Emerald Logistics Pty Ltd Port Terminal Services Access Undertaking

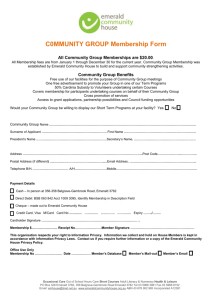

advertisement