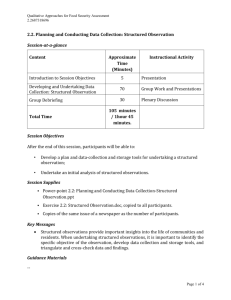

Documentation & Monitoring of Mortgage Loans

advertisement

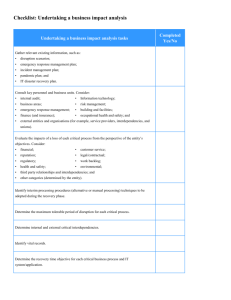

Askari Home Finance YOUR HOUSE CAN BE YOUR HOME Documentation & Monitoring of Mortgage Loans Documentation for Financing Facility Application Form duly signed by the applicant. Latest Salary Slip Borrower Basic Fact Sheet (BFS) duly completed (prior date of CA approval) Clear and visible photocopy of CNIC duly original seen and attested by ASM/RSM. Undertaking for Credit Facilities (CF-1) Residence Verifications Office Verifications 2 References plus Verification Two latest attested passport size Photographs Last Six Months Bank Statement KYC Completion Visit report SALARIED INDIVIDUALS Attested copy of CNIC. Two passport size photographs. Copy of the latest paid utility bill received at the residential address. Employment confirmation letter from the employer. Last three months original salary slip or attested photo copy. Last six months bank statement. Copy of the title documents/other supporting documents of the property to be placed with the bank as security. SOLE PROPRIETORSHIP Attested copy of CNIC. Two passport size photographs. Certificate from the bank indicating title & account opening date Copy of the latest paid utility bill received at the residential address. Copy of the latest utility bill received at the business address. Last six months bank statement (business/personal) Copy of the title documents/other supporting documents of the property to be placed with the bank as security. Copy of the latest income tax return or NTN. Certificate or other levy-able payment receipts. PARTNERSHIP Attested copy of CNIC. Two passport size photographs. Partnership Deed or Bank Certificate indicating title account opening date. Copy of the title documents or rent deed of business premises. Copy of the latest paid utility bill received at the residential address. Copy of the latest utility bill received at the business address. Last six months bank statement (business/personal) Copy of the title documents/other supporting documents of the property to be placed with the bank as security. Copy of the latest income tax return or NTN Certificate or other levy-able payment receipts. Basic Finance Documents Demand Promissory Note Buy Back Agreement Amortization Schedule duly signed by the borrower Direct Debit Authority Guarantees Personal Guarantee of Borrower / Mortgagor (owner of asset) PNWS/Wealth Tax returns for P-Gtee's Life Insurance Comprehensive Insurance Policy covering full value of Loan Amount with Bank's mortgage clause Evidence of premium payment and cheque realization certificate in case premium paid through cheque Insurance ( Mortgage ) Comprehensive Insurance Policy covering full value of Property/securities with Bank's mortgage clause Evidence of premium payment and cheque realization certificate in case premium paid through cheque Others Approval Branch Recommendation Data Check Customer Account # Confirmation required for disbursement of finance. Latest clean CIB report from SBP (prior date of CA approval) Facility Offer Letter duly acknowledged by the Borrower Sent to Branch Clear & visible photocopies of the witnesses. 12 / 36 Post dated cheques of Installment Amount Branch Confirmation for receiving Processing Fee Rs. 6,500/Copy of Pay Order & Payment confirmation Letter Documentation Required for Financing against the Purchase of House by Civilians - DHA • Original Sale / Conveyance Deed in favour of customer - Branch Undertaking required • Indenture of License in Form 'A‘ - Branch Undertaking required • Indenture of License in Form 'B‘ - Branch Undertaking required • Covering Letter of Approved Building Plan - Branch Undertaking required • Approved Building Plan - Branch Undertaking required • Allotment Letter issued by DHA - Branch Undertaking required • Agreement to Sale in favour of Customer - Branch Undertaking required • Token Mortgage Deed registered (TMD) for 5% of Finance Amount - Customer Undertaking Required • Agreement to create registered mortgaged • Affidavit by owner of property • Valuation Report by approved evaluator. • Building plans • Non-Encumbrance Certificate (NEC) - Customer Undertaking Required • PTM from the relevant authority to mortgage / prior lenders - Customer Undertaking Required • Lien Marking Confirmation from DHA - Customer Undertaking Required • Possession Letter - Customer Undertaking Required • Irrevocable Undertaking • Search Certificate • Completion Certificate • Extract from the Land Register issued by MEO showing the name of previous owner as Lessee. • Initial Opinion by Lawyer's confirming Clear Title • Final Opinion by Lawyer's confirming correct execution of Mortgage Documentation - Branch Undertaking required • Mutation of the Property in the name of Customer from MEO Customer Undertaking Required • Mutation of the Property in the name of customer from MEO • Memorandum of Deposit of Title Deeds (MOTD) for Rs… • General of Power Attorney registered (GPA) • Special Power of Attorney (APA) on Rs.500/- Stamp paper duly Notarized Documentation Required for Financing against the Purchase of House by Civilians – Other Than DHA Original Sale / Conveyance Deed in favour of customer Transfer Letter Covering Letter of Approved Building Plan Branch Undertaking required Approved Building Plan - Branch Undertaking required Allotment Letter issued by concerned Authority Agreement to Sale in favour of Customer Branch Undertaking required Search Certificate Completion Certificate Initial Opinion by Lawyer's confirming Clear Title Final Opinion by Lawyer's confirming correct execution of Mortgage Documentation - Branch Undertaking required Mutation of the Property in the name of Customer from MEO - Customer Undertaking Required Mutation of the Property in the name of customer from MEO Memorandum of Deposit of Title Deeds (MOTD) for Rs… General Power of Attorney registered (GPA) Special Power of Attorney (APA) on Rs.500/Stamp paper duly Notarized Token Mortgage Deed registered (TMD) for 5% of Finance Amount - Customer Undertaking Required Agreement to create registered mortgaged Affidavit by owner of property Valuation Report by approved evaluator. Non-Encumbrance Certificate (NEC) - Customer Undertaking Required PTM from the relevant authority to mortgage / prior lenders - Customer Undertaking Required Lien Marking Confirmation from DHA - Customer Undertaking Required Possession Letter - Customer Undertaking Required Irrevocable Undertaking Original Sub lease Occupancy certificate issued by KBCA Search Certificate PT-10 evidencing payment of up to date property tax payment Genuineness of the Property Documentation Required for Financing against the Purchase of Apartment • Original Sale / Conveyance Deed in favour of customer Branch Undertaking required • Original Sub lease in Favor of Seller • Occupancy certificate issued by KBCA • Search Certificate • NOC from the Association for transfer of Flat • PT-10 evidencing payment of up to date property tax payment • Initial Opinion by Lawyer's confirming Clear Title • Final Opinion by Lawyer's confirming correct execution of Mortgage Documentation - Branch Undertaking required • Memorandum of Deposit of Title Deeds (MOTD) for Rs… • General Power of Attorney registered (GPA) • Token Mortgage Deed registered (TMD) for 5% of Finance Amount - Customer Undertaking Required • Agreement to create registered mortgaged • Affidavit by owner of property • Valuation Report by approved valuator • PTM from the relevant authority to mortgage / prior lenders - Customer Undertaking Required • Genuineness of the Property CHECK LIST 1 ASM VISIT REPORT 2 BTF REQUEST ( IF REQUIRED ) 3 AUDITED BALANCE SHEET( RS. 10 MILLION OR ABOVE ) 4 COMPLETE APPLICATION FORM 5 COPY OF CNIC 6 2 PHOTOGRAPH 7 UTILITY BILLS / GAS/ELECTRICITY/TELEPHONE / ( FOR 2 MONTHS ) 8 CHILDREN FEE SLIP (IF ANY) 9 BASIC BORROWER FACT SHEET / CREDIT DECLARATION 10 UNDERTAKING ( IPO & CREDIT DECLARATION ) 11 FORMS (KYC & 2 REFERENCE) 12 PROCESSING FEE PAY ORDER IN FAVOUR OF ASKARI BANK LIMITED 13 RENTAL AGREEMENT OF RESIDENCE (IF ANY) 14 LAST THREE MONTHS ORIGINAL PAY SLIP 15 EMPLOYMENT LETTER WITH STATUS OF EMPLOYEMENT AND DATE OF JOINING 16 LAST SIX MONTH ORIGINAL BANK STATEMENT 17 INCOME TAX RETURN FOR THE LAST THREE YEARS 18 BALANCE SHEET FOR THE LAST 2 YEARS (FOR S.E.B) 19 PROPRIETORSHIP DECLARATION ON COMPANY LETTER HEAD 20 BANK LETTER FOR AUTHORIZED SIGNATORY 21 PARTNERSHIP DEED (IF ANY) 22 ARTICLE OF MEMORANDUM / 29 - ETC 23 COPY OF TITLE DEED OF BUSINESS PREMISES OR RENT AGREEMENT 24 COPY OF CREDIT CARDS BILL FOR THE LAST THREE MONTHS 25 COPY OF THE ALLOTMENT LETTER OF THE PROPERTY 26 COPY OF LEASE / SUB LEASE DEED 27 COPY OF ALL REGISTERED DEEDS 28 APPROVED BUILDING PLAN 29 MUTATION / TRANSFER LETTER 30 PROPERTY TAX CLEARANCE 31 POSSESSION LETTER 32 DATACHECK & ECIB REPORT 33 EXECUTIVE SUMMARY 34 VERIFICATION (PHYSICAL & DOCUMENTS) 35 INCOME ESTIMATION (IF REQUIRDE) 36 LEGAL OPINION OF THE PROPERTY 37 PROPERTY VALUATION 38 UP TO DATE SEARCH REPORTS 39 CSA 40 APPROVAL LETTER TO CUSTOMER 41 LIFE INSURANCE Monitoring of Mortgage Loans Normally the banks’ practice is to put on place an efficient computer based MIS for the purpose of consumer finance which is able to effectively cater the needs of consumer financing portfolio and generates necessary information reports used by the management / recovery & collection department for effective monitoring of the banks exposure and timely recovery of the installments from the customers through collection and recovery officers. Delinquency reports pertaining to 30,60,90,120,180&360 days & above are provided to the management / recovery & collection department on monthly basis in order to keep in tact with the customers to recover the monthly installments on time and to minimize the delinquency. The strong grip on the newly delinquent account enable the collection to stop maximizing the overdue portfolio. Therefore the basic concept should be to focus those customers who are newly irregular. THANK YOU!!