce 16 Comparing Medical Expenditures 17 50 Million Uninsured in US 18 1. Lack of insurance is not commerce Nature of insurance 3rd party insurance transfers risk of loss self-insurance retains risk of loss assumption of risk is an economic act but not an economic activity Does congress lack power to regulate insurance deductibles? Commerce Clause formalism (act vs activity) reminiscent of late 18th / early 19th C. cases 19 2. Lack of insurance is not related to IC Art. I, § 8, cl. 18 - Necessary & Proper Clause “Congress shall have power … To make all laws which shall be necessary and proper for carrying into execution the foregoing powers, and all other powers vested by the Constitution in the government of the United States” ACA reforms cannot work w/o mandate w/o mandate, premiums for insureds $1,000 each Uninsured cost treasury & economy hundreds $Billion Case law on N&P Clause Gonzales v. Raich (2005) Roberts: Mandate not “proper” because it “undermines the structure of government established by constitution” 20 3. Power to regulate is not power to create What does “regulate” mean? Does it include the power to license? Does it include the power to prohibit? Does it include the power to create? Roberts: can only “regulate” a thing already in existence Congress cannot originate (bring into existence) the object of its power Compare Congress’ enumerated powers 21 Art. I, § 8 - The Congress shall have power: 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. To To To To To To To To To To To To To To To To To To lay and collect taxes … ➔ borrow money … ➔ regulate foreign, interstate and Indian commerce ➔ establish rules of naturalization and bankruptcies ➔ coin money ➔ punish counterfeiting ➔ establish post offices and post roads ➔ [grant copyrights and patents] ➔ constitute inferior courts ➔ define and punish piracies ➔ declare war ➔ raise and support armies ➔ provide and maintain a navy ➔ govern the land and naval forces ➔ call forth the militia ➔ organize and train the militia ➔ legislate in the seat of government ➔ make all laws necessary and proper ➔ 22 power to originate power to originate no power to originate power to originate power to originate power to originate power to originate power to originate power to originate power to originate power to originate power to originate power to originate power to originate power to originate power to originate power to originate augmenting power Insurance Mandate as a Tax Congress shall have power: To lay and collect taxes, duties, imposts and excises, to pay the debts and provide for the common defence and general welfare of the United States Relation to § 8 substantive powers A penalty is a form of regulation (enforcement) A tax need not be related to substantive power Is the noncompliance penalty a “tax” Roberts: The “penalty” merely induces behavior; it does not compel behavior; thus it is akin to a tax Resurrects Hamilton/Madison debate on tax power 23 ACA Medicaid Expansion Congress shall have power: To lay and collect taxes, duties, imposts and excises, to pay the debts and provide for the common defence and general welfare of the United States Medicaid is Congress’ largest grant to States ACA expands coverage Additional $450 Billion by US over 10 years Additional $20 Billion by States Non-complying States lose all Medicaid funding “Conditional” federal funding is ok, but “Coercive” federal funding is not Congress cannot “commandeer” the States 24 Shelby County v. Holder (2013) Civil War Amendments: 13th (1865) – slavery 14th (1868) – citizenship, individual rights 15th (1870) – voting § 1 – “The right of citizens of the United States to vote shall not be denied or abridged by the United States or by any State on account of race, color, or previous condition of servitude.” § 2 – “The Congress shall have power to enforce this article by appropriate legislation.” note the similarity to the necessary & proper clause 25 Shelby County v. Holder (2013) Voting Rights Act of 1965 (VRA) Fruits of the civil rights movement § 2 prohibits any voting qualification or procedure that results in a denial or abridgement of the right to vote on account of race, color, or language status § 5 prohibits “covered jurisdictions” from changing voting procedures without “pre-clearance” from AG covered jurisdictions are defined in § 4 as those states with a history of disenfranchising minority voters Change allowed only if it "neither has the purpose nor will have the effect of denying or abridging the right to vote on account of race or color." 26 Shelby County v. Holder CJ Roberts’ Opinion VRA violates state sovereignty to extent it does more than simply “enforce” the 15th Amend. past discrimination is not sufficient basis for pre-clearance especially since the VRA has been so successful also violates “equal sovereignty” principle § 4 formula can no longer be used § 5 not invalidated, but inoperative § 2 still being enforced by DoJ 27 The Great Federalism War 28 28 Federalism Limits on States Dormant Commerce Clause Privileges & Immunities Clause Preemption 29 Federalism Limits on States Dormant Commerce Clause 1 States Can’t Regulate Interstate Commerce the DCC is an example of const’l preclusion – state law that is prohibited by the const’n (explicitly or implicitly) because congress has exclusive power in the matter Privileges & Immunities Clause Preemption Business Entry Extraterritorial Effect Sam Francis Fnd’n v. Christies (9th Cir. 5/5/15) (invalidating part California Resale Royalty Act) 30 Federalism Limits on States Dormant Commerce Clause 1 States Can’t Regulate Interstate Commerce 2 States Can’t Discriminate Against IC Privileges & Immunities Clause Preemption Higher taxes for out-state business; Regulatory preference for in-staters 31 Federalism Limits on States Dormant Commerce Clause 1 States Can’t Regulate Interstate Commerce 2 States Can’t Discriminate Against IC 3 States Can’t Burden IC More Privileges & Immunities Clause Preemption Amazon claimed that collecting sales tax in Calif would be burdensome “constitutional law” cases in fed. ct. involve DCC than 1st Am Burdensome business regulations Balancing – on its way out 32 Federalism Limits on States Dormant Commerce Clause Privileges & Immunities Clause States can’t discriminate against non-residents In enjoyment of “fundamental rights” Preemption Practicing trade, professions But not voting, subsidies 33 Federalism Limits on States Dormant Commerce Clause Privileges & Immunities Clause Preemption Express preemption (in text of federal law) Implied preemption (infer from text, history) Reading tea leaves of congressional intent State labor, environmental, banking, health, insurance regs, tort liability 34 Arizona v. United States (2012) SB 1070 - Operative terms: § 11-1051B - state officials must make “reasonable attempt” to ascertain immigration status whenever reasonable suspicion exists that a person is an [unlawful] alien § 11-1051E – arrest without a warrant if probable cause to believe that the person is removable from the US § 13-1509A - in addition to any violation of federal law, a person is guilty of trespassing if the person is (in Arizona) in violation of 8 U.S.C. §§ 1304(e) or 1306(a). § 1304(e) – failure to carry authorization State & local law enforcement personnel not typically trained in immigration matters 35 Arizona Immigration Law – SB 1070 or what if you’ve filed any of these forms? 36 Arizona Immigration Law – SB 1070 Purpose of SB 1070: “to discourage and deter the unlawful entry and presence of aliens and economic activity by persons unlawfully present in the United States” Does Arizona have power to deter unlawful entry? Preclusion: States lack power to regulate immigration Where power does not exist, it does not spring into being by need or failure of the US gov’t to act. Thus, even where state law is consistent, or where congress is silent, states would be powerless to act 37 Arizona Immigration Law – SB 1070 Preemption: SB 1070 is impliedly preempted by federal law frustrates congress intent in alien regulation federal immigration law “occupies the field” Especially true where dominant federal interest National security Matters of national sovereignty Foreign affairs Immigration "In respect of our foreign relations generally, state lines disappear. As to such purposes the State of New York does not exist." US v. Belmont (1937) 38 Executive Power Express (textual) Powers Domestic affairs Issue pardons & reprieves Fill temporary vacancies Take care that laws are “faithfully executed” Appoint judges & officers Recommend / approve (or veto) legislation Military & Foreign Affairs Commander-in-Chief of the armed forces Make treaties Appoint & receive ambassadors 39 Executive Power Express (textual) Powers Domestic affairs Issue pardons & reprieves Fill temporary vacancies Take care that laws are “faithfully executed” Appoint judges & officers Recommend legislation Military & Foreign Affairs Commander-in-Chief of the armed forces Make treaties Appoint & receive ambassadors 40 King v. Burwell (2015, pending) Affordable Care Act §1311(b)(1) ”Each State shall, not later than 1/1/14, establish an American Health Benefit Exchange.” §1311(c) If a state fails to set up an Exchange itself, then the Secretary of HHS shall "establish and operate such Exchange within the State.” §1411 Premium Assistance Tax Credit, based on monthly premiums for health plans offered in the individual valid interpretation by IRS? market within a State ... and which were enrolled in through an Exchange established by the State under §1311 26 C.F.R. § 1.36B-1: Premium tax credits available to “State Exchanges, regional Exchanges, subsidiary Exchanges, and a Federally-facilitated Exchange.” 41 King v. Burwell (2015, pending) Lawsuit Pl’s claim absent tax credit they’d be exempt is IRS rule ultra vires (contrary to statute)? Chevron Rule (Chevron v. NRDC) drafters claim the language was simply inadvertent Where legislative text or intent is clear, courts will interpret de novo Where text is silent or ambiguous, courts defer to agency interpretation unless unreasonable text is ordinarily read in context, not isolation 4th Circuit found IRS interpretation was plausible based on Congress’ intent to maximize coverage 42 Texas v. U.S. (May 26, 2015) Challenge to Obama’s DAPA program Deferred Action for Parents of Americans (2014) eligible for federal public benefits (incl. Medicare) and work authorization possibly state benefits (e.g., drivers’ licenses) “prosecutorial discretion” similar to DACA (2012) 26 States suit Violates Administrative Procedure Act (APA) Notice and Comment req’d for substantive law Review because non-enforcement imposes costs on TX Take Care Clause (faithfully execute the laws) 43 Administrative Agencies Rise of the Administrative State Due to breadth of federal regulation Develop institutional expertise What do they do? Legislate, Execute (administer), Adjudicate Constitutional Framework Agencies are nominally in executive branch But Congress can create “independent agencies” Exercising powers delegated by congress “Intelligible principle” principle Chevron test for validity of agency actions 44 Administrative Agencies Federal Government Art. II Legislature creates and delegates power Executive Judiciary reviews controls Administrative Agencies 45 Examples of Admin Agencies 46 47 Functions of Admin Agencies Executive functions administer/enforce federal law Quasi-Legislative Functions promulgate rules, regulations, & (micro) policy congress can override by statute Quasi-Judicial Functions adjudicate disputes involving agency functions 48 Administrative (Agency) Courts Article I Courts Usually resident within an agency Ex: USPTO, FCC, FDA, FTC, HHS, SEC Some are free-standing Ex: Bankruptcy court; Ct. of Federal Claims Administrative Law Judges look like real judges Hired, not appointed Ultimate review by Article III courts Guantanamo tribunals Similar role in state systems 49 Administrative (Agency) Courts Agencies adjudicate “public rights” disputes Controversies involving government Not “inherently judicial” matters Guantanamo Trials Combatant Status Review Tribunals Outside of (Article III) federal courts SCt rejects effort to insulate from judicial review Boumediene v. Bush (2008) 50 Phenomenon of Agency Capture Failure of government oversight Cozy relationship with industry Agencies become “regulated” by the industries they oversee, rather than regulate them Structural features allowing for capture No direct accountability (except through Pres.) Little public oversight Complexity of functions/industry Lack of press investigation counter-example: Net neutrality rule adopted by FCC Reduced “standing” to challenge actions 51 The Judicial Power Creates a “union” (federal gov’t) Vests power in three branches Article I – the Congress Article II – the Executive Article III – the Judiciary Federal judicial power is limited Each branch can in furtherance of federalism in our dual judicial system, limits on federal courts protect the jurisdiction (hence power) of state courts 52 exercise only those powers specified in the constitution Federal Courts Supreme Court only court created by Article III original jurisdiction cases involving states and foreign states/diplomats cases between states => mandatory jdx usually heard by Special Master appellate jurisdiction all other cases within the S.Ct’s judicial power jdx is discretionary (currently ~ 80 cases / ~3,000) certiorari usually granted when conflict among lower cts 53 Federal Courts Inferior Federal Courts created by Congress (pursuant to Art. III) 54 Federal Courts Limits on jurisdiction (apply to all fed cts) Standing / Justiciability Statutory limits Non-Article III courts created by Congress under Art. I 55 State Courts State judges are elected, may be less faithful to the constitution Derive “jurisdiction” from state constitutions “General” jurisdiction (not “limited” like fed cts) Federal issues in state court States must hear federal claims & defenses unless congress vests exclusive jurisdiction in fed. ct USSC can review fed issues in state decisions Lower federal courts can’t review state cases Exception: habeas corpus State issues in federal court 56 Choice of forum can be critical State Constitutional Law Parallel to federal constitution Structure Rights Bill of Rights did not apply to states before 14th Amd Some states have expanded rights Example Equal Education Funding Federal Law No right. San Antonio v. Rodriquez (1973) State Law In many state const’ns (Edgewood v. Kirby, 1989) 57 Standing Justiciability – “cases or controversies” Standing – is this the right plaintiff? Discrete & Palpable Injury (no generalized grievances) Caused by Defendant (Traceability), Redressable by the court Asserting Personal Rights (no 3rd party standing) Ripeness – is it too soon? Mootness – is it too late? Political Question – Some constitutional provisions were intended to be enforced solely by the political branches (not courts) 58 Clapper v. Amnesty Int’l (2013) FISC Foreign Intelligence Surveillance Act of 1978 created Foreign Intelligence Surveillance Court 11 judges appointed by the Chief Justice meet in secret; issue secret opinions FISA Intercepts Issued by FISC § 215 bulk metadata collection If purpose is foreign intelligence gathering Do not have to meet 4th Amd. standards Pre-PATRIOT Act - intercepts can be used only for intelligence purposes–NOT in criminal cases Post-PATRIOT – information sharing for crim purposes 59 Clapper v. Amnesty Int’l (2013) Background NY Times discloses massive illegal surveillance Congress passes FISA Amendments Act (FAA) to retroactively authorize warrantless intercepts Attorneys representing foreign nationals and journalists communicating with foreign sources challenged FAA as violating 1st Amendment Holding (5-4, by Alito) Plaintiffs lack standing – no particularized injury cannot show their communications were likely to be surveilled by U.S. intel agencies 60 Major Themes in Const’l Law Judicial Review Federalism Executive Power Individual Rights Saturday 61