University of Florida - American Agricultural Economics Association

advertisement

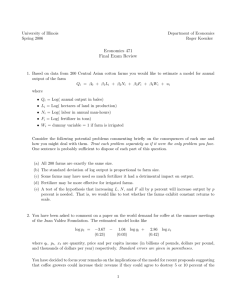

Food & Resource Economics Dept. Aaron Troyer Marisa Zansler 2001 AAEA Case Study Competition XS Inc.com “Redefining Agricultural Input Supply” XS Ag.com Website designed to enable producers, dealers, and manufacturers to trade agricultural seed, chemicals, fertilizer, etc. Nterline Combines the traditional agricultural input distribution system with up to date technology that streamlines the supply chain Problem Statement ? XS Inc.com must consider a marketing strategy designed to meet its challenges and allow profitable operation in the future XS Inc.com: Challenges Competition Supply Chain Inefficiencies Market Readiness XS Inc. Internal Forces Core Strengths Lower Input Prices 24 hour availability Fills Supply Efficiency need Allows for better price transparency Customer data management Company Weaknesses Internet Only Access Service “Return ability” Delivery Time No Personal Relationships XSInc. External Forces Opportunities Participates in large market Internet market is growing Access growers around US in one location Nterline is open platform Pressures Traditional markets turning e-friendly Strong service from traditionals Many online ag services Compete directly with manufacturers, distributors, and retailers. XS Ag.com Market Segmentation Total U.S. Farms Inputs 188.5 Billion Chemical Sales & Application Other Ag Inputs 166.88 8.48 Billion Seeds & Plants 7.35 Billion Machine Parts & Repairs 3.58 Billion Animal Health 2.26 Billion Percent of Farms and Land in Farms: By Economic Sales, U.S., 1998-2000 Farms Reporting Greater Than $100K 60 50 40 Percent of Farms Land in Farms 30 20 10 0 1998 1999 2000 Source: Farms and Lands in Farms, Agricultural Statistics Board, NASS, USDA February 2001 Alternatives Continue on current course Address issues of XSag.com and Nterline pricing and positioning Drop either two lines XSag.com Implementation Redefine the target market Launch a phone service for producers Add enticing information to website Increase customer service availability XSag.com: The Target Focus the target to specific users Promote planning Advertise use for specific crops Target mid-revenue not acreage Target By Region Mid revenue firm size by region Add New Telephone Service Hire or contract new telephone customer service Allow for orders over the phone Can provide price information Access potential new clients Fits with the traditional method of communication Expand Informational Services 65% of growers with access to the internet use it to find information Add news and weather Crop information New products available Commodity Prices and Outlooks Launch Promotional Campaign Advertising: @Agriculture online and in Successful Farming Promote Price New Telephone Order Service 800 number to access XS ag Evaluation PROS Establish Customer Loyalty Pinpoint Most Likely Users Addressing the needs expressed by the enduser CONS More capital risk Returns are somewhat unknown Revenues And Costs XSag.com Expected 2001 Revenues 1.44 million from XSag.com Base costs on Ag Services Powerfarm.com They lost .03/share or $164,000 dollars XS ag Costs then could range +/- 20% XSag.com Anticipated 2002 Financial Data 2001 2002 Revenues $1.44 $2.88 + $.600 Costs $1.43 - $2.05 $2.11-$2.83 Marketing Plan ROI Profit or (Loss) 22.5% $.01 – $(.61) $1.37 - $.65 Dollars are in millions Nterline Evaluation Core competency Software that anticipates and analyzes demand for ag inputs Open system Coordinates different users along different points in the supply chain Challenges Competition from large traditionals Many large distributors already use some form of ASP Must be compatible with all users Source: Gartner Group May, 2001 ASP Market Size Revs (M) Percentage USi $110 7.7 Qwest $100 7 Interliant $52 3.6 PeopleSoft $40 2.8 Corio $33.5 2.3 eOnline $25 1.7 Breakaway Sol. $20 1.4 Agilera $20 1.4 Surebridge $17 1.2 Telecomputing $11 0.8 Nterline Pricing Should be based on the level of service provided Three levels of service Customized Must be competitive with other available ASP Must save customers money Three Levels of Service First Level provides transactional assistance throughout supply chain Second Level available provides the first plus customer data tools and regional anonymous data Third level includes both 1 and 2 plus and website integration. Nterline Pricing Each level adds additional service, thus additional price First level $2,000 per quarter plus transactional fees Second level $3,000 per quarter plus transactional fees Third level $4,000 per quarter plus transactional fees plus website maintenance Nterline Financials Cost associated with the development of Nterline $5.0 million + .5M to promote and service Long term approach Target smaller to midsize firms and Co-Ops Set a goal of 125 customers in the first year Yields revenue of 1.5 million Conclusion Chose to continue development of both Nterline and XSag.com Nterline profitable after 2 years Investment recovered after 6 years XS ag restructured: Fits end-user needs Increases service and support