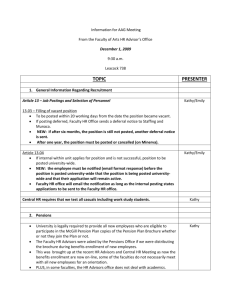

Now - Lothian Pension Fund

advertisement

Local Government Pension Scheme (Scotland) New Governance Arrangements Discussion paper FINAL Version 1.0 – 23 December 2013 1 Contents How to Respond 3 Introduction 4 Part 1 - Scheme Manager 5 Part 2 - Pension Board 5 Implementation 6 Membership of Pension Boards 9 Accountability of the Board 11 Training and Qualifications 11 Part 3 - Scheme Advisory Board 12 Membership 12 Implementation 13 Shadow Advisory Board 16 Resourcing of the Advisory Board 17 Constitution 18 Part 4 – Review of the Structure of the Scottish LGPS 18 General 19 Conclusion 19 List of Questions 20-21 Consultation response form 22 Heads of Agreement 24 2 How to respond You should respond to this discussion paper by Monday 3 February 2014 You can respond by email to; locgovpensionsreform@scotland.gsi.gov.uk When responding please ensure you have the words “Scheme governance discussion paper” in the email subject line. Alternately you can write to: Kimberly Linge, Policy Manager, Local Government Pension Scheme, Scottish Pensions Agency, 7 Tweedside Park, Tweedbank, Galashiels, TD1 3TE. When responding, please state whether you are responding as an individual or representing the views of an organisation. If responding on behalf of an organisation, please give a summary of the people and organisations it represents and, where relevant, who else you have consulted in reaching your conclusions. Introduction The Public Service Pensions Act 2013 includes several key provisions relating to the administration and governance of the new public service pension schemes established under Section 1 of the Act. In the case of the Local Government Pension Scheme in Scotland, these arrangements will apply to the new Scheme which comes into effect on 1 April 2015. This paper explores four specific sections of the Act which impact on the governance arrangements in the new Scheme: Scheme manager Pension board Pension board information, and Scheme advisory board Each section includes background and a more detailed summary of what we are required to include in the new Scheme to comply with the Act. Where appropriate, the paper also invites comment on consequential issues. Responses to the questions posed throughout the paper will enable us to start work on preparing draft regulations on governance for consultation early in 2014. 3 Part 1 -“Scheme manager” 1.1 Section 4 of the Act requires the new Scheme regulations to provide for a person (“the scheme manager”) to be responsible for managing or administering the Scheme. The term “person” is not to be taken literally. In the Local Government Pension Scheme (Scotland), the “scheme manager” for the purposes of Section 4 will be each of the individual Scheme administering authorities in Scotland. Part 2 - “Pension board” 1.2 Section 5 of the Act requires the new Scheme regulations to provide for the establishment of a board with responsibility for assisting the scheme manager, or each scheme manager, in:a) securing compliance with the scheme regulations and other legislation relating to the governance and administration of the scheme and any statutory pension scheme connected with it; b) securing compliance with requirements imposed in relation to the scheme and any connected scheme by the Pensions Regulator, and c) such other matters as the scheme regulations may specify. 1.3 In making these regulations, Scottish Ministers as the “responsible authority”, must have regard to the desirability of securing the effective and efficient governance and administration of the Scheme and any connected schemes. 1.4 Regulations will also need to include provision requiring each scheme manager to be satisfied that a person to be appointed as a member of a pension board does not have a conflict of interest, either at the outset, or from time to time. Section 5(5) of the Act defines “conflict of interest” as any financial or other interest which is likely to prejudice the person’s exercise of functions as a member of the board, but does not include a financial or other interest arising merely by virtue of being a member of the Scheme. 1.5 Scheme regulations will also need to require any person appointed to the pension board or proposed to be appointed, to provide information that can reasonably be requested by the scheme manager to determine whether or not a conflict of interest exists. 1.6 By virtue of Section 5(4)(c), the regulations will also need to ensure that each pension board includes employer representatives and member representatives in equal numbers. Under the Act “employer representatives” means persons appointed to the board for the purpose of representing employers for the Scheme and “member representatives” means persons appointed to the board for the purpose of representing members of the Scheme. In this respect, it is noted that the Act permits nominations for scheme member representatives to come from trades unions or from members who are not members of trades unions. 4 1.7 Under Section 5(7) of the Act, where the scheme manager is a committee of a local authority, Scheme regulations may provide for that committee also to be the board for the purposes of Section 5. 1.8 Scheme regulations will also need to include provision for each scheme manager to publish information about the pension board and to keep that information up to date. This information includes who the members of the board are; representation on the board of members of the scheme and the matters falling within the board’s responsibility. Implementation 1.9 It is clear that the new Scheme regulations will need to require each scheme manager/administering authority to establish their own pension board. 1.10 To comply with Section 5 of the Act, the new Scheme regulations will need to include the role of each pension board to assist the scheme manager/administering authority in securing compliance with scheme regulations and other legislation; with the Pension Regulator’s codes of practice and with any other matters specified in Scheme regulations. Q1. What “other matters”, if any, should we include in Scheme regulations to add to the role of local pension boards? Comments: We are of the view that the Public Service Pensions Act 2013 (the “Act”) creates a degree of confusion in seeking to address the issues of employer/member representation and independent governance/compliance of the Scheme Manager in a single Pensions Board. We view these as quite distinct areas, with scheme governance essentially being separated into (1) strategic decision making/operation (administrative authority/scheme manager, including an appropriate active role from stakeholders), (2) stakeholder representation and visibility, and (3) external and detailed scrutiny/regulation of the Scheme Manager’s compliance. Each of these areas necessarily requires a degree of separation and, in particular, different levels of knowledge, skill and expertise for those responsible for the different roles. Therefore it is not necessarily competent to combine these roles into a single body where regulation will impose a meaningful obligation on the members of, say, the Pension Board to perform a distinct function and so be an effective form of scrutiny. The regulations therefore need to ensure clarity in relation the roles and duties of the various bodies that the Act is seeking to introduce and ensure that the structures are simple and effective. The regulations also therefore need to recognise the importance of accountability, transparency and appropriate levels of active representation of employers and members. The function of the Pensions Board should be restricted to reviewing the activities of the Scheme Manager (the decision making body) to assist it in complying with the applicable law, regulation and codes of practice. It is important that this function remains separate from the decision making function and so we do not anticipate the role of the Pensions Boards extending to any other matters, except that would be consistent with the Pension Boards’ role in assisting the Scheme Manager in complying with the regulations and the requirements of 5 the Pensions Regulator. The Pensions Board could have a role/responsibility to raise any material and persistent noncompliance directly with the Pensions Regulator, an obligation which might make it a more effective body, should regulation seek to impose a meaningful obligation on its compliance role. This would be less appropriate where the regulations do not seek to impose obligations on the members of the Pensions Board in relation to its compliance role beyond that of simply assisting the Scheme Manager. 1.11 There is a requirement for scheme managers/administering authorities to check that no person appointed to the board has any conflict of interest as defined in the Act and also to undertake regular checks; Q2. Should Scheme regulations make it clear that nobody with a conflict of interest, as defined, may be appointed to or sit on a pension board? Comments: In principle, the Scheme regulations should mirror the Act, although we note that there is an inherent conflict of interest in having the Pensions Board comprised of member, employer and Scheme Manager representatives that already sit on the decision making boards, pensions committees, consultative panels and other bodies of the Scheme Manager (as the decision making entity). Given this, we would recommend that regulations should require members of the Pensions Board to declare any interests at each meeting and that, where an interest is declared, then that member would be excluded from voting on any related matter. Where the role of the Pension Board is limited to providing more technical/neutral advice on compliance with law and regulations (as distinct from strategic and operational decision making) there is less scope for conflicts to arise, albeit the need for a mechanism for declaring conflicts remains important in ensuring that the Pension Board operates in a neutral manner. The Scottish Ministers could produce guidance around the determination of a conflict of interest, to assist with the consistency of application across the Scottish Scheme Managers. 1.12 There is a provision requiring a member of the board or person proposed to be a board member to provide whatever information about conflict of interest that the scheme manager/administering authority reasonably require. Q3. Should Scheme regulations prescribe the type of information that may be “reasonably required”? Comments: We do not believe there is any need to address this in more detail in the regulations. 6 Q4. Should Scheme regulations prescribe the requirement for managers/administering authorities to undertake regular checks to ensure board members do not have any conflicts of interest? Comments: We believe that the Act itself would sufficiently cover this in conjunction with a provision in the regulations requiring Pension Board members to declare any interests at meetings of the Pension Board and fully report the matters under consideration/outcomes from such meetings (including any declared conflicts) to the Scheme Manager. Please also see our response to questions 1 and 6. 7 1.13 There is a requirement that each pension board must include employer representatives and member representatives in equal numbers. Q5. Although not required by the Act, should Scheme regulations prescribe a minimum number of employer and employee representatives? Comments: See our response to question 1. We believe that member and employer representation is more appropriately dealt with by having active participation in the decision making body of the Scheme Manager and (separately) a consultative/observer role for the wider member and employer groups, rather than being associated with a Pensions Board who’s primary role is that of compliance for the benefit of stakeholders (as distinct from compliance by stakeholders). Also, the role of a Pension Board member may be technically onerous and require an increased level of knowledge, skill and expertise in advising on the Scheme Manager’s compliance with the pension regulations and other applicable law and codes of practice. Where there is a meaningful regulatory obligation on members of the Pensions Board to provide this function, member and employer representatives may not be comfortable carrying out this role without support from other members with the necessary expertise. With that in mind, we do not believe there should be a minimum number of employer and employee representative and that this should be left to local discretion. The different profiles of the Scottish LGPS Funds, in terms of their respective employer bodies, would also support the need for flexibility in this area. We also believe that the Act is quite clear on requiring equal representation of employer and member representatives, as between themselves, but otherwise flexibility on the constitution of the numbers of the board. There does however appear to be a degree of confusion on this point in terms of some reading the Act as requiring equal membership for employer and member representatives on the entire Pensions Board (e.g. 50:50 as between employer and member reps and the rest of the board members). We would view that as an incorrect interpretation of the Act and were the legislation to have had this effect it would be in direct conflict with local government legislation (as regards a combined Pensions Committee/Board) which requires at least two thirds of the membership of local authority committees to be comprised of Councillors. 1.14 Section 5(7) of the Act would allow the new Scheme regulations to permit a committee of a local authority to also be the local pension board. This option was deliberately left open in the Act to ensure that a proper discussion of the issues with all interested parties could be undertaken. 1.15 The argument for and against separate bodies is finely balanced. Those who support the committee and pension board being one and the same body argue that local government cannot afford to spend more time and money setting up new bodies, particularly when the function could easily be undertaken by existing pension or investment committees. Others argue that a statutory decision making committee is in no position to fulfil the clear scrutiny role set out in the Act. It cannot, in effect, scrutinise itself and be in a position to assure the scheme manager that it is complying with all relevant legislation and Pension Regulator’s codes of practice. 8 1.16 Whilst we are seeking your views on the status of local pension boards and statutory committees, it is likely that Scheme Regulations will require that the final outcome must be applied consistently across the Scheme as a whole, i.e. all pension boards will either be combined or separated from statutory committees. Q6. How should the governance of the local government pension scheme in Scotland change to incorporate the changes required by the Act? Comments: We attach a diagram setting out the current LPF governance structure and stance on the separation of roles. Subject to our responses to Question 30 of this consultation, we are of the view that we adequately address active stakeholder participation and transparency and so do not anticipate any pending change to our structure in that regard generally or to accommodate the requirements of the Act. In particular, where the intention is for the Pensions Board to only have a very general role in assisting in compliance, we would look to make minimal changes (perhaps even weighing up the merits of a combined Pensions Committee/Board as against the potential for conflicts and a the possibility of an increased knowledge and skills obligation on all the members of the Committee as a result) to ensure that we were not compromising the effectiveness of our existing structure with unnecessary duplication. The attached slides also show how we might adapt our current structure to the Act if the Pensions Board is, however, given a regulatory mandate to scrutinise compliance by the Scheme Manager. This proposal would involve a small number of representatives of each of the employer and member groups to be joined on the Pension Board by certain number of independent members with the appropriate expertise. Necessary pensions expertise/resource could be procured/trained by Funds on a collective/national basis and so available to multiple funds’ Pension Boards, which would also assist in adopting a consistent approach across all Scottish funds and likely generate cost efficiencies. The resource may also be able to have a role in supporting the National Scheme Advisory Board. Q7. Should the new Scheme regulations require local pension boards to be a body separate from the statutory committee or for it to be combined as a single body? It would be helpful if you could provide the reasons which support your answer. Comments: As above, if the Pensions Board was conceived as a body with meaningful regulatory obligations to scrutinise compliance by the Scheme Adviser, this would necessarily require the Pensions Board to be a separate body with members with sufficient knowledge, expertise and skill to carry out this role. In such circumstances, it would not be appropriate to combine a statutory committee of the Scheme Manager with the Pensions Board. These functions need to have separation in order to be effective and the Pensions Board must be sufficiently independent and will likely require to include members with increased levels of technical knowledge and expertise (e.g. applicable law, regulation and codes of practice) in order to properly fulfil its function. However, where the remit of the Pensions Board was limited to assisting the Scheme 9 Manager with compliance without any material regulatory obligations of scrutiny/reporting, we would not view this as a body sufficiently incentivised by regulation to provide an enhanced compliance function (not already dealt with in our current structure) and so would look to make minimal adjustments to our existing structure to accommodate the Pensions Board, rather than committing further resource to operating an otiose body which might not make any meaningful improvements to our existing structure and which may create more confusion and be a drain on valuable resource. 10 Membership of Pensions Boards 1.17 Apart from requiring equal numbers of employer and scheme member representatives and the restriction on conflicts of interest, the Act is silent on key issues of the pension board including, for example, membership, constitution, frequency of meetings, the nomination process and training. Q8. To what extent should the new Scheme regulations specify the types of members of the pension boards? Comments: The Pensions Board should comprise of members with sufficient levels of knowledge and expertise in order to properly fulfil its function as set out in the Act and any further regulation. This could itself be included as a requirement in such regulation. We do however note that this provision could refer to a requirement for the Pensions Board collectively to have the necessary expertise, so that there is scope to cover off the various technical knowledge and skills between the members, rather than imposing an unrealistic standard on each individual member. This general obligation in the Act and regulations would be sufficient and we do not think there should be any further regulation specifying the types of members on the board. This could however be dealt with in a single guidance document provided by Scottish Ministers. Q9. How should the Pension Boards be chaired? Comments: The Scheme Managers should have the flexibility to adopt their own constitution for the Pensions Board rather than incorporate this into the regulations, particularly as we anticipate that this will be a body with a neutral/technical advisory function and not a decision making function. The Chairman would also have the usual role in leading the meetings, considering conflicts of interest that are declared etc. and we note that Funds could opt to include an independent chairperson to reinforce the effectiveness/neutrality of the Pension Boards function. The overriding obligation on the members in the Act and any regulations to perform their function should be sufficient to ensure that the Scheme Manager establishes a Pensions Board with a constitution that is fit for purpose. Q10. What should happen in the event of a tied vote at a Pensions Board? Comments: See response to Question 9 – this should be left for the constitution of each Pensions Board but would commonly be addressed by the Chairman having a casing vote. We do not think this needs to be included in the regulations. 11 1.18 The appointment process should be clear and transparent to ensure accountability of the board. Q11. To what extent should the new Scheme regulations specify the manner in which members of the pensions boards are selected? Comments: See response to Question 9 – this should be left for each Scheme Manager to determine. We do not think this needs to be included in the regulations. 1.19 Guidance currently sets best practice for funds to include representatives of participating employers, admitted bodies and scheme members (including pensioner and deferred members) in their governance. However the pension board will compel member and employer representation. Q12. Should the introduction of the pension board affect employer and member representation in other parts of funds’ governance? If yes, how? Comments: No. The Pensions Board is a body with a primary function to assist the Scheme Manager on compliance, it is not a decision making body. Member and employer comfort should come from the Pensions Board carrying out its role to the best possible standard. As above, the question of employer and member representation in the decision making function of LGPS funds is an entirely separate question and should focus on the Scheme Managers and employer/member representation on its bodies. See also our responses to question 30, in terms of the wider structural change of the LGPS. As set out in our response to questions 1 and 5 above, Lothian Pension Fund already has employer and member representatives with voting rights on our Pensions Committee and operates a consultative panel comprising 12 employer/member representatives which attends all meetings of the Pensions Committee. This ensures that our employers and members not only have an active say in the strategic operation of the fund, but also have full visibility of the detailed decisions taken at the main decision making arm of the Administering Authority/Scheme Manager. Subject to our responses to question 30, we therefore do not anticipate the need for any changes to our governance on this front and, in any event, view this as quite a separate matter to the compliance function of the Pensions Board. 12 Accountability of the Board 1.20 Under Section 6(1) of the Act, Scheme regulations will require scheme managers / administering authorities to publish certain membership details of their local pension board. Given that the main function of the board will be to assure the scheme manager/administering authority that those to whom they have delegated the pensions function are complying with legislation and codes of practice, there is a case for the new Scheme regulations to also require each board to publish an annual report summarising its work. Q13. Should the new Scheme regulations include a requirement for each local pension board to publish an annual statement of its work and for this to be sent to the relevant scheme manager, all scheme employers, the scheme advisory board and Pensions Regulator? Comments: We agree that a summary statement should be prepared. It is suggested that such a summary statement could be included in the Pension Fund Annual Report and so publically accessible to all the interested parties. It is proposed that further guidance could be issued, as part of a single guidance document on the Pensions Board, to promote consistency. Training and qualifications 1.21 Paragraph 14 of Schedule 4 of the Act amends Section 90 of The Pensions Act 2004 and requires the Pensions Regulator to issue various codes of practice, including one on the requirements for knowledge and understanding of members appointed to pension boards of public service pension schemes. 1.22 Scottish Ministers, together with other interested parties, are being consulted on the content of this and other codes of practice and this ought to be sufficient to ensure that the specific circumstances of the Local Government Pension Scheme in Scotland and the role of new local pension boards can be taken into account. Q14. Apart from the training and qualification criteria that may be covered by the Pensions Regulator in a code of practice, are there any specific issues that we should aim to cover in the new Scheme regulations as well? Comments: No, the general obligation in the regulations that the members of the Pensions Board should have sufficient knowledge, skill and expertise to fulfil the function of the board as set out in the Act would be sufficient. More detail would be helpful, but should be restricted to codes of practice and/or guidance. 13 Part 3 – “Scheme advisory board” 1.23 Section 7(1) of the Act will require Scheme regulations to provide for the establishment of a board with responsibility for providing advice to Scottish Ministers, at their request, on the desirability of changes to the Scheme. 1.24 For locally administered schemes, like the Local Government Pension Scheme in Scotland, where there is more than one scheme manager, Scheme regulations may also provide for the board to provide advice (on request or otherwise) to the Scheme managers or the Scheme’s pension boards, in relation to the effective and efficient administration and management of the Scheme or any pension fund of the Scheme. 1.25 Under Section 7(4), Scheme regulations will need to apply the same provisions relating to conflicts of interest to the scheme advisory board as described at paragraph 1.18 above, except that it will be for Scottish Ministers to consider and act on actual cases. Membership 1.26 As Section 7 of the Act makes no provision for membership of the scheme advisory board, it will be for Scheme regulations to make such provision. This could be achieved in a number of different ways, for example: The Scottish Local Government Pensions Advisory Group (SLOGPAG), could consider and make recommendations to Scottish Ministers relating to the number of members, where those members should be drawn from and the balance of membership across the representative areas e.g. employer and employee representatives; Scottish Ministers could appoint a small membership panel whose remit would be to nominate and appoint initial members of the board, including the Chairperson; The membership profile of SLOGPAG could be carried forward. Implementation Scope/role 1.27 Section 7(1) of the Act defines the scope and role of the scheme advisory board in the widest possible terms (see paragraph 1.23 above). Replicating the wording of the Act in Scheme regulations would be advantageous in terms of allowing the work of the scheme advisory board to evolve without the need for regulatory amendments, but equally, there may be merit in clearly defining certain areas of work, for example, making recommendations to Scottish Ministers on cost management proposals. 14 Q15. Should Scheme regulations simply replicate the wording of the Act? If not, what specific areas of work should the new Scheme regulations prescribe? Comments: We believe the Scheme Advisory Board should continue to have a broad remit in overseeing the Funds collectively and reporting to the Scottish Ministers, provided that they are duty bound to take into account the advice of the Pensions Boards of the Scheme Managers and have appropriate membership to carry out this role (see below). Members of the Scheme Advisory Board should also be required to have the requisite knowledge, skills and expertise to undertake their role. We also believe that, in addition to advising the Scottish Ministers, the Scheme Advisory Board could have a role in liaising with the Pensions Regulator. This could be built into the regulations, thereby placing a formal onus on this body to act in an effective and pro-active manner and be a meaningful conduit between the Scheme Managers and the Pensions Regulator (given the likely resource issues that the Pensions Regulator will face in actively regulating the LGPS in Scotland) and SPPA’s view that it does not wish to take on any regulatory function. We are also of the view that the remit of the Scheme Advisory Board should be clearly delineated and should not extend to any involvement in the decision making role of the Scheme Manager. 1.28 Section 7(1) of the Act provides that the scheme advisory board is responsible for providing advice to Scottish Ministers, as the responsible authority, at their request. It has been suggested that Scheme regulations include a requirement the advisory board to advise Scottish Ministers on the desirability of changes to the Scheme. Q16. Should Scheme regulations include a general provision enabling the scheme advisory board to advise Scottish Ministers on the desirability of changes to the Scheme as and when deemed necessary? Comments: Yes, provided that (i) the Scheme Advisory Board’s membership is such that it properly takes into account the views of the Scheme Managers and their Pensions Boards and the Pensions Regulator, and (ii) that such advice is given having consulted with the Scheme Managers. Q17. Are there any specific areas of advice that Scheme regulations should prohibit the scheme advisory board from giving? Comments: Nothing specific, but (as above) there requires clarity around lines of communication, 15 accountability and responsibility in relation to the Scheme Advisory Board, its membership and constitution and how it interacts with the other parties involved with the LGPS in Scotland (e.g. Pensions Regulator, Scheme Manager etc.). This could most simply be dealt with by ensuring the membership of the Scheme Advisory Board is appropriate (see below). 16 Q18. What would be your preference be for establishing membership of the scheme advisory board? Comments: We do not believe that it is appropriate to carry forward the current SLOGPAG membership into the new Scheme Advisory Board. It is suggested that SLOGPAG could be given the responsibility for considering and making recommendations in relation to establishing membership of the Scheme Advisory Board, however this proposal must involve wide ranging engagement and consultation with all stakeholder groups We believe that the membership could comprise representatives from: - The Pensions Regulator (1) The Scottish Ministers (1) (in a capacity as an Observer) The Pensions Boards (4) (by rotation) Employers (2) (by nomination/election) Members (2) (by nomination/election) Independent Experts (2) Whichever manner the membership is established, the members appointed must be subject to the sufficient knowledge, skills and expertise standards to enable them to effectively perform their role on the Scheme Advisory Board. Q19. Should Scheme regulations require the Scottish Ministers to approve any recommendation made for the position of Chair? Comments: No. Q20. Should Scheme regulations prescribe tenure of office? If so, what should the maximum period of office be and should this also apply to the Chair of the board? Comments: No. It is recommended that this is included in the constitution of the Scheme Advisory Board (see above) and should be determined as part of the consultation to agree that. The constitution should prescribe sensible tenures for the Board membership and reflect the knowledge, skills and expertise standard. We would anticipate that the different representative groups would require their own rights and process to nominate, remove and hold accountable their own representatives (e.g. members, employers, Pensions Boards (by rotation) etc.). 17 Q21. Should Scheme regulations make provision for board members, including the Chair, to be removed in prescribed circumstances, for example, for failing to attend a minimum number of meetings per annum? If so, who should be responsible for removing members and in what circumstances (other than where a conflict of interest has arisen) should removal be sought? Comments: As above, the representative groups should each have the right to appoint and remove their members on this board in line with their own requirements and interests, but there should be a general power for members to be removed by a vote of the Scheme Advisory Board if that member is not seen to be carrying out its role (whether through non-attendance or lack of requisite knowledge and understanding etc.) as the Scheme Advisory Board must be able to continue to effectively carry out its role, notwithstanding that interest groups have the right to elect the members to that body. Q22. Should Scheme regulations prescribe a minimum number of meetings in each year? If so, how many? Comments: This should be included in the constitution of the Scheme Advisory Board (see above). We would recommend a minimum of 2 meetings per year, but would not anticipate the role of the Scheme Advisory Board involving too many more meetings on an annual basis (except perhaps in the years of the cost cap mechanism review or annual valuation). Q23. Should Scheme regulations prescribe the number of attendees for the board to be quorate? If so, how many or what percentage of the board’s membership should be required to be in attendance? Comments: This should be included in the constitution of the Scheme Advisory Board (see above). We would recommend a minimum of one per interest group for the meeting to be quorate (see suggested groups in question 18). Q24. Rather than make specific provision in Scheme regulations, should the matters discussed at Q16 to Q23 be left as matters for the scheme advisory board itself to consider and determine? 18 Comments: As above, we believe that SLOGPAG should be given the initial role to propose the constitution and membership profile of the Scheme Advisory Board for wide ranging stakeholder engagement and consultation. The constitution would ideally be approved by the Scottish Ministers, the Pensions Regulator and at least 75% of Scottish LGPS funds (with appropriate consultation with, and taking account of the views of, their employer and member representatives). This general control should be prescribed in the regulations. Shadow Advisory Board 1.29 The Scheme Advisory Board will be established from 1 April 2015 and the establishment of a Shadow Scheme Advisory Board will be kept under review, but such a Shadow Scheme Advisory Board is anticipated to be beneficial from Autumn 2014 onwards. 1.30 In the period until the Board (or Shadow Board) is established, SLOGPAG will review the governance arrangements within its agreed remit of developing a new Scottish LGPS. Topics for consideration will include, but are not limited to: a. The structure of the 4 governance related roles identified by the Public Service Pensions Act 2013 b. The membership and constitution of the Scheme Advisory Board c. Operation of the cost control mechanism d. The requirements of the Pensions Regulator e. Publication of scheme information f. Relevant provisions in the Institutions of Occupational Retirement Provision (IORP) g. Data collection 19 Q25. What other specific issues should SLOGPAG consider prior to the Board being established? Comments: In particular there is a need to gain clarity, and a consistent view, on what this process is seeking to achieve (i.e. a focus on governance and compliance), address certain common misconceptions that have been apparent in the discussions and finalise the structure and roles of the Pensions Board, Scheme Manager and Scheme Advisory Board proposed by the Act and their inter-relationship with each other. Thereafter, the priority will be to gain clarity and agreement on the membership, remit and constitution of the Scheme Advisory Board. Any shadow board needs to properly reflect this agreement, otherwise the establishment and operation of a shadow board would simply be an unnecessary distraction and drain on valuable and limited resource. Once the membership of the Scheme Advisory Board is established the focus needs to be on securing the appropriate level of knowledge and understanding of the members ahead of the April 2015 commencement. Q26. Under what circumstances should a Shadow Board be established prior to April 2015? Comments: The priority should be in finalising a workable governance structure to be implemented for April 2015 (see above) rather than distracting the process with the establishment of a shadow advisory board prior to this – given limited time and resource. Resourcing of the Advisory Board 1.31 If the scheme advisory board is to undertake its full range of duties effectively, it will need to have access to finance for example to pay for secretarial services and the necessary advice or analysis on which to base its decisions. 1.32 It is proposed this is regarded as an administration cost and therefore payable by the individual pension funds. Q27. Do you agree that the scheme advisory board should be funded by a mandatory levy on all Scheme pension fund authorities? If not, what alternative approach would you propose? 20 Comments: A consistent approach should be adopted in funding the Scheme Advisory Board for the LGPS (Scotland) as for the advisory boards for other Public Sector Pension Scheme Advisory Boards (in terms of government/stakeholder funding). Subject to that consistency, we believe a low level administrative levy should be applied consistently to all LGPS funds and there may be scope for certain larger costs/expenses to be levied on an ad hoc basis and borne in proportion to fund size (should the scheme advisory board deem that demonstratively fair and equitable). However the Scheme Advisory Board must ensure the funding provided from the LGPS Funds is utilised in a transparent and value for money manner in the best interests of the LGPS funds collectively. There should be an annual review/report/audit on the spending of the Scheme Advisory Board to ensure its financial accountability. Please use this space for additional comments Q28. How should the subscription vary by fund? Should it be a fixed fee for all funds or proportional to their membership? Comments: See answer to question 27 above. Constitution 1.33 The Act requires the setting up of the scheme advisory board but not the manner of its legal constitution. This would imply some form of body corporate to be set out in scheme regulations. Beyond setting out the corporate status of the board, scheme regulations would also need to spell out the personal liability protection for board members. Q29. What would be your preferred manner of legal constitution of the scheme advisory board and how should Scheme regulations deal with the issue of personal liability protection for board members? Comments: The constitution of the Scheme Advisory Board should be established to enable it to efficiently and effectively deliver a clear and focused function. Please see our response to Question 24. The members of the Scheme Advisory Board should act with the benefit of taking proper advice and should only be liable if they have acted in a negligent manner either without the benefit of such advice or at odds with such advice. The body should retain appropriate liability insurance. Part 4 – “Review of the Structure of the Scottish LGPS” 21 1.34 The Heads of Agreement includes the commitment for SLOGPAG or the Shadow Scheme Advisory Board, as appropriate, to establish a process, commencing April 2014, to consult on, and collate data relevant to, a review of the structure of the Scottish LGPS, in order for the Scheme Advisory Board to be in a position to complete such a review. Q30. What factors should be taken into account in a review of the structure of the Scottish LGPS? Comments: Clarity and agreement on the objectives of the review of the structure of the Scottish LGPS is essential to its success. In particular, there needs to be clarity in relation to the duty of the Scheme Manager (e.g. its fiduciary duty to members, employers and taxpayers) and how this should be managed and/or how structural change could make the duty of the Scheme Manager clearer and more workable. Related to this, the issues around certain conflicts which might arise from the Administrative Authority/Scheme Manager being a single legal entity but performing different functions that are the subject of conflicting statute/regulation (e.g. separate legal distinction in relation to the administering body of the pension funds, which could be achieved within the administering body) need to be considered and addressed. This conflict also manifests itself in the current requirement for a two thirds majority of local authority Councillors on Pensions Committees, where that local authority in particular might not have an equivalent stakeholder interest, which can artificially skew the representation in favour of the Administering Authority/Scheme Manager. It is however important to also recognise that Councillors are elected members with expertise in decision making roles and boards do not always wholly comprise of stakeholder representation. We are generally comfortable that our Pensions Committee, and wider structure, adopts a neutral role (mindful of its separate regulation and duties), but that is not to say the current regulation and structure of the LGPS support these essential principles of good governance. Stakeholder participation at Administering Authority/Scheme Manager level in Scotland varies. Timescales for the review/any structural change need to be realistic and reflect the other significant pensions’ management burdens and delivery requirements that are currently impacting on the Scheme Managers. Consistency of data, particularly on investment costs, is a significant issue that needs to be addressed in order to make the appropriate informed decisions. General 1.35 The current LGPS (Scotland) Regulations have a light touch’ on governance, instead they refer to the Governance Compliance Statement. This allows for changes in governance arrangements to be made without having to amend existing regulations. 22 Q31. Would it be preferable to retain a ‘light touch’ to governance in the Scheme regulations, with reference instead to a Governance Compliance Document which would contain the detailed governance requirements? Comments: Yes, within reason, however the new bodies to be introduced by the Act will require some general principle based regulation in order for them to be effective (as above). However a single source of guidance from Scottish Ministers on the areas referred to herein (among others) would be welcomed. Conclusion 1.36 Scheme governance has a critical role in supporting the delivery of excellent LGPS performance and open and transparent governance arrangements have long been encouraged and supported in Scotland. We would strongly encourage you to consider this paper carefully and to respond to as many of the questions as you see fit. Your contribution will be of great assistance in helping us to prepare a set of draft regulations on Scheme governance for formal consultation. 23 List of Questions Q1. What “other matters”, if any, should we include in Scheme regulations to add to the role of local pension boards? Q2. Should Scheme regulations make it clear that nobody with a conflict of interest, as defined, may be appointed to or sit on a pension board? Q3. Should Scheme regulations prescribe the type of information that may be “reasonably required”? Q4. Should Scheme regulations prescribe the requirement for managers/administering authorities to undertake regular checks to ensure board members do not have any conflicts of interest? Q5. Although not required by the Act, should Scheme regulations prescribe a minimum number of employer and employee representatives? Q6. How should the governance of the local government pension scheme in Scotland change to incorporate the changes required by the Act? Q7. Should the new Scheme regulations require local pension boards to be a body separate from the statutory committee or for it to be combined as a single body? It would be helpful if you could provide the reasons which support your answer. Q8. To what extent should the new Scheme regulations specify the types of members of the pension boards? Q9. How should the Pension Boards be chaired? Q10. What should happen in the event of a tied vote at a Pensions Board? Q11. To what extent should the new Scheme regulations specify the manner in which members of the pensions boards are selected? Q12. Should the introduction of the pension board affect employer and member representation in other parts of funds’ governance? If yes, how? Q13. Should the new Scheme regulations include a requirement for each local pension board to publish an annual statement of its work and for this to be sent to the relevant scheme manager, all scheme employers, the scheme advisory board and Pensions Regulator? Q14. Apart from the training and qualification criteria that may be covered by the Pensions Regulator in a code of practice, are there any specific issues that we should aim to cover in the new Scheme regulations as well? Q15. Should Scheme regulations simply replicate the wording of the Act? If not, what specific areas of work should the new Scheme regulations prescribe? Q16. Should Scheme regulations include a general provision enabling the scheme advisory board to advise Scottish Ministers on the desirability of changes to the Scheme as and when deemed necessary? 24 Q17. Are there any specific areas of advice that Scheme regulations should prohibit the scheme advisory board from giving? Q18. What would be your preference be for establishing membership of the scheme advisory board? Q19. Should Scheme regulations require the Scottish Ministers to approve any recommendation made for the position of Chair? Q20. Should Scheme regulations prescribe tenure of office? If so, what should the maximum period of office be and should this also apply to the Chair of the board? Q21. Should Scheme regulations make provision for board members, including the Chair, to be removed in prescribed circumstances, for example, for failing to attend a minimum number of meetings per annum? If so, who should be responsible for removing members and in what circumstances (other than where a conflict of interest has arisen) should removal be sought? Q22. Should Scheme regulations prescribe a minimum number of meetings in each year? If so, how many? Q23. Should Scheme regulations prescribe the number of attendees for the board to be quorate? If so, how many or what percentage of the board’s membership should be required to be in attendance? Q24. Rather than make specific provision in Scheme regulations, should the matters discussed at Q16 to Q23 be left as matters for the scheme advisory board itself to consider and determine? Q25. What other specific issues should SLOGPAG consider prior to the Board being established? Q26. Under what circumstances should a Shadow Board be established prior to April 2015? Q27. Do you agree that the scheme advisory board should be funded by a mandatory levy on all Scheme pension fund authorities? If not, what alternative approach would you propose? Q28. How should the subscription vary by fund? Should it be a fixed fee for all funds or proportional to their membership? Q29. What would be your preferred manner of legal constitution of the scheme advisory board and how should Scheme regulations deal with the issue of personal liability protection for board members? Q30. What factors should be taken into account in a review of the structure of the Scottish LGPS? Q31. Would it be preferable to retain a ‘light touch’ to governance in the Scheme regulations, with reference instead to a Governance Compliance Document which would contain the detailed governance requirements? 25 CONSULTATION RESPONSE FORM LOCAL GOVERNMENT PENSION SCHEME (SCOTLAND) (please complete and return to the address at the end of the form to ensure that we handle your response appropriately). 1. Name/Organisation Organisation Name The City of Edinburgh Council / Lothian Pension Fund Title Surname Forename 2. Postal Address For the attention of: Clare Scott and Struan Fairbairn Lothian Pension Fund Level 5 &9, City Chambers, 249 High Street, Edinburgh Postcode EH1 1YJ Phone 0131 469 3865 Email Clare.Scott@edinburgh.gov.uk and Struan.Fairbairn@edinburgh.gov.uk 3. Permissions - I am responding as… (please complete either sections (a), (b) and (d) or sections (c) and (d): or Group/Organisation Individual (a) Do you agree to your response being made available to the public (in Scottish Government library and/or on the Scottish Government web site)? (c) The name and address of your organisation will be made available to the public (in the Scottish Government library and/or on the Scottish Government web site). Please state yes or no: (b) Where confidentiality is not requested, we will make your responses available to the public on the following basis Are you content for your response to be made available? Please state yes to one of the following: Please state yes or no: Yes Yes, make my response, name and address all available .......... or Yes, make my response available, but not my name and address ……... or Yes, make my response and name available, but not my address (d) 26 ……… We will share your response internally with other Scottish Government policy teams who may be addressing the issues you discuss. They may wish to contact you again in the future, but we require your permission to do so. Are you content for Scottish Government to contact you again in relation to this consultation exercise? Please state yes or no: Yes Please e-mail your response to locgovpensionsreform@scotland.gsi.gov.uk or send via mail to: LGPS Governance Consultation SPPA Policy 7 Tweedside Park Tweedbank Galashiels TD1 3TE The closing date for receipt of comments is 3 February 2014. 27 Heads of Agreement - Scheme Governance proposals The following details the governance proposals in the Heads of Agreement agreed by the Scottish Local Government Pension Scheme Advisory Group. The Public Service Pensions Act 2013 identifies 4 core governance related roles which must be established from 1 April 2015: a. b. c. d. Responsible Authority – the Scottish Ministers who make the regulations for the LGPS (Scotland) Scheme Manager – the function of managing and administering the scheme Pension Board – the body responsible for assisting the Scheme Manager in relation to compliance with scheme regulations and the requirements of the Pensions Regulator Scheme Advisory Board – the body responsible for providing advice to the Responsible Authority, at the authority’s request, on the desirability of changes to the scheme. The Scheme Advisory Board also provides advice to the Scheme Manager and Pension Board in relation to the effective and efficient administration and management of the scheme. SLOGPAG recognises the critical role governance has in supporting the delivery of excellent LGPS performance and therefore encourages and supports good practice through open and transparent governance arrangements. SLOGPAG will review the governance arrangements within its agreed remit of developing a new Scottish LGPS. Topics for consideration will include, but are not limited to: a. The structure of the 4 governance related roles identified by the Public Service Pensions Act 2013 b. The membership and constitution of the Scheme Advisory Board c. Operation of the cost control mechanism d. The requirements of the Pensions Regulator e. Publication of scheme information f. Relevant provisions in the Institutions of Occupational Retirement Provision (IORP) g. Data collection 28 SLOGPAG will discharge its duties, as defined in the ‘Role of SLOGPAG’ document agreed by SLOGPAG members in December 2012, and will then cease to operate. The Scheme Advisory Board will be established from 1 April 2015 and the establishment of a Shadow Scheme Advisory Board will be kept under review, but such a Shadow Scheme Advisory Board is anticipated to be beneficial from Autumn 2014 onwards. It is anticipated that the Scheme Advisory Board will be bilateral with an equal number of employer and employee representatives. There will be an independent chair and the size of the Board will be around 15 people. In addition, advisors and observers will also attend the Board but will not have membership status. SLOGPAG or the Shadow Scheme Advisory Board, as appropriate, will establish a process, commencing April 2014, to consult on, and collate data relevant to, a review of the structure of the Scottish LGPS, in order for the Scheme Advisory Board to be in a position to complete such a review.