BSc (Hons) Accounting - Online Undergraduate Handbook

advertisement

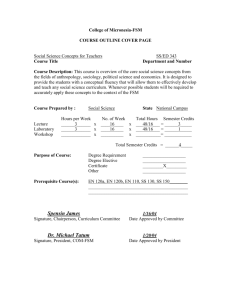

BSc (Hons) Accounting Professor Judy Day - Programme Director judy.day@mbs.ac.uk Viv Browne – BSc Accounting Programme Administrator vivien.browne@mbs.ac.uk 1 Presentation Structure • • • • • • • • Course Aims Learning Outcomes Programme Structure 1st year course choices Finding Information English, and Skills Development Support Important Contacts Accreditation 2 Programme Aims The BSc Accounting programme aims to: • Meet the needs of students who are seeking a career in accounting, business or related areas • Provide a thorough grounding in the theoretical knowledge and practical skills necessary for such careers • Offer substantial exemptions from professional accountancy examinations and the opportunity for students to undertake relevant experience via an internship year that will give a head-start towards obtaining full professional qualification 3 Programme Aims The BSc Accounting programme aims to: • Provide students with knowledge and understanding of the conceptual and applied aspects of accounting as an academic discipline • Provide a varied and challenging mixture of teaching and learning experiences • Encourage and enable students to acquire practices of independent thinking and learning, developing students’ powers of critical thinking, enquiry and logical expression • Develop core skills: computer literacy, numeracy, problem-solving, written and oral communication, teamwork, project management, and report writing • Place accounting in its broader economic, organisational, social and political contexts 4 Learning Outcomes • Understand, describe and critique the contexts in which accounting and auditing operate and the key areas of accounting and finance • Critically evaluate theories and evidence related to core aspects of financial and management reporting, auditing and accountability and finance • Record and summarise transactions and other economic events; prepare financial statements; analyse business operations • Exercise powers of inquiry, logical thinking, and critical analysis of arguments and evidence 5 Learning Outcomes • Understand the theoretical and practical aspects of auditing and taxation • Synthesise and evaluate data and solve problems • Plan, execute, and report on a piece of independent research in the form of an academic report • Develop appropriate transferable skills and take responsibility for personal development 6 Structure of Programme • 3 / 4 year programme, two semesters each academic year • Each year involves 120 credits of study, this consists of taking course units (normally 10 credits or 20 credits) • You will normally take 60 credits in each semester but a 70/50 or 50/70 is possible • Optional internship year comes after your second year of study 7 1st year – compulsory courses Compulsory courses – semester 1 Credits BMAN10501 Financial Reporting 10 LAWS10261 Introduction to English Law 10 ECON10041 Microeconomic Principles or ECON10081 The UK Economy – Microeconomics 10 Compulsory courses – semester 2 Credits BMAN10512 Introductory Management Accounting 10 BMAN10522M Financial Decision Making 10 ECON10042 Macroeconomic Principles; or ECON10082 The UK Economy – Macroeconomics 10 Compulsory courses – both semesters Credits BMAN10760 Auditing & Professional Accounting Practice BMAN10750 Quantitative Methods for Accounting and Finance 20 20 8 1st year course choices • You have 20 credits of optional courses to select • These can be chosen from the courses listed on the next slide although you should have completed and returned your course choice form to Viv • The choice is yours, though you may like to bear in mind that the ideal is to have 60 credits each semester 9 1st year – optional courses Optional courses – semester 1 Credits BMAN10791 People and Organisations 10 BMAN10801 Introduction to Work Psychology 10 Optional courses – semester 2 Credits BMAN10812 The Modern Corporation 10 SOCY10912 Work, Organisations and Society 20 10 Economics Courses • If you have A-Level Economics or equivalent qualifications, then you will be enrolled for: ECON10081 UK Economy – Microeconomics & ECON10082 UK Economy – Macroeconomics • If you have not got A-Level Economics, then you will be enrolled for: ECON10041 Microeconomic Principles & ECON10042 Macroeconomic Principles • At the end of this talk, there will be an Economics course list that you can check to see which Economics courses you will be studying • If we have been unable to assess your level of Economics, a letter will be in your arrival pack telling you that it is essential that you attend the Economics course registration session on Tuesday 20 September between 2:30pm – 3:30pm MBS East Room B8 to see an Economics tutor to ensure you are enrolled on the correct courses. 11 BMAN10750 Quantitative Methods for Accounting and Finance • Reminder: you have been sent pre-course reading for this module • It is important that you have bought the textbook before the module starts next week • You should read through chapters 1 to 4 and attempt the text box questions before next week • This is to help you check your level of understanding – if you find sections easy, then skip and move on • There are extra seminars in weeks 1 and 2 to help you with any difficulties you find with the reading 2nd year – compulsory courses Compulsory courses – semester 1 Credits BMAN20081 Financial Statement Analysis 10 BMAN21061 Introduction to Business Information Systems BMAN20881 Professional Accounting Practice 10 Compulsory courses – semester 2 10 Credits LAWS10302 Business Law I 10 BMAN20812 Business Strategy 10 Compulsory courses – both semesters Credits BMAN21020 Financial Reporting & Accountability 20 BMAN21040 Intermediate Management Accounting 20 BMAN23000B Foundations of Finance 20 You will also be able to select an optional course of 10 credits from available accounting, finance or other related subjects 13 Internship year • The internship year is optional • It will take place between your second and final years of study • You will start to apply for a placement during the summer after your first year on the programme • You will be given further information about the internship year as part of Auditing & Professional Accounting 14 Final year – compulsory courses Compulsory courses – semester 1 Credits BMAN30131 Accountability & Auditing 10 BMAN30091 Financial Derivatives 10 LAWS20301 Business Law II 10 Compulsory courses – semester 2 Credits BMAN31642 Principles of Taxation 10 Compulsory courses – both semesters Credits BMAN31610 Corporate Financial Communication & Valuation 30 BMAN30030 Contemporary Issues in Financial Reporting & Regulation 20 You will also be able to select optional courses totalling 30 credits from available accounting, finance or other related subjects 15 Feedback • You will receive feedback on your work in various forms: – Non-assessed coursework may be marked and returned to you – On-line quizzes on Blackboard – Comments on group or individual presentations – Generic feedback on examinations • The objective is to help you monitor your progress and improve your performance • Further information in the MBS Undergraduate Welcome Guide 16 Blackboard • Blackboard is the University-wide virtual learning environment for students and a virtual blackboard space will be attached to each first year course. • Further details on this will be covered in Thursday’s induction session. • You can log in to Blackboard via your student portal 17 Work and Attendance Monitoring • Attendance at all seminars, tutorials, labs and workshops is compulsory and will be monitored • If you are unable to attend a class because of illness or other good reason, you need to complete an ‘absence from class form’ and submit it to the undergraduate office. Forms are available from the UG office (D20) or can be downloaded from the MBS UG intranet. • If a student misses 3 or more consecutive seminars, tutorials, labs or workshops this will be followed up by the Assessment and Student Support Centre. We have a duty to make sure students attend classes and do not have any serious problems that are the cause of nonattendance. 18 English proficiency and language classes • Students whose first language is not English can take English language proficiency tests and sign up for English language classes if necessary. Further details will be covered at Thursday’s induction session • We strongly recommend that you take a test if you are unsure about whether your command of English will be enough to enable you to cope with the demands of the programme • Information on help available can be found at http://www.ulc.manchester.ac.uk/english/academicsupport/ 19 Time Management • Key to 1st year success! • You are responsible for your own learning and the time management implications of this! • Organisation and discipline required to juggle and balance social life and University responsibilities 20 Study Skills • Auditing and Professional Accounting (20 credits) will incorporate the following: – – – – Study Skills Academic Advisor Sessions Personal Development Plans Practice Essay on which feedback will be given • You will be informed who your academic advisor will be on Wednesday 21 September in the ICAEW session 21 Medical / Personal Problems • In case of medical, personal or other problems of a serious nature which have (or are likely to have) an adverse effect on your studies, ideally students should seek help from their academic adviser, the Assessment and Student Support Centre (ASSC) at D14 (Absence, Illness, Forms) and the Programme Administrators. • NOTE: It is important that the School is informed about issues affecting your study 22 Student Representatives • We need volunteers for the role! • Student reps will sit on the Programme Committee and attend the MBS UG Staff Student Liaison Committee • All interested (including self nominations) students should go to the undergraduate office (D20) for a nomination form by Monday 3 October 23 Peer Mentors • Peer mentoring is designed to provide pastoral support to first year students. All of the mentors are trained second or third year MBS undergraduate students • You will meet with your mentors during Welcome week, details of these meetings is included in your arrival pack. 24 Student Surveys and Questionnaires • We often ask you to help us by completing student surveys and questionnaires • These may be about one of your courses, or about other aspects of your teaching and learning • Or we may ask you to take part in focus groups on specific topics • We value your help with this, as it helps us to improve the quality of your experience at MBS 25 Progression Rules • The minimum overall pass mark will be 40% to progress from one year of a programme to the next for the Degree of Bachelor • To progress from one year to the next, a student must: – reach the minimum pass mark overall (40%); and – reach the pass mark (40%) in individual courses totalling at least 100 credits of the 120 credits for that year; and – reach the pass mark (40%) in all designated core courses. For the first year these are BMAN10501, BMAN10512 and BMAN10522; and – reach the compensatable fail mark (30%) in all remaining courses (a maximum of 20 credits) 26 Accreditation • ICAEW exemptions granted based on your performance in certain core courses – these include first year courses • Need an overall pass mark of at least 50% to be granted the exemption • Details of courses attracting accreditation can be found on the student intranet at http://ug.mbs.ac.uk/intranet/secure/pae/paa/icaew.aspx 27 BSc Accounting Welcome Reception You are invited to attend the Welcome Reception event immediately after the ICAEW event on Wednesday 21 September Please come along to the reception area of Crawford House on the mezzanine floor Good luck for the forthcoming year! 28