Preparing the Supervisory Authority and Pension Industry for

advertisement

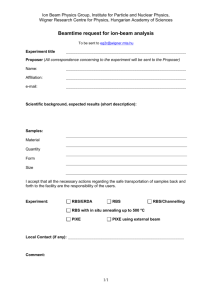

Preparing Supervisory Authority and Pension Industry for Risk-based Supervision Charles Machira, Manager, Supervision Retirement Benefits Authority, Kenya Contents • Retirement Benefits Industry in Kenya • Risk Based Supervision in RBA Kenya • Preparing the Supervisor and the Pensions Industry • Challenges in Implementing Risk Based Supervision Model in Kenya Kenya Pension System Private Occupational Non Contributory/Pay As You Go (PAYG) Civil Service Pension Scheme Pension System Individual Contributory Open Schemes State Old Age Pension on pilot program Mandatory National – National Social Security Fund 100% 90% 90% 65% 45% 37% 80% 70% 60% DC 50% DB 40% 30% 20% 10% 0% Number of schemes Number of Members Assets Estimated Actuarial Liability REGULATION MATRIX Scheme/Trustees Custodian Fund Manager Scheme Administrator Others (Actuary, Auditor, Legal advisors, etc.) Retirement Industry Assets 350,000 Other 300,000 Guaranteed Funds K 250,000 S h s Immovable Property Offshore 200,000 m i l l 150,000 i o n 100,000 s 50,000 Unquoted Equties Quoted Equities Government Securities Fixed Income Fixed Deposit Cash - June 02 June 03 June 04 June 05 June 06 June 07 June 08 Dec 08 June 09 Dec 09 Jun 10 Note: Excluding NSSF Regulatory Structure Ministry of Finance Central Bank of Kenya Retirement Benefits Authority Insurance Regulatory Authority Capital Markets Authority Commercial banks Retirement Benefits schemes Insurance Companies Non Bank Financial Institutions Individual pension Plans fund Managers Insurance Brokers Pooled Schemes Central Depository Systems Insurance Agents NSSF Custodians Assesors & Adjustors Administrators Investment Banks Health Management Companies Collective Investment Schemes Medical Insurance Providers Investment Advisors Mortgage Companies Forex Bureaus Building Societies Micro Finance CRBs Fund Managers Custodians Securities Exchanges Insurance Surveyors Insurance Investigators Stock Brokers Securities Dealers Listed companies Credit Rating Agencies Venture Capital Firms RETIREMENT BENEFITS AUTHORITY (RBA) Created in 2000 by an Act of Parliament 50 Staff • Regulate and supervise establishment and management of retirement benefits schemes. Statutory Objectives • Protect the interest of members and sponsors of retirement benefits schemes. • Promote the development of the retirement benefits industry. • Advise the Minister for Finance on the national policy to be followed with regard to the retirement benefits industry. • Implement all government policies relating to the retirement benefits industry Why did RBA adopt RBS? • Allows systematic assessment within a formalized framework both at the time of examination and in between through offsite monitoring • Allows Identification of schemes and areas within schemes where problems exist or are likely to emerge • Cost effective use of resources through greater emphasis on risk • Enables prompt intervention and timely action • RBS allows supervisor to • • spend the minimal amount of effort on schemes in satisfactory status concentrate on schemes requiring more attention • Reduces regulatory burden • Continuous monitoring FRAMEWORK DEVELOPMENT Preparing the Supervisor for RBS 2004 2005 2006 WB Institute facilitates training on Pension Supervision effectively introducing RBS Framework Introduction/ Consultation-Initial draft OECD Consultant Promontory Financial Group Australasia, reviews draft, recommended; • Legislative Changes to allow regulator issue Prudential Standards • Attachment of RBA Employees to Jurisdictions with operational RBS Model • RBA to Develop detailed manual and procedures for RBS 2007 2008 Final report on RBS case study for Kenya RBA Staff undergo attachments in Australia, SA & UK RBA appoints consultant to facilitate Implementation of RBS approach FRAMEWORK DEVELOPMENT Preparing the Supervisor for RBS 2009 Consultant Trains staff on RBS model Consultant submits final report including; • • • • 2010 Pre-requisites for RBS Procedure Manual Implementation Manual Training Syllabus for staff and Industry Law amended to give RBA powers to issue statutory guidelines RBA commences RBS for pilot 60 schemes (5 % of Schemes). RBA Launches RBS Model to the Industry On-going Development of supervisory guides Benchmarking methodology Preparing the Industry for RBS • Public announcements of shift to RBS since 2007 • Law amended in June 2009 to require all schemes to adopt mark to market time weighted performance reporting • Issue of Practice note on RBS in June 2010 • Stakeholder Workshop in June 2010 • Issue of interrogatories to all schemes: Governance self-assessment DC or DB interrogatory Practice note on Income draw Statutory guidance note on risk based supervision • Training of scheme administrators commenced in August 2010 Implementation Challenges • Change from compliance based approach to RBS requires change in mind-set • Educating scheme trustees and service providers on the new system and enabling them to complete interrogatories satisfactorily. • Supervisory Skills and Readiness • Industry Skills and Readiness • Difficulty in identifying and financing a suitable IT system in line with the new system as well as challenge of shifting industry towards electronic filling of returns in suitable format. Thank You Asante www.rba.go.ke