Normal hours

advertisement

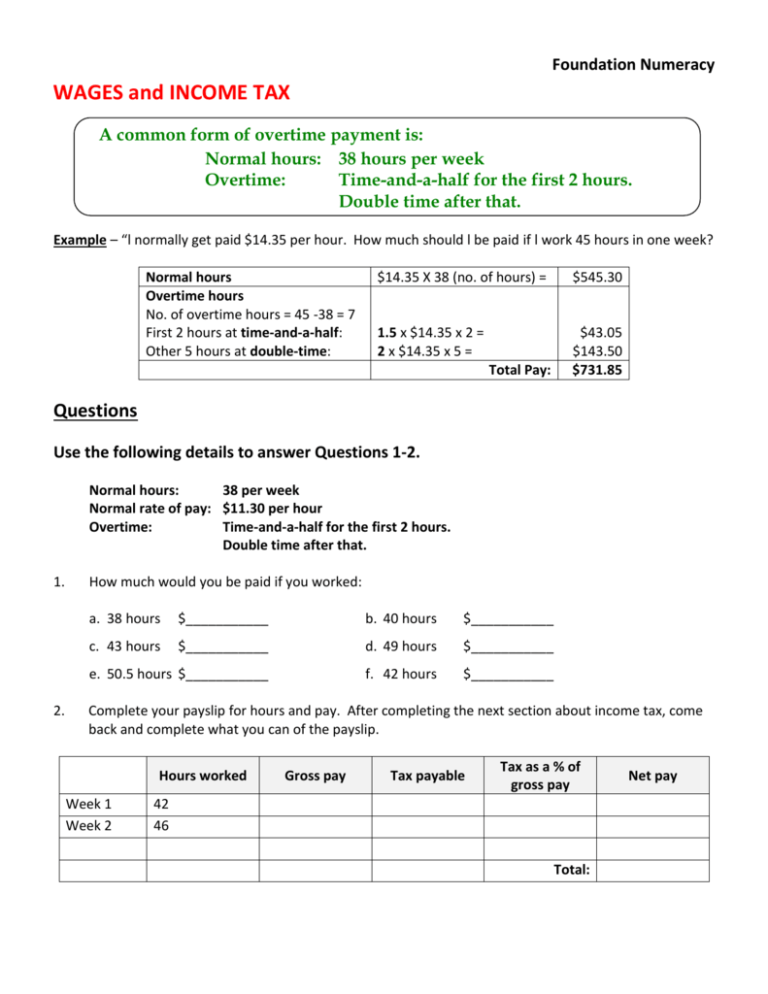

Foundation Numeracy WAGES and INCOME TAX A common form of overtime payment is: Normal hours: 38 hours per week Overtime: Time-and-a-half for the first 2 hours. Double time after that. Example – “l normally get paid $14.35 per hour. How much should l be paid if l work 45 hours in one week? Normal hours Overtime hours No. of overtime hours = 45 -38 = 7 First 2 hours at time-and-a-half: Other 5 hours at double-time: $14.35 X 38 (no. of hours) = $545.30 1.5 x $14.35 x 2 = 2 x $14.35 x 5 = $43.05 $143.50 $731.85 Total Pay: Questions Use the following details to answer Questions 1-2. Normal hours: 38 per week Normal rate of pay: $11.30 per hour Overtime: Time-and-a-half for the first 2 hours. Double time after that. 1. 2. How much would you be paid if you worked: a. 38 hours $___________ b. 40 hours $___________ c. 43 hours $___________ d. 49 hours $___________ e. 50.5 hours $___________ f. 42 hours $___________ Complete your payslip for hours and pay. After completing the next section about income tax, come back and complete what you can of the payslip. Hours worked Week 1 Week 2 Gross pay Tax payable Tax as a % of gross pay 42 46 Total: Net pay Income Tax Each payday, a worker pays income tax instalments. At the end of June (the end of the financial year), you receive a Group Certificate from anyone you have worked for during the year. This shows your gross earnings for the year, and the amount of tax that has been paid from these earnings. If you have paid more tax than you had to, you are entitled to a refund. If you have not paid enough tax, you will have to pay extra. The amount of tax you paid depends on your income. However, you do not have to pay tax on money you spent on items which are tax deductible. The cost of these items is subtracted from your income to calculate your taxable income. The lower your taxable income, the less tax you pay. Taxable income = Gross income – Deductions Your total income $ $ $ $ Gross Income Wages Commission Bonuses Bank interest $ Dividends from shares $ Austudy payments $ Pensions Tax Deductions $ Donations to charities $ Union subscriptions $ Materials you need for your job $ Work-related car expenses (not including driving to and from work) $ Dry cleaning/laundry of uniform Questions 1. Michael has a gross income of $56 870 and has $1487 worth of deductions. What is his taxable income? $ _________ 2. Lisa earned $49 876 (gross) last financial year. She paid $374 for union fees, spent $92 dry cleaning her uniform and made donations of $475 to charities. What is her taxable income? $ _________ 3. David’s gross income last financial year was $38 654. He spent $429 on union fees and $327 on equipment for his work. He also gave $273 in donations to charities. What is his taxable income? $ _________ How much tax do l have to pay? Once you know your taxable income, you can calculate the amount of tax you are supposed to pay from a tax table: Tax Table Taxable Income Tax on Taxable Income $0 - $6000 0 $6001 - $20 000 17% of taxable income over $6000 $20 001 - $50 000 $2380 + 30% of taxable income over $20 000 $50 001 - $60 000 $11 380 + 42% of taxable income over $50 000 $60 000 + $15 580 + 47% of taxable income over $60 000 Plus Medicare Levy (without private health insurance): 1.5% of taxable income for (single) incomes less than $50 000 2.5% for incomes over $50 000 Example – “My taxable income was $35 382. How much tax do l have to pay? $20 001-$50 000 $35 382 is between these $2380 + 30% of taxable income over $20 000 This is the tax on the first $20 000 Start by calculating how much more than $20 000 you earned $35 382 - $20 000 = $15 382 Therefore tax on $35 382 = $2380 + 30% of $15 382 = $6994.60 (Calculator for % - 15 382 / 30%) Add Medicare Levy 1.5% of $35 382 = $540.73 Therefore total tax payable = $6994.60 + $530.73 = $7525.33 If your Group Certificate shows you have already paid more than this, you will get a tax refund. Questions 1. How much tax has to be paid on a taxable income of: a. $31 932 b. $24 922 2. c. $47 922 d. 58 799 (Medicare Levy changes) e. $72 850 f. $119 873 a. For each of the taxable incomes in Question 1, work out the percentage paid in tax. Write them under each calculation above. b. Why do you think the percentage is not the same for every taxable income? Do you think this is fair? Give your reasons. 3. Lucy earned a total of $53 875 last year, and had $1386 worth of tax deductions. Her group certificates show that she paid $15 095.68 in tax. Calculate her refund for the extra amount of tax she has to pay. 4. George has a gross income of $34 628. He has deductions totalling $635. His group certificates show that he has paid $7287.82 in tax. Calculate his refund for the extra amount of tax he has to pay.