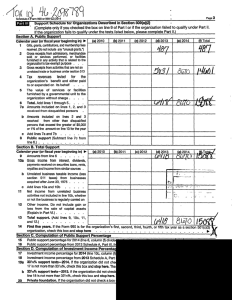

Tax - business transaction

advertisement

BUSINESS TRANSACTIONS VAT, Percentage Tax MS. Marinor G. Quintilla, ,CPA, MBA WHAT IS BUSINESS OR “IN THE COURSE OF TRADE OR BUSINESS?” QUERY 1: ANS. • MEANS THE REGULAR CONDUCT OR PURSUIT OF A COMMERCIAL OR ECONOMIC ACTIVITY • GOAL – PROFIT • REGULAR – REPETITION AND CONTINUITY OF ACTION. 3 MAJOR BUSINESS TAXES EXCISE TAXES- Imposed on manufacturers and importers PERCENTAGE TAXES VAT- imposed on sales of goods, properties, services, importation of goods or properties The General Outline VAT Background; Administrative and Fundamental Concepts Classification of Transactions/Sales; Exempt, Zero Rated, Taxable Laws on VAT; Sellers of services, importers of goods BACKGROUND TO VAT • VAT became effective in the Philippines on Jan. 1, 1988 by E.O. 273. • Its imposition eliminated traditional business taxes such as tax on hotels, motels, dealers in securities, caterer’s fee. • Passage of RA 9337: SALES OF GOODS AND SERVICES = SUBJECT TO VAT NATURE AND CHARACTERISTICS OF VAT • VAT is tax on consumption • Levied on the sale, barter, exchange or lease of goods, properties or services in the Philippines and importation of goods in the Philippines. • Seller is liable for payment of tax but the amount may be shifted to the buyer, transferee or lessee of goods, properties or services. SCOPE OF VAT • Any sale, barter or exchange of goods and properties (including real properties) in the course of trade or business; • Any sale of services in the course of trade or business • Any lease of goods & properties in the course of trade or business • Any importation of goods, whether in the course of trade or business or not “in the course of trade or business” Means the regular conduct or pursuit of a commercial or an economic activity including transactions incidental thereto any business pursued by an individual where aggregate sales is less than P100K during any 12 month period shall be considered for subsistence/livelihood and NOT in the course of business. MANDATORY REGISTRATION • 1. GROSS SALES OR RECEIPTS FOR THE PAST 12 MONTHS = EXCEEDED P1.5M; OR • 2. GROSS SALES OR RECEIPTS FOR THE NEXT 12 MONTHS WILL EXCEED P1.5M <GRADED RECITATION> CASE 1: If Baba is a VAT registered person, is he liable to pay VAT? BABA, OPERATES A BUSINESS. DURING THE YEAR, HIS GROSS RECEIPTS AMOUNTED TO P1.2M. ANSWER: • Yes, a VAT REGISTERED PERSON is subject to tax even if his gross receipts did NOT exceed P1.5M. If he is NOT REGISTERED, then he would NOT be subject to VAT because his gross receipts do not exceed P1.5M. (SAME PROBLEM) HOW ABOUT IF HE IS NOT VATREGISTERED BUT HIS ANNUAL GROSS RECEIPTS IS P1.8M ANSWER: • HE IS SUBJECT TO VAT BECAUSE THE GROSS RECEIPTS EXCEEDED P1.5M. Administrative Provisions Compliance Requirements: 1. Registration with the BIR 2. Keeping of acctg books/records 3. Issuance of sales invoices & OR’s 4. Filing & payment of tax returns 5. Withholding of taxes on specified/certain payments to suppliers-sellers MANDATORY REGISTRATION GROSS SALES OR GROSS RECEIPTS FOR THE PAST 12 MONTHS EXCEEDED P1.5M FRANCHISE GRANTEES OF RADIO AND OR TELEVISION BROADCASTING = GROSS ANNUAL RECEIPTS FOR THE PRECEDING CALENDAR YEAR EXCEEDED P10M shall register within 30 days from the end of the calendar year. Optional registration of VAT -EXEMPT PERSONS • Gross sales or gross receipts – do not exceed P1.5M for any 12 month. • Franchise grantees of radio and television broadcast station = annual gross receipts in the preceding year DOES NOT exceed 10M. • ONLY VAT – REGISTERED persons are required to print their TIN followed by word “VAT” in their invoices or receipts CLASSIFCATIONS OF VAT EXCISE TAX – known as privilege tax; tax imposed on the taxpayers’ exercising their rights and privileges of performing an act or engaging in an occupation. Ex. Donors tax, income tax. AD-VALOREM TAX – tax is computed by applying a % rate based on the property’s value. Indirect tax, National tax, Single rate or flat rate tax VAT ON SALE OF GOODS OR PROPERTIES TAX BASE = GROSS SELLING PRICE IN TAX GROSS SALES MEANS NET OF DEDUCTIONS TAX RATES 12% of Gross Selling Price - VAT 0% of gross selling price – export sale, foreign currency denominated sale FORMULA OUTPUT TAX – INPUT TAX = TAX PAYABLE OUTPUT TAX = SALES INPUT TAX PURCHASES APPEAR IN THE BALANCE SHEET AS VAT PAYABLE (LIABILITY) OUTPUT TAX > INPUT TAX = TAX PAYABLE APPEAR IN THE BALANCE SHEET AS DEFERRED INPUT TAX (ASSET SECTION) OUTPUT TAX < INPUT TAX = TAX PAYABLE INVOICE Sec. 109(1) of the Tax Code OTHER PERCENTAGE TAXES GROSS RECEIPTS /GROSS SALES OF NON-VAT REGISTERED PERSON • Do not exceed P1.5M per year is subject to 3% percentage tax rather than 12% of VAT. EXAMPLES • Domestic carriers and keepers of garages • Franchise • Overseas dispatch or message from the Philippines • Bank and non-bank financial institutions • Life insurance companies • Amusement places • Sale of shares of stock in local stock exchange • Business with annual sales of P1.5M DOMESTIC CARRIERS AND KEEPERS OF GARAGES • Includes cars for rent or for hire driven by the lessee, transportation contractors, including persons paid to transport passengers and other domestic carriers by land, for the transport of passengers, except owners of bancas, owners of animaldrawn two wheeled vehicles and keepers of garages. Note: • Businesses with annual gross sales of P100K and below are EXEMPT from VAT and other percentage taxes. FRANCHISES • A privilege acquired by special grants from the public through the legislature which imposes on the grantee as a consideration, a duty to the public to see that they are properly used. • Gas & water – 2% on gross receipt • Radio or TV broadcasting – annual gross receipts of last year do not exceed P10M LIFE INSURANCE • 5% of the total premium collected – basis for percentage tax AMUSEMENT PERCENTAGE TAX • BOXING – 10% • PROFESSIONAL BASKETBALL GAMES – 15% • COCKPITS – 18% • JAI-ALAI AND RACE TRACTS – 30% • NIGHT/DAY CLUBS – 12% WINNINGS ON HORSE RACES • 10 % TAX ON WINNINGS IN HORSE RACES • BASED ON ACTUAL AMOUNT PAID TO HIM FOR EVERY WINNING TICKET AFTER DEDUCTING THE COST OF THE TICKET. SHARES OF STOCK • ½ of 1% of the gross selling price • listed or traded in the local stock exhange. INITIAL PUBLIC OFFERING (IPO) • UP TO 25% - 4% • OVER 25% BUT NOT OVER 33 1/3% - 2% • OVER 33 1/3 %11 - 1% • BASED ON THE GROSS SELLING PRICE OR GROSS VALUE IN MONEY OF THE SHARES OF STOCKS RETURNS AND PAYMENT OF PERCENTAGE TAX • Every person shall file monthly return : within 20 days after the end of each taxable month. • STOCK TRANSACTION IN STOCK EXCHANGE: within 5 banking days from the date withheld by the broker • TAX ON WINNINGS – Remitted to the BIR within 20 days from the date withheld RETURNS AND PAYMENT OF PERCENTAGE TAX • Amusement tax – payable at the end of each month and complete tax return for the quarter shall be filed within 20days at the end of the quarter • Overseas dispatch – to be remitted 20 days after the end of each quarter. EXCISE TAX A NATIONAL INTERNAL REVENUE TAX APPLIES TO: • MANUFACTURERS • IMPORTERS EXCISE TAX EXAMPLES OF EXCISE TAX • IMPOSED ON HARMFUL OR NON-ESSENTIAL GOODS MANUFACTURED OR PRODUCED IN THE PHILIPPINES • FOR DOMESTIC SALE, CONSUMPTION OR FOR ANY DISPOSITION INCLUDING IMPORTED GOODS. 2 KINDS OF EXCISE TAXES • SPECIFIC TAX • AD VALOREM TAX FILING OF RETURN AND PAYMENT OF EXCISE TAX • Indigenous petroleum, natural gas or liquefied natural gas = paid by the first buyer, purchaser or transferee for local sale, barter or transfer • Exported goods _ shall be paid by the owner, lessee, concessionaire or operator of the mining claim LOCAL TAXES CONCEPT OF LOCAL TAXES • Belongs exclusively to the legislative body of the government • Local government units do not have the inherent power to tax but the law delegates such power to them through the LOCAL GOVERNMENT CODE (LGC) enacted by the Congress SCOPE OF LOCAL TAXATION • LOCAL GOVERNMENT TAXATION • REAL PROPERTY TAXATION WHO MAY EXERCISE LOCAL TAXATION POWER • • • • PROVINCIAL BOARD MUNICIPAL BOARD CITY COUNCIL BARANGAY COUNCIL 3 COMMON LOCAL TAXES • COMMUNITY TAX • PROFESSIONAL TAX • REAL ESTATE TAX GOD BLESS !!! -END-