Success Coaching Centre Sec-4 & sec

advertisement

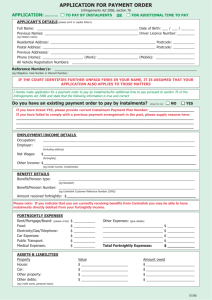

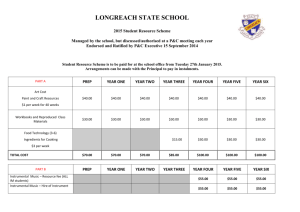

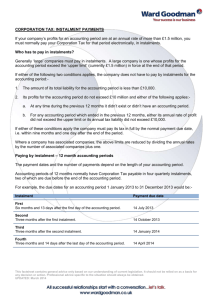

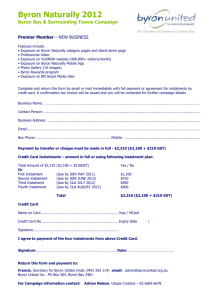

Success Coaching Centre Sec-4 & sec-14 Ph.9782016302, 9672269750, 9784094650 Hire Purchase System Q.No.-1. A. Ltd. purchased a machine on hire purchase system from B Ltd. on 1st April 2000. Cash price of the machine is Rs. 148700. Consideration is paid in 4 half yearly instalments of Rs. 40000 each. Vendor charged interest @ 6% per annum on half yearly basis. Pass journal entries in the books of A. Ltd. and prepare machine account also. A. Ltd. closes its books on 31st March every year. Depreciation is to be charged @ 10% on straight line basis. Use asset accrual method. Q.No.-2. Utopia Ltd. purchased a Truck on hire purchase system over a period of 4 years. Rs. 1,20,000 was payable as down payment on 1-4-2000 at the time of signing the agreement. Balance is payable in four annual instalment of Rs. 1, 20,000 each, on 31st March every year, Raj motors Ltd. who sold the Truck, charges interest @ 5% per annum on the yearly balance. The cash price of the truck is Rs. 5, 45,510. Depreciation is to be charged @ 20% on fixed instalment basis. Pass journal entries and Prepare ledger accounts in the books of Utopia Ltd. using asset accrual method and show the asset would appear in the B/S on 31.3.2001 and 31.3.2004. Q.No.-3. X Ltd. sold three vans on 1st April, 2002 to Y Ltd. on hire purchase system; the price of each van is Rs. 2, 25,000. Consideration is payable as follows: (a) Down payment for each van is Rs. 75, 000 payable at the time of signing. (b) The balance is payable in three equal instalments with interest @ 15% per annum. Y Ltd. writes off depreciation @ 20% per annum on reducing balance method. Purchaser paid the first instalment on 31st March, 2003, however, he could not pay the next. Both the parties agreed and decided that in lieu of the amount due two vans will be repossessed in adjustment and for this purpose depreciation will be written off @ 30% per annum. An amount of Rs. 5000 was spent on the repair of reposed goods and it was sold by X Ltd. for Rs. 2, 30,000. Open ledger accounts in the books of both the parties. Q.No.-4. For the year ending on 31st March, 2004, “Bharat and sons” performed the following sales on hire purchase system. (1) Goods costing Rs. 4000 was sold to Amar on 1st July, 2003 at Rs. 6000. The consideration is payable in 40 monthly instalments of Rs. 150 each, as per agreement. (2) Goods costing Rs. 2500 was sold to Akbar on 1st October, 2003 at Rs. 5000. The consideration is payable as agreed, in 50 half monthly instalments of Rs. 100 each. (3) Goods costing Rs. 3000 was sold to Anthony on 1st November, 2003 at Rs. 4000. The consideration of which is to be paid in 10 monthly instalments of Rs. 400 each. Amar, Akbar, Anthony started the payment of their instalments from 31st July, 15th October and 30th November, 2003 During the accounting period, Amar paid 9 instalments, Akbar 12 instalments and Anthony paid 4 instalments. However, Anthony could not pay the instalments which became due on 31st March, 2004. For the year ending 31st March, 2004 prepare (a) Memorandum Books and (b) Hire purchase Trading Account. Q.No.-5. Following particulars are in respect of a trader who sells goods of small value on hire purchase system after adding 50% to cost. Rs. 1/4/03 Stock out on purchase price with customers 1,53,000 1/4/03 Stock at shop at cost price 3,06,000 1/4/03 Instalments due but not received 85,000 31/3/04 Goods repossessed valued at (Instalment not Rs. 34000) 8,500 31/3/04 Cash received from customers 10,20,000 31/3/04 Purchases made during the year 10,20,000 31/3/04 Stock at shop at cost (excluding goods repossessed) 3,40,000 31/3/04 Instalments due but not received 1,53,000 Prepare hire purchase trading account for the year ended 31st March 1998. 1 AVINASH JAIN Success Coaching Centre Sec-4 & sec-14 Ph.9782016302, 9672269750, 9784094650 Q.No.-6. Atal commenced business on 1st April, 2003. During the year ended 31st March,2004, purchases amounted to Rs. 54,000 and ordinary sales RS. 62,000. In addition, the following sales were made under hire purchase arrangements: Article Cost Rs. Sales Price Deposit Monthly No. of instalments Rs. paid Instalment paid in year 1997-98 Radio 600 900 100 20 of Rs. 40 8 Room Cooler 800 1,200 120 12 of Rs. 90 2 Machine 700 1,000 100 18 of Rs. 50 4 Instalments on machine could not be kept up and it was returned on 31st March, 2004. Stock-in-trade on 31st March, 2004 excluding the returned machine amounted to Rs. 7,000. Prepare the hire purchase Trading Account and the General Trading Account for the year ending 31st March, 2004. Q.No.-7. Open necessary accounts in the books of purchaser from the details given below: Hire purchaser X Ltd. Vendor Date of agreement 1-4-2000 Down payment Rs. 20000 Annual Rate of interest instalments Y Ltd. Three each 5% per annum. of Rs. 20,000 Depreciation is to be charged @ 10% per annum on diminishing balance method. Cash price is Rs. 74,500. Q.No.-8. On 1st April 2002 Kumar and company purchased a machine on hire purchase system for Cash price Rs. 1, 20,000. Hire purchase price of the machine is Rs. 1, 50,000. Down payment of Rs. 30,000 was payable immediately and the balance was agreed to be paid in three equal instalment. Books are closed on 31st March every year. Company charges depreciation every year at the rate of 10% per annum, on straight line method. Calculate the interest included in each instalment and prepare machine account and hire vendors account in the books of purchaser for three years. Q.No.-9. Mr. Gujral commenced business on 1st April, 2008. He made sales for cash as well as on hire purchases basis. During the year 2007-08 his purchase amounted to Rs. 14,500. The cash sales were for Rs.12,000. The following items were sold on hire-purchase basis as per particulars given below: Article Cost Rs. Sales Price Initial Payment Instalments paid Rs. Rs. during the year Rs. Radio 200 350 50 125 Cycle 210 350 75 125 Room Cooler 400 600 100 150 The instalment on room cooler could not be kept up and the same was repossessed on 30th November, 2007. The closing stock including the room amounted to Rs. 5,000. Prepare the Hire-purchase Trading Account, Memorandum hire purchases Debtors account and the General Trading Account for the year ended 31st March, 2008. Q.No.-10. Krishna Agencies started business on 1st April, 1994.During the year ended31st, March, 1995; they sold under mentioned durables under two schemes- Cash price Scheme (CPS) and Hire Purchase Scheme (HPS). Under the CPS they priced the goods at cost plus 25% and collected it on delivery. Under the HPS the buyers were required to sign a Hire Purchase Agreement undertaking to pay for the value of the goods including finance charges in 30 instalments, the value being calculated at cash price plus 50%. The following are the detail available at the end of 31st March, 1995 with regard to the products: Product Nos. Nos. sold Nos. sold Cost per No. of No. of instalments purchased under CPS under HPS unit Rs. instalments due received during during the year the year 2 AVINASH JAIN Success Coaching Centre Sec-4 & sec-14 Ph.9782016302, 9672269750, 9784094650 TV sets 90 20 60 Washing machine 70 20 40 The following were the expenses during the year: 16,000 1,080 1,000 12,000 840 800 Rs. 1,20,000 1,44,000 12,000 1,20,000 Rent Salaries Commission to Salesmen Office Expenses From the above information, you are required to prepare: (a) Hire-Purchase Trading Account, and (b) Trading and Profit & Loss Account. Q.No.-11. Omega Corporation sells computers on hire purchase basis at cost plus 25%. Terms of sales are Rs. 10,000 as down payment and 8 monthly instalments of Rs. 5,000 for each computer. From the following particulars prepare Hire purchase Trading Account for the year 1999. As on 1st January, 1999 last instalment on 30 computers was outstanding as these were not due up to the end of the previous year. During 1999 the firm sold 240 computers. As on 31st December, 1999 the position of instalments outstanding were as under: Instalment due but not collected: 2 instalments on two computers and last instalment on 6 computers. Instalment not yet due: 8 instalments on 50 computers, 6 instalments on 30 and last instalment on 20 computers. Two computers on which 6 installments were due and one instalment not yet due on 31.12.99 had to be repossessed. Repossessed stock is valued at 50% of cost. All other in instalments has been received. Q.No.-12. Welwash (pvt.) Ltd. sells washing machines for outright cash as well as on hire- purchase basis. The cost of a washing machine to the company is RS. 10,500. The company has fixed cash price of the machine at Rs. 12,300 and hire purchase price at Rs. 13,500 payable as to Rs. 1,500 down and the balance in 24 equal monthly instalments of Rs. 500 each. On 1st April, 2000 the company had 26 washing machines lying in its showroom. On that date 3 instalments had fallen due, but not yet received and 675 instalments were yet to fall due in respect of machine lying with the hire-purchase customers. During the year ended 31st March, 2001 the company sold 130 machines of cash basis and 80 machines on hire-purchase basis. After paying five monthly instalments, one customer failed to pay subsequent instalments and the company had to repossess the washing machine. After spending Rs. 1,000 on it, the company resold it for Rs. 11,500. On 31st March, 2001 there were 21 washing machines in stock, 810 instalments were yet to fall due and 5 instalments had fallen due, but not yet received in respect of washing machines lying with the hire-purchase customers. Total selling expenses and office expenses including depreciation on fixed assets totaled Rs. 1, 60,000 for the year. You are required to prepare for the accounting year ended 31st March, 2001: (i) Hire-Purchase Trading Account, and (ii) Trading and profit & loss account showing net profit earned by the company after making provision for Income-tax @ 35%. Q.No.-13. A acquired on 1st January, 2003 a machine under a Hire Purchase agreement which provides for 5 half-yearly instalments of Rs. 6,000 each, the first instalment being due on 1st July, 2003. Assuming that the applicable rate of interest is 10% per annum, calculate the cash value of the machine. All working should from part of the answer. 3 AVINASH JAIN Success Coaching Centre Sec-4 & sec-14 Ph.9782016302, 9672269750, 9784094650 Q.No.-14. Sameera Corporation sells Computers on Hire-purchase basis at cost plus 25%. Terms of sales are 5,000/- as Down payment and 10 monthly instalments of Rs. 2,500/- for each Computer. From the following Particulars, prepare Hire-purchase Trading A/c. for the year 2002-03: As on 1st April, 2002, last instalment on 20 Computers were Outstanding as these were not due up to the end of the previous Year. During 2002-03, the firm sold 120 Computers. As on 31st March, 2003 the position of instalments outstanding were as under: Instalments due but not collected 4 Instalments on 4 Computers and Last instalments on 9 Computers. Instalment not yet due 6 Instalments on 50 Computers,4 Instalments on 20 and Last Instalment on 40 Computers. Two Computers on which 8 Instalments were due and one Instalment not yet due on 31.03.2003, had to be repossessed. Repossessed stock is valued at 50% of cost. All other Instalments have been received. Q.No.-15. ABC Ltd. sells goods on Hire-purchase by adding 50% above cost. From the following particulars, prepare Hirepurchase Trading account to reveal the profit for the year ended 31.32005: 1.4.2004 Instalment due but not collected 1.4.2004 Stock at shop (at cost) 1.4.2004 Instalment not yet due 31.3.2005 Stock at shop 31.3.2005 Instalment due but not collected Other details: Total instalments became due Goods purchased Cash received from customers Goods on which due instalments could not be collected were repossessed and valued at vendor spent Rs. 500 on getting goods overhauled and then sold for Rs. 2,800. Rs. 10,000 36,000 18,000 40,000 18,000 1,32,000 1,20,000 1,21,000 30% below original cost. The Q.No.-16. S Ltd. has a Hire-purchase department. Goods are sold on hire-purchase at cost plus 60%. From the following particulars draft Hire-purchase trading account and compute profit or loss for the year ended 31st March, 2007: Rs. Goods with customers on 1.4.2006 (instalments are not due) 3,20,000 Instalments due on 1.4.2006 (customers are paying) 20,000 Goods sold on hire-purchase during the year (i.e., from 1.4.2006 to 31.3.2007) 16,00,000 Cash received from the customers 11,20,000 Goods repossessed from customers valued at 40% 16,000 Unpaid instalments in respect of re-possessed goods 40,000 Goods with customers as on 31.3.2007(at hire-purchase price) 7,20,000 Q.No.-17. Ram & Co. acquired a motor lorry on hire-purchase basis. It has to make cash down payment of Rs. 1, 00,000 at the beginning. The payments to be made subsequently are Rs. 2, 63,000; Rs. 1, 85,000 and Rs. 1, 14,000 at the end of first year, second year and third year respectively. Interest charged is @ 14% per annum. Calculate the cost price of motor lorry and interest paid in each instalment. Q.No.-18. Wye sells goods on Hire-purchase at cost plus 50% prepare Hire-purchase Trading a/c from the information given below: 4 AVINASH JAIN Success Coaching Centre Sec-4 & sec-14 Ph.9782016302, 9672269750, 9784094650 Rs. 1,62,000 3,24,000 1,35,000 10,80,000 9,000 3,60,000 10,35,000 1,62,000 Stock with customs on hire-purchase price (opening) Stock in hand at shop (Opening) Instalments overdue (opening) Purchases during the year Goods re-possessed (instalments not due Rs. 36,000) Stock at shop excluding re-possessed goods (closing) Cash received during the year Instalments overdue (closing) The vendor spent Rs. 2,000 on goods re-possessed and then sold it for Rs. 15,000. Q.No.-19. Mr. X purchased a machine on hire-purchase system, Rs. 30,000 being paid on delivery and the balance in five instalments of Rs. 60,000 each, payable annually on 31st December. The bash price of the machine was Rs. 3, 00,000. Compute the amount of interest for each year. Q.No.-20. On January 1, 2006 HP and Co. acquired a pick-up Van on hire purchase from FM & Co. Ltd. The terms of the contract were as follows: (a) The cash price of the van was Rs. 1, 00,000. (b) Rs. 40,000 were to be paid on signing of the contract. (c) The balance was to be paid in annual instalments of Rs. 20,000 plus interest. (d) Interest chargeable on the outstanding balance was 6% p.a. (e) Depreciation at 10% p.a. is to be written off using the straight-line method. You are required to: (a) Give Journal Entries and show the relevant accounts in the books of HP and Co. from January 1, 2006 to December 31, 2008; and (b) Show the relevant items in the Balance Sheet of the purchaser as on December 31,2006 to 2008. Q.No.-21. X Ltd. purchased 3 milk vans from Super Motors costing Rs. 75,000 each on hire purchase system. Payment was to be made: Rs. 45,000 down and the remainder in 3 equal instalments together with interest @ 9%. X Ltd. writes off depreciation @ 20% on the diminishing balance. It paid the instalment at end of the 1 st year but could not pay the next. Super Motor agreed to leave one milk van with the purchaser, adjusting the value of the other two milk vans against the amount due. The milk vans were valued on the basis of 30% depreciation annually on written down value basis. X Ltd. settled the seller’s dues after three months. Q.No.-22. M/s Wye & Co. sell goods on hire purchase, adding 50% to cost. From the following figures prepare the Hire Purchase Trading Account: Rs. Goods with customers in Jan. 2008, instalments not yet due 5,400 Goods sold on hire purchase during 2008 25,500 Cash received from customers during 2008 20,100 Instalments due but not yet received at the end of the year, customers paying 1,800 All figures are on the basis of hire purchase price. Q.No.-23. From the following prepare Hire Purchase Trading Account of M/s Kolkata Traders who sells goods on hire purchase basis at cost plus 25%. Rs. Instalments not due on 31-12-2007 3, 00,000 Instalments due and collected during 2008 8, 00,000 Instalments due but not collected during 2008 Including Rs. 10,000 for which goods were repossessed 50,000 5 AVINASH JAIN Success Coaching Centre Sec-4 & sec-14 Ph.9782016302, 9672269750, 9784094650 Instalments not due on 31-12-2008 including Rs. 20,000 For which goods are repossessed Instalments collected on repossessed stock M/s Kolkata Traders valued repossessed stock at 60% of original cost. 3, 70,000 15,000 Q.No.-24. The hire purchase department of B.G. Ltd. sells television sets and room coolers. This department was newly started in 2008. The relevant information is as follows: Television set Room coolers Rs. Rs. Cost 5,400 2,000 Cash Price 6,300 2,400 Cash down payment 900 400 Monthly instalment 600 200 Number of instalment 10 12 During the year, 100 television sets and 120 room coolers were sold on hire purchase basis. Two television sets on which 3 instalments only could be collected and 4 room coolers on which 5 instalments had been collected were repossessed. These were valued at Rs. 10,000 and after reconditioning at a cost of Rs. 1,000 were sold outright for Rs. 14,000. Other instalments collected and those due (customer still paying) were respectively as follows: Television sets 270 and 20 Room coolers 400 and 30 Prepare Accounts on stock and debtors system to reveal the profit of the Department. Q.No.-25. Y Ltd. sells products on hire purchase terms, the price being cost plus 33⅓%. From the following particulars for 2008, prepare Hire Purchase Stock Account, Shop stock Account, Hire Purchase Debtors Account, Stock Reserve Account and Hire Purchase Adjustment Account (for profit): 2008 Rs. Jan. 1 Stock out on hire at Hire Purchase Price 1, 20,000 Stock in hand, at shop 15,000 Instalment due (Customers still paying) 9,000 Dec. 31 Stock out on hire at Hire Purchase Price 1, 38,000 Stock in hand, at shop 21,000 Instalment due (Customers still paying) 15,000 Cash received during the year 2, 40,000 6 AVINASH JAIN