Annual Report 2013-14 - Department of Environment, Land, Water

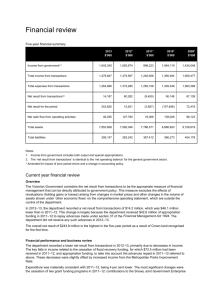

advertisement