2010 Kaiser Family Foundation Survey Slide Show

advertisement

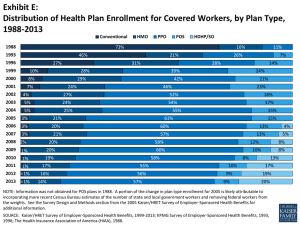

Employee Benefits BENCHMARKING DATA from 2010 and prior Resource: The Henry J. Kaiser Family Foundation (not Kaiser Permanente) discover the DBS difference (888) 490-7530 x 111 Mike Pondrom x 115 Brenda Fagan-Johnson / x 116 Mike Lutosky x 118 John Willadsen x191 David Broome • • • • • ABOUT THE SURVEY The Henry J Kaiser Family Foundation is a very reputable, third- party annual survey of employers providing a detailed look at trends in employer-sponsored health coverage, including premiums, employee contributions, cost-sharing provisions, and other relevant information. The survey continued to document the prevalence of high-deductible health plans associated with a savings option and included questions on wellness benefits and health risk assessments. The 2010 survey included 3,143 randomly selected public and private firms with three or more employees (2,046 of which responded to the full survey and 1,097 of which responded to an additional question about offering coverage). Researchers at the Kaiser Family Foundation, the National Opinion Research Center at the University of Chicago, and Health Research & Educational Trust designed and analyzed the survey. The attached slides are only part of the full survey – the slides which DBS feel present the most relevant data for our employer clients. For the entire survey, please refer to the following web site: http://ehbs.kff.org/ DBS Benchmarking Data Table of Contents 1) Premiums Information 2) 3) 4) 5) Contribution Information Plan Design Information Health Savings Accounts (H.S.A) / CDHPs WELLNESS DBS Benchmarking Data Table of Contents TOPIC: Premiums Average Annual Health Insurance Premiums and Worker Contributions for Family Coverage, 2000-2010 114% Premium Increase $6,438 147% Worker Contribution Increase Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2000-2010. $13,770 Average Annual Health Insurance Premiums and Worker Contributions for Family Coverage, 2005-2010 $1,284 Worker Contribution Increase $10,880 $2,713 $8,167 $13,770 27% $3,997 47% $9,773 20% 2005 Note: The average worker contribution and the average employer contribution may not add to the average total premium due to rounding. Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2005-2010. 2010 Worker Contribution Employer Contribution Percentage Increase in Health Insurance Premiums Compared to Inflation 14% 12% 13% Premium Increase 13% CPI 11% 10% 10% 10% 9% 8% 6% 6% 4% 5% 3.1% 3.5% 3.3% 1.6% 2% 2.2% 5% 3.9% 3.5% 2.6% 2.3% -0.7% 0% -2% 5% 2000 2001 2002 2003 2004 2005 2006 Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999-2009. Bureau of Labor Statistics, Consumer Price Index, U.S. City Average of Annual Inflation (April to April), 1999-2009. 2007 2008 2009 Annual Change Premiums for Employer-Sponsored Health Insurance, FEHBP, and CalPERS, 2000-2009 Employer-Sponsored Health Insurance FEHBP CalPERS 25% 20% 15% 11% (ESI) 10% 5% 6% (FEHBP) 9% (FEHBP) 9% (CalPERS) 5% (ESI) 0% 5% (CalPERS) -5% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Note: Employer-sponsored health insurance is the average premiums across all size employers based on the annual survey conducted by the Kaiser Family Foundation and Health Research and Educational Trust. The premiums are for employees (not retirees), for a family of four. FEHBP is the Federal Employees Health Benefits Program, which provides health insurance benefits to over 8 million federal enrollees, retirees, and their family members and former spouses. FEHBP data for this exhibit are weighted average premiums for employees (both non-Postal and Postal, not including retirees) in all plans, across all enrollment options (self and family). CalPERS is the California Public Employees’ Retirement System, which provides retirement and health benefits to California public employees and retirees. CalPERS is the nation’s third largest purchaser of employee health benefits, after the federal government and General Motors, covering nearly 1.3 million active and retired state and local government public employees and their families. CalPERS data for this exhibit are weighted average premiums for Basic Plans (non-Medicare Plans), across all enrollment options (single, 2-person, and family); the 1996 premium is for a period longer than 12 months because of a change in the reporting period. Source: Employer-sponsored health insurance premiums: Kaiser Family Foundation/Health Research and Educational Trust, Employer Health Benefits, 2009 Annual Survey, Exhibit 1.12, at http://www.kff.org/insurance/7936/index.cfm. FEHBP: Kaiser Family Foundation calculations using data provided by the Office of Personnel Management. CalPERS: Data for 1993, 1996, and 1999 provided by CalPERS; data for 2000-2009 from Facts at a Glance: Health, September 2009, on the CalPERS website at http://www.calpers.ca.gov/eip-docs/about/facts/health.pdf. Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Region, 2010 Monthly Annual Single Coverage Family Coverage Single Coverage Family Coverage 401* 1,142 4,817* 13,703 445 1,157 5,338 13,880 372 989 4,459 11,873 421 1,122 5,056 13,463 HMO West PPO West HDHP/SO West ALL PLANS West DBS Benchmarking Data Table of Contents TOPIC: Contributions Cumulative Changes in Health Insurance Premiums, Workers’ Contribution to Premiums, Inflation, and Workers’ Earnings, 1999-2010 Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999-2010. Bureau of Labor Statistics, Consumer Price Index, U.S. City Average of Annual Inflation (April to April), 1999-2010; Bureau of Labor Statistics, Seasonally Adjusted Data from the Current Employment Statistics Survey, 1999-2010 (April to April). Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, 1999-2010 * Estimate is statistically different from estimate for the previous year shown (p<.05). Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999-2010. Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Single Coverage, 1999-2010 $2,196 $2,471* $2,689* $3,083* $3,383* $3,695* $4,024* $4,242* $4,479* $4,704* $4,824 $5,049* * Estimate is statistically different from estimate for the previous year shown (p<.05). Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999-2010. Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Family Coverage, 1999-2010 $5,791 $6,438* $7,061* $8,003* $9,068* $9,950* $10,880* $11,480* $12,106* $12,680* $13,375* $13,770* * Estimate is statistically different from estimate for the previous year shown (p<.05). Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999-2010. Average Annual Worker Premium Contributions and Total Premiums for Covered Workers, Single and Family Coverage, by Firm Size, 2010 Single Coverage Family Coverage * Estimates are statistically different between All Small Firms and All Large Firms (p<.05). Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2010. Among Firms Offering Health Benefits, Percentage of Firms That Report They Made the Following Changes as a Result of the Economic Downturn, by Firm Size, 2010 *Estimate is statistically different between All Small Firms and All Large Firms within category (p<.05). Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2010. Among Firms Offering Health Benefits, Distribution of Firms Reporting the Likelihood of Making the Following Changes in the Next Year, 2009 Very Likely Somewhat Likely Not Too Likely Not At All Likely Don’t Know Increase the Amount Employees Pay for Health Insurance 21% 20% 14% 44% <1% Increase the Amount Employees Pay for Deductibles 16% 20% 18% 46% <1% Increase the Amount Employees Pay for Office Visit Co-pays or Coinsurance 15% 25% 19% 41% <1% Increase the Amount Employees Pay for Prescription Drugs 14% 23% 19% 43% <1% Restrict Employees’ Eligibility for Coverage 4% 5% 8% 83% <1% Drop Coverage Entirely 2% 6% 6% 86% <1% Offer HDHP/HRA‡ 5% 15% 19% 59% 1% Offer HSA-Qualified HDHP‡ 6% 16% 24% 54% <1% ‡Among firms not currently offering this type of HDHP/SO. Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2009. DBS Benchmarking Data Table of Contents TOPIC: Plan Designs & Misc. Distribution of Health Plan Enrollment for Covered Workers, by Plan Type, 1988-2010 * * * * * * * Distribution is statistically different from the previous year shown (p<.05). No statistical tests were conducted for years prior to 1999. No statistical tests are conducted between 2005 and 2006 due to the addition of HDHP/SO as a new plan type in 2006. Note: Information was not obtained for POS plans in 1988. A portion of the change in plan type enrollment for 2005 is likely attributable to incorporating more recent Census Bureau estimates of the number of state and local government workers and removing federal workers from the weights. See the Survey Design and Methods section from the 2005 Kaiser/HRET Survey of Employer-Sponsored Health Benefits for additional information. Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999-2010; KPMG Survey of EmployerSponsored Health Benefits, 1993, 1996; The Health Insurance Association of America (HIAA), 1988. Among Covered Workers With Copayments for a Physician Office Visit with a Primary Care Physician, Distribution of Copayments, by Plan Type, 2010 only $5 Per Visit $10 Per Visit $15 Per Visit $20 Per Visit $25 Per Visit $30 Per Visit Other 1 8 22 38 15 12 4 1 7 16 31 25 13 6 1 7 11 24 20 29 8 0 2 17 34 10 17 20 1 7 18 32 22 15 6 HMO 2010* PPO 2010* POS 2010* HDHP/SO‡ 2010 ALL PLANS 2010* * Distribution is statistically different from distribution for the previous year shown (p<.05). Percentage of Covered Workers Enrolled in a Plan with a General Annual Deductible of $1,000 or More for Single Coverage, By Firm Size, 2006-2010 *Estimate is statistically different from estimate for the previous year shown (p<.05). Note: These estimates include workers enrolled in HDHP/SO and other plan types. Because we do not collect information on the attributes of conventional plans, to be conservative, we assumed that workers in conventional plans do not have a deductible of $1,000 or more. Because of the low enrollment in conventional plans, the impact of this assumption is minimal. Average general annual health plan deductibles for PPOs, POS plans, and HDHP/SOs are for innetwork services. Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2006-2010. Percentage of Covered Workers Enrolled in a Plan with a General Annual Deductible of $2,000 or More for Single Coverage, By Firm Size, 2006-2010 *Estimate is statistically different from estimate for the previous year shown (p<.05). Note: These estimates include workers enrolled in HDHP/SO and other plan types. Because we do not collect information on the attributes of conventional plans, to be conservative, we assumed that workers in conventional plans do not have a deductible of $2,000 or more. Because of the low enrollment in conventional plans, the impact of this assumption is minimal. Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2006-2010. Changes in Average PPO Costs for Family Coverage, 20062010 Note: Each 2010 estimate is statistically different from the 2006 estimate within category (p<.05). The survey has asked comparable questions on family deductibles only since 2006. An aggregate deductible is one in which all family members’ out-ofpocket covered expenses count toward meeting the deductible amount. Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2006-2010. Among Covered Workers with a General Annual Health Plan Deductible for Single Coverage, Average Deductible, by Plan Type and Firm Size, 2010 (In-network PPO deductible) Single Coverage HMO All Small Firms (3-199 Workers) $998* All Large Firms (200 or More Workers) 354* ALL FIRM SIZES $601 PPO All Small Firms (3-199 Workers) $1,146 All Large Firms (200 or More Workers) 460 ALL FIRM SIZES $675 HDHP/SO All Small Firms (3-199 Workers) $2,216* All Large Firms (200 or More Workers) 1,676* ALL FIRM SIZES $1,903 DBS Benchmarking Data Table of Contents TOPIC: Health Savings Accounts Among Firms Offering Health Benefits, Percentage That Offer an HDHP/HRA and/or an HSA-Qualified HDHP, 2005-2010 * Estimate is statistically different from estimate for the previous year shown (p<.05). The 2010 estimate includes 0.3% of all firms offering health benefits that offer both an HDHP/HRA and an HSA-qualified HDHP. The comparable percentages for 2005, 2006, 2007, 2008 and 2009 are 0.3%, 0.4%, 0.2%, 0.3% and 0.1%, respectively. ‡ Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2005-2010. ‡ Among Firms Offering Health Benefits, Percentage That Offer an HDHP/SO, by Firm Size, 2005-2010 * Estimate is statistically different from estimate for previous year shown (p<.05). Note: The 2010 estimate includes 0.3% of all firms offering health benefits that offer both an HDHP/HRA and an HSA-qualified HDHP. The comparable percentages for 2005, 2006, 2007, 2008 and 2009 are 0.3%, 0.4%, 0.2%, 0.3% and 0.1%, respectively. Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2005-2010. Percentage of Covered Workers Enrolled in an HDHP/HRA or HSA-Qualified HDHP, 2006-2010 * Estimate is statistically different from estimate for the previous year shown (p<.05). Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2006-2010. Percentage of Covered Workers Enrolled in an HDHP/HRA or HSA-Qualified HDHP, by Firm Size, 2010 *Estimates are statistically different between All Small Firms and All Large Firms within category (p<.05). Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2010. Among All Large Firms (200 or More Workers) Offering Health Benefits to Active Workers, Percentage of Firms Offering Retiree Health Benefits, 1988-2010* *Tests found no statistical difference from estimate for the previous year shown (p<.05). No statistical tests are conducted for years prior to 1999. Note: Data have been edited to include the less than 1% of large firms who report “yes, but no retiree” responses in 2010. Historical numbers have been recalculated so that the results are comparable. Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999-2010; KPMG Survey of Employer-Sponsored Health Benefits, 1991, 1993, 1995, 1998; The Health Insurance Association of America (HIAA), 1988. DBS Benchmarking Data Table of Contents TOPIC: WELLNESS Among Firms Offering Health Benefits, Percentage of Firms That Offer Employees Health Risk Assessments and Offer Incentives to Complete Assessments, by Firm Size, 2010 ‡ *Estimate is statistically different between All Small Firms and All Large Firms within category (p<.05). ‡ Among Firms Offering Employees Option to Complete Health Risk Assessment. Note: A health risk assessment includes questions on medical history, health status, and lifestyle, and is designed to identify the health risks of the person being assessed. Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2010. Among Firms Offering Health Benefits, Percentage Offering a Particular Wellness Programs to Their Employees, by Firm Size, 2009 100% All Small Firms (3-199 Workers) 93% All Large Firms (200 or More Workers) 90% 79% 80% 70% 60% 63% 57% 61% 59% 53% 47% 50% 40% 27% 30% 36% 34% 34% 28% 24% 19% 20% 12% 10% 0% Offer at Least One Wellness Program* Smoking Wellness Weight Web-based Gym Cessation* Newsletter* Loss Resources Membership Programs* for Healthy or Exercise Living* Facilities* *Estimate is statistically different within type of wellness program between All Small Firms and All Large Firms (p<.05). Source: Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2009. Classes in Nutrition/ Healthy Living* Personal Health Coaching*