Bob Anderson, UCSB 2004

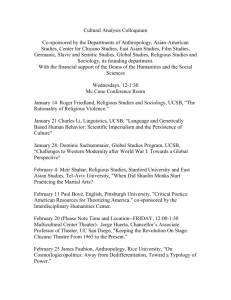

advertisement

Financial Accounting: Tools for Business Decision Making, 4th Ed. Kimmel, Weygandt, Kieso CHAPTER 3 Bob Anderson, UCSB 2004 3-1 Chapter 3 The Accounting Information System Analyze the effect of business transactions on the basic accounting equation. Explain what an account is and how it helps in the recording process. Define debits and credits and explain how they are used to record business transactions. Identify the basic steps in the recording process. Bob Anderson, UCSB 2004 3-2 Chapter 3 The Accounting Information System Explain what a journal is and how it helps in the recording process. Explain what a ledger is and how it helps in the recording process. Explain what posting is and how it helps in the recording process. Explain the purposes of a trial balance. Bob Anderson, UCSB 2004 3-3 External and Internal Events External Event – interaction between a business and its environment. Internal Event – event occurring entirely within a business. Transaction – any event that is recognized in a set of financial statements. RECOGNIZED- An accounting entry is recorded… it becomes reflected in the financial statements. REALIZED- regardless of whether it results in an accounting entry, the business actually receives or gives something. Bob Anderson, UCSB 2004 3-4 Exercise – Types of Events External 1. Internal A supplier of a company‘s raw material is paid an amount owed on account. 2. A customer pays its open account. 3. A new chief executive officer is hired. Not Recorded External External Not Recorded 4. The biweekly payroll is paid. External 5. Raw materials are entered into production. Internal 6. A new advertising agency is hired. 7. The accountant determines the federal income taxes owed based on the income earned. Bob Anderson, UCSB 2004 Not Recorded Internal 3-5 Source Documents Source Document – a piece of paper that is used as evidence to record a transaction. Sales invoice Payroll timecard Utility bill Stock certificate Promissory note (note payable) Payment terms are 2/10, n/30 NOTE: Not all recordable events are supported by a standard source document. Bob Anderson, UCSB 2004 3-6 Exercise – Source Documents 1. Utilities expense for the month is recorded. 2. A cash settlement is received from a pending lawsuit. 3. Owners contribute cash to start a new corporation. 4. The biweekly payroll is paid. 5. Cash sales for the day are recorded. 6. Equipment is acquired on a 30-day open account. 7. A sale is made on open account. 8. A building is acquired by signing an agreement to repay a stated amount plus interest in six months. Bob Anderson, UCSB 2004 Purchase invoice Sales invoice Cash register tape Time cards Promissory note Stock certificates Monthly utility statement Other/ or- No source document normally available 3-7 Effect on the Accounting Equation Assets = Liabilities + Equity Assets - Liabilities = Equity Assets - Liabilities = Net Assets Net Assets = Equity The accounting equation is made up of “Accounts.” An account is a record used to accumulate amounts for each individual asset, liability, equity, revenue, and expense. Bob Anderson, UCSB 2004 3-8 Sara Lee Corp. – Assets Accounts Consolidated Balance Sheets Dollars in millions except share data Assets Cash and equivalents Trade accounts receivable, less allowances of $184 in 2004, $181 in 2003 and $176 in 2002 Inventories Other current assets Net assets held for sale Total current assets July 3, 2004 $ Other noncurrent assets Deferred tax asset Property, plant, and equipment Land Buildings and improvements Machinery and equipment Construction in progress Accumulated depreciation Property, net Trademarks and other identifiable intangibles, net Goodwill Total assets LO 2 $ 638 June 28, 2003 $ 942 June 29, 2002 $ 298 1,929 2,779 400 5,746 1,857 2,704 378 1 5,882 1,768 2,509 341 7 4,923 153 275 284 437 192 4 155 2,052 5,087 283 7,577 4,306 3,271 2,024 3,414 14,883 202 1,915 4,917 291 7,325 3,975 3,350 2,110 3,387 15,450 176 1,744 4,299 320 6,539 3,384 3,155 2,106 3,314 13,694 $ $ Describe the qualitative characteristics of accounting information. Bob Anderson, UCSB 2004 3-9 Chart of Accounts Chart of Accounts Acct. No. 100 105 110 130 200 220 300 330 400 500 LO 3 Account Cash Accounts receivable Inventory Building Accounts payable Note payable Common stock Retained earnings Sales Cost of goods sold Analyze the effects of transactions on the accounting equation. Bob Anderson, UCSB 2004 3-10 FINALLY- DEBITS AND CREDITS Rule number one: forget the concept of “credit” to your account that you are probably familiar with. If your bank charges you a late fee, you complain and they reverse it, you THINK that is a credit to your account. BUT, as you will see, on YOUR books, the adjustment is a DEBIT to your cash. CRUTCH: ASSETS & LIABILITIES: DEBIT GOOD, CREDIT BAD EQUITY & INCOME: OPPOSITE (DEBIT BAD, CREDIT GOOD) MORE: ASSETS AND EXPENSES ARE DEBITS LIABILITIES, EQUITY AND REVENUES ARE CREDITS OH YEAH, ONE OTHER THING: DEBITS ON THE LEFT, CREDITS ON THE RIGHT! REMEMBER FROM PRIOR CHAPTERS: “FOR EVERY ACTION THERE IS AN EQUAL AND OPPOSITE REACTION”… IN ACCOUNTING TERMS, FOR EVERY DEBIT, THERE IS A CREDIT. Bob Anderson, UCSB 2004 3-11 Graphic debits and credits (GENERALLY) Balance Sheet Income Statement 2004 Assets: DEBITS 2004 Revenues & Gains: CREDITS Liabilities: CREDITS Equity: CREDITS Expenses & Losses: DEBITS Bob Anderson, UCSB 2004 3-12 ANOTHER CRUTCH “Debit” Card- comes from your checking account, which is an ASSET. “Credit” Card- creates a LIABILITY. DEBIT- ASSET CREDIT- LIABILITY Bob Anderson, UCSB 2004 3-13 Review What is the normal balance for the following accounts? Cash Debit Credit Accounts Payable Accounts Receivable Debit Service Revenue Credit Common Stock Credit Salaries Expense Debit Bob Anderson, UCSB 2004 3-14 Review What is the normal balance for the following accounts? Dividends Debit Debit Building Taxes Payable Credit Unearned Revenus Credit Prepaid Insurance Debit Rent Expense Debit Bob Anderson, UCSB 2004 3-15 Debits and Credits Balance Sheet Asset = Liab. + Equity Income Stmt. Rev. - Exp. = Debit Credit Bob Anderson, UCSB 2004 3-16 DEBITS AND CREDITS- POSTING We need to write a transaction in a format that can be communicated / input. We use a journal entry: DEBITS ON THE LEFT CREDITS ON THE RIGHT Bob Anderson, UCSB 2004 3-17 ACCOUNTING EQUATION- JOURNAL ENTRIES On Jan. 3rd, sold common stock for $100,000 cash. What is the impact to common stock? INCREASE $100,000 What is the impact to cash? INCREASE $100,000 HOW IS THIS EXPRESSED IN A JOURNAL ENTRY? ACCOUNT DEBIT/ DR. CREDIT/ (CR) Cash $100,000 Common Stock $100,000 Bob Anderson, UCSB 2004 3-18 ACCOUNTING EQUATION- JOURNAL ENTRIES On Jan. 10th, purchased a building by signing a $150,000 note payable.. What is the impact to Building (Fixed assets)? INCREASE $150,000 What is the impact to Notes Payable? INCREASE $150,000 HOW IS THIS EXPRESSED IN A JOURNAL ENTRY? ACCOUNT DEBIT/ DR. CREDIT/ (CR) Building $150,000 Note payable $150,000 Bob Anderson, UCSB 2004 3-19 HOW TO LEARN DEBITS AND CREDITS There is no way to teach it and no way to learn it other than by: PRACTICE!!!!! PRACTICE!!!!! PRACTICE!!!!! PRACTICE!!!!! Bob Anderson, UCSB 2004 3-20 ACCOUNTING EQUATION- JOURNAL ENTRIES On Jan. 15th, purchased inventory on account for $60,000. What is the impact to Inventory? INCREASE $60,000 What is the impact to cash? NONE- PURCHASED ON ACCOUNT What is the impact to accounts payable? INCREASE $60,000 HOW IS THIS EXPRESSED IN A JOURNAL ENTRY? ACCOUNT DEBIT/ DR. CREDIT/ (CR) Inventory $60,000 Accounts payable $60,000 Bob Anderson, UCSB 2004 3-21 BY THE WAY WHAT IS THE DIFFERENCE BETWEEN THESE ENTRIES: ACCOUNT DEBIT/ DR. CREDIT/ (CR) Inventory $60,000 Accounts payable $60,000 AND ACCOUNT Accounts payable Inventory DEBIT/ DR. CREDIT/ (CR) $60,000 $60,000 ANSWER: NOTHING- IT IS ONLY A CONVENTION TO LIST THE DEBITS FIRST! Bob Anderson, UCSB 2004 3-22 ACCOUNTING EQUATION- JOURNAL ENTRIES On Jan. 20th, sold inventory costing $30,000, for $75,000 on account. Did we “earn” the revenue? Yes- SALES INCREASE $75,000 Sold for cash or “on account” “ON ACCOUNT” ACCOUNTS RECEIVABLE INCREASE $75,000 What is the impact to Inventory? DECREASE $30,000 When we “Squeeze” Inventory from the Balance sheet to the income statement, where does it go (HAVE WE RECEIVED THE BENEFIT)? COGS $30,000 ACCOUNT Accounts receivable Sales Cost of goods sold Inventory HOW IS THIS EXPRESSED IN A JOURNAL ENTRY? DEBIT/ DR. CREDIT/ (CR) $75,000 $75,000 $30,000 $30,000 Bob Anderson, UCSB 2004 3-23 ACCOUNTING EQUATION- JOURNAL ENTRIES On Jan. 29th, received $40,000 cash from customers who purchased goods on account. SHOULD THIS IMPACT THE INCOME STATEMENT? NO! WE RECORDED THE SALE WHEN IT WAS EARNED, THIS ONLY REFLECTS A CHANGE FROM AN ACCOUNT RECEIVABLE TO CASH. What is the impact to sales? NONE What is the impact to accounts receivable? DECREASE $40,000 What is the impact to cash? INCREASE $40,000 HOW IS THIS EXPRESSED IN A JOURNAL ENTRY? ACCOUNT DEBIT/ DR. CREDIT/ (CR) Cash $40,000 Accounts receivable $40,000 Bob Anderson, UCSB 2004 3-24 Additional Terms General Ledger – a file that contains the activity of all the accounts. T Account – a format Account Name used to illustrate the increases, decreases and resulting total balance for each account. Debit / Dr. Credit / Cr. Slide JE-4 Copyright Bob Anderson, UCSB 2004 © 2003 by Coby Harmon 3-25 Account Name Debit / Dr. Credit / Cr. (T Account illustration with excel) Bob Anderson, UCSB 2004 3-26 Assets Debit / Dr. Credit / Cr. “NORMAL”- DEBIT Bob Anderson, UCSB 2004 3-27 Liabilities Debit / Dr. Credit / Cr. “NORMAL”- CREDIT Bob Anderson, UCSB 2004 3-28 Equity Debit / Dr. Credit / Cr. “NORMAL”- CREDIT Bob Anderson, UCSB 2004 3-29 Revenue Debit / Dr. Credit / Cr. “NORMAL”- CREDIT Bob Anderson, UCSB 2004 3-30 Expense Debit / Dr. Credit / Cr. “NORMAL”- DEBIT Bob Anderson, UCSB 2004 3-31 REMEMBER THIS SLIDE FROM BEFORE? On Jan. 3rd, sold common stock for $100,000 cash. What is the impact to common stock? INCREASE $100,000 What is the impact to cash? INCREASE $100,000 HOW IS THIS EXPRESSED IN A JOURNAL ENTRY? ACCOUNT DEBIT/ DR. CREDIT/ (CR) Cash $100,000 Common Stock $100,000 WHAT WOULD THIS LOOK LIKE IN THE T-ACCOUNTS? Bob Anderson, UCSB 2004 3-32 ENTRY POSTED TO T-ACCOUNTS ACCOUNT Cash Common Stock DEBIT/ DR. $100,000 CREDIT/ (CR) $100,000 CASH DEBIT CREDIT COMMON STOCK DEBIT CREDIT $100,000 $100,000 $100,000 $100,000 Bob Anderson, UCSB 2004 3-33 The Journal General Journal – a chronological record of transactions, also known as the book of original entry. What you record in the journal is known as a “Journal Entry.” Date Jan. 3 Account Title Cash Common stock 10 Building Ref. Debit 100 100,000 300 130 Note payable Credit 100,000 150,000 220 Bob Anderson, UCSB 2004 150,000 3-34 Posting Posting – the process of transferring amounts from the journal to the ledger accounts. General Journal Date Jan. 3 GJ1 Account Title Ref. Cash Debit 100,000 Common stock General Ledger Date Credit 100,000 Cash Explanation Acct. No. 100 Ref. Debit Credit Bob Anderson, UCSB 2004 Balance 3-35 Trial Balance Trial Balance – a list of each account and its balance; used to prove equality of debits and credits. Acct. No. 100 105 110 130 200 220 300 330 400 500 LO 7 Account Cash Accounts receivable Inventory Building Accounts payable Note payable Common stock Retained earnings Sales Cost of goods sold Debit Credit 140,000 35,000 30,000 150,000 60,000 150,000 100,000 75,000 30,000 385,000 Explain the purposes of a trial balance. Bob Anderson, UCSB 2004 385,000 3-36 Event 9 – Hiring of New Employees Oct. 9 – Sierra hired four new employees to begin work on Oct. 15. Accounting transaction has NOT occurred! Bob Anderson, UCSB 2004 3-37 4 11 Basic Steps in the Recording Process. 1.Analyze 2.Journalize 3.Post Bob Anderson, UCSB 2004 3-38