Module 23: Definition & Measurement of Money What is Money???

advertisement

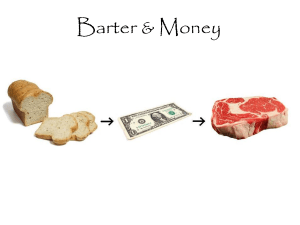

Module 23: Definition & Measurement of Money What is Money??? It is not the same as Wealth! Anything that is easily exchangeable for goods and services Roles of Money: 1. Medium of Exchange: The school exchanges dollars for my teaching I then, give those dollars to people at the Rubio’s for my burrito Then they give those dollars to the meat Co., avocado growers, etc. Without money, we would be thrown back into the barter system! “Double Coincidence of Wants” 2. Store of Value Who wants curdled milk???? Money stores pretty well without crazy inflation! 3. Unit of Account Just like before, money tells us what things are worth compared to each other. Value comparisons are much easier with money! Types of Money: 1. Barter system – Double coincidence of wants as discussed before. 2. Commodity Money – something used as money that has intrinsic value. Usually silver or gold. Has other uses… 3. Commodity-backed Money – has no intrinsic value but is guaranteed by a promise that it can be converted into a valuable good like gold. 4. Fiat Money – money whose value is derived entirely from its official status as a means of exchange by the government. Measuring the Money Supply How much money is out there??? Depends what you consider money… The Federal Reserve, our central bank, has two different measures. M1 – currency & coin in circulation + checking deposits + traveler’s checks This is money most easily used to make transactions (most liquid) M2 = M1 + savings accounts + short-term CD’s + money market accounts These are slightly less liquid than M1. These all pay interest where only checking accts. pay interest in M1. Sometimes called “near monies” We call both M1 & M2 monetary aggregates or an overall measure of the money supply.