Notes Chapters 2

advertisement

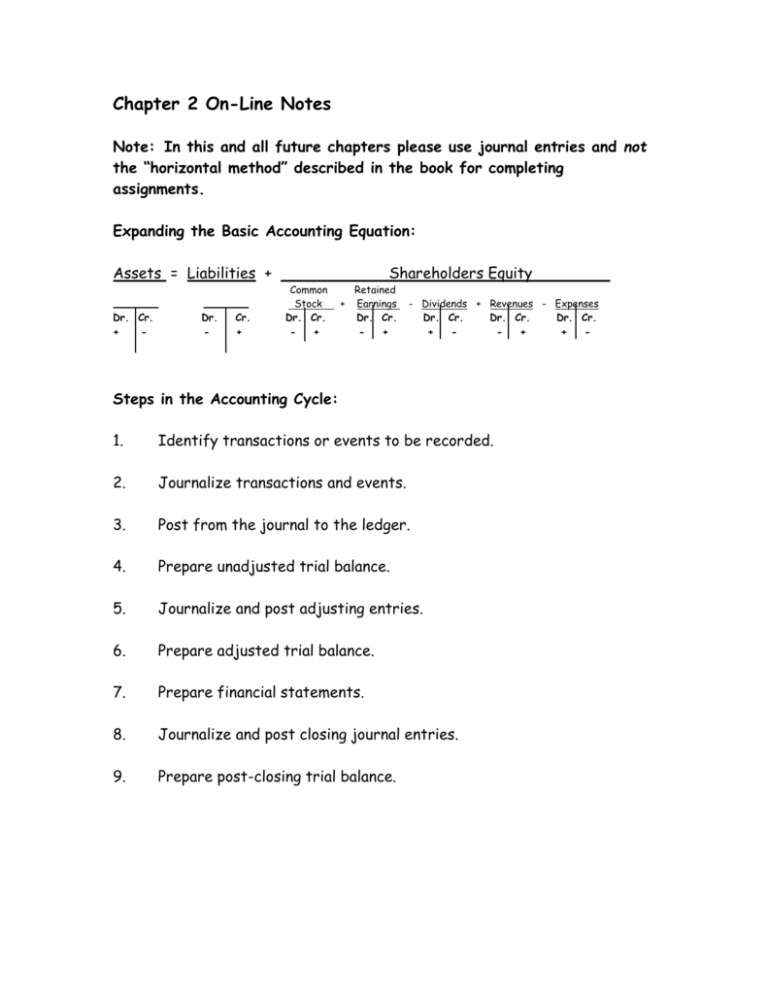

Chapter 2 On-Line Notes Note: In this and all future chapters please use journal entries and not the “horizontal method” described in the book for completing assignments. Expanding the Basic Accounting Equation: Assets = Liabilities + Dr. Cr. + - Dr. - Cr. + Common Stock Dr. Cr. + Shareholders Equity Retained + Earnings Dr. Cr. + - Dividends + Revenues - Expenses Dr. Cr. Dr. Cr. Dr. Cr. + + + - Steps in the Accounting Cycle: 1. Identify transactions or events to be recorded. 2. Journalize transactions and events. 3. Post from the journal to the ledger. 4. Prepare unadjusted trial balance. 5. Journalize and post adjusting entries. 6. Prepare adjusted trial balance. 7. Prepare financial statements. 8. Journalize and post closing journal entries. 9. Prepare post-closing trial balance. Accounting for Inventories a. Perpetual inventory systems. The Inventory account is not adjusted at year-end. Inventory records are maintained on an on-going (perpetual) basis rather than on a periodic (e.g., once-per-year) basis (i.e., counting the inventory once per year). The Cost of Goods Sold account is closed to the Income Summary account. b. Periodic inventory systems. The Inventory account is adjusted to reflect the year-end balance, and the related purchases accounts are closed to the Cost of Goods Sold account. Inventory records are not maintained on an ongoing basis. Procedures and the Double-Entry Recording Process The accounting process can be described as a set of procedures used in identifying, recording, classifying, and interpreting information related to the transactions and other events of a business enterprise. To understand the accounting process, one must be aware of the basic terminology employed in the process. The basic terminology includes: events, transactions, real accounts, nominal accounts, ledger, journal, posting, trial balance, adjusting entries, financial statements, and closing entries. These terms refer to the various activities that make up the accounting cycle and are discussed in greater detail below. Double-entry accounting refers to the process used in recording transactions. The terms debit and credit are used in the accounting process to indicate the effect a transaction has on account balances. Also, the debit side of any account is the left side; the right side is the credit side. Assets and expenses are increased by debits and decreased by credits. Liabilities, owners' equity, and revenues are decreased by debits and increased by credits. The Accounting Cycle In a double-entry system, for every debit there must be a credit and vice-versa. This leads us, then, to the basic equation in accounting: Assets = Liabilities + Stockholders' Equity. The first step in the accounting cycle is analysis of transactions and selected other events. The purpose of this analysis is to determine which events represent transactions that should be recorded. Events can be classified as external or internal. External events are those between the enterprise and its environment, whereas internal events relate to transactions totally within the enterprise. Journalizing Transactions are initially recorded in a journal, sometimes referred to as the book of original entry. A general journal is merely a chronological listing of transactions expressed in terms of debits and credits to particular accounts. No distinction is made in a general journal concerning the type of transaction involved. In addition to a general journal, specialized journals are used to accumulate transactions possessing common characteristics. Posting The next step in the accounting cycle involves transferring amounts entered in the journal to the general ledger. The ledger is a book that usually contains a separate page for each account. Transferring amounts from a journal to the ledger is called posting. Transactions recorded in a general journal must be posted individually, whereas entries made in specialized journals are generally posted by columnar total. Trial Balance The next step in the accounting cycle is the preparation of a trial balance. A trial balance is a list of all open accounts in the general ledger and their balances. An entity may prepare a trial balance at any time in the accounting cycle. A trial balance prepared after posting has been completed serves to check the mechanical accuracy of the posting process and provides a listing of accounts to be used in preparing financial statements. Chapter 3 On-line Notes Adjusting Entries Preparation of adjusting journal entries is the next step in the accounting cycle. Adjusting entries are entries made at the end of accounting periods to bring all accounts up to date on an accrual accounting basis so that correct financial statements can be prepared. Adjusting entries are necessary to achieve a proper matching of revenues and expenses in the determination of net income for the current period and to achieve an accurate statement of the assets and equities existing at the end of the period. One common characteristic of adjusting entries is that they affect at least one real account (asset, liability, or equity account) and one nominal account (revenue or expense account). Adjusting entries can be classified as: prepaid expenses, unearned revenues, accrued revenues, and accrued expenses. Prepaid expenses and unearned revenues refer to situations where cash has been paid or received but the corresponding expense or revenue will not be recognized until a future period. Accrued revenues and accrued expenses are revenues and expenses recognized in the current period for which the corresponding payment or receipt of cash is to occur in a future period. Estimated items are expenses such as bad debts and depreciation whose amounts are a function of unknown future events or developments. Adjusted Trial Balance After adjusting entries are recorded and posted, an adjusted trial balance is prepared. This trial balance serves as a basis for the preparation of the financial statements discussed in the next two chapters. Closing-Basic Process After financial statements have been prepared, nominal (revenues and expenses) accounts should be reduced to zero in preparation for recording the transactions of the next period. This closing process requires recording and posting of closing entries. All nominal accounts are reduced to zero by closing them through the Income Summary account. The net balance in the Income Summary account is equal to net income or net loss for the period. The net income or net loss for the period is transferred to owners' equity by closing the Income Summary account to Retained Earnings. Post-Closing Trial Balance A third trial balance may be prepared after the closing entries are recorded and posted. This post-closing trial balance shows that equal debits and credits have been posted properly to the Income Summary account. Closing Inventory and Related Accounts When inventory records are maintained on other than a perpetual basis, an adjustment is usually needed to reflect the difference between the beginning and ending inventory. This year-end inventory adjustment eliminates all nominal accounts related to the purchase of inventory by transferring them to Cost of Goods Sold. The adjustment also eliminates the beginning inventory amount and establishes the amount of ending inventory to be included on the balance sheet. A typical inventory adjusting entry would include debits and credits to the following accounts: Dr. Cr. Inventory (ending) XX,XXX Purchase Discounts X,XXX Purchase Returns and Allowances X,XXX Cost of Goods Sold XXX,XXX Inventory (beginning) Purchases Transportation-In XX,XXX XXX,XXX X,XXX In summary, the steps in the accounting cycle performed every fiscal period are as follows: a. Enter the transactions of the period in appropriate journals. b. Post from the journals to the ledger (or ledgers). c. Take an unadjusted trial balance. d. Prepare adjusting journal entries and post them to the ledger(s). e. Take a trial balance after adjusting (adjusted balance). f. Prepare the financial statements from the second trial balance. g. Prepare closing journal entries and post them to the ledger(s). h. Take a trial balance after closing (post-closing trial balance). i. Prepare reversing entries and post them to the ledger(s). (Optional step-see appendix) Chapter 4 On-line Notes Work Sheet A multicolumn (8, 10, 12, etc.) work sheet serves as an aid to the accountant in adjusting the account balances and preparing the financial statements. The work sheet provides an orderly format for the accumulation of information necessary for preparation of financial statements. Use of a work sheet does not replace any financial statements, nor does it alter any of the steps in the accounting cycle. An Example of Recording Transactions and Preparing Adjusting Journal Entries: Kwik Window Cleaning Service, Inc., began operations on April 1 of the current year. Transactions for April are as follows: Apr. 1 2 2 3 5 12 18 29 30 30 30 Issued 380 shares of $50 par value capital stock to initial investors for $19,000 cash. Purchased two used trucks for a total of $8,000, paying $3,000 in cash with the balance due in 60 days. Purchased ladders, scaffolding, and other equipment for $1,400 cash. Paid two-year premium on liability insurance, $600. Purchased supplies on account, $850. Billed customers for service, $2,900. Collected $1,700 on account from customers. Paid bill for truck fuel used in April, $190. Paid April newspaper advertising, $50. Paid wages of employees, $1,600. Billed customers for services, $1,850. Required: a. Record the above transactions in general journal form. b. Prepare adjusting journal entries to adjust the books for insurance expense, supplies expense, depreciation expense on trucks, depreciation expense on equipment, and income tax expense based on the following information: i. ii. Supplies on hand on April 30 amounted to $180. Depreciation for April was $150 on trucks and $45 on equipment. iii. Income taxes for the month are estimated at $350. Solution: Part a: Apr. 1 Cash 19,000 Capital Stock 19,000 Issued 380 shares of $50 par value stock for cash. (380 shares x $50 per share.) 2 Trucks 8,000 Cash 3,000 Accounts Payable 5,000 Purchased two trucks, $3,000 down, remainder due in 60 days. 2 Equipment 1,400 Cash Purchased scaffolding and other equipment. 3 Prepaid Insurance 600 Cash Paid two-year premium on liability insurance policy. 600 Supplies on Hand Accounts Payable Purchased supplies on account. 850 5 850 12 Accounts Receivable Service Fees Billed customers for service. 2,900 18 Cash 1,700 Accounts Receivable Collections on account from customers 1,400 2,900 1,700 29 30 Fuel Expense Cash Paid truck fuel bill for April. Advertising Expense Cash Paid for April newspaper advertising. 190 190 50 50 30 Wages Expense Cash Paid employees’ wages. 1,600 30 Accounts Receivable Service Fees Billed customers for service. 1,850 1,600 1,850 Part b: Apr. 30 Insurance Expense Prepaid Insurance To record insurance expense for April. 25 25 30 Supplies Expense Supplies on Hand To record supplies expense for April. 670 30 Depreciation Expense—Trucks 150 Accumulated Depr.—Trucks To record April depreciation on trucks. 150 30 Depreciation Expense—Equipment 45 Accumulated Depr.—Equipment To record April depreciation on equipment. 45 30 Income Tax Expense 350 Income Tax Payable To record estimated income taxes for April. 350 670 Kwik Window Cleaning Service Worksheet Description Unadjusted Trial Balance Dr. Cash Accounts Receivable Supplies on Hand Prepaid Insurance Cr. 850 670 600 25 Equipment 1,400 Accounts Payable Capital Stock Service Fees Wages Expense Dr. 3,050 8,000 Advertising Expense Adjusted Trial Balance Cr. 13,860 Trucks Fuel Expense Adjustments Dr. Income Statement Cr. Dr. Cr. Balance Sheet Dr. Cr. 13,860 13,860 3,050 3,050 180 180 575 575 8,000 8,000 1,400 1,400 5,850 5,850 5,850 19,000 19,000 19,000 4,750 4,750 190 190 4,750 190 50 50 50 1,600 1,600 1,600 Supplies Expense 670 670 670 Depreciation Exp.--Trucks 150 150 150 Depr. Exp.— Equip. 45 45 45 Insurance Expense 25 25 25 350 350 350 Income Tax Expense Acc. Depr.-Trucks 45 45 45 Acc. Depr.-Equip. 150 150 150 Income Tax Payable Subtotals 350 350 29,600 29600 1240 1240 30,145 30145 29,600 29600 1240 1240 30,145 30145 Net Income Totals 350 3080 4,750 27,065 25395 4,750 27065 27065 1,670 4,750 1,670