Tax Treatment of The Sale

and Acquisition of

Intellectual Property

Lorne Saltman

© 2009 Cassels Brock

Federated Press Course

June 3, 2009

General Comments on

Intangible Property

In the modern world of business, the

main force of economic activity and

growth is intangible or intellectual

property

Critical questions arise: how do you

identify intangibles, separate them from

other sources of income, and impose tax

appropriately?

© 2009 Cassels Brock

2

Outline of Presentation

• Tax Treatment of Costs of Acquisition,

Development and Use of IP

• Tax Treatment of Receipts for

Exploitation of IP

• Sale versus Lease Transaction

• Acquiring IP From a Non-Resident

• Transferring IP Offshore

© 2009 Cassels Brock

3

Meaning of “Intellectual

Property” for tax purposes

The terms “intellectual property” and

“intangibles” are often interchangeable

It is often said that an intangible must be

directly observable and commercially

transferable

© 2009 Cassels Brock

4

Meaning of “Intellectual

Property” for tax purposes

Intangibles can be classified into

•

•

© 2009 Cassels Brock

Manufacturing intangibles, e.g. patents,

inventions, trade secrets, formulae, processes,

designs, patterns or know-how; and

Marketing intangibles, e.g. trademarks, brand

names, symbols or pictures having an

important promotional value for the product

concerned, copyright, franchises, licences,

distribution channels, methods, systems,

studies, forecasts, customer lists or technical

data relating to marketing

5

Costs of Acquisition,

Development and Use of IP

The

principles

governing

the

determination of whether an expenditure

for developing, acquiring or using IP is

fully deductible for purposes of the

Income Tax Act (Canada) are essentially

the same as for other types of

expenditures

© 2009 Cassels Brock

6

Costs of Acquisition,

Development and Use of IP

• A taxpayer’s income from a business or property is the

taxpayer’s profit from that business or property for the

year

• Generally, income from a business is determined in

accordance with well-accepted principles of business,

accounting or commercial trading

• Accordingly, ordinary business expenses, the

deduction of which is not otherwise prohibited by a

specific provision of the ITA, may be deducted in

computing income from a business

© 2009 Cassels Brock

7

Costs of Acquisition,

Development and Use of IP

• No outlay or expense is deductible

unless it is made or incurred for the

purpose of gaining income from a

business or property

• No outlay or payment on account of

capital

is

deductible

except

as

specifically permitted by the ITA

© 2009 Cassels Brock

8

Costs of Acquisition,

Development and Use of IP

• An amount payable (whether by lump

sum or by instalments) for the acquisition

at one time of all, or substantially all, of

the rights associated with IP will be a

capital expenditure, unless the IP at the

time of acquisition has a short-term

anticipated life

© 2009 Cassels Brock

9

Costs of Acquisition,

Development and Use of IP

• Conversely, royalties paid for the use of

IP owned by another typically are

deductible as an ordinary business

expense

© 2009 Cassels Brock

10

Costs of Acquisition,

Development and Use of IP

• Inventory of a taxpayer can include IP

• Accordingly, where a taxpayer’s business

includes the development or acquisition

of IP on income account, the costs

associated with such IP are deductible at

the time not of acquisition but of

disposition

© 2009 Cassels Brock

11

Costs of Acquisition,

Development and Use of IP

• In computing a taxpayer’s income on an

accrual basis for a taxation year from a

business or property, no deduction may

be made for an outlay or expense to the

extent that it can reasonably be regarded

as having been made or incurred as a

royalty in respect of a period after the

end of the year

© 2009 Cassels Brock

12

Costs of Acquisition,

Development and Use of IP

• The costs of developing, acquiring or

using IP may be on capital account and

may be included within one of the

depreciable classes in the Income Tax

Regulations

• Capital cost allowance may be claimed

by the taxpayer based on the rate of the

applicable class on a declining-balance

basis

© 2009 Cassels Brock

13

Costs of Acquisition,

Development and Use of IP

• A patent, franchise, concession or licence for a

limited period, except for a licence to use

computer software, may be included in Class

14 of the ITR

• The amount of CCA is determined by

apportioning the capital cost of each asset in

the class over its life remaining at the time the

cost was incurred (may be straight-line or

another method that is reasonable)

© 2009 Cassels Brock

14

Cost of Patents

• Property that is a patent or a right to use

patented information for a limited period

or unlimited period that is acquired on

capital account is included in Class 44

• The undepreciated capital cost of Class

44 is eligible for CCA on a 25%

declining-balance basis

© 2009 Cassels Brock

15

Cost of Patents

• One would elect Class 14 over Class 44

if the remaining life of the patent under

the licence is short, resulting in a higher

CCA claim

© 2009 Cassels Brock

16

Cost of Patents

• Where the capital cost of a patent is

determined by reference to the use of the

property, the taxpayer may apportion the

capital cost of the property between the part

dependent on use and the part not dependent

on use

• The capital cost that is dependent on use may

be deducted in full as CCA. The part that is

not dependent on use may be deducted as

CCA in the normal manner

© 2009 Cassels Brock

17

Cost of Patents

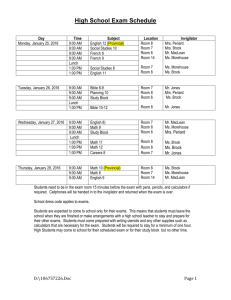

Assume patent

price is $1,000 plus

royalty of 10% of

revenues, resulting

in additional $1,000

annual payments

Customary CCA

deduction

Optional CCA

deduction

© 2009 Cassels Brock

Year One

(1/2 rate)

Year Two

2,000 x 12.5% =

250

1,750 + 1,000=

2,750 x 25%=

687.50

1,000 x 12.5% =

125, plus 1,000 =

1,125

875 x 25%= 218.75,

plus 1,000 =

1,218.75

18

Cost of Patents

• The capital cost of a patent will include not

only legal expenses incurred in applying for the

patent, but also costs incurred to develop the

invention to the point of application

• However, the capital cost of a patent will not

include any costs incurred to develop the

invention which have been included in the

taxpayer’s SRED or which have been properly

deducted as ordinary operating expenses

© 2009 Cassels Brock

19

Cost of Patents

• In the CRA’s view, an expenditure made

to acquire a patent will be an eligible

capital expenditure if the expenditure

does not result in the acquisition of a

depreciable property

© 2009 Cassels Brock

20

Deductibility of Eligible

Capital Expenditures

• A taxpayer may deduct in computing income

from a business an amount up to 7% of its

“cumulative eligible capital” at the end of the

year

• The taxpayer’s CEC generally includes threequarters of all eligible capital expenditures

made or incurred by the taxpayer in respect of

the business, and is reduced by all deductions

of CEC previously made by the taxpayer, and

by three-quarters of the net proceeds from

dispositions of eligible capital property

© 2009 Cassels Brock

21

Costs of Copyright

• Copyright that is acquired during a

creator’s lifetime will not qualify for Class

14, because the remaining life of the

copyright is indeterminate

• However, copyright that is acquired after

the creator’s death or during that

person’s lifetime under a limited-term

licence should qualify for Class 14

© 2009 Cassels Brock

22

Costs of Computer Software

• A licence to use computer software is

specifically excluded from Class 14

• Most computer software other than systems

software will qualify as Class 12 property for

which the CCA rate is 100%, where the

software is capital in nature

• The half-year rule is suspended for qualifying

acquisitions of computer software between January

27, 2009 and February 2011.

© 2009 Cassels Brock

23

Costs of Computer Software

• Computer software is defined to include a right

or licence to use computer software, but is not

considered by the CRA to include a contractual

right or licence of a capital nature to buy and

resell, to sublet or to otherwise market

computer software

• Such a contractual right is considered a Class

14 property if it is for a limited life or eligible

capital expenditure if the life is indeterminate

© 2009 Cassels Brock

24

Costs of Computer Software

• Systems software typically falls within

Class 10 at a 30% CCA rate, although

another class may apply depending on

the connection with property of that other

class

• The rate is increased to 100% for qualifying

acquisitions of computer systems software

between January 27, 2009 and February

2011.

© 2009 Cassels Brock

25

Costs of Trade-Marks

• A trade-mark has an indefinite life and so

cannot qualify for Class 14

• The CRA does not consider that it constitutes a

depreciable property that comes within any

class in Schedule II of the ITR

• Rather, its cost will be either an ordinary

expense if on income account or eligible

capital expenditure if on capital account

© 2009 Cassels Brock

26

Costs of Trade Secrets and KnowHow

• Unregistered trade secrets or know-how

likely will not qualify for Class 14

treatment, because the rights associated

with their use may have an indefinite life,

and

because

know-how

is

not

considered property

• The cost of a trade-secret that is

acquired on capital account usually will

be an eligible capital expenditure

© 2009 Cassels Brock

27

Expenditures on Scientific

Research & Experimental

Development

• The costs of an ongoing nature incurred

by a taxpayer to develop IP may be fully

deductible when incurred, in accordance

with the judicial principles decided under

ss. 9(1)

• However, s.37 establishes a specific

code for the deduction of SRED

© 2009 Cassels Brock

28

Expenditures on Scientific

Research & Experimental

Development

• S. 37 expands the range of deductions

immediately available to a taxpayer by

including qualifying capital expenditures that

otherwise might only be deductible over time

as CCA or cumulative eligible capital amounts

• Also, s. 37 provides for the calculation of an

expenditure pool for SRED that effectively

gives the taxpayer the option of deducting an

SRED expenditure in a subsequent year rather

than in the year of the expenditure

© 2009 Cassels Brock

29

Expenditures on Scientific

Research & Experimental

Development

• S. 37 is supplemented by

• s.127 which provides an investment tax

credit for a somewhat narrower range of

expenditures than under s.37, and

• s. 127.1 which may permit the taxpayer to

receive a refund of all or a portion of ITC’s

earned by it even where it has no current tax

liability against which to deduct the ITC

© 2009 Cassels Brock

30

Payment for Restrictive

Covenants

• The term “restrictive covenant” covers not only

non-competition covenants, but also an

agreement entered into, an undertaking made,

or a waiver of an advantage or right by the

taxpayer (other than an agreement or

undertaking for the disposition of the

taxpayer’s property) that affects, or is intended

to affect, the acquisition or provision of

property or services by the taxpayer or by

another taxpayer that does not deal at arm’s

length with the taxpayer

© 2009 Cassels Brock

31

Payment for Restrictive

Covenants

• Where an amount is paid for a restrictive

covenant in conjunction with acquisition

of a business, the payer of the amount

may make a joint election with the

recipient, and will be allowed to include

the payment in the cost of ECE

© 2009 Cassels Brock

32

Receipts for Exploitation of

IP

Both the way IP is exploited and the form

of consideration received for its

exploitation affect the tax treatment of

the proceeds received

© 2009 Cassels Brock

33

Receipts for Exploitation of

IP

• Revenue realized from exploiting IP that

is the focus of the taxpayer’s business

will generally be taxed on income

account, regardless of whether the

taxpayer sells the IP, assigns rights to

different markets on an exclusive or nonexclusive basis, or licenses the IP for a

royalty

© 2009 Cassels Brock

34

Receipts for Exploitation of

IP

• For a disposition of IP to be considered

on capital account, the taxpayer must in

fact part with some of its property and,

thus, must grant to the recipient some

degree of exclusivity in the IP

© 2009 Cassels Brock

35

Receipts for Exploitation of

IP

Royalties or other amounts on income

account will be included in income under

ss. 9(1) in the year of receipt, if the

taxpayer has an absolute entitlement to

the amount and is subject to no

restriction as to its disposition, use or

enjoyment

© 2009 Cassels Brock

36

Receipts for Exploitation of

IP

An amount may alternatively have to be

included in income under par.12(1)(a) if

received in the course of a business on

account of services to be performed after

the end of the year, or for any other

reason may be regarded as not having

been earned in the year

© 2009 Cassels Brock

37

Receipts for Exploitation of

IP

A reasonable reserve may be deducted under

paragraph 20(1)(m) for amounts included in

income under 12(1)(a), in respect of goods or

services that may reasonably be anticipated

will be delivered or rendered after the end of

the year, or for periods for which rent or other

amounts for the possession or use of chattels

(including IP contractual rights in certain

cases) have been paid in advance

© 2009 Cassels Brock

38

Receipts for Exploitation of

IP

This reserve will be available, for

example, where a licensor of IP is

required during the term of years of the

licence to perform ongoing services,

such as protecting the licensee’s lawful

rights in the specified territory to use the

licensed IP

© 2009 Cassels Brock

39

Receipts for Exploitation of

IP

Where consideration receivable for the

disposition of IP is an amount that varies

depending on the production or use

made of the property, paragraph 12(1)(g)

may deem all proceeds to be income to

the taxpayer, notwithstanding that the

transaction

otherwise

would

be

considered to have occurred on capital

account

© 2009 Cassels Brock

40

Receipts for Exploitation of

IP

The following principles reflect the

jurisprudence

and

the

CRA’s

administrative practice:

• Where all the payments under the

agreement of sale are based on production

or use, those amounts are brought into

income when received by the taxpayer;

© 2009 Cassels Brock

41

Receipts for Exploitation of

IP

• Where the agreement provides for the

payment of a fixed sum, plus an

additional amount should production or

use exceed a stipulated figure, the fixed

sum will be treated as proceeds of

disposition and the additional amounts, if

any, will be brought into income

© 2009 Cassels Brock

42

Receipts for Exploitation of

IP

• Where the agreement provides for payments

based on production or use and also stipulates

a minimum sale price, or minimum annual

payments, the payments based on production

or use are brought into income, irrespective of

whether they are less than or exceed the

minimum amount; however, any other

payments which must be made in order to

achieve the minimum requirements are treated

as proceeds of disposition

© 2009 Cassels Brock

43

Receipts for Exploitation of

IP

• Where the agreement calls for payment

of a fixed sum, but the timing of the

payments of that sum varies depending

on production or use, paragraph 12(1)(g)

does not apply

© 2009 Cassels Brock

44

Receipts for Exploitation of

IP

• Where the sale price is an amount equivalent

to the fair market value of the property at the

time of the sale, but can be decreased if

certain conditions relating to production or use

are not met in the future, the maximum amount

will be considered to be the proceeds of

disposition, provided there is a reasonable

expectation at the time of disposition that the

conditions will be met

© 2009 Cassels Brock

45

Receipts for Exploitation of

Intangibles

• Where on a sale of IP, a portion of the

sale proceeds is allocated (or should

have been allocated) to a restrictive

covenant provided by the taxpayer, that

allocated amount may be deemed to be

income under proposed s.56.4

© 2009 Cassels Brock

46

Receipts for Exploitation of

Patents

• Amounts (including lump sums) received for

the granting of a non-exclusive license to use

patents have been found to be income

receipts.

• A lump sum received for granting an exclusive

license to exploit a patent within a specified

area may be a capital receipt, provided that the

taxpayer’s business does not include buying

and selling patent rights, or otherwise dealing

in patents

© 2009 Cassels Brock

47

Receipts for Exploitation of

Copyright

• A distinction has been drawn between

compensation received by a writer or

artist for his/her services in creating a

work which is clearly taxable as ordinary

income, and the sale by a person of the

copyright to a work, which in some

circumstances can give rise to a capital

receipt

© 2009 Cassels Brock

48

Receipts for Exploitation of

Copyright

• A receipt by a writer or artist may be on capital account

where the payment is received after that person ceases

their career or in connection with the cessation of their

business

• Proceeds received on the sale of copyright out of the

ordinary course of business (for example, the sale price

received by a publisher selling all the assets of its

business as a going concern) normally would be

received on capital account

© 2009 Cassels Brock

49

Receipts for Exploitation of

Copyright

Because computer software developers

normally retain copyright, proceeds

received by them from licensees

generally will be on income account.

© 2009 Cassels Brock

50

Receipts for Exploitation of

Know-How

• The CRA’s view, based on the jurisprudence,

is that proceeds from outright sale of knowhow will be considered proceeds from the

disposition of eligible capital property, whereas

if knowledge is not sold outright but merely

licensed for a limited period of time, or its use

is permitted under the terms of a non-exclusive

licence, the total proceeds for the right to use

the trade secrets will be considered income

from exploiting the IP or from rendering

services

© 2009 Cassels Brock

51

Capital Receipts for

Exploitation of IP

• Proceeds of disposition of IP that is

depreciable property, as reduced by

applicable outlays and expenses, will be

deducted from the undepreciated capital

cost of the appropriate class of

depreciable property to the extent that

such net amount does not exceed the

capital cost of such property

© 2009 Cassels Brock

52

Capital Receipts for

Exploitation of IP

• To the extent that such deductions result in a

negative balance at the end of the year, that

balance of “recaptured depreciable” will be

included in the taxpayer’s income.

• If there is a positive UCC of a class following

the disposition of all the depreciable properties

of that class, that balance usually can be

deducted as a “terminal loss”

© 2009 Cassels Brock

53

Capital Receipts for

Exploitation of IP

• Any excess of proceeds of disposition of

a depreciable property over its capital

cost and applicable outlays or expenses

will be accounted for separately as a

capital gain. No capital loss may be

recognized on the disposition of a

depreciable property

© 2009 Cassels Brock

54

Capital Receipts for

Exploitation of IP

• Eligible capital amounts received are

deducted from the balance of a

taxpayer’s cumulative eligible capital in

respect of a business at three-quarters

rates

• Cumulative eligible capital generally

includes three-quarters of all eligible

capital expenditures made or incurred by

the taxpayer in respect of the business

© 2009 Cassels Brock

55

Capital Receipts for

Exploitation of IP

• Eligible capital amount includes three-quarters

of an amount received by a taxpayer on

account of capital in respect of a business,

other than an amount that

• is included in computing the taxpayer’s income, or

deducted in computing any balance of undeducted

outlays, expenses or other amounts,

• reduces the cost or capital cost of property or the

amount of an outlay or expense, or

• is included in computing any gain or loss of the

taxpayer from a disposition of a capital property

© 2009 Cassels Brock

56

Capital Receipts for

Exploitation of IP

• Where eligible capital amounts received

are credited against the taxpayer’s

cumulative eligible capital resulting in a

negative balance at the end of a year,

that amount will generally be included in

the taxpayer’s income from the related

business

at capital

gains

rates

© 2009 Cassels Brock

57

Sale Versus Lease

Transaction

• Prior to 2001, CRA’s IT-233R stated that

where a lease had a purchase option

with an exercise price at less than fair

market value, the lease would be

considered a sale

• This was intended to curb abuses in

leases where the substance of the

transactions disclosed that the parties

intended to effect a sale

© 2009 Cassels Brock

58

Sale Versus Lease

Transaction

• Supreme Court held in Shell Canada Limited v.

The Queen and other decisions that the

economic realities of a situation cannot be

used to recharacterize a taxpayer's bona fide

legal relationships

• Absent a specific provision of the ITA to the

contrary or a finding that there is a sham, the

taxpayer's legal relationships must be

respected in tax cases.

© 2009 Cassels Brock

59

Sale Versus Lease

Transaction

• The determination of whether a contract is a

lease or sale is based on the legal relationship

created by the terms of the agreement, rather

than on any attempt to ascertain the underlying

economic reality

• Legal substance will be examined, so that if a

lessee automatically acquires title to the

property after payment of a specified amount

of rentals, the legal relationship would be one

of purchaser/vendor rather than lessee/lessor

© 2009 Cassels Brock

60

Sale Versus Lease

Transaction

• Notwithstanding the legal relationship,

GAAR may be used to assess cases in

which there is an avoidance transaction

that results in a misuse or an abuse of

provisions of the ITA

© 2009 Cassels Brock

61

Sale of Shares of a

Corporation Owning IP

• Matters to consider:

• Personal and corporate tax integration when capital

gains or recapture realized by Canadian-controlled

private corporation and distributed to shareholder

• Lifetime Capital Gains Exemption now $750,000.

But “qualified small business corporation shares”

depend on value derived from IP used in “active

business”

• Earn-out treatment for capital gains on disposition

of shares versus income treatment under par.

12(1)(g) if IP transferred directly and payment

based on production or use

© 2009 Cassels Brock

62

Acquiring IP From a NonResident

• Most payments made to non-residents for royalties on

account of the right to use IP (other than copyright) in

Canada will be subject to 25% withholding tax

• Canada’s tax treaties generally reduce the rate to 10%

• In some treaties (e.g. with U.S.A.) an exemption

applies for payments for the use of, or the right to use,

any patent or any information concerning industrial,

commercial or scientific experience (but not including

any such information provided in connection with a

rental or franchise agreement)

© 2009 Cassels Brock

63

Acquiring IP From a NonResident

• Withholding tax will not apply to proceeds of

sale by non-resident

• Accordingly, a sale rather than license may

only subject the non-resident to tax on

business income

• Consider whether non-resident may be

carrying on business in Canada, and

• If a tax treaty is applicable, whether the profits

are attributable to a permanent establishment

of the non-resident in Canada

© 2009 Cassels Brock

64

IP Cost-Sharing Agreement

• Payment by a resident to a non-resident

pursuant to a Cost-Sharing Agreement may

avoid royalty withholding tax and transfer

pricing issues

• Costs must be shared on a reasonable basis,

and

• The Canadian resident must obtain some

reasonable right to use the IP that has been

developed

© 2009 Cassels Brock

65

Transferring IP Offshore

• Propose to shift business and profits associated with IP to a

low-tax jurisdiction

• Ideal to move IP offshore before its value increases

significantly

• Transfer must occur at fair market value – should be welldocumented and determined by an independent appraiser

• Consider alternative ways to transfer IP to a corporation

resident in a low-tax jurisdiction along with associated risks

• Residency and location of the associated business of the

transferee should be well-established

• Increased CRA enforcement activities

© 2009 Cassels Brock

66

Presenter

Lorne H. Saltman

Phone: 416 869 5386

Fax: 416 350 6912

Email: lsaltman@casselsbrock.com

© 2009 Cassels Brock

67

www.casselsbrock.com

2100 Scotia Plaza, 40 King Street West, Toronto, Canada M5H 3C2 Phone 416 869 5300

© 2008 Cassels Brock & Blackwell LLP. Cassels Brock and the CB logo are registered trade-marks of Cassels Brock & Blackwell LLP.

™ Trade-mark of Cassels Brock & Blackwell LLP. All rights reserved.

© 2009 Cassels Brock