Diapositive 1 - Safety Groups

advertisement

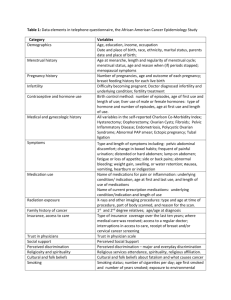

Imerys • Imerys of France purchased Rio Tinto’s talc operations on August 1st. • Imerys mines rare resources and turns them into specialities that improve the products and processes of its customers in industry and construction. • Imerys has an unmatched portfolio of resources in items of diversity and geographic balance and an excellent grasp of large-scale mineral conversion technologies. • Its innovation capability enables it to design high value-added solutions for its customers. Imerys, Luzenac Group • With an annual production of one million tonnes, Luzenac Group is the world leader in talc processing with total market share of approximately 15%. Imerys therefore broadens its functional offering for technical applications and in a wide range of industrial markets. • Thanks to its lightness and strength in Plastics & Polymers, talc can be used to reduce vehicle weight, for example: • Incorporated as a filler, it improves the quality of Paints & Coatings, through its matting, anti-corrosion, anti-cracking and anti-mold properties. • Used in the Paper-making process, it makes recycled paper whiter, in particular; Talc’s also contributes to other applications. Its thermal resistance and mechanical strength allows Ceramics manufacturers to lower their firing temperatures and limits thermal distortion. • Talc also improves quality of Health and Beauty Products. The Ontario Operations Penhorwood Mine – Open Pit with Stockpiles Timmins Micronizing Mill – Fine Grinding Mill Penhorwood Concentrator Facility – Flotation Plant Foleyet Loadout Facility – CN Rail Bulk Railcar Loading Facility Our Rich History • • • • • • • • • Mine and Micronizing plant located in Northern Ontario some 450 miles north of Toronto Opened in 1974 by John’s Manville, acquired by Steetley Talc in 1978, Luzenac in 1988 and then amalgamated with Luzenac America and Rio Tinto Major expansion in 1986, 1992, 1998, 2000 Started in pitch control, Expanded in paints with the Artic Mist Expanded in the polymers with JetFil line Expanded in ceramics Presently Timmins- Penhorwood – Foleyet 2011 Imerys purchased the worldwide talc operations Our Rich History Every Talc is Different! Penhorwood Operation Contract Mining 8 to 10 weeks per year Hazemag Impact Crusher Wet Grind ball mills Flotation circuit Propane fired Drying Three bulk silos and truck to Timmins ACM grinding mill Bulk Silo Truck to Timmins or Foleyet Timmins Micronizing Mill Two Bulk silos Primary Grinding Primary Grinding PT-9 Jet Mills, ACM PT-9 Jet Mills, Amvest, Hammer Mill Six Bulk silos Pellet Mills Semi-automatic Packaging Bulk Packaging Ship to Foleyet/ customer Shipping Semi-Bulk Packaging Manual Packaging Today's Applications for Talc Fascinating Facts About Talc • Talc is a rock formed over many millions of years. It is water repellent, inert, platy and the softest mineral on Earth. • 15,000 years ago, cave dwellers used talc as an ingredient in their paints. • The Chinese were already using talc in glazed pottery (618 to 907). • Talc has been used in cosmetics for thousands of years. The ancient Egyptians and the Vedics of India were using it to lighten their skins as much as five thousand years ago. Around the same time, the Chinese were making face powders from rice powder mixed with ground minerals such as talc and kaolin. • There are hundreds of talc deposits of various sizes in activity throughout the world. Each talc deposit has its own features, its own geological signature. Talc can be white, grey, pink, blue, violet, green and even black. • Talc is used in the manufacture of a myriad of everyday products including animal feed, automobiles, cables, sweets, ceramic tiles, chewing gum, cosmetics, fertilizers, foundry technology, olive oil processing, paint, paper, pharmaceuticals, plaster, plastics, printing inks, putties, refractories, roofing, sanitary ware, tyres and of course body powder. Leading supplier of industrial minerals d High value-added specialties essential to a wide range of industrial sectors Logistic Mining Logistic Process: Beneficiate & Transform 11 Consumer goods 45%(1) d Numerous applications for daily life Fused aluminum oxide for optical glass polishing Diatomite to filter beer and wine Kaolin for coated advertising papers Carbonates for baby diapers Clay bodies for tableware Graphite for batteries etc… 12 Building renovation & maintenance 15%(1) New construction 16%(1) d Variety of applications and products for construction Red clay for roof tiles and bricks in France Talc for paints Bodies for tiles & sanitary ware Fused aluminum oxide for polishing walls Carbonates additives for windows' PVC profiles etc… 13 (1) Imerys estimates – in % of 2010 consolidated net sales Industrial goods 24%(1) d Plenty of industrial applications Refractory linings for high temperature manufacturing processes Fused minerals for abrasives Carbonates, talc for industrial plastics Graphite for lubrication applications High purity quartz crucibles for photovoltaic cells Zirconia based oxygen sensors etc… 14 (1) Imerys estimates – in % of 2010 consolidated net sales Minerals for Ceramics, Refractories, Abrasives & Foundry d Four businesses Minerals for Ceramics (29% of 2010 sales) : products of raw materials and bodies for tableware, sanitary and floor tiles, quartz Minerals for Refractories and Oilfields (27%): production of acidic refractory minerals as andalousite, chamottes and specialties for oilfield industry Fused Minerals (36%): fused alumina and bauxite for cutting, grinding and polishing mills, sand papers, fused zirconia Graphite & Carbone (8%): high performance graphite powder for the mobile energy, engineering, refractory markets 15 Pigments for Paper & Packaging d d The world’s broadest range of white pigments Kaolin zones: Cornwall (UK), Georgia (USA) and the Amazon delta (Brazil) A global platform for the production of ground calcium carbonate (GCC): Europe, Americas, Asia/Pacific Various PCC production sites A dedicated business group to answer the fast-changing needs of global paper customers Europe (46% of 2010 sales) North America (28%) Mercosur (8%) Asia-Pacific (18%) 16 Performance & Filtration Minerals d d Two businesses Performance Minerals (56% of 2010 sales): mineral additives for paint, plastics, adhesives , sealants… Minerals for Filtration (44%) : diatomite and perlite for edible liquids filtration (beer, wine, edible oils,…) A wide range of raw materials with many matching characteristics... Carbonates clays, kaolin, mica, feldspar, Diatomite, perlite, vermiculite 17 Materials & Monolithics d d Building Materials (44% of 2010 sales): Clay roof tiles, bricks and chimney blocks Natural slates Refractories Solutions (56%): Monolithic refractory: concrete used used in numerous industries: such as cement factories, power stations, petrochemistry, incinerators, casting plants and industrial furnaces; Kiln furniture for the tiles and ceramics industries 18 Diversified markets(1) Europe North America Others (incl. 26% in emerging countries) 45% 18% 12% 15% Consumer Goods 24% 11% 5% 8% Industrial Equipment 16% 10% 2% 4% New Construction 15% 9% 2% 4% Renovation 48% 21% 31% 19 (1) Imerys estimates – in % of 2010 consolidated sales A large customer base d The Group’s 10 biggest customers account for 15% of its sales d None of them represent more than 3% of total sales 20 Based on 2010 figures Reserves and mining (2/2) d 30 minerals 116 mining sites(1) d 115 geologists all around the world d Almost 600 Mt of reserves with at least a 20-year horizon d Ongoing development of mineral reserves d State-of-the-art mining and manufacturing techniques d Ongoing site restoration program with objective and resources (exploration, mining, acquisitions of new deposits) Reporting compliant with the PERC code and reviewed by the Audit Committee of minimizing ecological footprint 21 (1) A mining site may include several mines or quarries. Sustainable Development (1/2) d Environment: environment-friendly activity management; responsible use of mineral reserves d Health & Safety: guarantee the health and safety of employees in the workplace d Human Resources development: social benefits, ongoing training and industrial dialog as the basis for sustainable growth d Community relations: the Group acts as a full member of every community where it is based d Innovation: energy efficiency and emission reductions factored into work on process and product development d Governance: best practices applied in strict compliance with transparency and ethical rules 22 Sustainable Development (2/2) d Safety 7.96 d - 82% decrease in frequency rate(1) since 2005 5.69 4.65 2.88 Environnement d Frequency rate(1) 11.79 Generalization of environmental management systems 2005 (1) 2006 2007 2008 2009 2.13 2010 Number of lost-time accidents x 1,000,000/number of work hours 160 sites are equipped with an EMS as of 12/31/10 Eco Bos Project Eco town to be developed on former mining and industrial sites in Cornwall 23 Accelerate development through innovation d d Global network of 270 engineers and technicians d Sustained effort coordinated by the Innovation Department d New products, applications and processes d 24 research centers : 7 main research centers (UK, USA, France, Austria, Switzerland) and 17 regional laboratories • Application R&D : renewal of the offering and development of our customers performance • Disruptive innovations entering new markets On average, R&D expenses account for about 1% of Group sales 24 Global presence d Worldwide locations of reserves and industrial sites • Europe (France, Italy, Spain, Austria, Belgium) • North America (United States, Canada) • Asia-Pacific (Japan, Australia) Sales by geographic zone(1) Japan/ Australia 4% Emerging countries 14% North America 28% Europe 54% d d Industrial site Headquarter More than 20 years’ mineral reserves and resources Modern industrial assets (1) non-audited estimate 25 Imerys d 2010 Key figures Sales €3,347 million Operating margin 12.5% d 15,090 employees in 47 countries More than 240 industrial facilities ROCE 7 main research 13.0% centers Listed on NYSE Euronext Paris stock market Market capitalization: €3.4 billion (September 2011) General mining sector 26 Headcount evolution Emerging countries 41% Western Europe 44% (of which China: 12 %) (of which France: 20 % UK: 8%) Japan/ Australia 1% United States/ Canada 14% 17,552 17,016 14,592 2007 2008 2009 15,090 2010 27