final order - Public Utility Commission

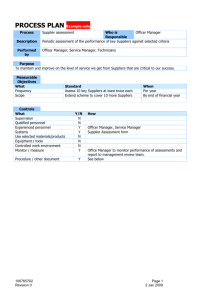

advertisement