Wellness and U - University of Montana

advertisement

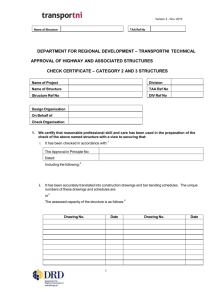

UNIVERSITY OF MONTANA FY2016 CHOICES Benefits Presentation by Terri Phillips, Associate VP/HRS TM Annual Benefit Election Period Online Elections: April 27, 2015 THRU May 20, 2015 2 Agenda for Today IMPORTANT CHANGES FOR FY2016 1. 2. 3. 4. Medical Benefit Improvements Flexible Spending Account Changes New Tax Advantaged Accounts (TAA) Wellness Incentive Program Benefit Changes and Your Decisions for FY2016 1. Medical, Dental, and Vision Hardware 2. Rates and Fees Time Frame for Making Benefit Change Decisions April 27, 2015 thru May 20, 2015 3 BENEFIT PLAN BASICS For FY2016, the employer contribution to health insurance will remain $887 per month. Any increase to the employer contribution is a decision that is made by the Montana Legislature and there is no evidence that will happen this session. Our self funded plan has two sources of revenue – the employer contribution as mandated by the State of Montana and the out of pocket contributions that are charged to members to cover children, spouses and adult dependents. The provisions of the plan are the same regardless of which insurance administrator you choose – Allegiance, Blue Cross/Blue Shield, or PacificSource. The difference between the three is with the doctors, hospitals and providers who have entered into discount arrangements with those administrators. (NOTE: PacificSource does not include St. Patrick’s Hospital as an in-network provider). 4 Our Plan is Operating Under “Closed Enrollment” You cannot add any spouses or adult dependents to the mandatory insurance items. You may add children who qualify up to age 26 to the mandatory insurance plan items. You can delete a spouse or adult dependent from the plan but you will not be able to add them back on until such time that we have another open enrollment period or you have a qualifying event. Will we ever have “open enrollment” again? With current, on-going changes to health insurance from the Affordable Care Act, it is hard to predict – not in the near future. 5 ELIGIBILITY Dependents up to age 26 may be enrolled annually in Medical, Dental, and/or Vision hardware benefits. (Does not include spouses). Your dependents must be eligible according to criteria in the Summary Plan document. Mid-year dis-enrollment may only occur with a “qualifying event” or during a “Special Enrollment Period.” 6 Qualifying Event Information New employees will have 30 days to enroll themselves and eligible dependents. Within 31days of the birth, adoption, or affidavit of intent to adopt, add a dependent child. Coverage begins on the date of birth of child(ren). For the following Qualifying Events, coverage begins on the 1st day of the month following the date HRS receives the valid mid-year change form with appropriate documentation: 1. Within 63 days of a family status change (marriage, divorce, legal separation, attestation of a domestic partnership, death, etc.) plan members may enroll or drop a dependent. 2. Within 63 days of the loss of eligibility for reasons other than non-payment of premiums (e.g. loss of job, elimination of other coverage, becoming ineligible for programs such as Medicaid or Healthy Montana Kids, or other significant adverse event), add a dependent. 3. With a child support order or change in support which makes an MUS plan member responsible for the medical coverage of a dependent child. 7 Health Plans and Networks To receive your best benefits, STAY IN-NETWORK with your health plan!! Allegiance: 1-877-778-8600 Website: www.abpmtpa.com/mus Blue Cross and Blue Shield: 1-800-820-1674 Website: www.bcbsmt.com PacificSource: 1-877-590-1596 Website: www.PacificSource.com/MUS 8 Health Insurance Facts Managed Care copays (flat dollar amounts that you pay for services) remain the same – for example: $15/office visit for “in-network” providers (these dollars count toward your out of pocket maximum). Managed Care plans all have networks they work with for out-of-state (national) coverage. Allegiance works with Cigna Blue Cross/Blue Shield works with Blue Card Pacific Source works with First Health & First Choice 9 Balanced Billing and Insurance Deductibles When you remain “in-network” you get the best possible use of your insurance dollars. You could complete the “innetwork” deductible and only have a maximum out of pocket cost for medical bills of $3,500 (Person) or $7,000 (Family). When you go “out-of-network” you have a second deductible and out of pocket maximum that you must meet – the “innetwork” and “out-of-network” costs do NOT add together. When you go “out-of-network” you could also face the concept of “balanced billing”. This means the provider has no agreement with the plan administrator in regard to how much they can charge for a service. They will charge whatever they want, the insurance plan will only cover the allowed portion, and you will pay the rest out of pocket – this can be VERY EXPENSIVE. 10 MEDICAL PLAN CHANGES Improvements to Complementary Health Care Services: Acupuncture Chiropractic Massage Therapy (New!) Benefits have a $15 co-pay and each service allows 30 visits per year. Naturopathic services have a $15 co-pay, no visit limit. The patient is responsible for any difference between the allowable amount for a service and the charge. Improvements to Miscellaneous Services Dietary/Nutritional Counseling, Obesity Management, TMJ and Infertility Treatment now have an out-ofnetwork coinsurance of 35%. 11 USE IN-NETWORK PROVIDERS Be sure to use “In-Network” providers to ensure you do not incur “balance billing” charges. Network participation by providers is changing in the health care market. Always check - DO NOT assume participation - your doctor may have dropped participation in the network. Check with your medical plan provider, the MUS Benefits office, or the UM HRS office, if you need help finding “in-network” providers. 12 FLEXIBLE SPENDING ACCOUNT CHANGES Beginning in FY2016, there are significant changes to how we have processed medical Flexible Spending Accounts (FSAs) based on federal regulations: 1. Employees will no longer be permitted to direct their excess employer contribution (state share) to a flexible spending account. 2. The maximum amount an employee can deposit from their paycheck into a flexible spending account increases to $2,550 for the FY2016 plan year. 13 FLEXIBLE SPENDING ACCOUNT CHANGES With the limitations on the manner and amount of employer funds that may be placed in a medical FSA, MUS Choices will now offer two account options for employees: 1. Medical FSA option funded only with employee contributions from paycheck (up to $2,550 per year). 2. NEW! A Tax Advantaged Account (TAA) • $750 employer contribution in FY2016 • Same allowable expenditures as a medical FSA • No “Use-it-or-Lose-it” annual requirement • Account balance is portable upon termination of employment • Must be elected during online benefits election – Not automatic. 14 MEDICAL SPENDING ACCOUNTS for FY2016 Tax Advantaged Account (TAA) Things to Know.... Only employer funds can be placed in a TAA--employee funds cannot be contributed (use the FSA instead). If your spouse has coverage through a HSA or has a highdeductible health plan, you may wish to consult with a tax advisor about when you can use the TAA. The TAA will be funded for FY2016 and MUS Benefits will review available funds to determine whether contributions can be made in the future. Account balances are not “use-it-or-lose-it “and can continue up to 24 months following the last day of employment with MUS (for terminating or retiring employees) and up to 24 months following the date that MUS Benefits ceases to make employer contributions (including Wellness Incentive funds). 15 MEDICAL SPENDING ACCOUNTS FY2016 NEW Arrangement for Medical Spending Accounts TAX ADVANTAGED ACCOUNT (TAA) • $750 Employer Contribution $$ • $250/$500 Wellness Incentive Funds will be placed in TAA instead of FSA. TAA FLEXIBLE SPENDING ACCOUNT • Up to $2,550 of Employee contribution $$ from your paycheck (pre-tax). Medical FSA 16 MEDICAL SPENDING ACCOUNTS FY2016 WELLNESS INCENTIVE PROGRAM 1. 2. 3. Benefits Eligible Employees Who Completed in 2014: A WellCheck in 2014 (biometric screening and blood draw), Took the Well-Being Assessment on Wellness Incentive program website, Reached Explorer level = 406 points during 2014, You will receive the $250/$500* Wellness Incentive funds to your TAA on July 1, 2015. * Employees whose spouses/adult dependents completed a WellCheck will receive an additional $250 in their employee TAA. Maximum of $500 per individual household enrolled in the MUS Plan. 17 WELLNESS INCENTIVE PROGRAM Discover great health with MUS Wellness and blaze a trail to your best life! Participate in MUS Wellness and earn points towards rewards. Sign up at https://muswell.limeade.com/Home . Wellness Incentive “Limeade” program runs the 2015 calendar year: January1, 2015 to December 27, 2015. You can earn a Fitbit Health Tracker, a $250/$500* tax advantaged incentive account distribution, a $150 Amazon Gift Card, a special Expedition Leader hoodie and plaque to show off your success, and be entered into a January 2016 raffle to win a $500 REI gift card. *Note - If a covered spouse/adult dependent participates in the WellCheck Health Screenings, you can each earn a $250 incentive account contribution ($500 maximum). Must participate in WellCheck in 2015, take the Wellbeing Assessment online and reach 1,000 points to be eligible for the $250/$500 incentive award into the TAA. Award will be available on July 1, 2016. Email notification of FitBit will come after 2015 WellCheck points are added to your profile--may take up to 8 weeks. Continue to earn points while you wait! 18 MEDICAL SPENDING ACCOUNTS FY2016 $500 Annual FSA Roll-Over If you have funds remaining in your FSA account as of June 30, 2015, the rollover provision is: 1. These funds will be placed in your FSA sometime in October 2015 after FY2015 accounting reconciliation is completed by Allegiance Flex. 2. You may incur expenses against these funds beginning July 1, 2015. However, the funds to pay expenses from the roll-over will not be available until they are deposited in to your FSA sometime in October 2015. 19 LIFE INSURANCE ELECTIONS Evidence of Insurability Now Required When: 1. An Active employee wishes to add Optional Supplemental Life Insurance in an amount above $300,000 or increase existing coverage more than one increment of $25,000 annually. 2. Adding Optional Supplemental Dependent Life for a spouse if not enrolled during the new hire election. Optional Supplemental Life and Optional AD&D Coverage premiums are paid on an after-tax basis. 20 VISION HARDWARE BENEFIT Optional Vision Hardware now covers ONLY hardware (frames, lenses, and contacts). Eye Exam is provided as part of the medical plan. (Bring your medical card to your eye exam). No need to use a network for purchasing hardware – simply select a place to purchase and then submit claim form to Blue Cross & Blue Shield. Claim form copies are available in the HRS office in Lommasson 252 or on the HRS website at: www.umt.edu/hrs/benefits/insurance 21 Healthy Montana Kids is available for qualifying MUS employees! The State of Montana allows the children of Montana University System (MUS) and State of Montana employees to participate in the Healthy Montana Kids program. This is a graduated program based on household income and number of dependents – it could provide savings for your family. You can decide to keep your child(ren) on the MUS insurance plan. For more information, contact your campus HRS office or go to ww.hmk.mt.gov or call 1-877-543-7669. The MUS Hardship Waiver for coverage for children is still available – you must apply for HMK and be denied before applying for the MUS waiver. This must be applied for every year. 22 Why is it important to complete Annual Benefit Election? Dependent children are eligible until age 26 – if you have children you previously had to drop, you can now add them back on until age 26. The medical plan monthly costs have increased – the plan you were in last year may no longer be the best plan for you. The health care providers that you use may or may not still be “in network” for the plan you were in last year- providers do change. Your goal is to stay “in network” to make the best use of your money – going “out of network” will cost you more. Flexible spending accounts for both medical and dependent care DO NOT ROLL FORWARD – you must ELECT that option every year. 23 CHANGES to CHOICES You MUST make a positive election for the TAA. Sign on to your CyberBear account during Annual Benefits Election, click on “Benefits Enrollment” to make your elections. Failure to do so will result in you not receiving the $750 dollars or your Wellness Incentive award in your TAA. Reminder - Closed enrollment for spouses in FY2016 (qualifying event required to add spouses – children to age 26 may be added). If you do not submit any changes, then you will be re-enrolled in the prior year benefit elections (except for FLEX or TAA). FLEX PLAN ENROLLMENT and TAA ELECTION 1. You must re-enroll in Flex each year and specify the dollars you wish to go into your account from your paycheck. 2. Remember that Flex is “USE IT OR LOSE IT”! Rollover provision permits up to $500 to carry forward to the following year. 3. WellCheck Incentive awards of up to $500 per household is available with the funds deposited into a TAA. 4. TAA MUST BE ELECTED BY EMPLOYEE ANNUALLY. 24 Annual Benefits Elections Online Facts Online Annual Benefits Election opens on April 27, 2015 and closes on May 20, 2015. Come to LA139 Computer Lab for online election assistance – check the emailed schedule. Please follow the instructions for using online enrollment that will be available on the HRS website – it WILL make the process easier. You will log on to CyberBear using your NetID and password. Most likely, you may be required to change your password. 25 Be sure to do these things Online annual benefit election process – hit the SUBMIT button when you are done. No signature page so be sure to print the “Calculate Cost” page for your records. If it isn’t what you elected, check it and/or contact HRS. If you want to contribute your own paycheck funds (pre-tax) to a Flexible Spending Account you must ELECT it each year – it is not automatic. Check covered dependents and provide correct SSN and birthdate. Make sure to ELECT the TAA so you receive the $750 contribution and any Wellness Incentive funds to that account. 26 QUESTIONS? Thank you for your time! HUMAN RESOURCE SERVICES Office: 406-243-6766 Email: HRSCommunications@mso.umt.edu 27