Test Hypotheses: Key Partners

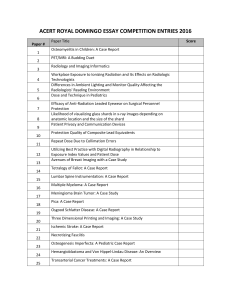

advertisement

Engineering 245 The Lean LaunchPad Lecture 6: Partners Professors Steve Blank, Ann Miura-Ko, Jon Feiber http://e245.stanford.edu/ key activities value proposition customer relationships key partners customer segments cost structure revenue streams key resources channels 1 images by JAM KEY PARTNERS which partners and suppliers leverage your model? who do you need to rely on? Test Hypotheses: Key Partners 3 What defines a “Partner?” • Shared economics • Mutual success / failure • Co-development/invention • Common customer But remember - you’re a startup 4 Why have partners? ● Faster time to market ● Broader product offering ● More efficient use of capital ● Unique customer knowledge or expertise ● Access to new markets 5 Partners – Physical Channels • Strategic alliances • Joint new business development efforts • “Coopetition,” (cooperation between competitors) • Key supplier relationships 6 Partners – Strategic Alliances • Reduce the list of things your startup needs to build or provide to offer a complete product or service. • Use partners to build the “whole product” • using 3rd parties to provide a customer with a complete solution • complement your core product with other products or services • Training, installation, service, etc 7 Partners – Joint Business Development • Joint promotion of complementary products • Share advertising, marketing, and sales programs • One may be the dominant player • Intel offered advertising fees to PC Vendors 8 Partners – Coopetition • Joint promotion of competitive products • Competitors might join together in programs to grow awareness of their industry • Tradeshows • Industry Associations 9 Partners – Key Suppliers • Outsource suppliers • Backoffice, supply chain, manufacturing • Direct suppliers • Components, raw materials, etc. 10 Startup mistake Strategic alliances and joint partnerships Not needed for Earlyvangelists Are needed for Mainstream customers Usually fail 11 Traffic Partners – Virtual Channels • Long-term agreements with other companies • deliver long-term, predictable levels of customers • “Cross referral” or swapping basis • Paid on a per-referral basis • Partners drive traffic using text-links, with onsite promotions, and with ads on the referring site • Partners sometimes exchange email lists 12 Partnership Disaster: Boeing Collaborative Looked great on paper. Worst business decision of the 21st century (so far!) 13 Mobile Location Based Applications Collaborative Partner 14 Managing partners - risks • • • • • • • • Impendence mismatch Longest of partners schedule becomes your longest item No clear ownership of customer Products lack vision – shared product design Different underlying objectives in relationship Churn in partners strategy or personnel IP issues Difficult to unwind or end Why Will a Large Company Partner? • You give them a competitive “leg-up” • In sales • Or “halo-effect” • You are on their technology road-map • You’re an economic opportunity for them • potential customer of large company • can leverage their existing products and sales • Change agent for the large company You need to understand their motivation Should I take an investment from a Large Company? • They are interested in their bottom line, not yours • Their objectives are not to make you a large company • Who’s the sponsor? What’s the motivation? • Needs to come from the business side • Not the venture side • Try to get sales deals not investment • Or try to offer warrants based on sales success Startup Partner Strategies • Don’t confuse partners for Earlyvangelists vs. mainstream • Don’t confuse big company partnering with startup strategy • Find the one that gives you an unfair advantage – Air Supply strategy • Recognize you don’t matter to a large partner 18 Team Deliverable for Next Week • What partners will you need? Why do you need them Why will they partner with you? What’s the cost of the partnership? Talk to actual partners • Summarized in a 5 Minute PowerPoint Presentation • • • • Ground Fluor Pharmaceuticals This is your brain on fluorine Team: Kiel Neumann (EL) Stephen DiMagno (PI) I-Corps 11/15/11 Allan Green (Mentor) Manufacture Clinical Trials GMP precursor manufactures GMP cassette manufacturers Radiopharmacies St. Jude Children’s Research Hospital Sloan Kettering UCSF I-Corps 11/15/11 22 The Business Model Canvas Nuclear Medicine and Radiology departments cGMP manufacturers Radiopharmacies Pharmaceutical development companies SOPs for precursors and drugs Recruit clinical sites In vivo animal studies Develop regulatory plan for pre IND meeting ID cGMP CRO Fund-raising IP PoP data IP PoP data Regulatory plan Understanding of the regulatory process Contract cGMP precursor manufacture Salary, Rents Clinical trials Accessibility (RCY) Purity Speed PET/SPECT Multiplatform Sensitivity (nca) Specific compounds General methodology for adding fluorine to lead compounds of interest Technical Assistance (Image Atlas) FDA regulatory support Equipment producers Prescribing physicians Technical assistance Radiologist who perform studies Direct sales of precursor Drug developers Sales of packaged precursor in cassettes Cassette manufacturers Sales of intermediates Technology license Product license (royalty) I-Corps 11/15/11 Radiopharmacies Radiologists Food Chain • F-dopa iodonium intermediate • F-dopamine iodonium intermediate We provide accessibility Reagents GMP Cassette or Components GMP Compliant Synthesizer PET Radiopharmacy distributor •ABX •Eckert & Ziegler •GE MX module for TracerLab •Siemens Explora •TracerLab/ GE •Eckert & Ziegler •Siemens Explora •Neoprobe •Synthra •Siemens PETNet •GE Amersham •Cardinal Health •AAA •Iason I-Corps 11/15/11 Could license precursor synthesis for incorporation in cassettes Require GMP precursor (or cassette) to develop our product with their synthesizer Only want GMP precursor in cassettes without development 24 GMP Precursor Finished Imaging Finished Agent Imaging Finished Agent Imaging Finished Agent Imaging Finished Agent Imaging Finished Agent Imaging Agent GMP Cassette $10’s per cassette One time setup $140,000 Revenue neutral thereafter $300 per cassette Licensing fee or nominal royalty ($50) per cassette Patients Hospitals $1700 per dose ~100 doses/cassette $500 fee per dose at existing price structure I-Corps Presentation 11/15 25 Richmond Chemical Albany Molecular GMP Precursor Contract Manufacture SRI International One time setup $50-140K I-Corps Presentation 11/15 Nebraska GMP Facility GMP Precursor Finished Imaging Finished Agent Imaging Finished Agent Imaging Finished Agent Imaging Finished Agent Imaging Finished Agent Imaging Agent GMP Cassette $10’s per cassette One time setup $140,000 Revenue neutral thereafter $300 per cassette Licensing fee or nominal royalty ($50) per cassette Patients Hospitals $1700 per dose ~100 doses/cassette $500 fee per dose at existing price structure I-Corps Presentation 11/15 27 ABX Synthra Precursor use license GMP Cassette Eckert& Ziegler Siemens Explora I-Corps Presentation 11/15 GMP Precursor Finished Imaging Finished Agent Imaging Finished Agent Imaging Finished Agent Imaging Finished Agent Imaging Finished Agent Imaging Agent GMP Cassette $10’s per cassette One time setup $140,000 Revenue neutral thereafter $300 per cassette Licensing fee or nominal royalty ($50) per cassette Patients Hospitals $1700 per dose ~100 doses/cassette $500 fee per dose at existing price structure I-Corps Presentation 11/15 29 Cardinal Health Iason Fee per dose Technology license Siemens Finished Drug AAA GE Healthcare 2.2 million doses per year %10 of the market is 200,000 doses $500 per dose = $100 million Current sales $2 M/year because production is limited and costs are high. Confidential financial Gannt chart prepared I-Corps 11/15/11 31 • F-dopa iodonium intermediate • Subcontracted manufacture (licensed) Precursor Sale • Small profit ($10/cassette) • Current price - $300/cassette. One cassette might provide 50-100 doses GMP Cassette of finished drug. License precursor incorporation in the cassette. Sales Drug Production I-Corps 11/15/11 • Current sales ~ $1000-$1500/dose. Potential manufacturing cost per dose (FDG) $200/dose. 35 ARKA Thermal Solution High Performance Heat Pipe Technology Ideation/Consulting Firm that offers design and prototyping solutions in Thermal Management Scan and respond to market needs and provide innovative product solutions. Offer solutions to industries and organizations proactively by seeking new avenues to utilize heat pipe technology 46 Week 6 Canvas Business Model (For First Product Idea – LED thermal management module) Market Manufacturer (Extension) Arka Thermal Communication of Design and Prototypes Money Flow Physical Product Flows Other Potential Markets Joint Venture Design Sources What Partners will we need? • Our partner in the new model is a Thermal Solutions manufacturer who is looking to extend into the heat pipe market. • We require partners with production and distribution expertise • The distribution of this product also requires access to a dedicated sales force. Why will they partner with us? • Arka Thermal offers design expertise in heat pipe design • Based on its talent, Arka Thermal proposes to offer novel and high-efficiency heat pipe solutions proactively to the market. 1st Product Idea LED Thermal Dissipation Module Offers higher lumen intensity with a longer life enabled by novel thermal dissipation technology. Replacement of current high lumen incandescent bulbs with LED equivalents without light quality/output compromises. Offer a novel thermal dissipation technology module that can be used in different LED product families Cost and Risks • Arka Thermal The cost of the partnership lies is the design and prototype creation (for pitching purposes) – – – Research and Development costs: we need to provide contemporary design that OEMS can incorporate easily in their systems. Effectiveness: the products needs to be efficient, meet standards and form specifications. The cost in this case is testing, certification and design upgrades to reflect OEM needs. Recruiting and maintaining high level talent in ideation and design The highest risk comes from not responding proactively to market change, or being first mover. Loss of design exclusivity. It is essential that design be protected. The Manufacturer may choose to work outside of Arka Thermal’s contracts with in-house or other design agencies that offer more benefits Cost and Risks • Manufacturer The initial cost of setup and maintaining a product extension. Risk lies in moving into a crowded established market. The market might not require our services. Manufacturer Incentives • • • • Impediments Potential increased sales • Investments in joint through joint venture creation venture is substantial with Arka • ROI cannot be established Extended product line with at this point access to Arka Designs, increased product extension • Presence of in-house R&D development possibilities Outsourcing R&D for product • Solutions from other providers might be more extension to Arka (greater efficiency due to lucrative specialization) • Standards preclude use of Customized solutions for heat pipes/ diminished each customer of the interest in heat pipes Manufacturer Benefits of Exclusive Partnership • Arka Thermal gains a partner with production and distribution expertise in thermal solutions manufacturing • Manufacturer can extend product line through joint venture and explore new markets Interviews Action Customer Interaction Meetings: 1. Regional Senior C/A Client Manager 2. Dr. Peter Foller, Former Director of R&D chemical and Optical, PPG 3. Eilis Rosenbaum and Jonathan Levine, Hydrate Researchers 4. Pine Liu, Entrepreneur in Smart Sensor Monitoring 5. Jim Miller, CMU Researcher 6. Frank Stienke, Schlumberger Affiliate Hypothesis Testing: 1. Custom semiconductor grower 2. Funding organization Motion Planned Customer Interaction Meetings: 1. Two C/A plant visits 2. Eilis Jill Rosenbaum and Jonathan Levine, Hydrate Researchers 3. Morty, CMU Facilities Planned Hypothesis Testing: 1. Wayne Meier, Matric Engineering Services 2. Diane L. Magin, BlackBox 3. Daedalus Designs C/A Market Industrial Plants Plant #1 Plant #2 Plant #3 Internal Pilot Test APPROVED 1. 2. 3. 4. Technology Supplier [Product Form] Bundled into larger product Standalone SenSevere can make bundle Monitoring Pilot Commercial Customer Test CONDITIONAL APPROVAL Pricing Detection limit of the sensor required is different for each step of the process. Discussions are in cell technologies Each step process has different risk premium associated Cell Technologies Drying Towers #GOAL Price the same product differently based on what we protect as opposed to an agglomerate value add. Tunable sensor sensitivity Liquifaction US Sensors Industry: $9.8B Projected Growth: 6.1%/year Operating Specifications Downtime / incident Time betw/Incidents Average cost / year from incidents # of Units Market Size: [/year] $73,250,000 C/A Market Cost / cell Price Year Type % Revenue [/year] 1 Innovators 2.5 $271,500 Operating costs for 1st year projected to be $200,000 2 Early Adopters 16 $8,785,000 3 Early Majority 50 $27,463,500 4 Late Majority 84 $46,141,500 Partner Margin: 25% Prototyping COG Sales Profit: [/year] $50,662,996 Other Markets! #KILLER APP #GOAL Chlorine production Achieve sales in both ends of the spectrum and all other applications fall within possible demonstrated capability Laboratory Industrial 1. Hydrate research 2. Micro-temperature measurement and heating 3. Wireless smart building control 1. C/A 2. Transformer gas monitoring 3. Wireless smart building control