Office of Management and Budget (OMB) Guidance on

Office of Management and Budget (OMB)

Guidance on Uniform Administrative Requirements,

Cost Principles, and Audit Requirements for Federal

Awards

IMPACT OF CHANGING REGULATIONS

UNIVERSITY OF ARKANSAS, FAYETTEVILLE

What is the Uniform

Guidance?

The Office of Management and Budget (OMB), consolidated the federal government’s guidance on

Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards, The

Uniform Guidance supersedes OMB Circulars A-21, A-

87, A-122, A-89, A-102, A-110, A-133, and the guidance in Circular A-50 on Single Audit Act follow-up.

The new guidance can be found in 2 CFR Chapter I and Chapter II, Part 200, et al.

The new guidance became effective on 12/26/2014

(section 200.110).

COFAR & COGR,

Who Are They?

COFAR - Council on Financial Assistance Reform is an interagency group of Executive Branch officials to coordinate financial assistance. Established by an OMB Memorandum these Federal officials have worked closely with OMB in developing the Uniform Guidance. They maintain a website https://cfo.gov/cofar/ that contains resources related to the

Uniform Guidance.

COGR – Council on Governmental Relations – is an association of research universities and is the national authority on the financial and regulatory infrastructure and the corresponding compliance requirements, associated with managing federal research grants and contracts within research institutions. They frequently lobby the Federal government on behalf of research institutions.

COFAR’s FAQs

The following are frequently asked questions presented by the COFAR on OMB’s Uniform Guidance at 2 CFR 200.

Please note that in case of any discrepancy, the actual guidance at 2 CFR 200 governs. If there is a question pertaining to the application of the guidance to a particular Federal award, that question should be addressed to the Federal awarding agency or passthrough entity in the case of a subrecipient. This document is intended to provide additional context and background for the guidance as Federal and non-Federal entities seek to understand the policy changes and will be referenced as an addition to the Uniform Guidance at 2 CFR 200 in the

2015 issuance of Appendix XI to Part 200 - Compliance

Supplement.

Will the new uniform guidance apply only to awards made after the effective date, or does it apply to awards made earlier?

The Uniform Guidance applies to awards or funding increments made after the effective date of 12/24/2014. It will not retroactively change the terms and conditions for funds or awards that a non-Federal entity has already received.

Outline of Uniform

Guidance

Subpart A – Definitions 200.0 – 200.99

Subpart B – General Provisions 200.100 - 200.113

Subpart C – Pre-Award 200.200 - 200.211

Subpart D – Post Award 200.300 - 200.345

Subpart E – Cost Principles 200.400 - 200.475

Subpart F – Audit Requirements 200.500 - 200.520

Appendix I – Full Text of Notice of Funding Opportunity

Appendix II – Contract Provisions for Non-Federal Entity

Appendix III – Indirect (F & A) Costs Identification and

Assignment , and Rate Determination for Institutions of

Higher Education

Definitions & General

Provisions

Sections 200.1 through 200.99 provide definitions of terms used in Federal awards.

The General provisions contained in sections 200.100 through 200.113 explain general provisions for uniform standards, requirements, applicability, exceptions, authorities, responsibilities and related information for all Federal grants and cooperative agreements.

Disclosure

Requirements

Section 200.113 & 180.335 - Before you enter into a covered transaction at the primary tier, you as the participant must notify the Federal agency office that is entering into the transaction with you, if you know that you or any of the principals for that covered transaction:

Are presently excluded or disqualified;

Have been convicted within the preceding three years of any of the offenses listed in §180.800(a) or had a civil judgment rendered against you for one of those offenses within that time period;

Are presently indicted for or otherwise criminally or civilly charged by a governmental entity (Federal, State or local) with commission of any of the offenses listed in §180.800(a); or

Have had one or more public transactions (Federal, State, or local) terminated within the preceding three years for cause or default.

These same provisions must be passed down to lower tier participants with whom you intend to do business per Section 180.330.

Pre-Federal Award

Requirements and Contents of Federal Awards

This section, 200.2XX requires Federal agency publication of certain information in announcements of funding opportunities and notices of awards. It also requires Federal agencies to publish terms and conditions of grants and to be responsible for informing recipients of national policy requirements as applicable. It includes a standard set of data elements to be included in all federal awards (200.210).

Fixed Amount Awards

Section 200.201(b) provides for fixed amount awards defined as “a type of grant agreement under which the Federal awarding agency or pass-through entity provides a specific level of support without regard to actual costs incurred…”(200.45). OMB is encouraging federal agencies to experiment with this type of agreement, hoping that the increased flexibility will result in better outcomes and lower costs for certain types of projects. Accountability for these awards will be based primarily on performance and results. Prior written approval from the Federal awarding agencies is required to issue fixed amount subawards.

Post – Award

Requirements

Sections 200.300 through 200.309 provides standards for Financial and Program

Management. This includes a financial management system that includes identification of all federal awards and accurate, current and complete disclosure of the financial results of each Federal award

(200.302). There is also a directive to funding agencies to relate financial data to performance requirements of the federal award (200.301)

Internal Controls

Section 200.303 requires federal award recipients to: Take reasonable measures to safeguard protected personally identifiable information and other information the

Federal awarding agency or pass-through entity designates as sensitive or the non-

Federal entity considers sensitive consistent with applicable Federal, state and local laws regarding privacy and obligations of confidentiality.

Payment

Section 200.305 has changed the amount of administrative expense that can be taken from interest earned on federal advances. Interest in excess of $500 per year must be remitted annually to:

Department of Health and Human Services

Payment Management System

Rockville, MD 20852

This process is managed by Research Accounting

Cost Sharing or

Matching

Section 200.306 - Voluntary committed cost sharing cannot be used as a factor during the merit review of applications or proposals, but may be considered if it is both in accordance with Federal awarding agency regulations and specified in a notice of funding opportunity.

Criteria for considering voluntary committed cost sharing must be explicitly described in the notice of funding opportunity.

Program Income

Section 200.307 – For Federal awards made to IHEs and nonprofit research institutions, if the awarding agency does not specify how program income is to be used, paragraph (e) (2) of this section must apply: (e)(2)

Addition. With prior approval of the Federal awarding agency, program income may be added to the

Federal award by the Federal agency and the nonfederal entity. The program income must be used for the purposes and conditions of the Federal award.

Note that the definition of program income in section

200.80 includes “license fees and royalties on patents and copyrights”

Equipment Section

200.313

Title to equipment acquired under a Federal award will vest upon acquisition with the non-federal entity as a

“conditional title”. Title generally vests subject to these conditions:

Equipment to be used for the until funding ceases, or until property is no longer needed for project.

Property cannot be encumbered without approval of

Federal awarding agency.

It should be used for the program as long as needed, whether or not the program continues to be supported by the award. When no longer needed for the original program it may be used in other activities supported by the Federal awarding agency (first priority), then other

Federal awarding agencies.

Equipment, Section 200.313

(continued)

When acquiring replacement equipment the non-

Federal entity may use the equipment to be replaced as a trade-in or sell the property and use the proceeds to offset the cost of the replacement property.

Property records must be maintained that includes a description of the property, serial number, source of funding, who holds title, acquisition date, cost , location and condition of the equipment as well as any ultimate disposition data including date of disposal and sales price.

Equipment Disposition Section

200.313 (Continued)

Disposition of equipment where title remains with the Federal government will be made in accordance with Federal awarding agency disposition instructions:

Items with a current per unit FMV of $5,000 or less may be retained, sold or otherwise disposed of with no further obligation to the

Federal awarding agency.

If the Federal awarding agency fails to provide requested disposition instructions within 120 days, items with a FMV in excess of

$5,000 may be retained by the non-Federal entity or sold. The

Federal awarding agency is entitled to an amount calculated by multiplying the current market value or proceeds from the sale by the Federal awarding agency’s % of participation in the cost of the original purchase. When sold the Federal awarding agency may permit the non-Federal entity to deduct and retain from the federal share $500 or 10% of the proceeds, whichever is less for its selling and handling expenses.

Supplies Section 200.314

Title to supplies will vest in the non-Federal entity upon acquisition. If there is a residual inventory of unused supplies exceeding $5,000 in total at the end of the project, and the supplies are not needed for another Federal award, the non-

Federal entity must retain the supplies for use in other activities or sell them, but must, in either case, compensate the Federal government for its share of the cost of the supplies. The amount of compensation must be computed in the same manner as for equipment.

Procurement

Section 200.318 requires non-Federal entity to maintain records sufficient to detail the history of procurement.

It also specifies that the non-Federal entity must avoid acquisition of unnecessary or duplicative items.

Section 200.319

Requires full and open competition

Prohibits the use of statutorily or administratively imposed state or local geographical preferences

Requires written procedures

Recipients must ensure that all prequalified lists of vendors are current and include enough qualified sources to ensure maximum and open free competition.

Methods of

Procurement

Section 200.320 elaborates on procurement methods defined in the definitions section.

Micro-purchase (200.67) $3,000 or less – does not require competitive quotations so long as price is reasonable

Simplified Acquisition Threshold (200.88) $3,000 - $150,000 – requires price or rate quotations from an adequate number of qualified sources. (Controversial and delayed implementation)

Purchases over $150,000 may use the Competitive Proposal or

Sealed Bids method.

Noncompetitive proposals from only one source may be used only when the item is only available from a single source, or public exigency or emergency will not permit delay, or express authorization from Federal awarding agency.

Contracting with small and minority businesses, women’s business enterprises, and labor surplus area firms

Section 200.321 requires affirmative steps to assure MBE/WBE and labor surplus firms are used when possible. Affirmative steps must include:

Placing qualified small and MBE/WBEs on solicitation lists.

Assuring that small and MBE/WBE are solicited when they are potential sources.

Dividing total requirements when economically feasible, into smaller tasks to permit maximum participation by small and MBE/WBE businesses.

Establishing delivery schedules when the requirement permits which encourage participation by small and MBE/WBE businesses.

Using the services and assistance, as appropriate, of such organizations as the Small Business Administration and the Minority Business Development

Agency of the Dept. of Commerce.

Requiring the prime contractor, if subcontracts are to be let, to take the affirmative steps listed in paragraphs (1) through (5) above.

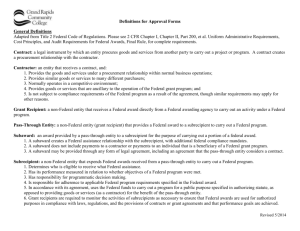

Subrecipient and Contractor

Determinations Section 200.330

Subrecipient:

Performance measured against federal award objectives

Responsible for programmatic decisions

Adherence to Federal program compliance requirements

Uses federal funds to carry out a program of the organization, not to provide goods and services

May determine who is eligible to receive Federal financial assistance

Contractor:

Provides goods or services and may provide similar goods or services to many different purchasers.

Operates in a competitive environment

Is not subject to compliance requirements of Federal program

Federal agencies may require specific support for determinations.

Requirements for passthrough entities

Section 200.331 requires that all pass-through entities must:

Ensure that every subaward is clearly identified to the subrecipient as a subaward and includes standard required information. A list of the required information can be found in this section.

Evaluate each subrecipient’s risk of noncompliance with Federal statutes, regulations, and the terms and conditions of the subaward for purposes of determining the appropriate subrecipient monitoring described in paragraph (e) of this section, which may include consideration of such factors as:

1.

The subrecipient’s prior experience with the same or similar subawards

2.

The results of previous audits including whether or not the subrecipient receives a Single Audit in accordance with subpart F

3.

Whether the subrecipient has new personnel or new or substantially changed systems

4.

The extent and results of Federal awarding agency monitoring (e.g., if the subrecipient also receives Federal awards directly from a Federal awarding agency).

Consider imposing specific subaward conditions upon a subrecipient if appropriate as described in Section 200.207

Requirements for pass-through entities (continued)

Monitor the activities of the subrecipient as necessary to ensure that the subaward is for authorized purposes, in compliance with Federal statutes, regulations, and the terms and conditions of the subaward; and that subaward performance goals are achieved. Passthrough monitoring of a subaward must include:

1.

Reviewing financial and programmatic reports required by the pass-through entity.

2.

3.

Follow-up and ensure that the subrecipient takes timely action on all deficiencies

Issue a management decision for audit findings pertaining to the Federal award provided to the subrecipient.

Depending on the assessment of risk posed by the subrecipient (paragraph b) the following monitoring tools may be useful to ensure compliance and achievement of program goals:

1.

Provide the subrecipient with training and technical assistance

2.

3.

Perform on-site reviews of the subrecipient’s program operations

Arrange for agreed-upon-procedures engagements as described in 200.425 Audit

Services

Verify that every subrecipient is audited as required by Subpart F – Audit Requirements.

Requirements for passthrough entities (continued)

Consider whether the results of the subrecipient’s audits, on-site reviews, or other monitoring indicates conditions that necessitate adjustments to the pass-through entities own records.

Consider taking enforcement action against noncompliant subrecipients as described in Section 200.338

Section 200.332 Fixed amount subawards – With prior written approval from the

Federal awarding agency, a pass-through entity may provide subawards based on fixed amounts up to the Simplified Acquisition Threshold (currently $150,000), provided that the subawards meet the requirements for fixed amount awards in

Section 200.201. Those requirements include payments based on meeting specific requirements of the Federal award. Such payments can be based on “milestones”,

“unit price basis”, or one payment at Federal award completion.

200.201 (2) A fixed price amount cannot be used in programs that require mandatory cost share or matching.

200.201 (3) The non-Federal entity must certify in writing to the Federal awarding agency or pass-through entity that the project or activity was completed or the level of effort was expended. If the level of activity was not carried out the amount of the award must be adjusted.

Subrecipients – Indirect costs

Section 200.331 (a)(4) if the subrecipient has a

Federally negotiated indirect cost use it. If not the non-Federal entity can either negotiate a rate with the subrecipient or use a de minimus rate of 10% of MTDC.

Direct Costs

Section 200.413 – Direct costs are those cost that can be identified specifically with a particular final cost objective. Costs incurred for the same purpose in like circumstances must be treated consistently as either direct or indirect costs. (see also

Fayetteville campus policy 310.1)

The salaries of administrative and clerical staff should normally be treated as indirect costs. Direct charging of these costs may be appropriate only if all of the following conditions are met:

Administrative or clerical services are integral to a project of activity.

Individuals involved can be specifically identified with the project or activity.

Such costs are explicitly included in the budget or have the prior written approval of the Federal awarding agency.

The costs are not also recovered as indirect costs.

Indirect

Costs

Section 200.414 (c) – A negotiated indirect cost rate must be accepted by all federal awarding agencies except when required by a federal statute or regulation, or “when approved by a Federal awarding agency head or delegate based on documented justification…The Federal awarding agency must implement , and make publicly available, the policies, procedures and general decision making criteria that their programs will follow to seek and justify deviations from negotiated rates.”

Indirect Costs

Section 200.414 (f) - Non-Federal entities that have never received a negotiated indirect cost rate may elect to charge a de minimis rate of 10% of MTDC.

Section 200.331 (a) (4) - authorizes pass-through entities to allow subrecipients to use the 10% de minimis rate if the subrecipient does not have a negotiated federal rate.

Record Retention

Section 200.333 – Records must be retained for a period of three years from the date of submission of the final expenditure report or for Federal awards that are renewed quarterly or annually, from the date of the submission of the quarterly or annual financial report, respectively, as reported to the

Federal awarding agency or pass-through entity in the case of a subrecipient. Federal awarding agencies and pass-through entities must not impose any other record retention requirements upon non-Federal entities.

Exceptions

(a) If any litigation, claim or audit is started records should be kept until such action is resolved and final action taken.

(b) When notified in writing by the Federal awarding agency to extend the period.

(c) Records of real property and equipment acquired with Federal funds must be retained 3 years after final disposition.

(d) If records are transferred to the Federal awarding agency or passthrough entity, the 3 year requirement is not applicable to the non-

Federal entity.

(e) Records of program income after the period of performance if reportable to the sponsor would be kept 3 years after the end of the non-

Federal entities fiscal year in which the program income was earned.

University of Arkansas

Record Retention Policy

Fayetteville campus policy 218.0 has various record retention requirements for different types of documents.

Relevant ones include:

Grant Proposals & Source Documents – active plus

3 years

Patent materials – indefinitely

Grant Accounting records - 5 years

Grant Property records – 5 years

Accounting entry records – indefinitely (electronic)

Selected Items of Cost

Sections 200.420 through 200.475 provide guidelines for selected items of cost which were previously provided in OMB Circular A-21 Section

J.

200.430 Compensation – still requires that the “Non-federal entity’s system of internal controls includes processes to review after-the-fact interim charges made to Federal awards based on budget estimates” (effort reporting).

200.453 Supplies including computing devices – “In the specific case of computing devices, charging as direct costs is allowable for devices that are essential and allocable but not solely dedicated, to the performance of a Federal award.”

200.463 Recruitment costs – Now permits visa costs as allowable direct costs when “critical and necessary to conduct of the project”.

200.474 Travel Costs – New requirement that there must be documentation justifying that “participation of the individual (in the travel) is necessary to the Federal award.” (b)(1)

Subpart F – Audit requirements

200.501 Raises Single Audit threshold to expenditures of $750,000 or more in

Federal awards. May impact whether some of our subrecipients have a Single audit.

Appendix III – F&A Costs and Rate Determinations for Institutions of Higher

Education

This section replaces OMB Circular A-

21 in defining how IHE’s are to prepare and submit IDC rate proposals. It also contains the definitions of the various direct and indirect cost bases discussed in the

Function Code presentation.