Slides

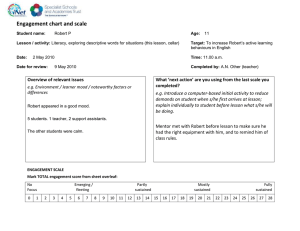

advertisement

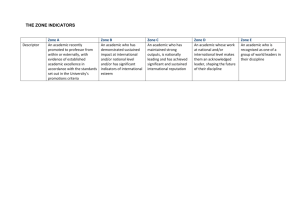

Joshua Downs 9/20/2015 Firm Resources and Sustained Competitive Advantage JAY BARNEY Journal of Management, 1991 Main Points Argues for deeper analysis than extant discussion of environmentally derived advantage at industry level and critiques assumptions of homogeneity and mobility at firm level Introduces VRIN Framework for determining whether idiosyncratic resources under firm control have the potential to facilitate sustainable value creating strategies over current and potential competitors ◦ Competitive advantage only sustainable in presence of resource heterogeneity and immobility ◦ Sustainable competitive advantage CANNOT BE PURCHASED ON OPEN MARKETS ◦ Schumpeterian shocks influence transformation of attributes to resources & vice versa Addresses issues of: ◦ Social welfare with efficiency rents argument ◦ Organization Theory and Behavior by discussing resource-based model as bridging agent Competing Theories of Sustained Advantage External Environmental Model ◦ Opportunities and Threats ◦ Porter’s Five Forces Assumptions ◦ Firms are identical in terms of the strategically relevant resources they control and strategies pursued ◦ Internal firm assets are highly mobile Objections to competitive advantage under these assumptions ◦ First mover advantage requires superior knowledge regarding opportunities ◦ Entry barriers requires heterogeneous strategies among incumbents and entrants Key Concepts Firm Resources ◦ All assets, capabilities, organizational processes, firm attributes, information, knowledge, etc. controlled by a firm that enable the firm to conceive of and implement strategies that improve its efficiency and effectiveness (Daft, 1983) ◦ Physical Capital Resources (Williamson, 1975) ◦ Human Capital Resources (Becker, 1964) ◦ Organizational Capital Resources (Tomer, 1987) ◦ Differs from attributes that can constrain firm efficiency and effectiveness Competitive Advantage ◦ Value creating strategy not simultaneously being implemented by current or potential competitor Sustained Competitive Advantage ◦ Strategy that continues to create value after competitive efforts to duplicate have been exhausted ◦ Not dependent on calendar time ◦ Can be undone by Schumpeterian Shocks rendering resources into attributes Sustained Competitive Advantage To hold the potential to provide competitive advantage, firm resources must be ◦ Valuable ◦ Enable the firm to conceive of or implement strategies that improve efficiency and effectiveness ◦ Exploit opportunities and neutralize threats in external environment ◦ Rare ◦ Number of firms possessing less than the number needed for perfect competition dynamics in an industry (Hirshleifer, 1980) ◦ Non-rare exploited for competitive parity and economic survival To hold the potential to provide sustained competitive advantage, resources must ALSO be ◦ Inimitable ◦ Dependent on unique historical conditions (Path Dependency), causal ambiguity for both firm and competitors, and social complexity beyond systematic influence ◦ Non-substitutable ◦ No common or imitable strategically equivalent resources Examples Strategic Planning ◦ Formal: Not rare, unlikely to be a source of sustained competitive advantage by itself ◦ Can lead to recognition of potential of other possessed resource ◦ Informal: Some firms actively constrain, thus likelier to be rarer ◦ Socially complex, but could be substituted by formal planning in the right setting Information Processing Systems ◦ Computers/Machines: Generally mobile, unlikely to be a source of sustained competitive advantage ◦ Deeply embedded systems: Manager-computer interface mirrors social complexity ◦ Potential substitutes (Management teams) must include: Efficient information flow & processing as well as rarity &/or inimitability Positive Reputations ◦ Can be rare, difficult to duplicate historically, varying social complexity between firm & stakeholders ◦ Contractual measures as substitutes? Discussion How could the sustained competitive advantage endowed by the three resource examples be undone by Schumpeterian Shocks? Can you think of some examples of attributes transformed into resources? Where does risk enter the discussion? Is risk tolerance a type of resource? How can resources help determine the assignment of residual control rights?