The Role of Institutional Investors in US Shareholder Litigation

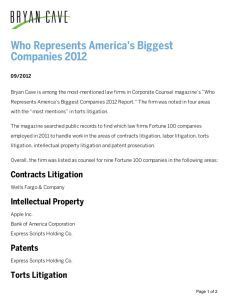

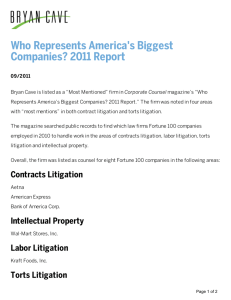

advertisement

USING THE LAW TO PROTECT YOUR FUND’S ASSETS: The Role of Institutional Investors in U.S. Shareholder Litigation Prepared for: The Tel Aviv Institutional Investor Conference June 20, 2011 Benjamin Kaufman, Esq. Partner Todd Kammerman, Esq. Partner 1 © Milberg 2011 Protection of Future Income Litigation to Prevent or Recover Institutional Investor Losses through: •Securities Litigation; •Derivative Litigation; and •Transactional Litigation •Commercial Litigation 2 © Milberg 2011 “This Court has long recognized that meritorious private actions to enforce federal antifraud securities laws are an essential supplement to criminal prosecutions and civil enforcement actions brought, respectively, by the Department of Justice and the Securities and Exchange Commission (SEC).” -- Justice Ruth Bader Ginsburg in the opinion of the Supreme Court in Tellabs, Inc. v. Makor Issues & Rights, Ltd., 551 U.S. 308, 313 (2007), which was litigated by Milberg LLP 3 © Milberg 2011 Institutional Investors Account for Vast Majority of Settlements 96 total settlements valued at $2.9 billion in 2010 61% of cases settled in 2010 had institutional investor involvement However, the value of the cases led by an institutional investor that settled in 2010 accounted for 77% of the value of total 2010 settlements Eight of the top ten settlements in 2010 (including the year’s largest) had institutional investors as the lead plaintiff Sources: PricewaterhouseCoopers 2010 Securities Litigation Study (April 2011) 4 © Milberg 2011 Institutional Investors Role Private and public funds dominate the market and have vested interest in: Maintaining integrity of financial markets Assuring corporate accountability Maximizing returns Increasingly stepping forward to seek recoveries for losses due to securities fraud Fulfill fiduciary duties to take action when necessary Serve as Lead Plaintiff and/or Class Representative 5 © Milberg 2011 Why Not Let Others Serve Instead? Your fund controls the litigation Your fund picks the attorneys Your fund has direct input into any settlement structure You are taking proactive steps to help your Fund and fulfilling your fiduciary duties 6 © Milberg 2011 Recent Jury Verdict: In re Vivendi Universal, S.A. Recent trial ended with a jury verdict finding Vivendi liable on all counts Retirement System for the General Employees of the City of Miami was a lead plaintiff Class includes foreign institutional and individual investors who purchased their shares on U.S. exchanges Investors estimated to recover over $1 billion 7 © Milberg 2011 Transactional and Derivative Litigation – Protecting Assets From Future Losses Comverse Derivative Litigation Southwest Airlines Improved reporting procedures Anheuser Busch Litigation $62 million in cash + significant corporate governance reforms (settlement approved at June 21, 2010 hearing) Settled for additional disclosures in proxy statement concerning merger with InBev, protections for certain AB employees and an increase in the merger consideration Madoff Litigation Brought on behalf of feeder funds that invested with Madoff Alleges that the funds’ managers failed to conduct adequate due diligence Alleges that the funds’ auditors failed to conduct proper audits 8 © Milberg 2011 Attractiveness of U.S. Lawsuits Ability to sue on behalf of other similarly situated persons is largely unique to the United States Availability of contingency fee arrangements Absence of “loser pays” fee-shifting rules Confidentiality Order Scheduling Orders, which move the litigation Right to expansive discovery after Motion to Dismiss phase Well-developed system for certifying class actions Potential for a large jury verdict 9 © Milberg 2011 Opting-Out of Class Actions Depends on the particulars of a plaintiff’s claims and the strengths of those claims connected to the plaintiff’s purchases Typically reserved for plaintiffs with substantial losses and financial and structural wherewithal to pursue its own claims The ability of defendants to pay damages 10 © Milberg 2011 Opting-Out of Class Actions Advantages of opting-out The ability to select the venue in which to file The power to select counsel The ability to direct settlement unimpeded by the court or class issues Possibility of obtaining a recovery many times larger than what would have been obtained in a class recovery No need to seek class certification Risks Opt-out plaintiff runs the risk of non-recoveryopting out forever bars that plaintiff in participating in the class settlement or judgment 11 © Milberg 2011 Commercial Litigation Protecting your Fund against: Breach of Contract Breach of Fiduciary Duty Fraud Arbitration 12 © Milberg 2011 The Milberg Difference 13 © Milberg 2011 Milberg LLP: Setting the Standard Expertise Recovered over $55 billion on behalf of shareholders Leadership in landmark cases (e.g., Vivendi; Tellabs, Inc. v. Makor) Resources Financial and human resources to oppose defense firms Top-tier attorneys supported by in-house experts Forensic accountants and investigators Litigation technical support Results More than 45 years of unparalleled recoveries on behalf of investors 14 © Milberg 2011 Sample of Milberg’s Significant Cases Vivendi Universal Securities Litigation Xerox Securities Litigation Tyco International Securities Litigation Estimated $1 Billion jury verdict in favor of an international class of defrauded investors $750 Million settlement in 2009 $3 Billion settlement in 2007 Nortel Securities Litigation IPO Securities Litigation Prudential $1.142 Billion settlement in cash and company stock in 2006 Lucent Technologies Inc. Securities Litigation $517 Million settlement in 2003 $586 Million cash settlement in 2009 $4 Billion settlement in 1997 Raytheon Co. Securities Litigation Sears, Roebuck and Company $410 Million settlement in 2004 $215 Million cash settlement in 2006 15 © Milberg 2011 Judicial Commendations of Milberg Following the jury verdict in Vivendi, in describing the work of the attorneys trying the case, Judge Holwell stated: In Judge Barbadoro’s order approving the $3.2 billion Tyco settlement, the court noted: “I can only say that this is by far the best tried case that I have had in my time on the bench. I don’t think either side could have tried the case better than these counsel have. The jury has spoken and that’s the end of the trial. It was a pleasure having you in the courtroom.” “This was an extraordinarily complex and hard-fought case. Co-Lead Counsel put massive resources and effort into the case for five long years, accumulating [millions of dollars in expenses] and expending [hundreds of thousands of hours] on a wholly contingent basis. But for Co-Lead Counsel’s enormous expenditure of time, money, and effort, they would not have been able to negotiate an end result so favorable for the class. . . . [L]ead Counsel’s continued, dogged effort over the past five years is a major reason for the magnitude of the recovery.” In Judge Thompson’s order approving the $750 million settlement in Xerox, the court noted: “The class received high-quality legal representation and obtained a very large settlement in the face of vigorous opposition by highly experienced and skilled defense counsel.” 16 © Milberg 2011 Milberg LLP Practice Areas Institutional Investor Services Class Action Litigation Portfolio Monitoring Securities Fraud Quarterly Reporting Consumer Fraud Case Evaluation ERISA Insurance Antitrust Corporate Governance and Shareholder Rights Advice Litigation Bankruptcy Pro Bono Litigation False Claims – Qui Tam Mass Torts 17 Human Rights and Labor Practices Derivative Madoff Transactional Governance and Fees © Milberg 2011 Thank You 18 © Milberg 2011 Benjamin Y. Kaufman, Esq. E bkaufman@milberg.com T 212.631.8641 F 212.273.4378 Admitted: Education: States of New York and New Jersey B.A., Yeshiva University, 1985 J.D., Benjamin N. Cardozo School of Law of Yeshiva University, 1988 Beklin Fellow, Belkin Scholar M.B.A., Stern School of Business of New York University, 1999 Mr. Kaufman focuses on class actions on behalf of defrauded investors and consumers. Mr. Kaufman’s successful securities litigations include In re Deutsche Telekom AG Securities Litig., No. 00-9475 (S.D.N.Y.), a complex international securities litigation requiring evidentiary discovery in both the United States and Europe, which settled for $120 million. Mr. Kaufman was also part of the team that recovered $46 million for investors in In re Asia Pulp & Paper Securities Litigation, No. 01CV-7351 (S.D.N.Y.) and $43.1 million, with contributions of $20 million, $14.85 million and $8.25 million from Motorola, the individual defendants, and defendant underwriters respectively, in Freeland v. Iridium World Commc’ns, Ltd. Mr. Kaufman’s outstanding representative results in derivative and transactional litigations include: In re Trump Hotels Shareholder Derivative Litigation (Trump personally contributed some of his holdings; the company increased the number of directors on its board, and certain future transactions had to be reviewed by a special committee.) He recently argued the appeal in In re Comverse Technology, Inc. Derivative Litig., 56 AD3d 49 (2008) which led to the seminal New York Appellate Division opinion which clarified the standards of demand futility, and held that a board of directors loses the protection of the business judgment rule where there is evidence of self-dealing and poor judgment by the directors; and In re Topps Company, Inc. Shareholder Litig. which resulted in a 2007 decision which vindicated the rights of shareholders under the rules of comity and doctrine of forum non conveniens and to pursue claims in the most relevant forum notwithstanding the fact that jurisdiction might exist as well in the state of incorporation. Mr. Kaufman is also at the forefront of consumer litigations with a recently-filed litigation brought on behalf of paid e-mail subscribers against web hosting and e-mail service providers in Golf Clubs Away LLC v. Hostway Corporation, et al., Case No. 09-29596 (Fl. Cir. Ct., Broward County). In addition, Mr. Kaufman represents many of the firm's corporate clients in complex commercial litigation matters and arbitrations, including Puckett v. Sony Music Entertainment, No. 108802/98 (New York Cty. 2002) (a complex copyright royalty class action) and in arbitrations on behalf of oppressed minority shareholders in both public and privately held corporations. Prior to joining Milberg in August of 1998, Mr. Kaufman was a Court Attorney for the New York State Supreme Court, New York County (1988-1990) and Principal Law Clerk to Justice Herman Cahn of the Commercial Division of the New York State Supreme Court, New York County (1990-1998). 19 © Milberg 2011 Todd Kammerman, Esq. E tkammerman@milberg.com Admitted: T 646.733.5692 Education: F 212.273.4339 States of New York and New Jersey B.A., Brandeis University, 1999 cum laude with honors J.D., Benjamin N. Cardozo School of Law of Yeshiva University, 2002 Alexander Fellow Mr. Kammerman focuses his practice on securities class action litigation, shareholder derivative litigation and commercial litigation. Mr. Kammerman’s successful litigations include In re CMS Energy Securities Litigation, No. 02-72004 (E.D. Mich.) ($200 million recovery); In re Royal Dutch/Shell Transport ERISA Litigation, No. 04-1398 (D.N.J.) ($90 million recovery); Scheiner v. i2 Technologies, et al., No. 01-418 (N.D. Tex.) ($87.8 million recovery); and In re Collins & Aikman Corporation Securities Litigation, No. 03-71173 (E.D. Mich.) ($10.8 million recovery). Mr. Kammerman played a pivotal role in the In re Comverse Technology, Inc. Derivative Litigation ($62 million recovery), particularly in drafting the appellate briefs which led to the seminal New York Appellate Division opinion, reported at 56 A.D.3d 49 (2008), clarifying the standards of demand futility, and holding that a board of directors loses the protection of the business judgment rule where there is evidence of self-dealing and poor judgment by the directors. He was also a member of the team that litigated the appeal in Tellabs, Inc. v. Makor Issues & Rights, Ltd. before the United States Supreme Court, in which the Supreme Court issued an opinion defining the pleading standard for scienter in all federal securities fraud cases, and is reported at 551 U.S. 308 (2007). While at Cardozo, he was named an Alexander Fellow, through which he worked as a judicial intern in the chambers of the Honorable Joseph A. Greenaway, Jr., U.S.D.J. in Newark, New Jersey. Mr. Kammerman is a member of the bars of the States of New York and New Jersey and is admitted to practice before the United States District Courts for the District of New Jersey, Southern District of New York, Eastern District of Michigan and the Eastern District of New York and the United States Courts of Appeals for the Third and Eleventh Circuits. 20 © Milberg 2011 Milberg LLP www.milberg.com New York One Pennsylvania Plaza 49th Floor New York, New York 10119 T 212.594.5300 or 800.320.5081 F 212.868.1229 Los Angeles One California Plaza 300 South Grand Avenue Suite 3900 Los Angeles, California 90071 T 213.617.1200 F 213.617.1975 Tampa Corporate Center One 2202 N. Westshore Blvd. Suite 200 Tampa, Florida 33607 T 813.639.4248 F 813.639.7501 Detroit One Kennedy Square 777 Woodward Avenue Suite 890 Detroit, MI 48226 T 313.309.1760 F 313.447.2080 21 © Milberg 2011