Introduction to Production and Resource Use

advertisement

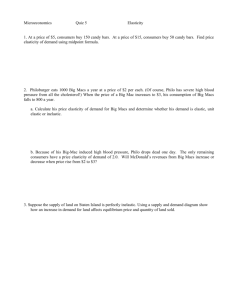

Measurement and Interpretation of Elasticities Chapter 5 Discussion Topics Own price elasticity of demand Income elasticity of demand Cross price elasticity of demand Other general properties How can we use these demand elasticities 2 Key Concepts Covered… Own price elasticity = %Qi for a given %Pi, ηii i.e., the effect of a change in the price for hamburger on hamburger demand: ηHH = %QH for a given %PH Cross price elasticity = %Qi for a given %Pj, ηij i.e., the effect of a change in the price of chicken on hamburger demand: ηHC = %QH for a given %PC Income elasticity = %Qi for a given %Income, ηiY 3 i.e., the effect of a change in income on hamburger demand: ηHY = %QH for a given %PY Pages 70-76 Key Concepts Covered… Arc elasticity = elasticity estimated over a range of prices and quantities along a demand curve Point elasticity = elasticity estimated at a point on the demand curve Price flexibility = reciprocal (the inverse) of the own price elasticity %Pi for a given %Qi 4 Pages 70-76 Own Price Elasticity of Demand 5 Own Price Elasticity of Demand Own price elasticity of demand Percentage change in quantity demanded (Q) ηii = Percentage change in own price (P) Point Elasticity Approach: Own price Q elasticity of Qa demand Q = (Qa – Qb) P = (Pa – Pb) 6 P Q Pa Pa P Qa $ Single point on curve Pa Pb Qa Qb Q The subscript • a stands for after price change • b stands for before price change Pages 70-72 Own Price Elasticity of Demand Own price Percentage change in quantity elasticity of ηii =Percentage change in own price demand Arc Elasticity Approach: Own price elasticity of demand Q Q P P Q P P P Q where: Avg Price P = (Pa + Pb) 2 Q = (Qa + Qb) 2 Avg Quantity Q = (Qa – Qb) P = (Pa – Pb) $ Specific range on curve Pa Pb Equation 5.3 Qa Qb Q The subscript • a stands for after price change • b stands for before price change Page 72 7 Q Interpreting the Own Price Elasticity of Demand If Elasticity Measure is: Demand is said to be: % in Quantity is: Less than –1.0 Elastic Greater than % in Price Equal to –1.0 Unitary Elastic Same as % in Price Inelastic Less than % in Price Greater than –1.0 8 Note: The %Δ in Q is in terms of the absolute value of the change Page 72 Demand Curves Come in a Variety of Shapes $ Q 9 Demand Curves Come in a Variety of Shapes $ Perfectly Inelastic ∆P Perfectly Inelastic: A price change does not change quantity purchased Perfectly Elastic Q 10 Page 72 Demand Curves Come in a Variety of Shapes $ Inelastic Demand ∆P ∆P Elastic Demand Q ∆Q 11 ∆Q Page 73 Demand Curves Come in a Variety of Shapes $ Elastic where –%Q > % P Unitary Elastic where –%Q = % P Inelastic where –%Q < % P Q 12 Page 73 Example of Arc Own-Price Elasticity of Demand Unitary elasticity 13 –% Change in Q = % Change in P ηii= –1.0 Page 73 Elastic demand Inelastic demand Page 73 14 Elastic Demand Curve $ With the price decrease from Pb to Pa What happens to producer revenue? Pb Pa 0 15 Qb Qa Q Elastic Demand Curve $ Cut in price Pb Pa 0 16 Results in a larger % increase in quantity demanded Q Qb Qa Elastic Demand Curve Producer revenue (TR) = price x quantity • Revenue before the change (TRb) is Pb x Qb $ C Pb A B Pa 0 17 Represented by the area 0PbAQb • Revenue after the change is (TRa) is Pa x Qa Represented by the area 0PaBQa Qb Qa Q Elastic Demand Curve Change in revenue (∆TR) is TRa – TRb → ∆TR = 0PaBQa – 0PbAQb → ∆TR = QbDBQa – PaPbAD $ Red Box C Pb Pa 0 18 A D Qb Purple Box →TR ↑ %Q ↑ is greater than %P ↓ B Qa When you have elastic Q demand ↑ in price → ↓ total revenue ↓ in price → ↑ total revenue Inelastic Demand Curve $ Pb Cut in price Pa Results in smaller % increase in quantity demanded Q Qb Qa 19 Inelastic Demand Curve $ With price decrease from Pb to Pa What happens to producer revenue? Pb Pa Q 20 Qb Qa Inelastic Demand Curve $ Producer revenue (TR) = price x quantity Revenue before the change (TRb) is Pb x Qb Represented by the area 0PbAQb Revenue after the change is (TRa) Pa x Qa Pb Pa 0 21 A Represented by the area 0PaBQa B Q Qb Qa Inelastic Demand Curve Change in revenue (∆TR) is TRa – TRb $ ∆TR = 0PaBQa – 0PbAQb ∆TR = QbDBQa – PaPbAD Purple Box Red Box Pa 0 22 →TR ↓ % Q increase is less than %P decrease A Pb B D When you have Q Qb Qa inelastic demand ↑ in price → ↑ total revenue ↓ in price → ↓ total revenue Revenue Implications Own-price Elasticity is: Cutting the Price Will: Increasing the Price Will: Elastic (ηii< -1) Unitary Elastic (ηii= -1) Inelastic (-1< ηii < 0) Increase Total Revenue Decrease Total Revenue Not Change Revenue Not Change Revenue Decrease Total Increase Total Revenue Revenue Typical of Agricultural Commodities 23 Page 81 Elastic Demand Curve Consumer surplus (CS) $ C Pb A B Pa 0 24 Before price cut CS is area PbCA After the price cut CS is area PaCB Qb Qa Q Elastic Demand Curve $ C Pb The gain in consumer surplus A B Pa 0 25 after the price cut is area PaPbAB = PaCB – PbCA Q Qb Qa Inelastic Demand Curve $ Inelastic demand and price decrease Pb Pa 0 26 Consumer surplus increases by area PaPbAB A B Q Qb Q a Retail Own Price Elasticities • • • • • • • Beef and veal= -0.62 Pork = -0.73 Fluid Milk = -0.26 Wheat = -0.11 Rice = -0.15 Carrots = -0.04 Non food = -0.99 Source: Huang, (1985) 27 Page 79 Interpretation Let’s use rice as an example Previous Table: own price elasticity of –0.15 → If the price of rice drops by 10%, the quantity of rice demanded will increase by 1.5% $ Pb 10% drop 1.5% increase 28 Demand Curve With a price drop What is the impact on rice producer revenues? What is the impact on consumer surplus from rice consumption? A Pa B 0 QB Qa Q Own Price Elasticity Example 1. The local Kentucky Fried Chicken outlet typically sells 1,500 Crunchy Chicken platters per month at $3.50 each 2. The own price elasticity for the platter is estimated to be –0.30 Inelastic demand 29 3. If the KFC outlet increases the price of the platter to $4.00: a. How many platters will the KFC outlet sell after the price change?__________ b. The KFC outlet’s revenue will change by $__________ c. Will consumers be worse or better off as a result of this price change?_________ The answer… 1. The local KFCsells 1,500 crunchy chicken platters per month at $3.50 each. The own price elasticity for this platter is estimated to be –0.30. If the local KFC outlet increases the price of the platter by 50¢: a. How many platters will the chicken sell? 1,440 Solution: -0.30 = %Q%P P Avg. Price -0.30= %Q[($4.00-$3.50) (($4.00+$3.50) 2)] %P 30 -0.30= %Q[$0.50$3.75] -0.30= %Q0.1333 → %Q=(-0.30 × 0.1333) = -0.04 or –4% → New quantity = (1–0.04)×1,500 = 0.96×1,500 = 1,440 The answer… b. The Chicken’s revenue will change by +$510 Solution: Current revenue = 1,500 × $3.50 = $5,250/month New revenue = 1,440 × $4.00 = $5,760/month →revenue increases by $510/month = $5,760 - $5,250 c. Consumers will be __worse___ off as a result of this price change Why? Because price has increased 31 Another Example 1. The local KFC outlet sells 1,500 crunchy chicken platters/month when their price was $3.50. The own price elasticity for this platter is estimated to be –1.30. If the KFC increases the platter price by 50¢: Elastic demand a. How many platters will the chicken sell?__________ b. The Chicken’s revenue will change by $__________ c. Will the consumers be worse or better off as a result of this price change? 32 The answer… 1. The local KFC outlet sells 1,500 crunchy chicken platters/month when the price is $3.50 . The own price elasticity for this platter is estimated to be –1.30. If the KFC increases the platter price by 50¢: a. How many platters will the KFC outlet sell? 1,240 Solution: -1.30 = %Q%P -1.30= %Q[($4.00-$3.50) (($4.00+$3.50) 2)] -1.30= %Q[$0.50$3.75] -1.30= %Q0.1333 %Q=(-1.30 × 0.1333) = -0.1733 or –17.33% → New quantity = (1 ̶ 0.1733)×1,500 = 0.8267 ×1,500 = 1,240 33 The answer… 1. b. The Chicken’s revenue will change by –$290 Solution: Current revenue = 1,500 × $3.50 = $5,250/mo New revenue = 1,240 × $4.00 = $4,960/mo →Revenue decreases by $290/mo = ($4,960 – $5,250) c. Consumers will be worse off as a result of this price change Why? Because the price increased. 34 Income Elasticity of Demand 35 Income Elasticity of Demand Income Percentage change in quantity demanded (Q) elasticity of ηY = Percentage change in income (I) demand where: Q ηy Q I = (Ia + Ib) 2 Q = (Qa + Qb) 2 Q = (Qa – Qb) I = (Ia – Ib) I Q I I I Q ηY : A quantitative measure of changes or shifts in quantity demanded (ΔQ) resulting from changes in consumer income (I) Page 74-75 36 Interpreting the Income Elasticity of Demand When the income elasticity is: The good is classified as: Greater than 0.0 A normal good Greater than 1.0 A luxury (and a normal) good Less than 1.0 but greater than 0.0 A necessity (and a normal) good Less than 0.0 An inferior good Page 75 37 Example Assume Federal income taxes are cut and disposable income (i.e., income fter taxes) is increased by 5% Assume the chicken income elasticity of demand is estimated to be 0.3645 What impact would this tax cut have upon the demand for chicken? Is chicken a normal or an inferior good? Why? 39 The Answer 1. Assume the government cuts taxes, thereby increasing disposable income (I) by 5%. The income elasticity for chicken is 0.3645. a. What impact would this tax cut have upon the demand for chicken? Solution: 0.3645 = %QChicken % I → 0.3645 = %QChicken .05 →%QChicken = .3645 .05 = .018 or + 1.8% b. Chicken is a normal but not a luxury good since the income elasticity is > 0 and < 1.0 40 Cross Price Elasticity of Demand 41 Cross Price Elasticity of Demand Cross Price Percentage change in quantity demanded elasticity of ηij = Percentage change in another good’s price demand Qi Pj Qi Pj i and j are goods ηij (i.e., apples, Q P P Q i j j i where: oranges, peaches) Pj = (Pja + Pjb) 2 Qi = (Qia + Qib) 2 Qi = (Qia – Qib) Pj = (Pja – Pjb) ηij provides a quantitative measure of the impacts of changes or shifts in the demand curve as the price of other goods change Page 75 42 Cross Price Elasticity of Demand If commodities i & j are substitutes (ηij > 0): Pi↑→Qi↓, Qj↑ i.e., strawberries vs. blueberries, peaches vs. oranges If commodities i & j are complements (ηij < 0): Pi↑→Qi↓, Qj↓ i.e., peanut butter and jelly, ground beef and hamburger buns If commodities i & j are independent (ηi j= 0): Pi↑→Qi↓, Qj is not impacted i.e., peanut butter and Miller Lite 43 Page 75 Interpreting the Cross Price Elasticity of Demand If the Cross-Price Elasticity is: Positive The Good is Classified as a: Substitute Negative Complement Zero Independent Page 76 44 Some Examples Quantity Changing Prego Ragu Hunt’s Values in red along the diagonal are own price elasticities 45 Price That is Changing Prego Ragu Hunt’s -2.550 0.810 0.392 0.510 -2.061 0.138 1.029 0.535 -2.754 Off diagonal values are all positive → These products are substitutes Page 80 Some Examples Spaghetti Sauce Prego Ragu Hunt’s Price Change Prego Ragu Hunt’s -2.550 0.810 0.392 0.510 -2.061 0.138 1.029 0.535 -2.754 Note: An increase in Ragu spaghetti sauce price has a bigger impact on Hunt’s spaghetti sauce demand (ηRH = 0.535) than an increase in Hunt’s spaghetti sauce price on Ragu demand (ηHR = 0.138) 46 Page 80 Some Examples Spaghetti Sauce Prego Ragu Hunt’s Price Change Prego Ragu Hunt’s -2.550 0.810 0.392 0.510 -2.061 0.138 1.029 0.535 -2.754 A 10% increase in Ragu spaghetti sauce price increases the demand for Hunt’s spaghetti sauce by 5.35% Page 80 47 Some Examples Spaghetti Sauce Prego Ragu Hunt’s Price Change Prego Ragu Hunt’s -2.550 0.810 0.392 0.510 -2.061 0.138 1.029 0.535 -2.754 A 10% increase in Hunt’s spaghetti sauce price increases Ragu spaghetti sauce demand by 1.38% Page 80 48 Example 1. The cross price elasticity for hamburger demand with respect to the price of hamburger buns is equal to –0.60 a. If the price of hamburger buns rises by 5%, what impact will that have on hamburger consumption? b. What is the demand relationship between these products? 49 The Answer 1. The cross price elasticity for hamburger demand with respect to the price of hamburger buns is equal to –0.60 a. If the price of hamburger buns rises by 5%, what impact will that have on hamburger consumption? -3.0% Solution: -0.60 = %QH %PHB -0.60 = %QH .05 %QH = .05 (-.60) = -.03 or – 3.0% b. What is the demand relationship between these products? These two products are complements as evidenced by the negative sign on the associated cross price elasticity 50 Another Example 2. Assume a retailer: i) Sells 1,000 six-packs of Pepsi/day at a price of $3.00 per six-pack ii) The cross price elasticity for Pepsi with respect to Coca Cola price is 0.70 a. If the price of Coca Cola rises by 5%, what impact will that have on Pepsi sales? b. What is the demand relationship between these products? 51 The Answer a. If the price of Coca Cola rises by 5%, what impact will that have on Pepsi consumption? Solution: .70 = %QPepsi %PCoke .70 = %QPepsi .05 = .035 or 3.5% New quantity of Pepsi sold = 1,000 1.035 = 1,035 six-packs, 35 additional six packs New value of sales = 1,035 $3.00 = $3,105 or $105/day extra b. What is the demand relationship between these products? The products are substitutes as evidenced by the positive sign on this cross price elasticity 52 Price Flexibility of Demand 53 Price Flexibility The price flexibility is the reciprocal (inverse) of the own-price elasticity • If the calculated elasticty is - 0.25, then the flexibility = 1/(-0.25) = - 4.0 Price Flexibility interpretation: 54 %∆P ÷ %∆Q Price Flexibility This is a useful concept to producers when forming expectations for the current year • i.e., Assume USDA projects an additional 2% of supply will likely come on the market • Given above price flexibility then producers know the price will likely drop by 8%, or: %Price = - 4.0 x %Quantity = - 4.0 x (+2%) = - 8% →If supply ↑ by 2%, price would ↓ by 8% Note: make sure you use the negative sign for both the elasticity and the flexibility. 55 Revenue Implications Own-Price Resulting Increase in Decrease in Elasticity Price Supply Will Supply Will Flexibility Elastic Unitary elastic Inelastic < -1.0 Increase Revenue Decrease Revenue Not Change Not Change Revenue Rrevenue Increase Between 0 Decrease Revenue Revenue and -1.0 = -1.0 Characteristic of a large number of agricultural commodities 56 Page 81 Changing Price Response Over Time Short run effects Long run effects Over time consumers respond in greater 57 numbers This is referred to as a recognition lag With increasing time, price elasticities tend to increase → flatter demand curve Page 77 Implications of Agriculture’s Inelastic Demand Curve $ Pb A agricultural product prices to ↓ sharply Explains why major program crops receive Federal government subsidies Pa Increase in supply 0 58 Small ↑ in supply will cause Q Qb Qa Inelastic Demand Curve Price Pb Pa 0 59 A B Qb Qa While this ↑ the costs of government programs and hence budget deficits, remember consumers benefit from cheaper food costs. Quantity Demand Characteristics Which market is riskier for producers…elastic or inelastic demand? Which market would you start a business in? Which market is more apt to need government subsidies to stabilize producer incomes? 60 The Market Demand Curve Price What causes movement along a demand curve? Quantity 61 The Market Demand Curve Price What causes the demand curve to shift? Quantity 62 In Summary… Know how to interpret all three elasticities Know how to interpret a price flexibility Understand revenue implications for producers if prices are cut (raised) Understand the welfare implications for consumers if prices are cut (raised) Know what causes movement along versus 63 shifts the demand curve Chapter 6 starts a series of chapters that culminates in a market supply curve for food and fiber products…. 64