Auditing- REPORT

ACC3510 Auditing

The A-Team

One.Tel Ltd

Prepared by:

Emily Eardley-Wilmot

Carrie-Anne Gallo

Quraisah Ismail

Han Han Tran

Table of Contents

1. Executive Summary

............................................................................................ 3

2. Introduction

3. Overview of OneTel Operations and Culture

................................................. 4

4. Reasons for Collapse

......................................................................................... 5

4.1 Role of Management and Key Financial Personnel

................................ 5

4.2 Role of Auditor

............................................................................................... 6

4.3 High Inherent Risk

......................................................................................... 8

4.4 Lack of Internal Controls

.............................................................................. 9

5. Consequences of OneTel Collapse

...............................................................10

6. Conclusion

7. References

8. Appendices

Page | 2

1. Executive Summary

2. Introduction

One.Tel’s inception into the corporate world of telecommunications was prominent. With the financial backing off high flyers James Packer and Lachlan Murdoch the company seemed like it would succeed. However, One.Tel’s collapse was rapid with the company only operating for 6 years. This report will provide an overview of One.Tel, reasons for the collapse and consequences of the collapse. The role of management, financial officers, the auditors and the effectiveness of internal controls will be questioned, and the aftermath following the delisting of One.Tel will be outlined.

Page | 3

3. Overview of OneTel Operations and Culture

One.Tel was an Australian telecommunication company which was established on the

1st of May 1995 by Jodee Rich and Brad Keeling. The company’s initial capital investment of $995 million (Cook, 2001) was provided by shareholders- James Packer and Lachlan Murdoch. The company founded themselves on the slogan “You’ll tell your friend about OneTel”. After success in Australia, One.Tel hoped to expand its operations into the global markets, especially in Europe and the USA, by applying low price strategies and a customer driven approach. One.Tel customer base increased from 1,000 to 100,000 in the space of one year (The life and death of One.Tel, n.d).

This was largely attributed to the fact that the company was able to offer a high quality telecommunication service at a cheap price.

One.Tel set out with good intentions and hoped to create a youth orientated image. Rich and Keeling “wanted to start a new telephone company, one that the average person would understand. The company was very people focused and focused on the residential market, as opposed to corporate business” (Case Study of Corporate

Governance, n.d). One.Tel created a logo known as ‘the dude’. “The dude was a massive hit, and vital in making One.Tel an instantly recognisable brand ” (Barry, 2002).

Since it was established, One. Tel seemed to generate significant returns. According to

One.Tel’s annual reports, the company earned $3.723 million profit after tax in 1997,

$5.91 million in 1998 and $6.965 million in 1999. As a result, One.Tel was one of the fastest growing companies in Australia in the late 1990s and the second highest ranking telecommunication company in Australia (The life and death of One.Tel, n.d). However, despite great expectations, One Tel’s good performance could no longer continue and the company’s descent was rapid. In 2000, the company reported a $291.1 million loss, which sent alarm bells ringing. Despite efforts from shareholders to invest substantially more capital into the company in order to overcome the cash crisis, it was unsuccessful and One.Tel finally met its destiny, and ceased trading on the 28th May 2001.

Page | 4

4. Reasons for Collapse

The collapse of the telecommunication company One.Tel in May of 2001 can be attributed to a multitude of factors. Recurring reasons for the collapse include the failure of directors and management to exercise their proper duties as outlined in the

Corporations Act 2001, lack of independence in the audit function and a lack of internal controls.

4.1 Role of Management and Key Financial Personnel

The collapse of One.Tel can largely be attributed to the actions of managing directors-

Jodee Rich and Richard Keeling and their lack of involvement in the running of the company. They adopted a ‘management-by-crisis’ approach and failed to do any forward planning. Reassurance was continually given to the company’s shareholders that One.Tel was generating sufficient cash flows to meet obligations; however they were really operating beyond the available financial means and misstating huge profits.

The company director- Rodney Adler failed to act in the shareholders best interests hence disregarding the agency relationship. His biggest mistake was approving excessive expansions and loans and failing to ensure One Tel has a appropriate system of controls and audits. He did not act honestly, in good faith and in the best interests of the company as whole, thus contravening s 180, 181, 182 and 183 of Corporations Act

2001.

John Greaves the CFO of One.Tel also played a key role in the collapse of OneTel. As a qualified Chartered Accountant he owed the company a responsibility to ensure the accurate reporting of accounts and he should have been able to spot discrepancies and take corrective action. His failure to alert the OneTel board of the company’s dire financial circumstances (including poor cash balances and aging debtors).

The finance director of One.Tel (Mark Silberman) was also involved in misleading the board of t he company’s true cash position. A lack of due care and diligence was exercised which can be evidenced by Silberman, when in “In 1999-2000, One.Tel was

Page | 5

forced to expense $245 million of advertising and set-up costs in Europe and Australia that it had previ ously been deferring” (

The life and death of One.Tel, n.d).

James Packer and Lachlan Murdoch- the Board Directors of One.Tel approved the payment of bonuses despite the company recording a loss of $291 million, this shows that they were not acting in good faith or for the best interests of One.Tel. Their lack of questioning and investigation into the financial position of One.Tel demonstrates their lack of concern and involvement. The board relied on information provided by Jodee

Rich and should have questioned the validity and reliability of that information.

In summary, it is clear that the key management and financial personnel at One.Tel failed to exercise their duties with due care and diligence and act in good faith, as required by the Corporations Act 2001. The director’s lack of involvement in the day-today running of the company and failure to notify the shareholders of the ‘true’ financial position is why One.Tel collapsed and was unable to recover. It is all a matter of ‘too little, too late’.

4.2 Role of Auditor

The role of the One.Tel’s auditors has been heavily scrutinized following the liquidation of One.Tel. The auditor ’s failure to exercise their duties and act independently are the two main concerns.

Auditors Duties

Over One.Tel’s seven years of operation they were audited by two different accounting firms. BDO was One.Tel's first auditor and provided services from May 1995 to 2000.

Then in January 2001, BDO was replaced by Ernst & Young. There is much evidence that both BDO and Ernst & Young failed to fulfill their role and responsibility as One.Tel auditors. For instance, unqualified reports were issued by BDO in the years from 1997 to 2000. However, after the Institute of Chartered Accountants Australia (ICAA) examined One.Tel's financial report in 1998-1999, there were 48 items of concern, which could lead to material misstatement.

Page | 6

In addition, in the auditors report it states that "our audit has been conducted in accordance with Australian Auditing Standard to provide reasonable assurance whether the finacial statements are free of material misstatement. Our procedures included examination, on the test basis, of evidence supporting the amounts and other disclosures in the financial statement, and the evaluation of according policies and significant accounting estimates" (ONE.TEL ANNUAL REPORT). Nevertheless, ICAA's committee found out that One.Tel's audit report was in breach of the Corporations Law,

Australian Accounting Standards, and Australian Auditing Standards. Further evidence of a failure to perform auditor duties was Ernst & Young failing to acknowledge and report to shareholders regarding One.Tel’s actual financial circumstances prior to collapse.

Auditor Independence

There are many reasons as to why the independence and ethics of One.Tel’s auditors was of concern. Brian Long

– chairman of Enrst & Young, was auditor of majorityowned Packer family media company Publishing & Broadcasting Ltd, Packer family company Consolidated Press Holdings and One.Tel (of which Packer is also a major shareholder). A ccording to APES 110 section 290.13, “if a Firm is deemed to be a

Network Firm, the Firm shall be Independent of the Audit Clients of the other Firms within the Network. The independence requirements in this section that apply to a

Network Firm apply to any entity”. Therefore there was a conflict of interest between

Brian Long and the Packer companies, and a familiarity threat to independence.

There is evidence that One.Tel purchased a lot of non-audit services from BDO.

Amongst the total fees paid to BDO the non-audit fees comprised 41% in 1996-97, 54% in 1997-98, 52% in 1998-99 and 46% in 1999-2000 (The life and death of One.Tel). This provision of additional non-audit services poses another conflict of interest and creates a self-review threat, which is where the auditor may not appropriately evaluate the results of a previous judgement if has been provided by individuals within that auditors firm.

Page | 7

Ethics of Auditors

According to APES 110 section 100.5, there are five fundamental ethical principles which are required to be followed by auditors, these include: Integrity, Objectivity,

Professional Competence and Due Care, Confidentiality and Professional Behaviour.

Amongst these five principles, both auditors – BDO and Enrst & Young were deemed to be in breach of some elements, such as:

Integrity

Ernst & Young auditor did were not straightforward and honest in their professional and business relationship with One.Tel. Whereas BDO issued unqualified reports every year while a qualified report was more reasonable.

Professional behaviour

APES 110 section 150.1 states that “the principle of professional behaviour imposes an obligation on all Members to comply with relevant laws and regulations and avoid any action or omission that the Member knows or should know may discredit the profession”. Based on this requirement, it is obvious that both auditors were not fulfilling this ethical element because they didn’t recognise that breaches of Corporations Act,

Australian Accounting Standards and Australian Auditing Standards had been breached

(according to ICAA examination).

Objectivity :

Both BDO and Ernst & Young provided a lot of non-audit services to One.Tel over the time that they audited the company, this reduces objectivity and means that the auditor may be bias and their ability to provide a neutral and fair opinion could be compromised.

4.3 High Inherent Risk

The company's high risk, low yield strategy, with generous incentives for new customers could not be sustained in the small Australian market which had six mobile phone providers

—the second largest number of any country in the world

(3)

Page | 8

Outlays way beyond financial capacity (3)

Telecom services were offered to subscribers at prices lower than what the company was paying (2)

Business strategy relied heavily on Telstra and Optus who were also their competition. OneTel was selling excess phone capacity purchased from Telstra and Optus and offering cheap packages. But Telstra and Optus who had much lower operating costs, determined the price of access rentals. (3)

There was no access fee, no minimum call spend, and the contracts had no fixed term, so there was no way of ensuring that the customers would stay with

One.Tel and spend money (10)

4.4 Lack of Internal Controls

Failure of Billing System

The intentions of Senior IT staff at One.Tel are questionable. Development personnel are given bonuses based on the timely creation and set up of new programs and systems. With no testing required or the need to provide documentation the quality of these programs was compromised, and it would only be a matter of time before they collapsed such was the case of the billing system. A senior accountant suggested that “The place was a joke. There were no structures, no accounting systems, no processes and no controls”

(Barry, 2002, p185).

In the start up phase of One.Tel the billing system in place was sufficient to cope with the small customer base. However, as the company established its reputation and experienced a substantial increase in the volume of customers it was servicing, the billing system was unable to meet this demand. As a result, the processing and delivery of invoices to customers was sometimes taking many months, and OneTel was unable to track the receipts from customers. For a long time One.Tel continued to depend on this system which was not only inadequately designed but remained unmonitored. By the time IT staff recognised these problems it was to late to take effective action.

Page | 9

Rich and Keelings bonus packages were tied to the rise of the companies shares rather than to profit or any other indicator of company viability (3)

Sim card sign ups were done by hand, using photocopies and handwriting numbers and pin codes. Sims were activated as soon as they left the building and there was no guarantee they'd arrive at the right place. If the sim card wasn't kept active for at least 12 months, Optus would take back their $120 sign up bonus from One.Tel. At least half on the sim cards were never used at all. (10)

Credit checks in the early stages were very lax and even after the procedures where tightened, dealers often found ways to get around the safeguards. As such

60-70% of customer bills were paid late or not at all. (10)

Almost everybody in the company was paid on commission and targets were set optimistically high. Anyone who protested were told that 'You're not a team player, not a One.Tel person' (10)

5. Consequences of OneTel Collapse

As discussed previously, there seemed to be obvious breaches of the Corporations Act by the directors at One.Tel, more specifically, s180 Care and diligence, s181 good faith and s183 use of information. One.Tel finished trading on the stock market on May 28,

2001 and was later liquidated after it was in fact found out that the company was insolvent. The collapse of One.Tel has left a lasting impact on the creditors, shareholders, employees and ASIC.

The delisting of One.Tel resulted in 1,400 workers losing their jobs and being owed $19 million in accrued entitlements (Cook, 2001). In addition, $600 million is owed to company creditors. Due to the significance of these debts, many creditors and employee entitlements went unpaid.

Bartholomeusz (2009) states that in 2003 John Greaves (One.Tel chairman) and Brad

Keeling (joint CEO) agreed to compensate the company for $20 million and $92 million respectively. They also accepted disqualification for running a company for 10 years

(Greaves) and 4 years (Keeling).

Page | 10

In the case of ASIC v Rich (2009)

“ASIC alleged that, in the period leading up to the cancellation of a proposed rights issue in May 2001, Rich and Silbermann failed to exercise due care and diligence by failing to keep the board of directors of One.Tel sufficiently informed of material information about the true financial condition, performance and prospects of One.Tel, especially in the crucial period of January,

February, March and April 2001” (Wikipedia, n.d). This claim was unsuccessful and the judge declared that ASIC had failed to prove any aspect of its case. This failed court case came at a $20 million cost to ASIC.

One.Tel’s downfall not only left the company with a huge financial burden but resulted in the loss of reputation of founders Rich and Keeling but also major shareholders

Murdoch and Packer.

6. Conclusion

It is clear, that the downfall of One.Tel cannot be attributed to any one party. A lack of company structure, professional ethics and corporate governance are to blame. The

One.Tel case and the succeeding corporate collapses, send a message. This message is that; directors and management must play an active role in the running of the company, people must be held accountable for their actions and decisions, accurate reporting of cash position is a must and internal controls should be monitored and assessed continually to account for changes and growth in an organisation

Page | 11

7. References

Bartholomeusz, S. 2009. Forget Jodee Rich’s victory – One.Tel was never a success.

Retrieved 20 March 2011 from http://www.smartcompany.com.au/telecommunications/20091119-forget-jodee-rich-svictory-one-tel-was-never-a-success-bartholomeusz.html

Carson, V. 2005. "One.Tel auditor denies conflict". The Australian (Canberra, A.C.T.)

(1038-8761) , p. 22. http://0-global.factiva.com.library.ecu.edu.au/ha/default.aspx

Case Study of Corporate Governance. Retrieved 7 March 2011 from http://www.scribd.com/doc/16875566/Case-Study-of-Corporate-Governance

Cook, T. (2001). Collapse of Australia's fourth largest telco adds to growing list of corporate failures. Retrieved 7 http://www.wsws.org/articles/2001/jun2001/onte-j08.shtml

March 2011 from

IT Failure and Professional Ethics: The One.Tel Case. Retrieved 7 March 2011 from http://www.cse.unsw.edu.au/~se4921/PDF/OneTel.pdf

One.Tel auditor was linked to Packer. Retrieved 7 March 2011 from http://www.smh.com.au/news/business/onetel-auditor-was-linked-topacker/2005/10/25/1130239522655.html

Opinion What OneTel foretells. Retrieved 7 March 2011 from http://www.companydirectors.com.au/Director-Resource-Centre/Publications/Company-

Director-magazine/Back-editions-2010/March/March/Opinion-What-OneTel-foretells

Role of company auditors under the spotlight. Retrieved 7 March 2011 from http://www.abc.net.au/pm/stories/s309176.htm

Barry, P. (2002). The great One.Tel giveaway. Retrieved April 5 2011 from http://www.theage.com.au/articles/2002/04/07/1017206286964.html

The life and death of One.Tel.

(n.d). Retrieved 23 March, 2011, from Accounting and

Finance Association of Australia and New Zealand: http://www.afaanz.org/

Wikipedia. (n.d.). ASIC v Rich. Retrieved 15 March 2011 from http://en.wikipedia.org/wiki/ASIC_v_Rich

Page | 12

8. Appendices

Appendix 1

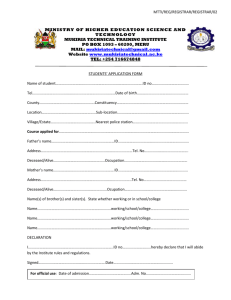

1997

ONE.TEL

PROFIT AFTER TAX

1998 1999

3 723 000 5 910 000 6 965 000

50 000 000

-

(50 000 000)

(100 000 000)

(150 000 000)

(200 000 000)

(250 000 000)

(300 000 000)

(350 000 000) profit after tax

2000

(291 100 000)

Page | 13