HONR289O - Digital Markets Wednesday, 5pm – 7:30pm

advertisement

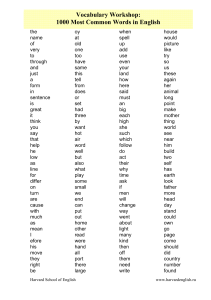

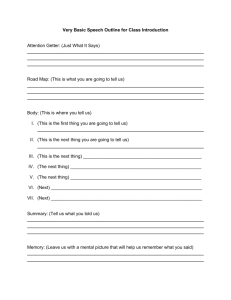

HONR289O - Digital Markets Wednesday, 5pm – 7:30pm Instructor: Dr. Joseph P. Bailey, Department of Decision, Operations and Information Technologies The Robert H. Smith School of Business 4315 Van Munching Hall; College Park, MD; jbailey@rhsmith.umd.edu Office Hours: TBD, and via gchat: joepbailey@gmail.com office: 301.405.3437; cell: 240.464.8096 classroom: TBD Required Materials All required cases and readings are found in the Xanedu Course Pack No. TBD (www.xanedu.com). Please make sure you buy the correct coursepack on the basis of its above-mentioned Xanedu ID; there may be other coursepacks with similar course names or numbers. Additional optional readings are listed in the course schedule if students wish to dive deeper into the course material. Course Description In this course we will examine the question of how to manage digital businesses and markets. As businesses become increasingly buying and selling digital goods, participating in digital markets, and relying on digital information to manage their operations, they often face new challenges. In this course, we will examine some of the characteristics of digital businesses and markets that make them unique and understand how companies can best manage them. Course Format, Assignments, Evaluation and Grading 80% of the grade will be based on your individual effort; the remaining 20% will be based on your group’s collective effort according to the following table: Exams (4 @ 15% each) Group Presentation Peer Evaluation 60% 20% 20% All members of a group will receive the same grade on their respective group assignments. The following text provides more detail. Exams — Individual Grade — 6 @ 10% each There will be four exams throughout the course. Students are to take the exam on the day listed in the syllabus. If a student cannot attend class on the day of the exam, they must provide at least one week’s prior notice for a make-up date. The make-up date must be prior to the date the exam is scheduled. Group Presentation — Group Grade — 20% As shown in the schedule, groups will give a 15 minute presentation on a digital market that is shaping or being shaped by the concepts we cover in this course. The purpose of this assignment is to give you the opportunity to connect the theory and concepts that we have been emphasizing in class with the marketplace and practice of managing digital businesses. More specifically, each group should select a digital market and address the following questions: • • • • • • • What technology is driving this market? Is this digital market winner-take-all? What is/are the platform/s facilitating this market? How are network effects shaping this market? How is technology shaping the value proposition between buyer and seller? How are sellers using the strategies we discussed in class to take advantage of this digital market? How are consumers responding and shaping responding to the sellers’ strategies? A one-paragraph proposal should be submitted through the wiki on the course web site. The group’s PowerPoint slides should address the questions above. In addition to your presentation, please use the slides and speaker notes as your group’s deliverable. The group’s PowerPoint slides are to be posted to the course web site prior to your presentation. There are several sources of information for groups with their research project: Course material Web sites • www.alexa.com (for web traffic data) • www.redherring.com • www.wired.com • www.technologyreview.com • www.techcrunch.com • www.fastcompany.com • Periodicals • • • • • www.cnet.com “Marketplace” section of the WSJ “Business Day” section of the NY Times “Information Technology” section of Business Week “Science and Technology” section of The Economist Past years’ student presentations Peer Evaluation — Individual Grade — 20% Students will be evaluated at the end of the semester by their group members. There will be a question on the course web site similar to this one: Please list your teammates and distribute 100% among them to indicate their level of team participation. Be sure to identify yourself. If there are individuals who received substantially more or less than their fair share, please describe why. Here is an example response: Team Bow Tie 25% Joe (self) 25% Sally 40% Reggie 10% Gus Gus meant well, but was often absent and was unprepared when we met. He hadn’t done the readings and he didn’t meet with us to prepare for our team’s presentation. On the other hand, Reggie was outstanding. He found some incredible data to help us with our research project, he always did the reading, and he helped set up our team meeting times. I look forward to working with Reggie again. I will stay away from Gus. Grading It is important to recognize that a grade reflects another’s evaluation and judgment of your work. I will seek to ensure that grading is fair and consistent for all students. Class Format Please be sure to complete the readings before class. Students are expected to come to class prepared (for both cases and readings) and ready to contribute. In most classes, there will be an in-class simulation or “game” to help demonstrate course concepts. These “games” are a vital learning tool because it allows student groups to make pricing decisions within a digital market context. Inclement Weather Policy Any class cancellations due to inclement weather will be determined by the Smith School and the University of Maryland. Students should check the University’s main web site (www.umd.edu) or call 301.405.SNOW for the latest information. Special Administrative Considerations Accommodations Any student in this course who has a disability that may prevent him or her from fully demonstrating his or her abilities should contact me personally as soon as possible, but not later than the second week of class so we can discuss accommodations necessary to ensure full participation and facilitate your educational opportunities. Academic Integrity The University’s Code of Academic Integrity is designed to ensure that the principles of academic honesty and integrity are upheld. All students are expected to adhere to this Code. The Smith School does not tolerate academic dishonesty. All acts of academic dishonesty will be dealt with in accordance with the provisions of this code. Please visit the following website for more information on the University’s Code of Academic Integrity: http://www.studenthonorcouncil.umd.edu/code.html On each exam or assignment you will be asked to write out and sign the following pledge. “I pledge on my honor that I have not given or received any unauthorized assistance on this exam/assignment.” Course Schedule Week 1: Lesson 1: Winner-Take-All-Markets Required: “Winner-Take-All in Networked Markets.” Eisenmann, Thomas R. Case No. 9-806-131. Published 02/21/2006, Revised 09/18/2007. Harvard Business School Publishing, (15 pages). Optional: The Tipping Point: How Little Things Can Make a Big Difference, Gladwell, Malcolm, Back Bay Books, 2002. Week 2: Lesson 2: Information Goods Required: “eReading: Amazon’s Kindle.” Anand, Bharat N.; Tripsas, Mary; Olson, Peter W. Case No. 9-709-486. Published 02/27/2009, Revised 12/09/2009. Harvard Business School, (14 pages). Optional: Information Rules: A Strategic Guide to the Networked Economy, Shapiro, Carl and Varian, Hal, Harvard Business Press, 1998. Week 3: Lesson 3: Network Effects Required: “What Is a Free Customer Worth?” Gupta, Sunil; Mela, Carl F. In Harvard Business Review, Case No. R0811G. Published 11/01/2008, Harvard Business School Publishing, (8 pages). Optional: Free: The Future of a Radical Price, Anderson, Chris, Hyperion, 2009. Week 4: Lesson 4: Versioning & Bundling Exam 1 Required: “TripAdvisor” Gupta, Sunil and Herman, Kerry, Harvard Business School Case 9-511004, Published 1/24/2011, Revised 4/14/2011, (19 pages). Optional: The Long Tail: Why the Future of Business is Selling Less of More, by Chris Anderson, Hyperion, 2006. Week 5: Lesson 5: Lock-In Group presentation proposal due Required: “Lock-In Strategies: A New Value Proposition.” Kaplan, Robert S.; Norton, David P. In Balanced Scorecard Report, Case No. B0309A. Published 09/15/2003, Harvard Business School Publishing, (6 pages). Optional: Exit, Voice, and Loyalty: Responses to Decline in Firms, Organizations, and States, by Albert O. Hirschman, Harvard University Press, 1970. Week 6: Lesson 6: Innovation Required: “Google Inc.,” Edelman, Benjamin; Eisenmann, Thomas; Harvard Business School; Published 01/28/2010, Revised 4/11/2011; (21 pages) Optional: Googled: The End of the World As We Know It, by Ken Auletta, Penguin Press, 2009. Week 7: Lesson 7: Two-Sided Markets Exam 2 Required: “Strategies for Two-Sided Markets (HBR OnPoint Enhanced Edition).” Eisenmann, Thomas; Parker, Geoffrey; Van Alstyne, Marshall W. In HBR OnPoint, Case No. 1463. Published 10/01/2006, Harvard Business School Publishing, (12 pages). Optional: Invisible Engines, by David S. Evans, Andrei Hagiu, and Richard Schmalensee, MIT Press, 2008. Full-text available for free on the web: http://mitpress.mit.edu/catalog/item/default.asp?ttype=2&tid=10937 Week 8: Lesson 8: Platform Design Required: “Facebook” Piskorski, Mikolaj Jan, Eisenmann, Thomas; Chen, David; Feinstein, Brian. Case No. 9-808-128. Published 03/18/2008, Revised 10/28/2011. Harvard Business School Publishing, (29 pages). Optional: The Facebook Era, by Clara Shih, Prentice Hall, 2009. Week 9: Lesson 9: Platform Competition Required: “The Last DVD Format War?” Hagiu, Andrei. Case No. 9-710-443. Published 11/22/2009, Revised 9/16/2011. Harvard Business School, (5 pages). Optional: “Competition, Compatibility and Standards: The Economics of Horses, Penguins and Lemmings,” by Joseph Farrell and Garth Saloner, University of California Berkeley, Department of Economics, 1986. Week 10: Lesson 10: Public Goods Exam 3 Required: “Pandora: Royalties Kill the Web Radio Star? (A).” Pozen, Robert C.; Rosenfeld, Alex. Case No. 9-310-026. Published 08/06/2009, Revised 1/12/2012. Harvard Business School, (21 pages). Optional: The Wisdom of Crowds, by James Surowiecki, Anchor, 2005. Week 11: Student Group Presentations During this class, student groups will present. Week 12: Lesson 11: Government Required: “EU Verdict Against Microsoft.” Yoffie, David B.; Slind, Michael. Case No. 9-706-503. Published 05/03/2006, Revised 10/11/2007. Harvard Business School Publishing, (7 pages). Optional: The Future of Ideas: The Fate of the Commons in a Connected World, by Lawrence Lessig, Random House, 2001. Week 13: The Future of Electronic Markets Exam 4 Required: “How to Thrive in Turbulent Markets.” Sull, Donald. In Harvard Business Review, Case No. R0902F. Published 02/01/2009, Harvard Business School Publishing, (12 pages). Optional: “Predicting the Present with Google Trends,” by Hyunyoung Choi and Hal Varian, Google, 2009.