- Syneratio

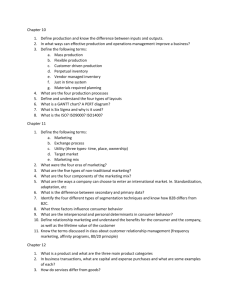

Summary Midterm Marketing Communication

Literature:

chapters 5, 6, 8, and 9 in the De Pelsmacker et al handbook & Internet questions take aways.

Chapter 5: Objectives

Marketing objectives are formulated to contribute to the overall company goals, like applying the correct communications, media mix, strategy development, budgeting and R&D goals. Campaigns are successful when their objectives are met. A good set of communication goals:

fits in with the overall company and marketing goals.

-

Is relevant to the identified problems and specific to cope with threats or to build on opportunities in the market.

-

Is targeted differently to different target audiences.

-

Is quantified in order to be measurable, which allows precise evaluation.

-

Is comprehensive and motivating to all involved persons, but at the same time realistic and achievable.

-

Is timed to enable specific scheduling of the campaign as well as planning of results evaluation.

-

Is translated into sub-goals when necessary.

§1. A hierarchy of marketing communications objectives

Marketing communications should be divided into the following categories:

-

Reach goals, which are about reaching the target group effective and efficiently.

-

Process goals, which means that communications should be processed and remembered. They should be set before communications can be effective.

-

Effectiveness goals

A model to define communication goals is the DAGMAR model (Defining Advertising Goals for

Measured Advertising Results). Consumers pass through the following stages respectively during purchasing decisions according to the model:

1.

Category need: Companies alert customers of their presence in the category, their points of parity and their points of difference.

2.

Brand awareness: The association of physical characteristics with a category need. Top-ofmind brand awareness refers to prototype brands (Coca Cola), and brand recall refers to coming up with several brands simultaneously. Brand recognition occurs when a package, symbol or slogan is recognized.

3.

Brand knowledge/comprehension: customers are aware of the most essential brand characteristics, features and benefits, preferably also of brand positioning.

4.

Brand attitude: The result of evaluating different brands within 1 product category, resulting in a perceived added value to the customer.

5.

Brand purchase intention: Under low involvement, companies won’t need to intervene.

Though, under high involvement (e.g. risk), communication is needed.

6.

Purchase facilitation: Remove barriers to purchase.

7.

Purchase

8.

Satisfaction: will lead to re-purchasing. It is important for marketers to guide the word-ofmouth behavior that arises after (dis) satisfaction.

9.

Brand loyalty: relation between the customer and a brand, not to be confused with habitual purchasing or repeat purchasing.

Critics: Customers don’t necessarily have feelings of desire before purchase. Nowadays, ATR is used more often: Awareness

Trial of products

Reinforcement towards purchasing.

§2. Stages in the product life cycle and marketing communications objectives

During introduction stage of the product life cycle, companies should focus on creating category needs, brand awareness and brand knowledge. The basic selling points and central functional advantages of the product have to be stressed. Critically important is also to stress the points of difference, and most of all making customers believe these points.

In growth stage, the customer is aware of most brands in the category. Therefore, defending the brand position becomes most important. Brand attitudes and preferences will stimulate the competitive position of a brand.

Under maturity, competition is heavy and markets don’t grow anymore. Therefore, brand loyalty and customer satisfaction become very important. In addition, psycho-social experiences, brand awareness and points of differentiation will help surviving.

In the decline stage, product sales decline. The focus is now on communicating product adaption or change, drawing attention to new moments of use, approaching new target groups, and increasing the frequency of use.

§3. Consumer choice situation might affect effectiveness of communications objectives

1.

Choice process: highly involved customers will orientate and process longer.

2.

Consumer characteristics: experience, knowledge, socio-economic characteristics.

3.

Consumer/product relationships: engagement and frequency of purchasing.

4.

Point-of-purchase characteristics

5.

Advice involved with purchase, personal advice has a big influence.

6.

Product characteristics: daily sales, existing brands, speciality goods.

Different type of products / services arise based on the previous variables, namely: Standard mass products, Standard services, Mail order products, impulse products, Quality products, Quality services,

International Luxury products, Special niche products, Products with new techniques, Investment products and Unsought products. Each type has its own communication strategy (see page 182/183).

§4. Corporate communications objectives

The goals of communication strategies will have to be in line with the gap between the intended corporate identity and the perceived external image. After extensive analysis, this gap should become apparent. When the image differs from the identity, the reality has to be changed first. This means that negative aspects of the company (perceived image), have to be changed first before improvement can be communicated. Adjustments that could be made to reality are:

1.

Improve internal corporate culture through internal communications, mainly explaining what is going wrong internally.

2.

Improving corporate awareness: often the first necessary step in the development of a corporate image.

3.

Renaming the company. This requires intensive internal corporate communication when corporate structure and strategy are changed.

4.

Integrating companies is difficult since two companies with different target groups, cultures and identities will merge. Communications will have to combine the best of both companies, and add something extra.

5.

Changing or introducing new strategies will require communication to all audiences.

6.

Creating goodwill is considered long-term image building for a stable and favorable corporate image.

§5: Additional Notes and Pearson website findings (that are not mentioned above):

-

Coverage goals are related to target group definition and media reach. They only assure sufficient exposure.

-

To allow evaluation of campaigns, objectives should be quantified.

-

Category needs can not be ignored as a communication objective.

-

According to the DAGMAR model brand attitude objectives should be present after creating brand awareness.

-

Purchase intention is a better metric to measure loyalty among light users than among heavy users.

-

The following statement is incorrect: the weak theory of communications stresses that consumers first try a product and then increase their brand awareness.

-

Communication budget does not affect communication objectives, consumer involvement with the product, product type and the brand life cycle do.

-

All communication goals should not necessarily be presented in the communication plan.

-

Showing product packages will stimulate brand recognition.

-

Consumer choice situations influence the choice of objectives.

-

Be advised that all questions on the pearson website ask whether statements are not true. This will probably also be done in the test if our teacher literally copies these questions.

-

Chapter 6: Budgets

Companies tend to cut on expenses that influence them in the short term. Communication budgets are therefore often the victim. Since communication returns are difficult to assess, what budget to allocate?

§1: How communications budgets affect sales

Concave

Sales response models depict the relationship between sales and communication efforts. These are often “concave” or “S” shaped, diminishing as the communication efforts increase, since the amount of potential buyers is always limited. Therefore it makes no sense to spend millions on communication efforts, because there is no gain when everyone is already informed. Moreover, in an S-shaped model, it takes a while before communication efforts start to pay off. Such models are difficult to set up since communication activities aren’t the only things that influence sales, namely also distribution, prices and other decisions. In addition, competitive forces aren’t taken into account.

S-Shaped

Finally, it is difficult to incorporate both the long and short-term effects of communication efforts into models. Traditional theories consider communications as a long-term investment in goodwill, making long-term effects much higher than short-term. John Philip Jones criticizes this traditional view by pointing out that traditional analyses were incapable of recording short-term effects. By setting up the STAS differential, he discovered that 70% of all ad campaigns were able to generate immediate, small, temporary, short-term advertising effects. In contrast, 46% of brands created long term effects (more market share 1 year after the campaign). Furthermore, he found out that the first exposure of an ad causes the largest part of sales return, while later exposure has smaller effects. In reality, both short/long-term effects are important.

§2: 7 Communications budgeting methods:

1.

Marginal Analysis: Investments are made when they are compensated by higher extra returns.

Communication expenditures are plotted against sales and gross margin. Profit is calculated as the difference between gross margin and communication expenditures. The optimum in terms of profit is usually located where gross margin stops increasing drastically as communication expenditures grow. This is a very theoretical method, difficult to estimate in reality.

2.

Inertia: Simply keeping budgets constant year on year. Not really strategic.

3.

Arbitrary allocation: Whatever the general manager or managing director decides will be implemented. Lacks critical analysis and overall strategy.

4.

Affordability method: Whatever budget is left after spending the regular operating costs is invested in communications. Used by SMEs that barely need marketing communications.

5.

Percentage of Sales: budgets are defined as a percentage of projected sales of the next year.

Easy to use and therefore very popular. Criticism: Communication budgets should not be the result of sales but should rather create demand and thereby stimulate sales. Taking a percentage of last year’s sales or even of the projected profits is not advised.

6.

Competitive parity: Base your upcoming budget on the previous budget of competitors, i.e. copying. This will avoid over or under investment, and is often used in fast-moving consumer goods markets, where sales are believed to be highly influenced by advertising and communications spending. Critics: it is assumed that the competitors set their budget efficient and effectively, and that all competitors have the same financial and operational structure.

Share of Voice: a company’s communications budget as a share of the market’s communications budget. Comparing a company’s SOV to competitors identifies minimal required Share of Voice (usually 5% below average). Strategies for different market positions:

7. Objective and Task method: Calculates what budget is needed to reach planned goals.

Superior to all other methods.

§3: Factors influencing budgets

1. Market size: smaller markets are easier to reach.

2. Market potential: preferably invest in markets with high potential.

3. Market Share: New brands that need market share require more budget than mature brands.

4. Contingencies/change: see crisis.

5. Economies of scale: Larger companies can possibly benefit from economies of scale.

6. Organizational characteristics like structure, experience and number of experts.

7. Planning gap: Be careful with cutting budgets when profits are disappointing. On the short-term this gives profit, but in the long-term it won’t.

8. Crisis: Disasters will require unforeseen spendings.

9. Unexpected opportunities / threats: can change strategic plans.

A lot of companies cut communications budgets in periods of recession. This provides great opportunities for companies that are willing to actually increase their communication efforts.

§4: Budgeting for new brands or products

Branding a new product within an established product category is a common task, but very difficult.

The objective and task model should be the primary budgeting method, despite a lack of historical data and possible risk.

A second approach is looking at the advertising to sales ratio (A/S), Once established, try to double the industry average percentage in the first year, simply to make an impact. In the 2 nd year, 50% more than average should be sufficient.

A 3 rd approach, the Peckham’s 1,5 rule, recommends setting the Share of Voice of the brand at 1,5 times the desired Share of Market at the end of the brand’s first two years. Sadly, SoV and SoM are often highly correlated which makes this approach difficult to sustain.

On average, a new entrant gains 0.71 times the market share of the previous market entrant (0.92 for fast-moving consumer products). Overcoming this order of entry effect can be achieved with superior quality, large advertising spending, or better advertising quality.

§5: Additional Notes and Pearson website findings (that are not mentioned above):

-

Additional critics on the competitive parity budgeting method: o It is based on the past o It only takes promotional budgets into account

-

Experimental budgeting methods are hard to keep reliable and accurate.

SoV is lower than the SoM of a market leader and Niche player. For followers, it’s the other way around. Brands with a higher SoM than SoV are called profit taking brands. Brands with the opposite relation are investment brands.

-

Penetration supercharge is NOT the tendency to invest in communications to increase market share.

-

Budgeting methods most used in the US:

-

Anti-cycle budgeting will not influence communication budget.

Chapter 8: Media Planning

Media planning is a matter of selecting the appropriate media distribution channels, and calculating and comparing technical issues such as frequency, reach, weight, cost and continuity

§1: The media planning process

A media plan specifies which media and vehicles will be purchased when, at what price and with what expected results. Just as marketing plans require an environmental analysis, communications environment analysis is required for a media plan. It consists of the following steps:

1.

Assess the communications environment: Be aware of all regulations and legal aspects concerning advertising. In addition, judge the communications efforts of competitors: a.

Category spending: did it increase, decrease or remain stable in the last 5 years? b.

Share of voice: compare relative spending on advertising in the product category. c.

Media mix: How do competitors divide advertising spending across different media?

2.

Describe the target audience, paying special attention to their media behaviour, i.e. when do they watch TV, what magazines do they read, etc.

3.

Set the media objectives (see §2)

4.

Select the media mix (see §3)

5.

Buy media.

§2: Media objectives

Media objectives are derived from communications objectives, measurable, realistic and concrete.

§2.1 Frequency

“How often is a consumer of the target group, on average, expected to be exposed to the advertiser’s message within a specified time period”.

An advertiser should define up front how often a consumer should be exposed to its message. According to the two-factor model, repeating advertisements initially stimulates learning, but also brings boredom at later stages if seen too often.

Wear-out is the negative response to a brand. This often occurs at early stages due to the novelty of a brand, or when advertisements are repeated too often.

Wear-in (positive responses to a brand) is optimal at medium levels of exposure.

Wear-out might be avoided by slightly changing an advertisement or when an advertisement is being processed unnoticed (shallow or superficial). In addition, economic signalling theory assumes that repetition of an advertisement is perceived as a signal of the quality of a brand, since brands show that they are willing to invest. Here, over-stimulation can also deteriorate the quality of the brand, but not as rapidly as the deterioration of one single advertisement. Additional pro’s of repetition:

It makes the message more memorable and raises brand recall.

It makes consumer attitudes more accessible and raises confidence in attitudes, leading to more resistance to attitude change and brand switching.

It increases the believability of the ad claims.

It leads to a greater top-of-mind brand awareness.

It functions as a signal or cue for brand quality.

What frequency to pick? Motivational / effective frequency is described as the minimum number of exposures, within a purchase cycle, considered necessary to motivate the average prospect in the target audience to accomplish an advertising objective. The ß-coefficient analysis by Morgensztern describes the relation between the number of exposures and the degree of memorization: M n

= 1 – (1-ß) n . Here,

M n

is the memorization after n exposures, and ß is the medium specific memorization rate. This method assumes that the ß-coefficient grows cumulatively as the number of exposures increases.

Depending on the type of media, growth of the ß coefficient varies: Memorability of Cinema advertisements increase by 70% per exposure, Magazines and Daily papers by 10%, TV by 15%, Radio by 5% and Outdoor by 2%. This means that the first cinema add makes 70% of people remember it, and the 2 nd add makes an additional 70% of the 30% that is left remember it (i.e. 70% + 21% = 91%).

See the image on the next page for a more visual explanation of this theory.

Therefore, recommended number of exposures is:

5-14 for Radio

4-9 for Press

3-6 for TV

2 for Cinema

§2.2 Reach and Weight

Total reach is defined as the number or percentage of people who are expected to be exposed to the advertiser’s message during a specified period, often defined as a share of the total population. Useful reach is about how many customers are actually likely to see the advertisement methods. Gross reach is the sum of the number of people each individual medium reaches, regardless of how many times the individual is reached by different media. Reach is the sum of all people reached at least once (i.e. gross reach minus the duplicated audience). Effective reach starts counting percentage points based on a minimum numbers of exposures. When the first exposure has a reach of 20%, the 2 nd reaches 16% and the 3 rd 11.5%, then an add that has to be exposed at least 2 times only reaches 11,5%.

The Weight of a campaign is expressed in Gross rating points (percentage of target group). These can be summed over various campaigns, meaning that 10 campaigns of 40% reach lead to 400 points.

Opportunity to see (OTS) is the average probability of exposure that an average reached target consumer has. It is calculated by dividing gross reach by reach. Example: If 15 campaigns total 720

GRP’s, and the reach is 65%, then the OTS is 720 / 65 = 11.1. Finally, GRP can again be computed by multiplying Reach with OTS.

§2.3 Continuity

1.

A continuous schedule: spend a continuous amount of money through a campaign period.

2.

A pulsing schedule: A standard level of money is spent on advertising, but now and then higher levels of spending are used.

3.

A flighting schedule: Only focuses on a few periods. This allows spending more in periods where advertisements are needed.

Trying to reach as many people in the target group once within the period near their point of purchasing is considered to be much more effective than repetitive exposure. Others argue that when the purpose of advertising is to give information, frequent exposure can be important. In case of reminding people, one exposure may be enough, but repetition is still beneficial. Two tactics often used: Double spotting: two related advertisements are displayed within the same program.

Roadblocking: place the same add across many channels simultaneously.

§2.4 Cost

Usually expressed as CPT / CPM (Cost per thousand people reached): (Cost of the medium / total reach) * 1000. Even more interesting: CPM-TM (The cost per thousand people of your target market):

(cost of the medium / useful reach) * 1000.

§3 Selecting Media

Media are communications channels like papers, magazines, TV. Vehicles are particular programmes or magazines such as The Simpsons, The Osbournes, Pop Idol etc. TV is the medium that is spent on most in terms of advertising costs. Magazine and Outdoor advertising is more popular in Europe, while radio, other press and internet advertising is more popular in the US (2004). Criteria for media mix:

Quantitative: Reach, frequency, selectivity, geographical flexibility, speed of reach, message life and seasonal influence.

Qualitative: Image-building capacity, emotional impact, medium involvement, active or passive medium, attention devoted to the medium, quality of reproduction, adding value to the message, amount of information that can be conveyed, demonstration capability, extent of memorization of the message (ß) and clutter.

Technical: Production cost (CPM), media buying characteristics, media availability.

Medium selectivity: the extent to which a medium is directed towards the target group. The index:

(% of the target group in total reach / % of the target group in the universe ) * 100. If <100, the target group is under-represented and the vehicle isn’t selective. If 100, the target group is proportionally represented. If >100, the target group is over-represented, the vehicle is selective on the target group.

When choosing media, it is important to know which customers use what vehicles, i.e. which TV channels do they watch and which magazines do they read. Different types of media:

1.

Outdoor advertising such as billboards, buses, trams, stations. Effective reach, lifetime of a message and frequency are very high for this medium. Also, costs are moderate. However, attention is not easily won, involvement is usually low and selective targeting isn’t possible.

2.

Magazines: Reaches a large audience, allows for selective targeting, a high-quality context can be offered, high involvement and credibility, and a lot of information can be included.

Disadvantages: slow medium, magazines are only temporarily used, last minute changes aren’t possible, unfavourable magazine image.

3.

Newspapers: Very high reach in very low time, last minute change is possible, be the front page, high involvement, allows regional targeting, high credibility, and allows incorporating much information. Downsides: limited selective targeting, low quality of reproduction, very short life since newspapers last only one day.

4.

Door-to-door: Geographically flexible and relatively high reach. Also relatively cheap, and including a lot of information. However, people tend to ignore these promotions and quality of reproduction is doubtful.

5.

Television: High communication power due to audio-visual messaging, leading to high emotional impact. This makes transferring a brand image or personality ideal. Mood can be included, many people can be reached in a short time, regional targeting is possible, and selective targeting can be done. Drawbacks are high costs, occasional viewers, limited selective targeting, low message lifetime, seasonality (greater reach in winter).

6.

Cinema: Benefits from audio-visuality, audience is trapped so high attention, audience has a positive mood and high expectations, young and upmarket audience. Disadvantages: high production costs per targeted individual, limited reach, slow frequency and short lifetime.

7.

Radio: Very dynamic, low production costs, high potential reach, selective targeting.

Disadvantages are low attention and short lifetime of an advertisement message.

§4: Media context

An advertising context consists of the receiver context; the situational circumstances in which a person is exposed to an advertisement; and medium context; the characteristics of the content of the medium.

Media context has an influence on how people perceive, interpret and process the advertising message.

Context is agreed to have the biggest influence in the vehicle TV, according to most studies. In addition, sexual and violent content appears to damage/impair the memory for television ads.

Moreover, increasing advertising clutter reduces the effectiveness of advertisements.

Two types of ad blocks can be distinguished: interrupting blocks (displayed during a programme) or shoulder blocks (displayed between two programmes). Because of context reasons, interrupting blocks are agreed to be more effective, due to more arousal and interest. Sequence within a block also matters, because higher motivation is paid to the ad that is displayed earliest. For magazines, upper left corners, front pages and the right pages are very important (flat page when a magazine opens).

Some claim that the better the fit between the ad and the media context, the more motivated consumers will be to process the ad and the easier the job will be for them. Congruency between the ad and the context means that the ad can be more easily interpreted since the relevant knowledge structures are already activated. However, other studies provide contradicting results, so what to do? Under low involvement, context contributes positively. Under high involvement, people prefer contextincongruent ads. The majority of studies point in the direction of a positive impact of intensity of context responses on attitudes and purchase intentions. Valence of context-induced responses: emotional responses to the context indeed carry over to the ad, but not to the brand.

Chapter 9: Advertising Research

Some perceive research as limiting creativity, and inferior to experience and intuition. However, research can serve as a guideline to avoid mistakes, adapt and control in the communication process.

§1: Strategic Advertising planning and

Advertising Research

Since advertising research improves decision making, it can be linked to stages of the advertising process. Here, strategic advertising research is the starting point of a good advertising plan. Pre-tests refer to the development and testing of multiple advertising tools. A post-test assesses the impact of each tool. Finally, a campaign evaluation research compares the initial objectives of the campaign to the outcome.

Marketing and communications are heavily integrated. Therefore, the following elements have to be prepared and studied:

Product: Unique strengths and weaknesses.

Market: Size, evolution, shares, segments, consumers and competitors.

Environment: Legal issues, culture, politics, economics.

In addition, several more specific analyses can prepare a communications strategy:

Communications audit: assess the consistency of internal and external communications with overall strategy, and their internal consistency.

Competitor communications strategy research judges competitive strategies in order to define target groups and positioning strategies for a company. Several vehicles are judged.

Communications content research is used to set up new campaigns, such as brainstorming.

Management judgment test has a jury investigating whether the strategic brief is correctly represented in an advertisement proposal.

§1: Pre-tests

Pre-tests test advertising stimuli before they appear in the media. They guide decisions, but don’t provide the best ad solution. Problems that might possibly be solved by pre-tests are:

Optimising exposure frequency based on the effectiveness of advertising executions.

Selection of appropriate stimuli

Testing a finished ad

Assess communication effects, such as creating attention, acceptance, credibility, positive reactions and purchase intention.

There are 3 different types of pre-tests (target group is very involved in the measurement):

1.

Internal evaluation of characteristics, e.g. by a.

Using a check list b.

Using a readability analysis: checking whether advertising copy is easy to understand. Sometimes quantified by Reading Ease (RE) = 206.8 – 0.77 wl – 0.93 sl

(where sl = average amount of words per sentence, wl = syllabels per 100 words).

2.

Communications or intermediate effects, measured from a sample of customers. Types are: a.

Physiological tests, measuring the reaction of the body to advertising stimuli. Here, either arousal is measured or the potential of an ad being seen. b.

Testing the recall of a new or existing ad. c.

Direct opinion measurement asks customers to rate ads on various characteristics.

Critics: unnatural advertising environment, which leads to biased response. d.

Indirect opinion test: tests an opinion before and after someone has seen an ad.

3.

Behavioural effects: observes behaviour and responses. Split scan procedure: comparing the observations to ads to buying behaviour by handing out store cards.

§2: Post-tests

Used to test the effectiveness of a single ad, meaningful if there is a before measurement. Types:

1.

Exposure: the extent to which to ad reached its audience (GRP, OTS, Net reach).

2.

Communications effect / Message processing a.

Recall (only purpose is to see whether an ad drew attention): i.

Unaided request: indicate which ads consumers remember having seen. ii.

Aided request: Include several cues iii.

Gallup-Robinson Impact Test: First a magazine is given, and the next day the customer is asked which ads he recalls and what content. Indicators:

1.

Proved name registration: % of subjects that remember an ad without having seen it during the test.

2.

Idea penetration: The extent to which subjects have understood the main idea in the ad.

3.

Conviction: The percentage of subjects that want to buy or use the product. iv.

Day After Recall (DAR) test: A call is made, asking to name yesterday’s ads, then whether they remember brand ads, and finally content questions.

Most often used for television commercials. b.

Recognition request (somewhat unreliable): i.

Starch method: resulting in non-readers, noted observations, seen/associated observations or read most cases (people reading 50% of the ad). It is a print advertisement post-test. ii.

Masked Identification test: part of an ad is masked (usually the brand), and the subject is asked to recognise the brand (similar to Aided recall request).

3.

Measurement of behaviour: The amount of people actually responding to an ad.

§3: Campaign evaluation research

Used to evaluate the effectiveness of a whole advertising campaign

more useful than a post-test.

Focus is now on the brand rather than a single ad. Things that can be measured:

1.

Communications effects such as awareness, knowledge, attitude and intention to buy. Top-ofmind awareness indicates which brand in a product category is the first to come to mind. This awareness can be measured both before and after a campaign. a.

Attitude change: A change in opinions towards the brands can be measured using scale techniques. b.

Measure the intention to buy: “Next time you buy coffee, what’s chance on a brand?”

Tracking studies are frequently used to measure communications effects, i.e. tracking a customer’s behaviour at regular intervals during a period of time. Such studies are however difficult to control for exogenous factors, and effects of campaigns may not always directly be visible.

2.

Behavioural studies test the relation between advertising and buying behaviour directly. Most of the time, market share and sales are being observed. Again, these may also change due to exogenous factors, which decrease the usefulness of this evaluation. More specific methods: a.

Trial Purchases b.

Degree of adoption or loyalty to a brand

Previously described tests were effectiveness measures. Efficiency measures might provide different insights: the extent to which investment in an ad has had a commercial result. The following function could be established:

S = 1.5 + 0.2 x A, where S is sales in million euros and A is advertising spending in million euros.

Costs could be included, to better observe the profitability. Moreover, carry-over effects (long-term effects) of advertisements might also be included, resulting in:

S (t) = 1.5 + 0.2 x A (t) + 0.8 x S(t-1), where S(t) is sales in period t, A(t) is advertisement in period t and S(t – 1 ) = sales in period t – 1.

Now, the gain per euro in advertising is 0.25 euro in the short-term, and 0.8 x 0.25 euros in the long term. In practice, such functions aren’t established this easily, mainly because of long-term effects of many campaigns.

§4: Additional Notes and Pearson website findings (that are not mentioned above):

The Starch Method doesn’t measure how many people have been convinced by the ad message.

Measuring things such as recognition and correct brand attribution is useless: this is not a limitation of post-testing.

A tracking study does not have a standard set of questions to monitor the evolution of brand awareness.