implementation of 2008 system of national accounts and

advertisement

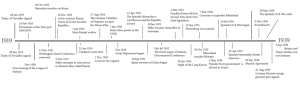

IMPLEMENTATION OF SYSTEM OF NATIONAL ACCOUNTS 2008 AND BALANCE OF PAYMENTS AND INTERNATIONAL INVESTMENT POSITION MANUAL 6TH EDITION BY THE AUSTRALIAN BUREAU OF STATISTICS Michael Davies, First Assistant Statistician, Macroeconomics and Integration Group, Australian Bureau of Statistics 1 The ABS… • … is Australia’s official national statistical agency. • … has the authority to conduct statistical collections. • … has obligations to publish and disseminate compilations and analyses of statistical information, and to maintain the confidentiality of information. • …ensures formulation, and compliance with, standards for the carrying out by official bodies of operations for statistical purposes. 2 Standards used in Australia • The ABS is a strong contributor to the development of international standards. • 2008 System of National Accounts (2008SNA) • Balance of Payments and International Investment Position 6th edition (BPM6) • Australian and New Zealand Standard Industrial Classification 2006 (ANZSIC06…..consistent with ISIC REV 4) • Standard Economic Sector Classifications of Australia 2008 (SESCA08) 3 Management of change process • Industry classification fundamental – integral to ABS systems and databases • Simultaneous implementation of 2008SNA/BPM6/SESCA08 to minimise disruption, a ‘big bang approach’. • Therefore, long lead times for implementation of changes – Need to ensure funding/resourcing – Need to ensure business continuity 4 Standards change control • ANZSIC Implementation Board and Macroeconomic Statistics Review Committee set up in 2005 – Methods board to assess and document changes • Transition plans to identify and prioritise tasks – Together with risks and risk mitigation strategies • Communications plans to identify key clients and communication mechanisms • Implementation workshops, information sessions and publications 5 Principles • Standards • Timing of implementation • Coordination and consultation 6 Standards • Departures from standards: – few in number & demonstrate a significant benefit or avoidance of an unwarranted cost – carried through to all accounts/statistics – enable a straightforward reconciliation with the standard where feasible – be implemented after extensive consultation and publicity • Proposed departures were discussed with major users 7 Departures from standards • 2008 SNA – Repurchases agreements and securities lending – Databases – Change from ‘consumption of fixed capital’ to ‘depreciation’ – Goodwill and marketing assets – Valuation of water – Some components of illegal economy – The debtor approach to recording interest: 1. Realistic e.g. Current market yields 2. Avoids artificial measurement e.g. indexed debt, concessional loans. 8 Departures from standards • BPM6 – – – – – Repurchase agreements Treatment of originals and copies Treatment of patented entities Goodwill and marketing assets Reclassifications for exchanges in international positions – Treatment of holding companies – Signage 9 Timing of implementation • Changes resulting in changes to GDP should be at same time – Needs 3 year lead time for Australian National Accounts – Some consideration of other changes can take place • Decided to release on the quarter that coincided with the annual publication (Sept quarter 2009, published in December 2009) 10 11 Timing (Big bang approach) • ABS implemented all changes at once: – Pros • minimised disruption for clients • reduced total cumulative effort: – system, questionnaire changes – balancing – Cons • • • • made it a very large task was difficult to disentangle individual impacts not all standards / issues finalised in time was difficult to be responsive to change 12 Coordination and consultation • Must be centrally coordinated • Provide clients and stakeholders with sufficient information to manage their own changes. • Consulted regularly with key clients – In Australia these include the Reserve Bank of Australia and The Treasury. 13 Extensive User Consultation • A series of information papers released between 2004 and 2009 – – – – – 2004 information paper on ANZSIC development 2006 information paper on ANZSIC implementation plans 2007 information paper on introduction to revised SNA/BPM 2008 update on ANZSIC implementation 2009 information paper on implementation of revised SNA/BPM • Consultation with key government agencies and other users – Including road shows in each State and Territory 14 Managing a long time series under new standards • Implementation involved extensive changes to statistical infrastructure – – – – Business Register coded to ANZIC 2006 from March 2006 Creation of new survey frames Back casting methodologies Systems reengineering and database changes • Parallel runs to generate ‘bridged data’ for measurement of impact • Progressive migration of collections – Starting in 2006 – Culminating with the National Accounts in SQ09 15 Changes to data collections • ABS has a strong integrated suite of economic collections from Survey and Administrative data • Easy changes – Changes to in-house economic surveys – Changes to estimation models • Complex changes – Changes to systems and processes – Changes to compilation of Supply-Use tables after changes – Changes to external administrative collections (Tax data, prudential information) 16 General business of statistics process map 17 Changes to data collections – financial account • New financial sector classification – Separation of money-market funds and other investment funds. • Only those investment funds investing predominantly in financial assets are treated as financial corporations. – Small divergence from standards. 18 Changes to data compilation – Input-Output • Made complex from changes to industry classification • Divergence from 2008SNA use of Producer Prices – Users prefer Basic Prices since Transport is an important consideration – Continued use of 1968SNA methodology 19 Impacts from implementing new standards • Level shift in GDP aggregate • Minimal change to growth rates • Minimal change to Current Account Balance • Minimal change to International Investment Position • Minimal change to Net Foreign Debt 20 GDP SEASONALLY ADJUSTED SERIES, CVM—%change GDP SEASONALLY ADJUSTED SERIES, CVM—Levels %change 2 2008SNA 1993SNA SNA08 SNA93 million 320000 300000 1 280000 0 260000 –1 Sep 2004–05 Mar Sep 2005–06 Mar Sep 2006–07 Mar Sep 2007–08 Mar Sep 2008–09 Mar 240000 Sep 2004–05 REVISIONS TO GDP GROWTH, Seasonally adjusted CVM Mar Sep Mar 2005–06 Sep 2006–07 Mar Sep 2007–08 Mar Sep 2008–09 Mar CURRENT ACCOUNT SEASONALLY ADJUSTED SERIES, Levels mean revision latest revision % 0.6 $m –6000 BPM6 BPM5 0.4 –9000 0.2 –12000 0 –15000 –0.2 –18000 –0.4 Jun 2008–09 Sep 2009–10 Dec Mar Jun Sep 2010–11 Dec Mar –21000 Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep 2004–05 2005–06 2006–07 2007–08 2008–09 2009–10 21 NET FOREIGN DEBT, Original series—Levels BPM6 BPM5 $m 700000 600000 500000 400000 300000 Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep 2004–05 2005–06 2006–07 2007–08 2008–09 2009–10 NET IIP AT END OF PERIOD, Original Series—Levels BPM6 BPM5 $m 800000 700000 600000 500000 400000 Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep 2004–05 2005–06 2006–07 2007–08 2008–09 2009–10 22 Challenges from implementing new standards • R&D • FISIM • These will be described in more detail later 23 User response to implementing new standards • Global Financial Crisis influenced user views on new standards – Calls for a delay to the publication release – Problems with coherence in accounts were of concern • Little user response to 2008SNA/BPM6 changes were the result of a good communication plan 24 Areas of user concern • Unfunded pension liabilities was not a problem as they were already done. • Little impact on productivity measures post capitalisation of Research & Development. • Financial Intermediation Services Indirectly Measured (FISIM) performed badly during crisis. • Change to performance indicators which relied on GDP. 25 Implementing Research & Development case study • Principles: – Treat expenditure on R&D as capital formation. • Should be in terms of future economic benefit. • Practically, this is difficult to measure. – Value R&D output at market prices. • Most R&D is own account and there is no recognised market price • ABS valued R&D at cost. • Difficulty in assigning an asset life for depreciation – Assume international trade in R&D is covered by trade in services collection. • Makes little difference to productivity story 26 International reporting obligations • Problems with early adoption – out of step with other countries. • Evolution of new standards and reporting obligations outside of a formal framework – G20 finance ministers – Basel III developments – Globalisation indicators (for example: Ultimate beneficiaries/owner, foreign affiliates) • Delay in some complementary manuals development (eg. Government Finance, Trade in Services) 27 Timeline for Standards and Disasters Bear Stearns falls Lehman Bros falls Planning and funding bid development Market bottoms Funding granted ANZSIC 2006 Cyclone Floods Tsunami - Japan Sovereign debt crisis Development of A06 ANZSIC released Implementation Industry collection project board established Dual coding of units ceases Industry surveys Funding migrated to ANZSIC ceases Decision to proceed with implementation of standards Release of NA/BOP on new standards Development of Standards SNA08/BPM6 /SESCA 08 Implementation Steering com'tte established Jan-2002 Jan-2003 Jan-2004 Jan-2005 NPP funding granted Jan-2006 Funding ceases Jan-2007 Jan-2008 Jan-2009 Jan-2010 Jan-2011 28 The Financial Crisis • Global Financial Crisis hits in December 2008 following the collapse of Lehman Bros – Prior to this it was difficult to anticipate the full scale of the crisis and its impact on transmission mechanisms • By this stage a number of critical implementation milestones had been passed – Dual coding of the units frame ceased in June 2008 – Migration of the annual industry collections in August 2008 • • • Government funding for SNA implementation ceased at the end of 2009. FISIM estimates became unstable impacting on financial industry output and consumer prices index. Statistics on derivatives, the main transmission mechanism for the GFC, are a significant data gap in Australia. 29 Some economic phenomena during volatile times MINING GVA AND ALL EXPORTS TO CHINA, Seasonally Adjusted and Orginal TERMS OF TRADE, Seasonally adjusted index 120 Mining GVA Exports to China $m 40000 100 30000 80 20000 60 10000 0 40 Mar Sep Mar 2005–062006–07 Mar Mar Mar Mar Mar Mar Mar Mar Mar 1993–94 1995–96 1997–98 1999–00 2001–02 2003–04 2005–06 2007–08 2009–10 FINANCE GVA, Seasonally Adjusted Sep Mar Sep 2007–08 2008–09 Mar Sep Mar Sep 2009–10 2010–11 Mar FINANCE SECTOR GROSS OPERATING SURPLUS, Seasonally adjusted Finance A93 Finance A06 $m 35000 $m 18000 Finance Sector GOS S98 Finance sector GOS S08 15000 30000 12000 25000 9000 20000 6000 15000 3000 10000 Jun 1995–96 Jun 1997–98 Jun 1999–00 Jun 2001–02 Jun 2003–04 Jun 2005–06 Jun 2007–08 Jun 2009–10 0 Jun 1995–96 Jun 1997–98 Jun 1999–00 Jun 2001–02 Jun 2003–04 Jun 2005–06 Jun 2007–08 30Jun 2009–10 Managing national accounts in a volatile environment and lessons learned • Long period of stable growth in Australia from 1992 to mid-2000’s. o There is a tendency for complacency after an extended period of relative market stability Exacerbated by staff turnover: many staff have not been through a full business cycle • Generally most series performed well until 2007. • Statistical discrepancy emerged as a problem after December quarter 2009. o Effective measurement in times of crisis requires statistical infrastructure in place BEFORE the crisis For example, measurement of the financial services industry Full set of accounts, including balance sheets and financial accounts are an advantage. 31 Managing national accounts in a volatile environment and lessons learned - continued • Government measures to stimulate the economy introduced in 2009. • Onset of natural disasters from 2009 onwards • Sovereign debt issues emerged in 2010 and continue to disrupt markets. o Implementation of the full set of accounts helps to manage through crisis events. These problems were faced by many NSOs. 32 FISIM • FISIM performed unpredictably in a financial crisis. – Was influencing CPI and headline inflation rates and National Accounts aggregates. • Responses – – – – Forced a review of the FISIM model. Removal of FISIM from headline CPI (inflation) Implemented a revised Balance of Payments model Improved data sources for National Accounts. 33 Future developments • Revised Government Finance Statistics Manual • Emergence of new practices around 2008SNA and BPM6 from implementation in USA (2013), Canada (2013) and Eurostat (2014). 34