Document

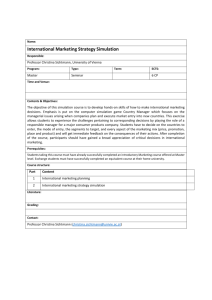

advertisement

14. Simulation and Factory Physics

1. @Risk: Harriet Hotel and Overbooking Problems

2. Introduction to Simulation

–

–

Methods of modeling uncertainty

Monte Carlo simulation

3. Managing production lines without variability

4. Managing production lines with variability

–

–

–

Throughput rate, flow time and inventory levels

Line balancing

Single machine stations vs. parallel machines

1

Overbooking Problem

• Common practice in

• Difference between overbooking problems and newsvendor

problems

2

Harriet Hotel

100

125

30

0.95

200

Note:

HarrietHotel.xls is

available on

CourseInfo

=B2-B3

try different values

=RiskBinomial(B7, B4)

=MIN(B1,B8)

=B8-B9

=RiskOutput() +B6*B9-B5*B10

1. First, start @Risk. Excel will start automatically.

2. Make “Actual Arrivals" a Binomial Random Variable:

3.

4.

5.

6.

Menu: Insert, Function, @RiskDistribution, RiskBinomial

Make "Nightly Profit" an Output: Menu: @Risk, Model, Add Output

Set Iterations & Sampling: Menu: @Risk, Simulation, Settings

Run the Simulation: Menu: @Risk, Simulation, Start

3

Analyze the Results: Results Window: Results, Results Settings or Quick Report

@Risk Simulation Settings. Menu: @Risk, Simulation, Settings

Number of times the simulation is

repeated for each scenario.

Number of Scenarios.

• use 1 if you enter a single value

for “Number of Reservations

Accepted", or

• use 7 if use RiskSimTable with

seven different values.

“Monte Carlo” causes @Risk to

show randomly generated values

when you press function key F9.

A "fixed seed" causes @Risk to

use the same random numbers

every time a run is repeated.

This means that all simulations

will face the same “Actual

Arrivals”.

4

@Risk Report Settings

Results Window: Results, Report Settings

Specify the reports you are interested in.

For example, you can put these

results on an Excel spreadsheet.

Generate the selective reposts.

5

Using the @Risk Simulation Add-in for Excel

1.

2.

Open @Risk. (Excel will be opened for you.)

Create your model and think about what are the

–

–

–

3.

Use probability functions to represent your random variables

–

–

4.

Go to @Risk | Add Output, or simply type in Riskoutput()

You can see the list of your input and output cells by going to

@Risk | Model | List of Outputs and Inputs

Specify simulation settings: @Risk | Simulation | Settings

–

–

6.

7.

Go to Insert | Function and select @Risk Distribution, or

go to @Risk | Model | Define Distributions

Identify the performance measures you wish to gather data on

–

–

5.

Performance measures (output cells)

Decision variables (under your control)

Random variables (input cells)

Iterations: # iterations and # simulations

sampling

Start the simulation (@Risk | Simulation | Start)

Analyze results

6

Selecting a Distribution (p. 550)

• Quantifying Uncertainty

– Mean and Standard Deviation

– Shape (skewness)

– Min, mostlikely, max

You can also go to @Risk |

Model | Define Distributions,

which is helpful in choosing

among the different probability

distributions.

• Discrete Probability Distributions:

–

–

–

–

RiskIntUniform (x,y)

RiskDuniform({x1,x2,…,xn})

RiskDiscrete ({x1,x2,…,xn}, {p1,p2,…,pn})

RiskBinomial(n,p)

• Continuous Probability Distributions:

–

–

–

–

RiskUniform(x,y)

RiskNormal(m,s)

RiskLogNorm(m,s)

RiskTriang(min, most likely, max)

7

Analyzing Simulation Results

• After the simulation runs, the Results Window will automatically open,

showing summary statistics for

– the output cells and

– the input cells if you’ve chosen to collect them in the Sampling tab of

Simulation Settings

• You can move back and forth between the results and your

spreadsheet through the “Show Excel Window” button and the “Show

Result Window” button (or through @Risk | Results).

• From the Results Window:

– Copy the simulation results to an Excel worksheet for further analysis and

safekeeping by going to Results | Report Setting or Quick Report

– To generate a graph, right-click on an output (or input) cell and then

choose the type of graph you want (histogram or cumulative). Right-click

on any graph to change its format or to copy it into a standard Excel

graph.

• To simulate for different values of a decision variable (One variable at

a time!):

– Use RiskSimTable({x1,x2,…xn}); x1, x2, … xn can be cells or numbers.

– type n in “# of simulations” under @Risk | Simulation | Settings

• Reports: mean, std, percentiles

8

Some Tips

• @Risk will run all the models that are open. If you are only

interested in results from one model, close all other models.

• @Risk can handle multiple random variables.

Year

Return

1998

=Riskuniform(0.07,0.15)

1999

=Riskuniform(0.03,0.10)

• @Risk allows formulas such as: B1*(1+RiskNormal(10,9))+B3

• @Risk can handle multiple output cells

Annual profit

RiskOutput()+formula

Service level

RiskOutput()+formula

Inventory cost

RiskOutput()+formula

9

Introduction to Simulation

• Approaches to analyzing uncertainty:

• Monte Carlo simulation using computers

• Why important?

• Disadvantages

10

Factory Physics

•

Managing production lines without variability

•

Managing production lines with variability

–

–

–

–

Throughput rate, flow time and inventory levels

Line balancing

Single machine stations vs. parallel machines

Sources of variability

11

The Penny Fab

punch press

cuts penny

blanks

stamps

Lincoln’s

face

places a

rim on the

penny

cleans

away any

burrs

A production line that makes giant one-cent pieces. The line

consists of four machines in sequence. Capacity of each

machine is one penny every two hours. (A balanced line with

no variability.)

• Theoretical flow time (hours) T0 =

• Bottleneck rate per hour R0 =

• To achieve R0 , Inventory needed is: I0 =

12

Penny Fab One

T = Flow

Time for

each Penny

Critical

WIP level I0

2 hrs

2 hrs

I

1

2

3

4

5

6

7

8

9

T

2 hrs

R

2 hrs

RxT

1

2

3

4

5

6

7

8

9

R=

Throughput

Rate for

System

13

.5

20

.4

16

.3

12

.2

8

.1

4

0

0

2

4

6

8

10

12

14

Flow time (Hours)

Throughput (Jobs/hr)

Throughput and Flow Time vs. Inventory

0

Inventory (jobs)

To achieve the Theoretical Throughput Rate R0 = 0.5 jobs per hour

The minimum Inventory needed is I0 = 4.0 jobs

14

5 hr

Station 4

Station 3

Station 2

Station 1

Penny Fab Two

2 hr

3 hr

10 hr

15

Penny Fab Two

R0 =

Station

c

Tp

1

1

2 hr

2

2

5 hr

3

6

10 hr

4

2

3 hr

Capacity

T0 = _______________ I0 = ________________

Station 1

Station 2

Station 3

Station 4

# of jobs

Utilization

16

Line Balancing

5 jobs/shift

2.5 jobs/shift

on each machine

=> Extra capacity at the first station!

• Processing rate at station 1: 1 job/shift 50% of the time, 4

jobs/shift 50% of the time; avg 2.5 jobs/shift

• Processing rate at station 2: 2 jobs/shift 50% of the time,

8 jobs/shift 50% of the time; avg 5 jobs/shift

17

Line Balancing (cont.)

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

M1

1

1

1

1

4

4

4

4

1

1

1

1

4

4

4

4

Potential Production

Station 1

Station 2

M2

M3

M1

1

1

2

1

4

2

4

1

2

4

4

2

1

1

2

1

4

2

4

1

2

4

4

2

1

1

8

1

4

8

4

1

8

4

4

8

1

1

8

1

4

8

4

1

8

4

4

8

The expected output rate =

Actual

Output

2

2

2

2

2

2

2

2

3

6

6

8

6

8

8

8

69

jobs/shift

18

Line Balancing (cont.)

• If we shut down one of the machines at station 1, the expected

output rate

jobs/shift.

1

2

3

4

5

6

7

8

Potential Production

Station 1

Station 2

M1

M2

M1

1

1

2

1

4

2

4

1

2

4

4

2

1

1

8

1

4

8

4

1

8

4

4

8

Actual Output

2

2

2

2

2

5

5

8

28

What is the capacity of a line with variability?

19

Penny Fab Two Throughput Rate

0.5

without variability

Throughput Rate, R

0.4

with variability

0.3

0.2

0.1

0

2

4

6

8

10

12

14

16

18

20

22

24

26

Inventory, I

With

variability

• Simulation is the tool to find R(I) and T(I) !!

• To get close to the bottleneck rate R0 you might

20

need a huge inventory!!

Penny Fab Two Flow Time

80

Flow Time, T

70

T

60

50

40

30

without variability

20

10

0

0

2

4

6

8

10 12

14 16 18 20 22 24 26

Inventory, I

21

Penny Fab One

• Single Machine Stations

c=1

2 hrs

c=1

c=1

c=1

2 hrs

2 hrs

2 hrs

• Parallel Machines

c=1

2 hrs

c=1

c=2

2 hrs

4 hrs

22

Internal Benchmarking Example

Large Panel Line:

Process

Treater

Machining

Circuitize

Optical Test/Repair

Drilling

Copper Plate

Procoat

Sizing

EOL Test

Bottleneck rate,

theoretical process time

Rate (p/hr)

191.5

186.2

150.5

157.8

185.9

136.4

146.2

126.5

169.5

126.5

Time (hr)

1.2

5.9

6.9

5.6

10.0

1.5

2.2

2.4

1.8

33.1

23

Internal Benchmarking

• Best inventory level without variability = 126.5 33.1 = 4,187

• Actual Values:

– T = 34 days = 816 hours

– I = 37,400 panels

– R = 45.8 panels/hour

• Benchmark:

– Theoretical FT = 33.1 hours

– “best inv level” = 4,187 panels

– Bottleneck rate = 126.5 panels/hr

• Conclusions:

– Throughput is 36% of capacity

– WIP is 8.9 times the “best inventory level”

– Flow Time is 24.6 times theoretical flow time

• Why?

24

Takeaways

1. @Risk

–

–

–

–

–

–

Spreadsheet model: performance measures, decision

variables, random variables

Probability functions for representing random variables,

e.g., RiskNormal(m,s)

Decision variables: RiskSimTable (one variable at a time!)

Output cells for performance measures (Riskoutput)

Simulation settings (run length, desired reports)

Reports (mean, std., percentiles)

2. Simulation

–

–

Methods of modeling uncertainty

Monte Carlo simulation: random number generation

25

Takeaways

3. Managing production lines without variability

– There exists an optimal Inventory level =

bottleneck rate theoretical flow time

– Managing production lines with variability

4. Throughput rate increases as inventory

increases

– Throughput rate < bottleneck rate

– Unbalance Lines

– Single machine stations vs. parallel machines

26